- Home

- »

- Medical Imaging

- »

-

U.S. Dermatology Imaging Devices Market, Report, 2030GVR Report cover

![U.S. Dermatology Imaging Devices Market Size, Share & Trends Report]()

U.S. Dermatology Imaging Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Modality (Digital Photographic Imaging, OCT, Dermatoscope), By Application (Skin Cancers, Inflammatory Dermatoses), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-335-3

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

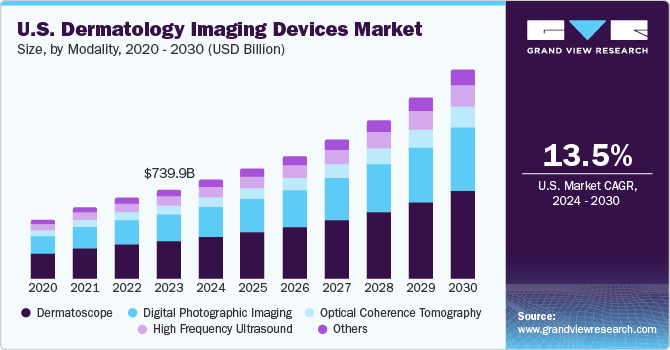

The U.S. dermatology imaging devices market size was estimated at USD 815.5 million in 2023 and is projected to grow at a CAGR of 13.50% from 2024 to 2030. The rising incidence of skin cancer, the growing prevalence of skin disorders, and technological advancements are major factors driving the market's growth. According to the American Academy of Dermatology Association, the most prevalent type of cancer in the U.S. is skin cancer, affecting around 9,500 individuals daily. It is predicted that one in every five Americans develops skin cancer during their lifetime, with over 5.4 million cases managed annually in the country.

Technological advancements are a significant driver in the U.S. market. For instance, In April 2024, Lumisight (pegulicianine) was approved by the FDA for use in adults with breast cancer. This fluorescent imaging drug is intended to help detect cancerous tissue inside the resection cavity after the primary tumor has been removed during a lumpectomy. Lumisight is given to patients as an intravenous injection before surgery. Lumisight is utilized alongside the Lumicell Direct Visualization System (DVS) or any other fluorescence imaging equipment that has received FDA approval for employment with pegulicianine in breast lumpectomy procedures.

Innovations such as high-resolution imaging, AI integration, 3D visualization, optical coherence tomography, digital photography, and high-frequency ultrasound have significantly enhanced dermatologists' diagnostic capabilities. For instance, In April 2024, researchers from Stanford Medicine discovered that artificial intelligence, particularly deep learning-based computer algorithms, enhances the accuracy of skin cancer diagnoses among healthcare professionals. Furthermore, In January 2024, US FDA approved the innovative DermaSensor, the first AI-powered tool for diagnosing over 200 types of skin cancer, including melanoma and other common carcinomas. Utilizing AI-driven spectroscopy, DermaSensor offers real-time, precise detection by analyzing lesions at the cellular level. This approval was based on a study led by the Mayo Clinic involving more than 1000 patients, confirming the device's effectiveness.

The public health programs offered by the American Academy of Dermatology (AAD) are significantly driving the market growth. Recent statistics suggest that about 20% of Americans will face skin cancer during their lives, with around 9,500 new cases diagnosed daily in the U.S. The AAD's skin cancer awareness education and public awareness campaigns are helping to increase public understanding of the importance of early detection and prevention of skin cancer. This heightened awareness drives the demand for dermatology imaging devices that can detect skin cancer early on, such as digital photographic imaging systems and optical coherence tomography (OCT) devices. The AAD's exclusive summer camp provides kids with chronic dermatological conditions and an exceptional camping experience, including medical support. The SPOT Skin Cancer initiative aims to raise awareness about skin cancer. Through teaching the public about ways to lower their risk of skin cancer and how to detect it early, they hope to alter habits and save lives.

The growing demand for minimally invasive dermatology procedures such as cryosurgery, laser surgery, radiofrequency surgery, chemical peels, microdermabrasion, micro needling, injectable therapies is driving the demand for dermatology imaging devices that can provide high-resolution images of the skin without the need for invasive procedures. Patients increasingly seek non-invasive diagnostic and treatment options to avoid the risks and discomfort associated with traditional invasive procedures. This shift towards minimally invasive approaches is further fueled by increased awareness about skin health, particularly the early detection of skin cancers, and the growing focus on cost-effective and patient-centric care. As a result, the demand for dermatology imaging devices that can deliver accurate, non-invasive diagnostic capabilities is rising, driving the market growth.

