- Home

- »

- Medical Devices

- »

-

U.S. Diabetic Foot Ulcer Treatment Market, Industry Report, 2030GVR Report cover

![U.S. Diabetic Foot Ulcer Treatment Market Size, Share & Trends Report]()

U.S. Diabetic Foot Ulcer Treatment Market Size, Share & Trends Analysis Report By Treatment (Therapy Device, Wound Care Dressing), By Ulcer Type (Ulcer, Neuro-ischemic Ulcer), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-302-9

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

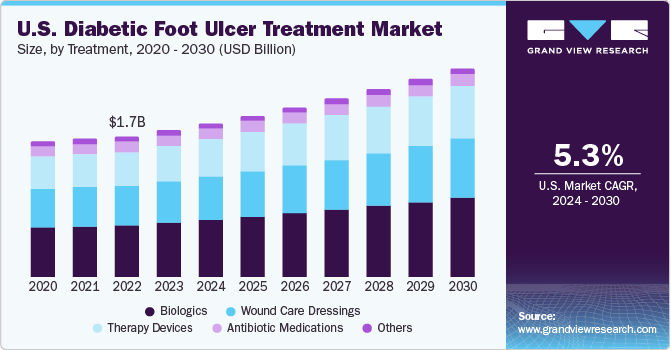

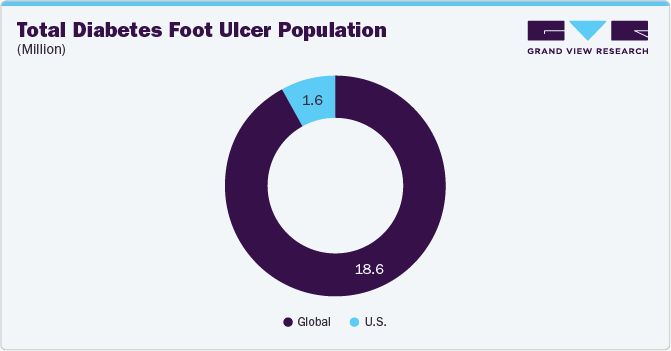

The U.S. diabetic foot ulcer treatment market size was estimated at USD 1.75 billion in 2023 and is expected to grow at a CAGR of 5.25% from 2024 to 2030. There are several factors contributing to the market growth in the U.S. which include, the growing prevalence of diabetes in the country, aging population, advancements in treatment technology, growing R&D activities, and lifestyle changes. For instance, according to the International Diabetes Federation, in 2021 there were about 32.21 million diabetes patients aged 20 -79 years in the U.S. which is further expected to increase to 36.28 million by 2045.

The growing prevalence of diabetes is increasing the chances of people causing diabetic foot ulcers. For instance, according to the data published by the University of Michigan, diabetic foot ulcer occurs in about 15 percent of individuals with diabetes. Diabetes can lead to nerve damage and decreased blood flow to the feet, putting individuals at a greater risk for these ulcers. Therefore, the rising rates of diabetes are concerning because they increase the chances of developing diabetic foot ulcers, which present significant health challenges that require immediate and effective management to avoid serious complications. As per the International Diabetes Federation in 2021, the total cost related to diabetes care in the U.S. was USD 470.2 million, and it's projected to grow to USD 537.4 million by 2045.

Another major factor propelling the market for diabetic foot ulcer treatment in the U.S. is the increasing geriatric population. Growing geriatric population is the major driver of the diabetes epidemic, as diabetes in older people is directly linked to higher mortality rates and reduced functional status. For instance, the Population Reference Bureau anticipates that the population of Americans aged 65 and above will grow from 58 million in 2022 to 82 million by the year 2050, marking a 47% increase. Additionally, the proportion of this age group within the overall population is expected to expand from 17% to 23%.

The growing R&D activities in the country are also expected to contribute to the market growth in the country. For instance, in April 2024, a team of researchers at the University of Texas at Arlington designed an innovative shoe insole technology designed to lower the risk of diabetic foot ulcers. These ulcers are harmful open wounds that can result in hospital stays and potentially lead to the amputation of a leg, foot, or toe. Such developments are thus expected to contribute to market growth.

