U.S. Dietary Supplements Market Size, Share & Trends Analysis Report By Application-End User, By Application-Ingredient, By Form, By Type, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-052-0

- Number of Report Pages: 194

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Dietary Supplements Market Trends

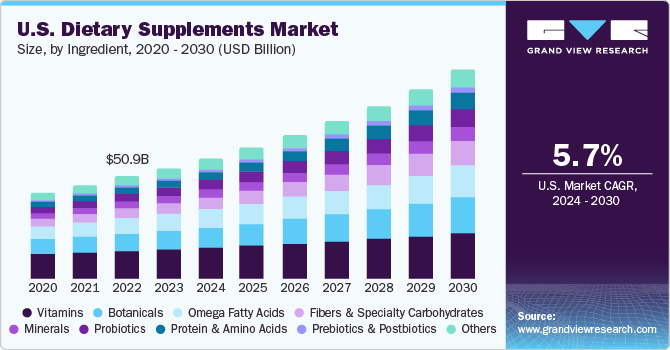

The U.S. dietary supplement market size was estimated at USD 53.58 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030. The primary factors driving the market growth are the growing population of senior citizens, rising awareness and focus on preventive healthcare, and rising demand for sports nutrition supplements. Additionally, consumers are moving towards self-directed care, which is also expected to drive demand for dietary supplements in the U.S.

Consumers in the U.S. are shifting towards self-directed care, which has helped in shaping the growth of the dietary supplements industry in the country. Consumers are opting for nutraceuticals rather than prescription pharmaceuticals owing to the growing focus on preventive healthcare. The high cost of prescription pharmaceuticals and the reluctance of insurance companies to cover the cost of drugs have further helped the dietary supplements industry solidify its presence in the U.S. market. Increasing hospitalization costs are driving consumers toward nutraceutical and health supplements, further aiding the market growth.

Factors fueling interest in dietary supplements in the U.S. include growing healthcare costs, changes in food laws affecting label and product claims, rapid advances in science and technology, rising geriatric population, and growing interest in attaining wellness through diet.

Prebiotics, together with probiotics, open new avenues for heightened levels of health in general, thus, allowing consumers to afford and include them in their daily diets. These products are specifically beneficial for the gut as they promote digestion by retaining and promoting healthy intestinal flora in the human digestive system. High intake of prebiotics lowers the risk of cardiovascular diseases and retains healthy cholesterol levels, thereby, leading to increasing product demand in the U.S. market.

In addition, the aging population in the U.S. is a significant driver of the dietary supplements market growth. As people age, they often require additional nutritional support to maintain their health and vitality. This demographic trend has created a steady demand for supplements that cater to the specific needs of older adults, such as bone health, joint support, and cognitive function. New estimates from the U.S. Census Bureau indicate that in 2022, the median age of the US population reached an all-time high of 38.9 years.

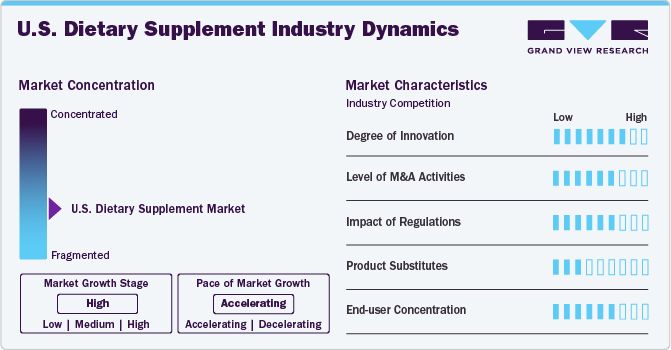

Market Concentration & Characteristics

The U.S. dietary supplements market is highly innovative, driven by advanced research and development, personalized nutrition, and new delivery systems like gummies and transdermal patches. The integration of supplements into functional foods and beverages, along with a shift towards plant-based and natural ingredients, has further fueled growth. Additionally, the market embraces regenerative and adaptogenic products, digital health integration for personalized tracking, and sustainable practices in sourcing and manufacturing. These innovations cater to the health-conscious consumer, enhancing the efficacy, convenience, and appeal of dietary supplements.

