- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Draught Beer Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Draught Beer Market Size, Share & Trends Report]()

U.S. Draught Beer Market Size, Share & Trends Analysis Report By Type (Keg Beer, Cask Beer), By Category (Super Premium, Premium, Regular), By End-use (Commercial Use, Home Use), By Production Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-240-5

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Draught Beer Market Size & Trends

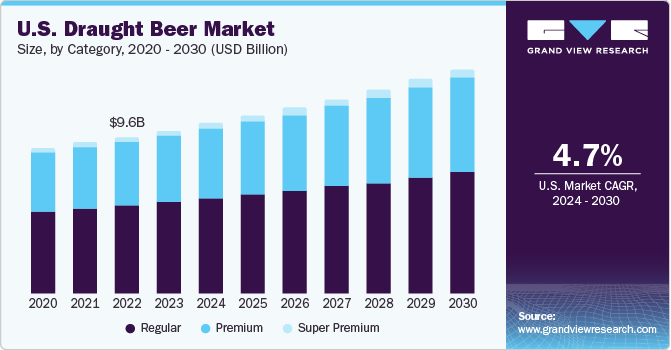

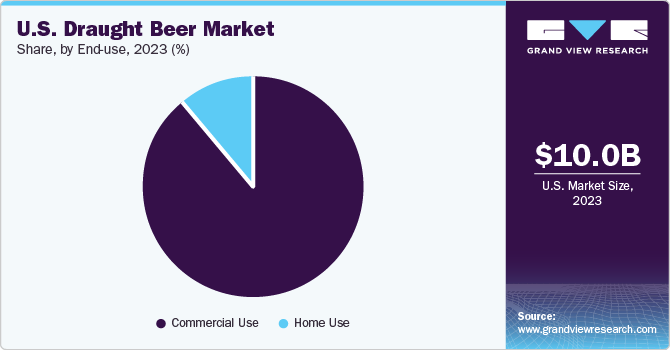

The U.S. draught beer market size was estimated at USD 10.04 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. The draught beer is usually served through tap and poured in glasses and mugs directly for consumption. Consumers at clubs, pubs, bars, restaurants, beer cafes and other placer serving alcohol popularly choose the particular type of the beer. This industry is driven by aspects such as increase in disposable income of young consumers, trends associated with urban lifestyles, upsurge in demand for limited edition draught beers served by micro-breweries and brands.

The U.S. market accounted for a share of 24.2% of the global draught beer market in 2023. The draught beer market in the U.S. has been generating colossal demand owing to several factors such as rapid expansion strategies executed by the breweries, distinctive and varied flavors offered by the makers, quality focused and innovative recipes developed by breweries, response to locally produced beers, authenticity and sense of connection offered by the draught beer brands, beer's history and connection to the community, culture of beer consumption in the region, and significant symbolic value held by beers in rituals, celebrations, and communal gatherings.

In addition, the industry has been experiencing upsurge in demand owing to various other factors such as trends on social media, venue events organised by local breweries, beer cafes, and restaurants, increasing number of young population in the region, growth in premium range brands, easier availability of pasteurized and filtered form of the beer, and more. Furthermore, availability through delivery application, online purchase, and presence of internationally applauded brands are some other aspects, which have been driving the unceasing growth for draught beer market in Europe.

Market Concentration & Characteristics

The U.S. draught beer industry is growing at accelerating pace and growth stage is identified as medium. The industry is characterized by the existence of globally admired brands, century old breweries, increasing number of multinational companies entering the regional space, efficiently run new entrants and renowned serving places across the region including popular clubs and bars in towns, international restaurant franchise, and other local breweries.

Degree of innovation is moderate in the industry. The innovation is primarily driven by the sense of urgency to deliver newer, better products. In this industry, consumer behaviour rarely admires newer, inventive tastes, as the beer consumption is highly relevant to personal interests and preferences. However, key companies use the innovation as strategy in terms of equipment upgradation, enhancement of manufacturing processes, improved packaging, efficient distribution networks, and analytically formed partnerships as well as collaborations.

The level of M&A (mergers & acquisitions) is low in the industry. However, there are certain instances where the larger brand or global company has acquired local brands or breweries. For instance, United States Beverage acquired Utah’s independent craft brewer known as Unita Brewing Co. in January 2022. Partnerships and collaborations is routine practice in this industry as it helps in enhancing the sale of beer and improving brand visibility.

The threat of substitute is at moderate level. This industry is part of the larger alcoholic beverages industry, which is characterized by the presence of various alternatives such as premium range whiskey, limited edition wine, and more. These products might get preference by the consumers occasionally, however the distinguished taste and experience associated with the draught beer consumption is most likely to assist the market in maintaining the rapid pace of growth.

Category Insights

Regular draught beer accounted for a revenue share of 56.2% in 2023. This industry is primarily driven by the price difference offered by the brands and regular category beers. The premium and craft beers are comparatively costlier than regular beers. The consumers who are seeking value for money and are budget - conscious are key buyers for regular beers. This industry generates demand from huge pool of buyers. These beers are generally mass manufactured while diligently maintaining the taste, appearance and quality of the product.

The super premium draught beer market in the U.S. is expected to grow at a CAGR of 7.3% from 2024 to 2030. The super-premium range is of beers is often produced by craft breweries who tend to focus on maintaining the authenticity and originality of the beer. These beers are made in smaller batches while ensuring the innovative ingredients, and meticulous brewing techniques are efficiently used to develop the products, which can generate great response from consumers who are seeking sense of authenticity and diversity in flavour.