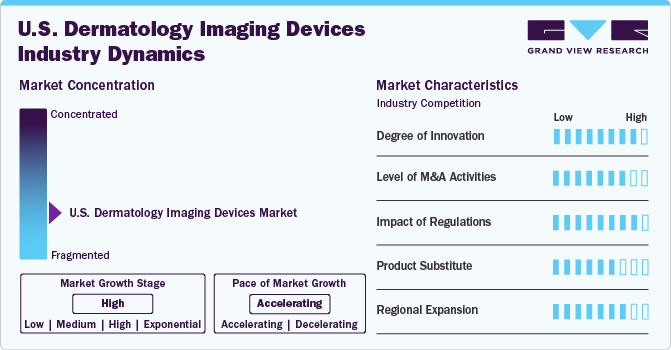

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market has witnessed a high degree of innovation, marked by several instances of regulatory approvals, partnerships, and collaborations. In recent years, the market has experienced an increase in the introduction of new products, presenting challenges for established companies to maintain their positions amidst market fluctuations. Nevertheless, prominent companies significantly invest in research and development efforts to create advanced imaging technologies, anticipated to drive market expansion. In May 2024, Epredia and NovaScan, Inc. announced a U.S. exclusive deal to distribute MarginScanTM, a device for real-time detection of non-melanoma skin cancer. Epredia is working with Avantik to make the device available to Mohs surgeons.

The degree of innovation is high in the market driven by advancements in imaging technologies, product launches, and regulatory approvals. For Instance, in May 2023, the U.S. FDA gave Breakthrough Device Designation to Orlucent’s Skin Fluorescence Imaging System for its capability to identify suspicious moles. This development marks a major advancement in imaging technology for dermatology and plays a crucial role in the early identification of skin cancer, including melanoma.

The degree of mergers and acquisitions (M&A) in the U.S. market is moderate. Several market players are engaged in M&A activities to expand their product portfolios, enhance their market presence, and improve their competitive edge. For instance, in March 2024, FotoFinder Systems acquired DermLite LLC, a renowned manufacturer of handheld dermatoscopes. The merger leverages DermLite's advanced dermatoscope technology with FotoFinder's advanced imaging systems, creating a comprehensive range of products and services for modern dermatological diagnostics and research.

The impact of regulations on the U.S. market is significant. The U.S. Food and Drug Administration (FDA) has strict regulations regarding the approval of medical devices, which can affect the availability and support of existing devices and the introduction of new devices. For Instance, in January 2024, the Dermasensor was approved by the FD A for its technology that utilizes AI to identify skin cancer. This device employs elastic scattering spectroscopy (ESS) to assess the properties of cells and subcells in questionable skin lesions, aiming to identify melanoma, basal cell carcinoma, and squamous cell carcinoma.

The degree of substitutes in U.S. market is moderate. The progress in telemedicine and teledermatology has introduced new devices enabling dermatologists to examine and manage patients from a distance. This development could challenge the U.S. market for conventional dermatology imaging devices.

The market is expanding in the Southeastern and Midwestern regions of the U.S. Specifically, states such as Florida, Georgia, Texas, Illinois, and Ohio are seeing significant growth. This expansion is driven by factors like an increasing aging population, rising awareness of skin cancer, and the adoption of advanced imaging technologies. However, challenges include the need for skilled professionals, competition from established players, and the cost of implementing new technologies. The benefits of expansion in these regions include access to a large patient pool, potential for higher revenue, and the opportunity to serve underserved communities.

Modality Insights

Based on modality, the dermatoscope segment led the market with the largest revenue share of 41.18% in 2023. Dermatoscopes provide dermatologists with a magnified and illuminated view of skin lesions, enabling them to identify characteristic patterns and structures that are not visible to the naked eye. This enhanced visualization improves diagnostic accuracy, particularly in differentiating benign and malignant skin lesions, reducing the need for unnecessary biopsies. Continuous improvements in dermatoscope technology, such as higher resolution, better illumination, and integration with digital imaging, have further enhanced their diagnostic capabilities.