Regulation has significantly impacted the U.S. market for dietary supplements by ensuring product safety and quality while fostering innovation. The FDA's oversight under the Dietary Supplement Health and Education Act (DSHEA) requires manufacturers to follow Good Manufacturing Practices (GMPs) and ensures accurate labeling and truthful claims. While these regulations protect consumers, they also allow a broad range of products to be marketed, encouraging industry growth and consumer confidence.

In the U.S. market, dietary supplement product substitutes include functional foods and beverages, fortified foods, and whole foods rich in essential nutrients. Pharmaceuticals and over-the-counter medications can also serve as substitutes, particularly for specific health conditions. Additionally, natural and holistic health practices, such as herbal remedies and wellness therapies, provide alternative options to traditional dietary supplements. These substitutes offer consumers various ways to meet their nutritional and health needs, potentially influencing the demand for conventional supplements.

The level of mergers and acquisitions (M&A) activities in the U.S. market for dietary supplements is currently moderate. As the technology matures and market demand grows, companies are increasingly exploring strategic partnerships, acquisitions, and collaborations to enhance their capabilities, expand their application-end user offerings, and gain a competitive edge.

Application-End User Insights

Consumption of energy and weight management supplements among adults accounted for a market share of 67.5% in 2023. In the U.S., the purchase of energy and weight management supplements is driven by the busy, hectic lifestyles of many Americans, making quick and convenient solutions for fatigue appealing. At the same time, a strong cultural emphasis on achieving a certain body type fuels the demand for weight management products. Health and fitness trends promote active lifestyles and the use of supplements to support them, with aggressive marketing and endorsements by celebrities and influencers enhancing their appeal. Consumers are attracted by the potential benefits of these supplements, such as increased metabolism, appetite suppression, and enhanced energy levels.

The National Institutes of Health's Office of Dietary Supplements provides a fact sheet on dietary supplements for weight loss, highlighting the usage statistics and noting the higher prevalence among women. Approximately 15% of U.S. adults have used a weight-loss dietary supplement at some point in their lives, with usage reported by more women (21%) than men (10%). Americans spend about USD 2.1 billion annually on weight-loss dietary supplements in pill form, including tablets, capsules, and soft gels. One of the top 20 reasons people take dietary supplements is to lose weight.

Demand for prenatal health supplements among pregnant women is anticipated to grow at a CAGR of 11.5% from 2024 to 2030. Pregnant women take prenatal dietary supplements to meet increased nutritional demands for fetal development and maternal health. These supplements, including folic acid, iron, calcium, and omega-3 fatty acids, help prevent birth defects like neural tube defects, reduce the risk of anemia, and support the baby's bone, brain, and eye development. Ensuring adequate intake of these nutrients through supplements is crucial for both the mother's well-being and the baby's healthy growth during pregnancy.

According to a 2017 survey conducted by the March of Dimes, less than half of women in the U.S. adhere to recommended vitamin intake prior to pregnancy. The survey highlighted that although 97% of women reported taking prenatal or multivitamins during their most recent pregnancy or current pregnancy, merely 34% commenced their use before discovering they were pregnant. Moreover, the data indicated significantly lower initiation rates among Hispanic (27%) and African-American/Black (10%) women.

Application-ingredients Insights

Usage of Vitamins in energy and weight management supplements accounted for a market share of 35.9% in 2023. Americans consume vitamin supplements for energy and weight management to boost energy levels and support metabolic processes. Additionally, these supplements fill nutritional gaps that may be present in the diet, ensuring adequate intake of essential vitamins. This enhanced energy and metabolic support ultimately improve physical performance and weight management efforts.

