- Home

- »

- Smart Textiles

- »

-

U.S. Disposable Gloves Market Size, Industry Report, 2030GVR Report cover

![U.S. Disposable Gloves Market Size, Share & Trends Report]()

U.S. Disposable Gloves Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Natural Rubber, Nitrile, Vinyl, Neoprene, Polyethylene), By Lubricant (Powdered, Powder-free), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-219-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Disposable Gloves Market Trends

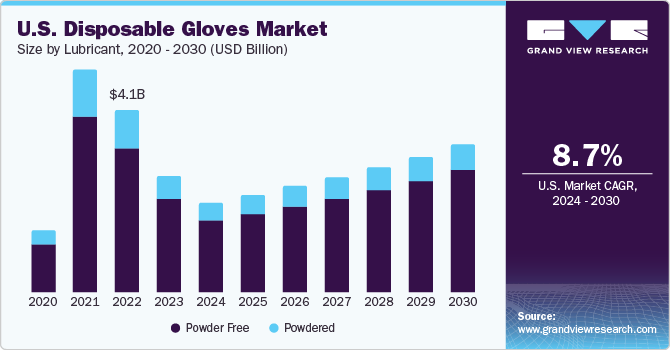

The U.S. disposable gloves market size was estimated at USD 3.16 billion in 2023 and is projected to grow at a compounded annual growth rate (CAGR) of 8.7% from 2024 to 2030. The demand for disposable gloves is driven by the anticipated hospital industry growth due to ongoing innovations and surgical breakthroughs such as standardizing procedures, advancing technology, and implementing high-reliability organizing (HRO). The market is also anticipated to grow as a result of supportive occupational safety laws, the growing significance of security and safety in the workplace, and rising healthcare costs.

Throughout the forecast period, it is projected that ongoing innovations and developments in the field of cancer therapy, such as standardizing processes, high-reliability organizing (HRO), and technological advancements, will spur the growth of the healthcare industry and drive demand for disposable gloves.

Several factors, including a sizable elderly population, a sophisticated healthcare infrastructure, and increased patient disposable income fuel the U.S. disposable gloves market. To prevent further transmission, the COVID-19 pandemic has also increased demand for disposable gloves, particularly in the healthcare industry. The country's need for disposable gloves was influenced by the COVID-19 pandemic outbreak. The U.S. is among the countries most badly impacted by the coronavirus worldwide. As of July 5, 2021, there were 33,343,961 COVID-19 cases in the United States overall, according to the WHO. To prevent further transmission, the rapid spread of COVID-19 throughout the nation has raised the demand for disposable gloves, particularly in the healthcare industry.

Furthermore, exposure to toxic chemicals poses a considerable risk to the health of workers in a variety of industries, including mining, healthcare, and medicine. This can result in difficulties, including skin disorders, rashes, hand wounds, amputations, and exposure to blood-borne infections. The enforcement of safety rules is anticipated to be a key factor in the market's expansion. The significance of raw materials in producing disposable gloves with excellent heat resistance, comfort, flexibility, and lightweight qualities is becoming more widely recognized. It is predicted that this awareness will stimulate research and development efforts by leading industry players, to improve disposable gloves' usability and broaden their applicability through creative design improvements.

Market Concentration & Characteristics

The U.S. disposable market is marked by a moderate degree of innovation. Introducing nitrile gloves as a substitute for latex is one example of a manufacturing process innovation. However, compared to other industries, the disposable glove market has not seen particularly high levels of innovation. The main goals of innovations are to improve barrier protection, comfort, and durability.

The market has a moderate level of merger and acquisition activity, with some consolidation among major competitors looking to increase their market share or broaden their range of products. It is not as fierce as in certain other industries, though, which indicates a rather steady competitive environment.

The market is greatly influenced by regulations, especially those that deal with product safety, quality requirements, and environmental issues. Rules like OSHA safety standards for the workplace and FDA requirements for medical gloves must be followed. These rules have a big impact on product development and market dynamics.

As disposable gloves are vital protective gear in various industries, such as healthcare, food processing, and manufacturing, where there are few alternatives to fulfill their functions, there hasn't been much of an impact from service substitutes on the market. Even while there might be some alternatives in some situations, like reusable gloves, they frequently fall short of the convenience and hygienic benefits of disposable gloves.