The digital photographic imaging market is growing at the fastest CAGR over the forecast period. The growth of this segment is attributed to the ease of availability of smartphones, which allow capturing high-quality images of skin lesions, and handheld cameras with high-resolution transcripts of the image into a document of the patient's condition. In addition, the rise in skin cancer cases and the growing demand for non-invasive diagnostic procedures are also driving the growth of this segment. For instance, the MoleScope, FotoFinder, and Canfield VISIA are some of the digital photographic imaging devices used in the U.S. market, providing high-resolution skin images and allowing dermatologists to identify and track changes in the skin over time.

Application Insights

Based on application, the skin cancer segment led the market with the largest revenue share of 48.24% in 2023. This was due to the higher prevalence and increased awareness of skin cancers. For instance, the American Cancer Society reports that in the U.S., skin cancers, primarily basal and squamous cell types, are the most prevalent form of cancer. Around 5.4 million cases are diagnosed annually, affecting approximately 3.3 million individuals, with basal cell cancers accounting for about 8 out of 10 cases. Squamous cell cancers are less frequent. The increasing incidence of skin cancer is expected to drive the demand for dermatology imaging devices. Technological advancements, such as optical coherence tomography (OCT) and confocal microscopy, are transforming the diagnosis of skin disorders by providing high-resolution images of skin layers in a non-invasive procedure.

The plastic and reconstructive surgery segment is anticipated to grow at a significant CAGR over the forecast period, driven by the rising demand for minimally invasive procedures and technological innovations in the field of plastic and reconstructive surgery. As the number of cosmetic surgeries continues to rise, there is a growing need for accurate imaging technologies to achieve optimal results. According to the American Society of Plastic Surgeons data, the number of cosmetic and reconstructive procedures performed in the United States increased significantly in 2022, with a total of 26.2 million procedures. This represents a 19% increase since 2019.

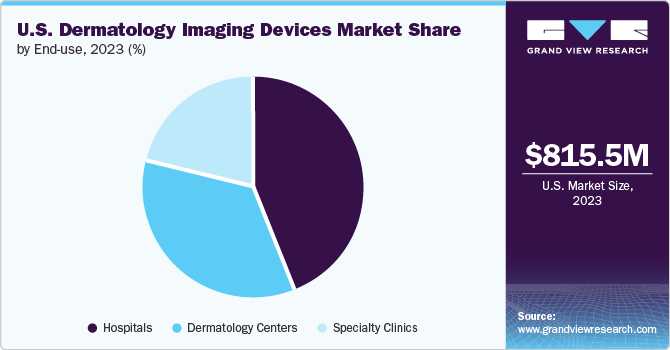

End Use Insights

Based on end use, the hospital segment accounted for the largest revenue share of 43.62% in 2023. This is due to the widespread adoption of advanced dermatology imaging devices in hospitals, which enable dermatologists to accurately diagnose and effectively treat various skin conditions, including skin cancer. Hospitals employ highly trained and experienced dermatologists and imaging technicians, ensuring optimal utilization of these advanced technologies. They have the necessary infrastructure, resources, and expertise to provide patients with comprehensive diagnosis, treatment, and follow-up care. For Instance, in March 2024, the renewed collaboration between GE HealthCare and Hartford HealthCare is expected to strengthen the hospital segment of the market further, as it ensures that Hartford HealthCare continues to have access to GE HealthCare's advanced dermatology imaging technologies, enhancing its ability to provide high-quality care to patients.

The dermatology centers segment is expected to experience at a significant CAGR during the forecast period. This growth can be attributed to the increasing popularity of dermatology centers among patients seeking treatment for skin-related issues. These centers offer specialized care and expertise in skin-related issues, which not always be available in hospitals. For instance, dermatology centers utilize advanced imaging technologies such as dermatoscopes and digital photographic imaging systems to diagnose and treat various skin conditions. These devices provide high-resolution images of the skin, enabling dermatologists to identify characteristic patterns and structures that are not visible to the naked eye.

Key U.S. Dermatology Imaging Devices Company Insights

The key market players operating in the U.S. market include GE HealthCare, VisualSonics, Koninklijke Philips N.V., Canfield Scientific, Inc., FotoFinder Systems GmbH, e-con Systems Inc., and others. These players are focusing on mergers, acquisitions, and strategic partnerships to strengthen their market position, enhance their product portfolio, and gain access to new technologies and expertise.