The application of probiotics in prenatal health supplements is expected to grow at a CAGR of 13.0% from 2024 to 2030. Probiotics boost the immune system, helping to protect both the mother and the developing baby from infections.It also supports a healthy gut microbiome and has also gained attention for its potential benefits in reducing inflammation and supporting fetal growth.

Form Insights

Based on form, the market is segmented into tablets, capsules, soft gels, powders, gummies, liquids, and others. The tablet dietary supplements market segment accounted for a revenue share of 32.4% in 2023. Consumers in the U.S. prefer dietary supplements in tablet form because they are convenient, easy to store and transport, and offer excellent stability and shelf-life by protecting active ingredients from light, moisture, and oxygen. Tablets ensure accurate dosages and are cost-effective, making them an economical and reliable choice for consumers.

The liquid dietary supplement market segment is anticipated to grow at a CAGR of 8.6% from 2024 to 2030. Liquid supplements are easier to ingest, particularly for those who have difficulty swallowing pills, such as children and the elderly. They offer faster absorption and quicker effects compared to tablets and capsules. Additionally, liquid supplements can be easily mixed with beverages or foods, providing a convenient and versatile consumption method. This growing preference for convenience, ease of use, and rapid efficacy drives the increasing popularity of liquid dietary supplements.

Type Insights

The Over the Counter (OTC) dietary supplement market segment accounted for revenue share of 76.0% in 2023. OTC sales of dietary supplements in U.S. are anticipated to witness steady growth because of rising consumer awareness regarding the nutritional value and health benefits of these products. Self-medication for the treatment of gastrointestinal and immunity-related issues is another key factor driving the demand for OTC dietary supplements. The convenience of direct purchases and cost-effectiveness are expected to promote the sales of these dietary supplements.

The prescribed dietary supplement market segment is anticipated to grow at a CAGR of 6.3% from 2024 to 2030. Dietary supplements in the U.S. are preferred from prescribed stores due to trust in their quality assurance and rigorous safety standards. Consumers value the guidance of healthcare professionals in these outlets, ensuring tailored recommendations. The authenticity of products and the reduced risk of counterfeit items also play a role. Additionally, individuals with specific medical needs often require professional supervision for supplements, and potential insurance coverage for medically necessary supplements adds to the appeal.

Distribution Channel Insights

Sales through offline channel accounted for a revenue share of 78.0% in 2023. The offline channel is sub divided into supermarkets/hypermarkets, pharmacies, specialty stores, practitioners, and others. Sales through pharmacies accounted for a share of 29.1% in 2023. People in the U.S. purchase dietary supplements from pharmacies because they trust the quality and safety standards of these outlets. Pharmacies offer the guidance of healthcare professionals, ensuring personalized and informed recommendations. Additionally, the authenticity of products is assured, reducing the risk of counterfeit or substandard items. For those with specific medical conditions, pharmacies provide professional supervision, and insurance coverage for necessary supplements is often available, making pharmacies a preferred choice for dietary supplements.

Sales through online channel is anticipated to grow at a CAGR of 6.3% from 2024 to 2030. The convenience offered by online shopping has played a pivotal role in the industry's growth. Consumers can browse a wide range of dietary supplement from the comfort of their homes, eliminating the need to visit physical stores. Additionally, online platforms frequently offer promotions and discounts, making it an attractive option for many consumers.

Key U.S. Dietary Supplement Company Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the largest dietary supplement companies including Amway, Bayer AG, GlaxoSmithKline plc have entered into the market. Along with that, in order to improve their efficiency and by using the international distribution channel, the companies have been ruling the industry.

Key U.S. Dietary Supplement Companies:

- Amway

- Abbott

- Bayer AG

- Glanbia plc.

- Pfizer Inc.

- Archer Daniels Midland

- GlaxoSmithKline plc.

- NU SKIN

- Herbalife Nutrition

- Nature's Sunshine Products Inc.

- DuPont de Nemours Inc.