Lifestyle changes play a significant role in the increasing incidence of diabetic foot ulcers, thereby influencing market expansion. The move towards less active lifestyles, together with a rise in obesity due to poor nutritional choices, are key contributors to the growing rate of diabetes. Thus, as diabetes becomes more prevalent, the chances of developing complications like foot ulcers also increase.

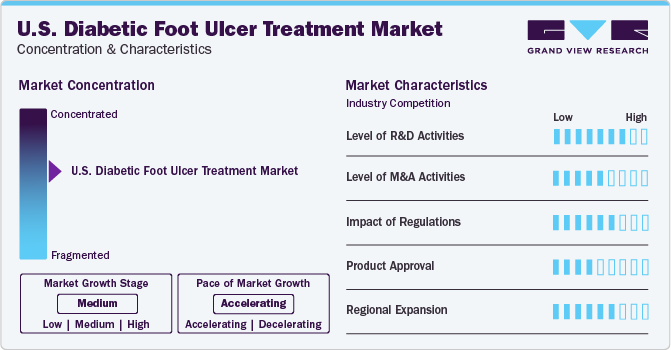

Market Concentration & Characteristics

The industry growth stage is moderate, and the pace of the industry growth is accelerating. The industry for U.S. diabetic foot ulcer treatment has seen significant innovation, marked by the advent of advanced wound care products, improved diagnostic tools, and new therapeutic approaches. These innovations aim to enhance healing processes, reduce infection rates, and ultimately lower the risk of amputations for individuals suffering from diabetic foot ulcers.

Major market players are engaged in several strategic approaches or initiatives to hold a prominent share in the U.S. diabetic foot ulcer treatment industry. For instance, in January 2022, Convatec Group Plc disclosed a definitive agreement to acquire Triad Life Sciences Inc, a medical device company in the U.S. that specializes in creating biological products for surgical wounds, chronic wounds, and burns, aiming to fulfill unmet clinical requirements. This partnership aims to enhance the Convatec Group’s entry into the large and rapidly growing wound biologics segment.

The growing research and development activities in the country are expected to boost industry growth in the country. For instance, in March 2024, Omeza, a company specializing in regenerative skincare and focusing on marine-derived treatments for chronic wounds, announced results from a clinical trial on diabetic foot ulcers (DFU). The trial indicated that the combined use of Omeza OCM and offloading to relieve pressure on the affected foot led to a 91 percent reduction (PAR) within twelve weeks, and a 63 percent reduction within four weeks. The PAR metric is used as an indirect measure of total wound closure, with a 50 percent reduction at the four-week mark in patients with diabetic wounds being a reliable indicator of full healing in the future.

Companies that manufacture U.S. diabetic foot ulcer treatment products are undertaking merger and acquisition activities. This strategic approach seeks to improve technological capabilities, expand industry reach, and maintain competitiveness. For instance, in April 2024, Molnlycke Health Care has announced its plans to acquire P.G.F. Industry Solutions GmbH, an Austrian company known for producing Granudacyn, a line of wound cleansing and moisturizing products.

“With an aging population in combination with increased chronic wounds, such as diabetic foot ulcers or venous leg ulcers, it is our obligation to help ease the burden of wounds on national healthcare regimes”

-Zlatko Rihter, (CEO of Mölnlycke Health Care)

In the U.S., the management of diabetic foot ulcers is regulated through a comprehensive system that combines both federal and state laws, alongside guidelines issued by professional healthcare organizations. The Food and Drug Administration (FDA) is at the forefront of this regulatory structure, with a critical function in sanctioning the use of medications, medical devices, and various treatments specific to diabetic foot ulcer care.

Manufacturers are seeking product approvals by government agencies to stay competitive in the industry. For instance, in October 2023, a new approach for treating diabetic foot ulcers (DFUs) might soon be available to individuals with diabetes in the U.S. ON101 represents an encouraging topical solution expected to receive FDA approval in the next few years. Having received approval from the Taiwan Food and Drug Administration in 2021, ON101 cream, known commercially as Fespixon, is applied topically to manage DFUs.