Lubricant Insights

The powdered free lubricant segment dominated the market and accounted for the largest market share of 80.7% in 2023. This growth is attributed to the growing need for powder-free gloves in a variety of industries, such as the food processing, chemical, and medical sectors. In addition, it is anticipated that the market for powder-free gloves will benefit from strict regulations on powdered gloves implemented by numerous countries worldwide during the forecasted period. To avoid the need for powder, gloves treated with chlorination become less form-fitting, facilitating effortless donning and taking off. Increasing demand for powder-free gloves in several sectors, including food processing, medical, and chemical, is anticipated to propel the market.

The Powdered segment held a significant market share in 2023 owing to its ability to adapt tightly and provide defense against dangerous chemicals or physical impurities. The use of cornstarch powder in latex gloves may aggravate allergies or sensitivities. However, this is not an issue with vinyl or nitrile gloves.

End-use Insights

The healthcare segment led the market with the largest revenue share in 2023. This growth is attributed to the increased consciousness of cleanliness and infection prevention, particularly during international health emergencies like the COVID-19 pandemic. The tight guidelines and standards for hygienic practices and safety in healthcare facilities further support the market's expansion. Moreover, the aging population and rising incidence of chronic illnesses require the usage of disposable gloves in medical procedures more frequently, which is driving the market's expansion.

The food segment held a substantial revenue share in 2023 owing to the country's growing use of convenience and ready-to-eat foods. Furthermore, the market is growing at a faster rate thanks to the emergence of takeout and delivery services, which helps to expand the segment.

The manufacturing segment saw notable growth in 2023 due to the use of automation and technological developments more often, necessitating the use of gloves when handling delicate components and equipment. Additionally, the market for disposable gloves is driven by the increased focus on hygienic practices and cleanliness in production facilities.

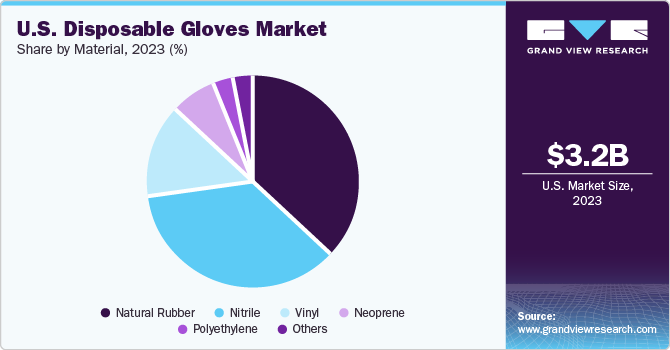

Material Insights

The natural rubber segment accounted for the largest market share in 2023. This growth is attributed to the increase in demand for disposable natural rubber gloves for use in a variety of settings, including the medical, surgical, and laboratory. Natural rubber gloves are used to shield workers from infections and hand injuries that are frequent in a variety of industries, such as chemicals, oil and gas, food processing, medical, and healthcare. Because of their elasticity and chemical resistance, latex rubber gloves have become increasingly popular in the disposable gloves market. This is especially true while handling chemicals and performing surgery.

The nitrile gloves segment held a significant market share in 2023 as they are being used more in the chemical, painting, dental, laboratory, and oil industries. Nitrile gloves provide several advantages over latex gloves, including a longer shelf life, less friction, and resistance to punctures. Furthermore, it is projected that the demand for nitrile gloves will be driven throughout the forecast period by the rising demand for infection control as well as the increasing occurrence of pandemic diseases like COVID-19 and swine flu (H1N1).

The Vinyl segment witnessed significant growth in 2023 due to the increased demand for FDA-certified and antimicrobial gloves. Vinyl disposable gloves are also composed of plasticizers and polyvinyl chloride, without the need for latex. Compared to neoprene gloves, these gloves are more comfortable and have better touch sensitivity. Vinyl gloves are far more affordable than latex and nitrile. Vinyl or polyvinyl chloride gloves have become more important in the food processing, medical, and healthcare industries because of their low cost and chemical resistance.

Key U.S. Disposable Gloves Company Insights

The U.S. disposable gloves market is characterized by a high degree of competition, with a few key players dominating the industry. Companies in this sector usually offer a diverse range of disposable gloves, catering to different industries such as healthcare, food, pharmaceuticals, and industrial sectors.