- NOW Foods

Recent Developments

-

In May 2024, Bayer launched a One A Day social media campaign featuring former NFL star Julian Edelman to combat wellness misinformation. The campaign started running across major social platforms, including Instagram, Facebook, and TikTok. Its primary objective was to inspire individuals to share honest accounts of their wellness experiences, countering the often unrealistic or pseudoscientific claims in online wellness spaces.

-

In May 2024, NOW Foods reaffirmed its commitment to independent retailers by launching 20 product sizes exclusively available for sale in brick-and-mortar stores. These specially tailored products, which include popular items like 5HTP, CoQ10, probiotics, and vitamin D, fill a niche between the typical small and large bottle quantities offered by NOW. Each product prominently features an "In store only" logo on its label.

-

In February 2024, Herbalife Nutrition unveiled a new line of food and supplement combinations, dubbed the 'GLP-1 Nutrition Companion', specifically tailored to support the nutritional needs of individuals using GLP-1 and other weight-loss medications. This innovative range features Herbalife's signature protein shake, recognized globally for its quality and effectiveness, along with a carefully curated selection of other nutritional supplements.

-

In August 2023, Herbalife Nutrition introduced Herbalife V, a new plant-based supplement line designed to meet the growing demand for plant-based products. These supplements are certified USDA Organic, non-GMO verified, kosher, and certified plant-based and vegan by FoodChain ID.

U.S. Dietary Supplement Market Report Scope

|

Report Attribute |

Details |

|

Market end user value in 2024 |

USD 56.49 billion |

|

Revenue forecast in 2030 |

USD 78.94 billion |

|

Growth rate |

CAGR of 5.7% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application-end user, application-ingredient, form, type, distribution channel |

|

Country scope |

U.S. |

|

Key companies profiled |

Amway; Abbott; Bayer AG; Glanbia plc.; Pfizer Inc.; Archer Daniels Midland; GlaxoSmithKline plc.; NU SKIN; Herbalife Nutrition; Nature's Sunshine Products Inc.; DuPont de Nemours Inc.; NOW Foods |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Dietary Supplement Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. dietary supplement market report on the basis of application-end user, application-ingredients, form, type, and distribution channel:

-

Application-end User Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy & Weight Management

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

General Health

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Bone & Joint Health

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Gastrointestinal Health

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Immunity

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Cardiac Health

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Anti-cancer

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Diabetes

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Lungs Detox/Cleanse

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Skin/Hair/Nails

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Sexual Health

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Brain/Mental Health

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Insomnia

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Menopause

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Anti-aging

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Prenatal Health

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Others

-

Adults

-

Male

-

Female

-

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

-

Application-ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy & Weight Management

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

General Health

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Bone & Joint Health

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Gastrointestinal Health

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Immunity

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Cardiac Health

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Anti-cancer

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Diabetes

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Lungs Detox/Cleanse

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Skin/Hair/Nails

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Sexual Health

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Brain/Mental Health

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Insomnia

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Menopause

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Anti-aging

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Prenatal Health

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

Others

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Others

-

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquids

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioners

-

Others

-

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. dietary supplements market is worth USD 53.58 billion in 2023 and is projected to reach USD 56.49 billion in 2024

b. The U.S. dietary supplements market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 78.94 billion by 2030

b. Adults in the energy and weight management segment accounted for a share of 67.5% in 2023. Adults in the U.S. are becoming more aware of the role supplements play in maintaining good health and preventing chronic diseases. Growing awareness of health and fitness further propels adults to invest in supplements that enhance physical performance, manage stress, and support metabolic health, which are often challenging to maintain through diet and exercise alone.

b. Some of the key market players in the U.S. dietary supplements market are Amway, Abbott, Bayer AG, Glanbia plc, Pfizer Inc., GlaxoSmithKline plc., NU SKIN, and NOW Foods.

b. Key factors that are driving the dietary supplements market growth in the U.S. are increasing geriatric population, increasing consumer awareness regarding nutrition, health & wellness and increasing demand for sports nutritional supplements

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."