U.S. Distributed Fiber Optic Sensor Market Size Share & Trends Analysis Report By Application, By Technology, By Vertical (Oil & Gas, Power And Utility, Safety And Security), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-293-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

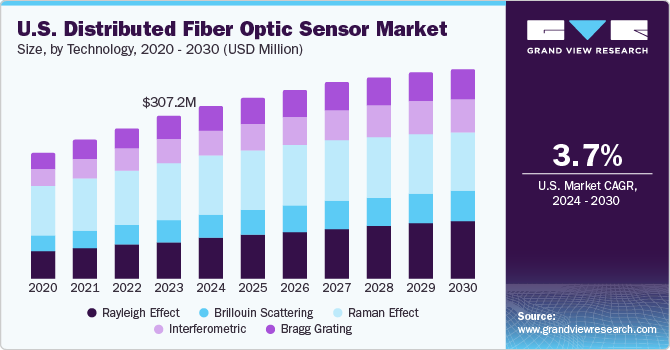

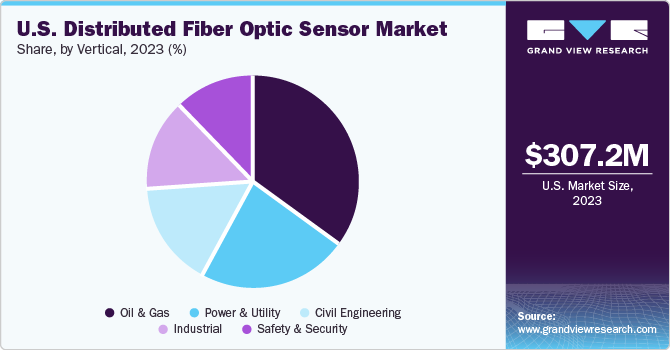

The U.S. distributed fiber optic sensor market size was valued at USD 307.23 million in 2023 and is projected to grow at a CAGR of 3.7% from 2024 and 2030. An increased need to foster sensing operations and boost detection and monitoring will bode well for the industry growth. The demand for optic sensing has gained ground across industry verticals, including oil and gas, industrial, civil engineering, safety and security and power and utility. Besides, end-users are likely to seek Rayleigh’s effect-based and Raman Effect-based sensing technologies.

The prevalence of advanced Optical Frequency Domain Reflectometry (OFDR) and Optical Time Domain Reflectometry (OTDR) has boded well for stakeholders gearing up to bolster their portfolios. Moreover, end-users have exhibited traction for fiber cables with reliable connectivity at the lowest price and high speed. Prominently, the growing penetration of fiber optic cables is largely attributed to high transmission capacity and high efficiency. Optical fibers will continue to gain prominence to control and monitor heavy operations in border security, pipelines and civil engineering.

Incumbent manufacturers are expected to regulate the efficiency and optimize their production practices to stay ahead of the curve. Stakeholders expect the high functionality of the Distributed Fiber Optic Sensor (DFOS) to help ramp up R&D activities and spur investments in the technology. Besides, demand for distributed sensors in water pipelines for pipeline leak detection, inline inspection tracking, ground movement monitoring, and intrusion and security will be pronounced in the ensuing period.

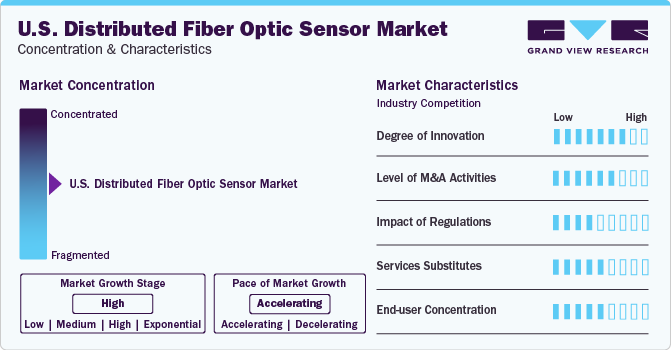

Market Concentration & Characteristics

The market is expected to witness innovations as leading companies contemplate investing in technologically advanced tools, including Raman-based sensing and Brillouin scattering. The demand for versatility, reliability and precision has steered innovations in sensors. In essence, miniaturized and multiplexed sensors, Fiber Bragg Grating (FBG) Sensors, distributed sensing systems and optical interrogation techniques have opened plethora of possibilities across end-use applications. For instance, FBG sensors help measure parameters, including temperature and strain with high accuracy.

