- Home

- »

- Food Additives & Nutricosmetics

- »

-

U.S. DHA Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![U.S. DHA Market Size, Share & Trends Report]()

U.S. DHA Market (2025 - 2030) Size, Share & Trends Analysis Report By Source, (Marine, Plant, Micro-algae), By Application (Pharmaceutical, Nutraceutical, Functional Food & Beverages), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-487-2

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. DHA Market Size & Trends

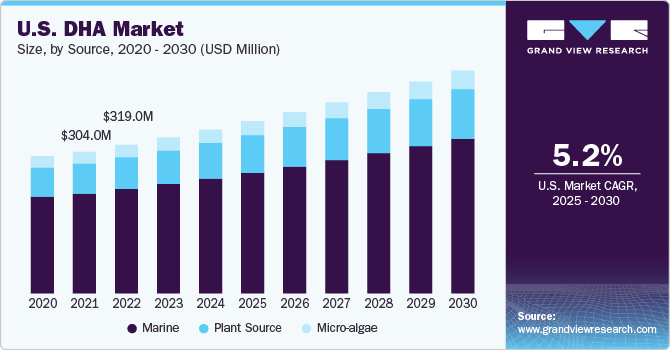

The U.S. DHA market size was estimated at USD 352.11 million in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. The market growth is primarily driven by increasing consumer awareness of the health benefits associated with omega-3 fatty acids. As more individuals recognize the importance of these nutrients for brain and heart health, the demand for DHA-rich products has surged. This trend is particularly evident in the dietary supplement sector, where consumers are actively seeking natural solutions to enhance their well-being.

The dietary supplement sector plays a crucial role in this demand as more individuals seek natural solutions to enhance their well-being. In addition, the incorporation of omega-3s into functional foods and beverages is expanding, catering to health-conscious consumers looking for convenient options. Manufacturers are responding to this trend by developing innovative products that meet the growing appetite for health-promoting ingredients.

Favorable government policies supporting dietary supplements are contributing to market growth. As consumers continue to prioritize health and wellness, the outlook for this market remains strong, with ongoing innovation and a shift towards sustainable sourcing further driving demand. Overall, the landscape is evolving, positioning omega-3s as a key component in the health and wellness sector.

Source Insights

Based on source, the marine segment led the market with the largest revenue share of 70.09% in 2024. Marine sources, particularly fish oil, have traditionally been the primary source of DHA. Fish such as salmon, mackerel, and sardines are rich in omega-3 fatty acids, including the market. However, due to overfishing and sustainability concerns, there is a growing shift towards alternative sources that can provide similar health benefits without depleting marine ecosystems. This has led to increased interest in sustainable aquaculture practices that utilize alternative feeds, including those derived from algae.

While plant sources do not naturally produce products, certain transgenic plants have been developed to produce omega-3 fatty acids, including DHA. These innovations aim to provide a sustainable and vegetarian-friendly option for consumers seeking the health benefits of DHA without relying on fish-derived products. The development of these plant-based sources is part of a broader trend towards sustainable food production and dietary supplements.

Microalgae are emerging as a significant source of DHA, offering a sustainable and environmentally friendly alternative to traditional fish oil. Microalgae can synthesize DHA and EPA, making them a valuable resource for dietary supplements and functional foods. Companies like Arizona Algae Products are leading the way in producing omega-3 oils from green algae, which are used in various food and dietary supplement applications. The market derived from algae is expected to grow significantly, driven by consumer demand for plant-based and sustainable options.

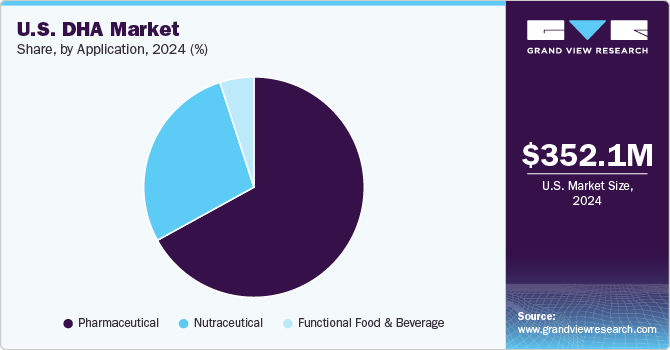

Application Insights

Based on application, the nutraceutical segment led the market with the largest revenue share of 93.90% in 2024, owing to the fact that the DHA is widely recognized as a key ingredient in the nutraceutical sector, which encompasses products that provide health benefits beyond basic nutrition. These products often include dietary supplements that promote heart health, cognitive function, and overall wellness. The increasing consumer awareness of the health benefits associated with omega-3 fatty acids, particularly products, has driven demand for nutraceuticals. Research indicates that long-chain polyunsaturated fatty acids products play a significant role in various biochemical processes, supporting cell growth and maintenance, which enhances their appeal in this market.