-

Key players in the market include Adenna LLC; 3M; and Atlantic Safety Products, Inc.

-

Adenna LLC, manufactures and supplies disposable gloves and safety supplies, wipers, and basic bathroom supplies. The company has three production facilities in North America, including bathroom basics, wiping cloth legacy, and disposable gloves & safety offerings.

-

Atlantic Safety Products, Inc. manufactures and supplies disposable gloves. The company’s Lightning Gloves, Aloe Power Gloves, In Touch, Lighthouse, and Market Edition are among the brands under which the disposable gloves are produced. Vinyl, latex, and nitrile are used in the production of disposable gloves.

Kimberly-Clark Corporation; Sempermed USA, Inc.; and Halyard Health, Inc. are other participants operating in the U.S. disposable gloves market.

-

Sempermed USA, Inc. has production sites in Malaysia and Austria and produces protective gloves for use in the medical and industrial fields. Under the trade names Best Touch, Semperforce, Sempercare, Sempershield, and Semperguard, the company produces single-use gloves made of nitrile, latex, vinyl, polyethylene, and chloroprene.

Key U.S. Disposable Gloves Companies:

- Adenna LLC

- MCR Safety

- Atlantic Safety Products, Inc.

- Ammex Corporation

- Kimberly-Clark Corporation

- Sempermed USA, Inc.

- Halyard Health, Inc.

- Medline Industries

- Renco Corporation

- 3M

Recent Developments

-

In January 2024, Medline, a market-leading manufacturer and supplier of medical supplies and solutions, announced a successful acquisition of United Medco. With the expansion of its supplemental benefits packages and enhancement of its best-in-class distribution capabilities, this strategic deal represents a major turning point in Medline's development of its Health Plans business.

-

In January 2024, Kimberly-Clark Professional announced new Kimtech Polaris Nitrile Exam Gloves for usage in laboratory environments, offering users the highest level of protection, durability, and comfort from a glove in the Kimtech portfolio, will be available. When compared to top competitors, Kimtech Polaris Nitrile Exam Gloves had one of the lowest acceptable quality levels (AQL) for pinholes, at 0.65.

-

In April 2023, AMMEX Corp. introduced a new range of disposable gloves to assist consumers in protecting themselves in the most peculiar circumstances. These gloves are the end product of 35 years of research and development. They'll keep you safe in anything from the garage to the office to space travel. Disposable glove usage and perception will be completely transformed by these gloves.

U.S. Disposable Gloves Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.43 billion

Revenue forecast in 2030

USD 5.64 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, lubricant, end-use.

Key companies profiled

Adenna LLC; MCR Safety; Atlantic Safety Products, Inc.; Ammex Corporation; Kimberly-Clark Corporation; Sempermed USA, Inc.; Halyard Health, Inc.; Medline Industries; Renco Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Disposable Gloves Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. disposable gloves market report based on material, lubricant, and end-use:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Natural

-

Nitrile

-

Vinyl

-

Neoprene

-

Polyethylene

-

Others

-

-

Lubricant Outlook (Revenue, USD Billion, 2018 - 2030)

-

Powdered

-

Powder Free

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. disposable gloves market was valued at USD 3.16 billion in the year 2023 and is expected to reach USD 3.43 billion in 2024.

b. The U.S. disposable gloves market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 5.64 billion by 2030.

b. The powdered free lubricant segment dominated the market and accounted for the largest market share of 80.76% in 2023. This growth is attributed to the growing need in a variety of industries, such as the food processing, chemical, and medical sectors, for powder-free gloves.

b. The key market player in the U.S. disposable gloves market includes Adenna LLC; MCR Safety; Atlantic Safety Products, Inc.; Ammex Corporation; Kimberly-Clark Corporation; Sempermed USA, Inc.; Halyard Health, Inc.; Medline Industries; Renco Corporation.

b. The key factors that are driving the U.S. disposable gloves market include, the demand for disposable gloves is driven by the anticipated hospital industry growth due to ongoing innovations and surgical breakthroughs such as standardizing procedures, advancing technology, and implementing high-reliability organizing (HRO).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.