Mergers and acquisitions could be moderate, with prominent companies likely to acquire smaller companies with niche expertise or technologies. Besides, partnerships and collaborations between system integrators and technology providers could be prevalent. Industry players are poised to bolster and diversify their portfolios and increase market share. For instance, in December 2023, Luna Innovations announced the acquisition of Silixa Ltd. to use the latter’s expertise and capabilities in the mining, natural environments, energy and defense sectors.

Regulation and regulatory compliance have redefined the end-use industries, including oil & gas pipelines. Notably, rigorous certification requirements and quality standards can create a roadblock for new companies. Meanwhile, stringent regulations can underpin the growth of high-performance and reliable sensors. The flexibility of fiber optic sensors will boost easy installation, while continuous and accurate data collection will foster compliance with regulatory standards.

The threat of substitutes may be less pronounced as alternative sensing technologies, including traditional electrical sensors, may have a dearth of long-distance coverage and multi-parameter sensing capabilities. Furthermore, immunity to electromagnetic interference has made distributed fiber optic sensors a valuable proposition in the landscape. Meanwhile, legacy technologies may be sought where cost would be a major concern.

End-user concentration could be redefined by aerospace, power & utilities and civil infrastructure sectors. Besides, the oil & gas industry will continue to be a major recipient of fiber optic sensors. Predominantly, surging building and construction activities and the penetration of electricity transmission distribution will bode well for the regional outlook.

Application Insights

The temperature sensing segment spearheaded the U.S. distributed fiber optic sensor market, accounting for 46.8% revenue share in 2023. The growth is partly attributed to the innate ability of the sensors to produce a continuous flow of acoustics, strain, temperature, and fiber length. In essence, temperature monitoring has gained ground to identify and detect abnormalities in equipment quickly. Lately, predictive maintenance has received an impetus across the U.S. to detect signs of trouble. For instance, temperature sensing devices are highly sought-after for fire detection in special hazard areas, including metros, conveyor belts, tunnels, airports, and factories.

The acoustic/vibration sensing segment will depict robust growth on the back of rising applications across border security, seismic sensing, perimeter security, transportation structures safety, industrial safety, and pipeline security. Some dynamics, such as high flexibility, immunity and sensitivity, will encourage market companies to inject funds into acoustic/vibration sensing technologies.

Technology Insights

The Raman Effect segment will rise in the light of the demand for coolant leak detection, safety of large structures, and fire detection. Raman scattering is sought-after for distributed temperature sensing, such as fire detection in buildings, tunnels, pipeline monitoring, power cable monitoring and oil and gas in-well monitoring. Additionally, end-users seek the technology to monitor the temperature and strain accurately.

The Rayleigh effect segment will witness considerable growth during the forecast period, partly on the heels of its ability to measure physical parameters, including temperature and strain. Industry leaders are likely to inject funds into the technology due to its higher efficiency that leverages measurements on long ranges, high measurement rates and higher spatial resolution. Similarly, the penetration of optical time-domain reflectometry (OTDR) and optical frequency-domain reflectometry (OFDR will continue to gain prominence in the near term. Moreover, Rayleigh scattering-powered distributed sensing helps turn optic fiber cable into a host of virtual temperature and strain.

Vertical Insights

The oil and gas segment accounted for the largest revenue share in 2023 and will continue to remain at the helm. The growth is largely attributed to the use of DFOS real-time data fueled decision-making. Further, the technology has gained immense popularity in the industry for pipeline leak detection, ground movement monitoring, inline inspection tracking and intrusion and security. The fiber optic sensors provide accurate temperature monitoring in pipelines, reducing energy loss and boosting optimal flow conditions.

The power and utility segment will observe a significant uptake in the wake of surging demand for hot spot detection and smart grid. Additionally, DFOS has received an impetus due to wind fluctuation over the fiber, vibrational modes of fiber and control of elongation fiber/wire. Specifically, the Brillouin scattering technology has added fillip to the industry vertical by helping detect stresses and strain, thereby fostering monitoring and minimizing risks.