“ON101 cream is an effective treatment to chronic, non-healing DFUs that have failed to heal via conventional therapy”

-Dr. Yur-Ren Kuo (professor and chief of plastic and reconstructive surgery at Kaohsiung Medical University Hospital in Taiwan)

The geographical reach of U.S. diabetic foot ulcer treatment has been expanding at a moderate to high level. For instance, in March 2023, Medline inaugurated a distribution facility near Hammond Airport. This facility improves the availability of Medline medical supplies in the region.

Treatment Insights

Based on treatment, the biologics segment dominated the market with the largest revenue share of 37.0% in 2023. This dominance is largely due to the efficacy and innovative nature of biologic treatments for diabetic foot ulcers. Including a variety of products like growth factors and skin grafts, biologics deliver targeted therapy by leveraging the body's own biological mechanisms to enhance wound healing and prevent infections. Their significant therapeutic potential, along with rising approvals from regulatory bodies and increasing recognition of their advantages in managing wounds, has elevated the biologics segment to a leading position in the diabetic foot ulcer treatment market.

The therapy devices segment is expected to grow at the fastest CAGR over the forecast period. Therapy devices such as ultrasound therapy, which utilizes sound waves to stimulate healing and reduce inflammation, along with negative pressure wound therapy that employs suction to promote wound healing and remove excess fluids, are becoming increasingly popular. This growth can be attributed to their effectiveness in enhancing wound healing processes, reducing the duration of hospital stays, and also lowering the overall treatment costs.

Ulcer Type Insights

Based on ulcer type, the neuro-ischemic ulcers segment dominated the market with the largest revenue share in 2023. These ulcers are typically characterized by a combination of neuropathy (nerve damage) and ischemia (reduced blood flow), making them particularly challenging to manage. Because diabetic neuropathy can lead to a loss of sensation in the feet, patients may not notice injuries or ulcers forming, while ischemia further complicates the healing process by reducing blood flow to the affected area. As a result, neuro-ischemic ulcers often require comprehensive treatment approaches that address both the neuropathic and vascular components of the condition.

The ischemic ulcers segment is expected to grow at the fastest rate over the forecast period. Ischemic ulcers, or arterial ulcers, form when tissues receive insufficient blood flow, usually in the lower limbs. Several factors contribute to their growth. Conditions like peripheral artery disease (PAD) or diabetes can worsen ischemic ulcers by reducing blood circulation and weakening the immune system. Additionally, infections can exacerbate ulcer progression by damaging tissues and slowing down the healing process.

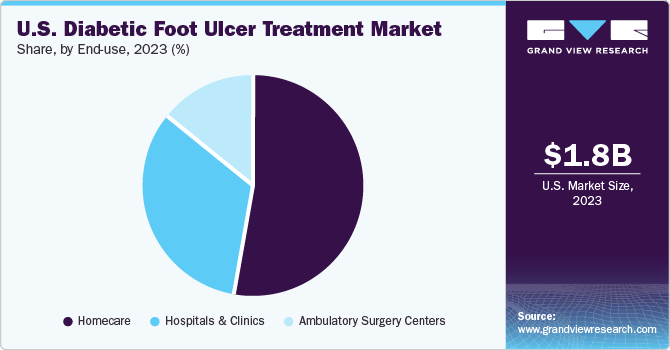

End-use Insights

The homecare segment dominated the market with the largest revenue share in 2023 and is further expected to grow at the fastest CAGR over the forecast period. Advancements in medical technology and the availability of user-friendly wound care products have made it feasible for patients to perform treatments at home under the guidance of healthcare professionals, thus contributing to the segment growth. Furthermore, homecare treatments offer the advantage of personalized care plans beneficial to individual needs and lifestyles, promoting improved treatment outcomes. Additionally, home-based care may enhance patient comfort and convenience, reducing the need for frequent clinic visits and improving overall quality of life.