Key U.S. Dermatology Imaging Devices Companies:

- Caliber Imaging and Diagnosis.

- Canfield Scientific, Inc.

- Clarius

- Cortex Technology

- Courage+Khazaka electronic GmbH

- Comp6

- DermLite

- DRAMIŃSKI S. A.

- e-con Systems Inc.

- FotoFinder Systems GmbH

- GE HealthCare

- Koninklijke Philips N.V.

- Longport, Inc.

- Michelson Diagnostics Ltd (MDL)

- VisualSonics

Recent Developments

-

In June 2024, the U.S. FDA has granted Breakthrough Device Designation to Enspectra Health’s cutting-edge AI-powered VIO Skin Platform. This platform combines the FDA-cleared VIO technology with VIO.ai NMSC software, aiming to aid physicians in assessing lesions suspected of being basal cell carcinoma (BCC) and squamous cell carcinoma (SCC) in selected high-risk populations

-

In March 2024, EMZ Partners portfolio company FotoFinder Systems, recognized as a global leader in skin imaging solutions, finalized an agreement to acquire DermLite, manufacturer of handheld dermatoscopes. This acquisition represents EMZ Partners' first investment in the U.S.

-

In January 2024, GE HealthCare had announced an agreement to acquire IMACTIS, a French company specializing in computed tomography (CT) interventional guidance technology. The acquisition will strengthen GE HealthCare's interventional guidance offerings, providing more accurate and efficient procedures for interventional radiologists and hospitals

-

In June 2023, DeepX Diagnostics, a company specializing in teledermatology and skin cancer diagnostics, has received approval from the US Food and Drug Administration (FDA) for its digital dermatoscopy device, DermoSight. This approval allows DeepX Diagnostics to offer teledermatology screening for suspicious skin cancer lesions in the United States. This marks the company’s entry into the US market following its successful deployment in Europe, where it has already been used to assess over 180,000 skin lesions in pharmacies and primary care clinics

U.S. Dermatology Imaging Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 904.2 million

Revenue forecast in 2030

USD 1933.5 million

Growth rate

CAGR of 13.50% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, application, end use

Country scope

U.S.

Key companies profiled

Caliber Imaging and Diagnosis; Canfield Scientific, Inc.; Clarius; Cortex Technology; Courage+Khazaka electronic GmbH; DermLite; DRAMIŃSKI S. A.; e-con Systems Inc.; FotoFinder Systems GmbH; GE HealthCare; Koninklijke Philips N.V.; Longport, Inc.; Michelson Diagnostics Ltd (MDL); VisualSonics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dermatology Imaging Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dermatology imaging devices market report based on modality, application, and end use:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Photographic Imaging

-

Optical Coherence Tomography (OCT)

-

Dermatoscope

-

High Frequency Ultrasound

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Cancers

-

Inflammatory Dermatoses

-

Skin psoriasis

-

Eczema (Atopic dermatitis)

-

Others

-

-

Plastic & Reconstructive Surgery

-

Others

-

-

End Use Outlook (Revenue in USD Million; 2018 - 2030)

-

Hospitals

-

Dermatology centers

-

Specialty Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. dermatology imaging devices market size was estimated at USD 815.5 million in 2023 and is expected to reach USD 904.2 million in 2024.

b. The U.S. dermatology imaging devices market is expected to grow at a compound annual growth rate of 13.50% from 2024 to 2030 to reach USD 1933.5 million by 2030.

b. Dermatoscope dominated the U.S. dermatology imaging devices market with a share of 41.17% in 2023 as it offers dermatologists and healthcare providers a non-invasive and highly effective method for examining skin lesions and conditions.

b. Some key players operating in the U.S. dermatology imaging devices market include Canfield Scientific, Inc.; FotoFinder Systems GmbH; e-con Systems Inc.; Courage+Khazaka electronic GmbH; Longport, Inc.; Cortex Technology; DRAMIŃSKI S. A.; GE HealthCare; VisualSonics; Clarius; Koninklijke Philips N.V.; Michelson Diagnostics Ltd (MDL); Caliber Imaging and Diagnosis.; and DermLite

b. Key factors that are driving the market growth include technological advancements in high-resolution imaging systems, increasing prevalence of skin disorders necessitating accurate diagnostics, and expanding adoption of digital and AI-integrated dermatoscopes for enhanced diagnostic accuracy and efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.