Key U.S. Distributed Fiber Optic Sensor Company Insights

Some of the leading players operating in the market include Halliburton, Schlumberger Limited and OFS Fitel, LLC. They are likely to focus on organic and inorganic strategies to underscore their strategies in the regional landscape. Some emerging companies are slated to expand their portfolios to bolster their value propositions.

Key U.S. Distributed Fiber Optic Sensor Companies:

- AP Sensing GmbH

- Bandweaver

- DarkPulse Inc.

- Halliburton

- Hifi Engineering Inc.

- Luna Innovations Incorporated

- OFS Fitel, LLC

- Omnisens SA

- Qinetiq Group PLC

- SLB

Recent Developments

-

In December 2023, Luna Innovations Incorporated announced a USD 50 million investment from White Hat Capital Partner to implement its solutions and foster recurring revenue through monitoring of assets, including pipelines, tunnels and bridges.

-

In July 2023, OFS and Heraeus Comvance announced that the latter acquired manufacturing draw towers and a facility to produce telecommunication fibers. OFS will continue to offer its customers a full range of fiber types from draw towers in the U.S.

-

In December 2022, DarkPulse, Inc. inked a definitive business combination deal with Global System Dynamics, Inc. and the latter’s wholly-owned merger subsidiary, Zilla Acquisition Corp.

-

In November 2022, QinetiQ U.S. won a USD 48 million contract for research, development and engineering to underpin advanced optics and image processing for the U.S. Army. These concerted efforts the Army’s modernization priorities through sensor protection and hardware integration, among others.

-

In March 2022, Luna Innovations Incorporated announced the acquisition of LIOS Sensing to cash in on the latter’s dominance in temperature and strain sensing and combine those dynamics with its fiber optic offerings.

-

In April 2022, Schlumberger inked a deal with Sintela to co-develop new fiber-optic solutions for a myriad of industrial markets.

U.S. Distributed Fiber Optic Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 326.50 million |

|

Revenue Forecast in 2030 |

USD 395.77 million |

|

Growth rate |

CAGR of 3.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, technology, vertical |

|

Key companies profiled |

AP Sensing GmbH; Bandweaver; DarkPulse Inc.; Halliburton; Hifi Engineering Inc.; Luna Innovations Incorporated; OFS Fitel, LLC; Omnisens SA; Qinetiq Group PLC; SLB |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Distributed Fiber Optic Sensor Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. distributed fiber optic sensor market on the basis of application, technology, and vertical:

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Acoustic/Vibration Sensing

-

Temperature Sensing

-

Other

-

-

Technology Outlook (Revenue, USD Million; 2017 - 2030)

-

Rayleigh Effect

-

Brillouin Scattering

-

Raman Effect

-

Interferometric

-

Bragg Grating

-

-

Vertical Outlook (Revenue, USD Million; 2017 - 2030)

-

Oil & Gas

-

Power and Utility

-

Safety & Security

-

Industrial

-

Civil Engineering

-

Frequently Asked Questions About This Report

b. The U.S. distributed fiber optic sensor market size was estimated at USD 307.23 million in 2023 and is expected to reach 326.50 Million in 2024

b. The U.S. distributed fiber optic sensor market is expected to grow at a compound annual growth rate of 3.7% from 2024 to 2030 to reach USD 395.77 million by 2030.

b. The temperature sensing segment dominated the U.S. distributed fiber optic sensor market with a share of 46.8% in 2023. This is attributable to innate ability of the sensors to produce a continuous flow of acoustics, strain, temperature, and fiber length. In essence, temperature monitoring has gained ground to identify and detect abnormalities in equipment quickly.

b. Some key players operating in the U.S. distributed fiber optic sensor market include AP Sensing GmbH, Bandweaver, DarkPulse Inc., Halliburton, Hifi Engineering Inc., Luna Innovations Incorporated, OFS Fitel, LLC, Omnisens SA, Qinetiq Group PLC, SLB

b. Key factors that are driving the market growth include the demand for optic sensing and the prevalence of advanced Optical Frequency Domain Reflectometry (OFDR) and Optical Time Domain Reflectometry (OTDR) technologies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."