In the pharmaceutical sector, DHA is utilized for its therapeutic properties. It is often included in formulations aimed at treating or preventing chronic diseases, such as cardiovascular diseases and neurodegenerative disorders. The recognition of the market’s role in supporting brain health has led to its incorporation into prescription medications and therapeutic supplements. As the pharmaceutical industry continues to explore the potential of nutraceuticals as alternatives or complements to traditional medications, the market is positioned as a valuable ingredient due to its well-documented health benefits.

DHA is increasingly being integrated into functional foods and beverages, which are designed to provide health benefits beyond basic nutrition. This includes products like fortified dairy items, snacks, and beverages that contain added products to enhance their nutritional profile. The trend towards healthier eating habits and the demand for functional foods that support specific health outcomes have fueled the incorporation of products into various food products. Consumers are looking for convenient ways to include beneficial nutrients in their diets, making DHA-enriched foods and beverages an attractive option.

Country Insight

U.S. DHA Market Trends

The DHA market in the U.S. is a significant segment of the broader omega-3 fatty acids market, which also includes Eicosapentaenoic Acid (EPA). The market is primarily sourced from fish oil and algae and is widely recognized for its health benefits, particularly in supporting brain health, cardiovascular health, and overall wellness.

Key U.S. DHA Company Insights

Some of the key players operating in the market include AK BIOPHARM CO., LTD., Bizen Chemical Co., Ltd., Corbion, Croda International Plc, Epax, Glentham Life Sciences Limited, Haihang Industry, KD Pharma Group SA, LKT Laboratories, Nissui.

-

AK BioPharm Co., Ltd. is a prominent player in the biopharmaceutical industry, primarily recognized for its specialization in omega-3 fatty acids. The company is involved in the manufacturing and sale of various unsaturated fatty acids, including Eicosapentaenoic Acid (EPA) and Docosahexaenoic Acid, which are essential components of omega-3 supplements. Additionally, AK BioPharm offers products such as Omega 7 and arachidonic acids.

-

Croda International Plc is a British specialty chemicals company headquartered in Snaith, England. The company is recognized for its innovative and high-performance ingredients and technologies that serve a wide range of industries, including personal care, health care, and industrial applications. Croda is known for its commitment to sustainability and the development of natural-based products, positioning itself as a leader in the specialty chemicals sector.

Key U.S. DHA Companies:

- AK BIOPHARM CO., LTD.

- Bizen Chemical Co., Ltd.

- Corbion

- Croda International Plc

- Epax

- Glentham Life Sciences Limited

- Haihang Industry

- KD Pharma Group SA

- LKT Laboratories

- Nissui

Recent Developments

-

In September 2023, Corbion launched AlgaPrime DHA P3 to address the demand for active nutrition in the pet food industry. The product offers higher levels of DHA (35%) in the biomass powder form and enables the reduction of dependency on traditional omega-3 sources. AlgaPrime DHA P3 is also suitable for use in wet, dry, and Injection-mold applications allowing the use of long-chain omega-3s.

-

In September 2023, Epax upgraded its omega-3 fatty acids facility in Aalesund, Norway, with the installation of its new molecular distillation technology, EQP+Tech. The upgrade, worth USD 40 million, increased the company’s distillation capacity as well as the output of omega-3 concentrates.

U.S. DHA Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 370.25 million

Revenue forecast in 2030

USD 478.65 million

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application

Country scope

U.S.

Key companies profiled

AK BIOPHARM CO.,LTD.; Bizen Chemical Co., Ltd.; Corbion; Croda International Plc; Epax; Glentham Life Sciences Limited; Haihang Industry; KD Pharma Group SA; LKT Laboratories; Nissui

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. DHA Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. DHA market report based on the source, & application:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Marine

-

Plant

-

Micro-algae

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Nutraceutical

-

Functional Food & Beverages

-

-

Frequently Asked Questions About This Report

b. The U.S. DHA market was valued at USD 352.11 million in 2024 and is projected to reach USD 370.25 million by 2025

b. The global U.S. DHA market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 478.65 million by 2030.

b. The U.S. DHA market is a significant segment of the broader omega-3 fatty acids market, which also includes Eicosapentaenoic Acid (EPA). Market is primarily sourced from fish oil and algae and is widely recognized for its health benefits, particularly in supporting brain health, cardiovascular health, and overall wellness.

b. Some of the key players operating in the market include AK BIOPHARM CO.,LTD., Bizen Chemical Co., Ltd., Corbion, Croda International Plc, Epax, Glentham Life Sciences Limited, Haihang Industry, KD Pharma Group SA, LKT Laboratories, Nissui

b. The growth of the DHA market is primarily driven by increasing consumer awareness of the health benefits associated with omega-3 fatty acids

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.