Type Insights

Keg beer accounted for a revenue share of 76.2% in 2023, clearly indicating that the regional consumers prefer pasteurised or filtered versions of beer over beers that have shorter shelf life. Based on statistics published by PennState Extension in February 2023, approximately 63% of consumers aged 18 or above consumed alcohol in 2021-2022. It has also been observed that consumers aged 18-34 are the major consumers of beer in the United State. These consumers might tend to prefer drinking beers that are served in attractive packaged form such as cans, bottles and more. The pasteurised versions of draught beer, with lesser fizzy texture and better shelf life are generating higher demand in the U.S. market of draught beers.

The U.S. cask beer market is expected to grow at a CAGR of 3.4% from 2024 to 2030. Cask beers are generally served at slightly warmer temperature as compared to the keg beer, which in turn has influence on the flavour and aroma of the beer. One of the key aspects that distinguishes the cask beer from keg beer is the higher and superior control over quality as compared to other packaged and mass-market beers. This adds authenticity and sense of super premium quality to these beers.

End-use Insights

The commercial demand for draught beer accounted for a revenue share of 88.5% in 2023. The industry is mainly driven by the culture of clubs and pubs in the region. In addition, certain trends such as association of music concerts and sporting events with breweries or beer brands are also driving the growth for commercial use of draught beers in the United States. The industry is also experiences upsurge in demand in certain seasons such as summers, holidays, year-end and more. The commercial use is essentially fuelled by the availability of craft as well as regular beers across the beer cafes, bars, clubs, pubs, restaurants and other on-premise serving places.

The demand for draught beer, for home use, is expected to grow at a CAGR of 5.5% from 2024 to 2030. The home use is influenced by a variety of trends, aggressive marketing strategies executed by the international brands, the increased acceptance of beer as key choice of beverage over other sugar or carbon infused packaged beverages, overall culture associated with home use of beer at the time of family dinners, occasions, birthdays or anniversaries.

Production Type Insights

Draught beer market produced through macro-breweries accounted for a share of 73.9% in 2023. The industry has significant influence on overall consumption of the draught beer in the region. Such breweries produce beers on larger scale while maintaining the same quality and taste throughout the batches for years and years. The consumers often prefer these beers, as they are consistent in terms of taste and aroma profile. Microbreweries also provide manufacturing services to brand who wish to concentrate on the marketing and selling functions while they outsource the making of the product to large-scale operator who knows what they are doing.

The demand for draught beer from microbreweries is expected to grow at a CAGR of 5.5% from 2024 to 2030. Increasing response to limited edition crafted beers, growing ask for authenticity as key product feature and few more aspects associated with the quality and overall perception about the crafted beers are the factors which are helping the industry to attain the expected growth.

Key U.S. Draught Beer Company Insights

The market is characterized by the existence of international brands as the United States is considered as one of the primary markets for many types and varieties of beer. Also, the presence of century-old breweries and newly formed craft beer companies provide for an extremely competitive market.

Key U.S. Draught Beer Companies:

- United States Beverage

- D.G. Yuengling & Son, Inc.

- Miller Genuine Draft

- Milwaukee's Best

- Budweiser

- Corona

- Boston Beer Company.

- Constellation Brands, Inc.

- Molson Coors Beverage Company

- New Belgium Brewing Company

Recent Developments

-

In March 2023, Constellation Brands, Inc. revealed its collaboration with Tastemade, a contemporary media firm, in a multi-year, multi-million dollar partnership.

-

In October 2022, Boston Beer launched four primary offerings in craft beer: Cold Snap white ale for spring, Summer Ale citrus wheat ale for summer, Octoberfest for fall, and Winter Lager for winter. Each flavor had some subtle adjustments, aiming to create lighter, brighter, and easier drinking experiences.

U.S. Draught Beer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.47 billion

Revenue Forecast in 2030

USD 13.79 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Type, category, end-use, production type

Key companies profiled

United States Beverage; D.G. Yuengling & Son, Inc.; Miller Genuine Draft; Milwaukee's Best; Budweiser; Corona; Boston Beer Company; Constellation Brands, Inc.; Molson Coors Beverage Company; New Belgium Brewing Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Draught Beer Market Report Segmentation

This report forecasts growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the report based on U.S. draught beer market based on type, category, end-use, and production type:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Keg Beer

-

Cask Beer

-

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Super Premium

-

Premium

-

Regular

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial Use

-

Home Use

-

-

Production Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Macro Breweries

-

Microbreweries

-

Frequently Asked Questions About This Report

b. The U.S. draught beer market size was estimated at USD 10.04 billion in 2023 and is expected to reach USD 10.47 billion in 2024.

b. The U.S. draught beer market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 13.79 billion by 2030.

b. Keg beer dominated the U.S. draught beer market with a share of 76.2% in 2023. This is attributable to the growing consumer preferences towards pasteurized or filtered versions of beer over beers that have shorter shelf lives.

b. Some key players operating in the U.S. draught beer market include United States Beverage, D.G. Yuengling & Son, Inc., Miller Genuine Draft, Milwaukee's Best, Budweiser, Corona, Boston Beer Company, Constellation Brands, Inc., Molson Coors Beverage Company, and New Belgium Brewing Company.

b. Key factors that are driving the market growth include the increase in disposable incomes of young consumers, trends associated with urban lifestyles, and the upsurge in demand for limited edition draught beers served by micro-breweries and brands.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."