The hospital and clinic segment also held a significant market share in 2023. Hospitals provide a wide range of resources and expertise, including advanced wound care methods, specialized medical tools, and teams of healthcare professionals from various fields. This allows for a comprehensive approach to treatment, considering not only the wound but also related conditions like diabetes and vascular problems. Additionally, hospital settings offer close collaboration among healthcare providers, allowing for rapid modifications to treatment strategies based on ongoing assessments of how patients are responding. Thus, the aforementioned factors are expected to contribute to market growth.

Key U.S. Diabetic Foot Ulcer Treatment Company Insights

Key players operating in the U.S. diabetic foot ulcer treatment market include 3M Healthcare, Medline Industries, Coloplast Corp., Medtronic Plc, Molnlycke Health Care AB, and others. These players are focusing on enhancing their product offerings through product upgrades, strategic collaborations, and merger & acquisition activities to hold a prominent share in the market.

Key U.S. Diabetic Foot Ulcer Treatment Companies:

- ConvaTec, Group Plc

- 3M Health Care

- Coloplast Corp.

- Smith & Nephew Plc

- B Braun Melsungen AG

- Medline Industries, LP.

- Molnlycke Health Care AB

- Medtronic Plc

Recent Developments

-

In July 2022, Smith+Nephew announced the launch of the WOUND COMPASS Clinical Support App to help reduce variation in wound care practice. The app will provide digital support to healthcare professionals who aid in wound assessment, decision-making, & reducing practice variation.

-

In April 2021, Mölnlycke expanded in Malaysia with the construction of a new factory. This would help the company establish its position in the Malaysian market.

-

In January 2021, Integra LifeSciences completed the acquisition Of ACell, Inc. This acquisition would strengthen Integra's complex wound management portfolio.

U.S. Diabetic Foot Ulcer Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.82 billion

Revenue forecast in 2030

USD 2.47 billion

Growth rate

CAGR of 5.25% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, ulcer type, end-use

Key companies profiled

ConvaTec Group Plc; 3M Health Care; Coloplast Corp.; Smith & Nephew Plc.; B Braun Melsungen AG; Medline Industries, LP; Molnlycke Health Care AB; Medtronic Plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Diabetic Foot Ulcer Treatment Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the U.S. diabetic foot ulcer treatment market report based on treatment, ulcer type, and end-use:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Wound Care Dressings

-

Alginate Dressings

-

Hydrofiber Dressings

-

Foam Dressings

-

Film Dressing

-

Hydrocolloid Dressings

-

Surgical Dressings

-

Hydrogel Dressings

-

-

Biologics

-

Growth Factors

-

Skin Grafts

-

-

Therapy Devices

-

Negative Pressure Wound Therapy

-

Ultrasound Therapy

-

-

Antibiotic Medications

-

Others

-

-

Ulcer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ulcers

-

Ischemic Ulcers

-

Neuro-ischemic Ulcers

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory surgery centers

-

Homecare

-

Frequently Asked Questions About This Report

b. The U.S. diabetic foot ulcer treatment market size was estimated at USD 1.75 billion in 2023 and is expected to reach USD 1.82 billion in 2024.

b. The U.S. diabetic foot ulcer treatment market is expected to grow at a compound annual growth rate of 5.25% from 2024 to 2030 to reach USD 2.47 billion by 2030.

b. Homecare segment dominated the U.S. diabetic foot ulcer treatment market with a share of 53.1% in 2023. This is attributable to the factors such as advancements in medical technology and the availability of user-friendly wound care products.

b. Some key players operating in the U.S. diabetic foot ulcer treatment market include ConvaTec Group Plc; 3M Health Care; Coloplast Corp.; Smith & Nephew Plc.; B Braun Melsungen AG; Medline Industries, LP; Molnlycke Health Care AB; Medtronic Plc

b. Key factors that are driving the U.S. diabetic foot ulcer treatment market growth include the growing prevalence of diabetes in the country, aging population, advancements in treatment technology, growing R&D activities and lifestyle changes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."