- Home

- »

- Medical Devices

- »

-

U.S. Dermatology Devices Market, Industry Report, 2030GVR Report cover

![U.S. Dermatology Devices Market Size, Share & Trends Report]()

U.S. Dermatology Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Diagnostic Devices, Treatment Devices), By Application, By End-use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-284-3

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Dermatology Devices Market Trends

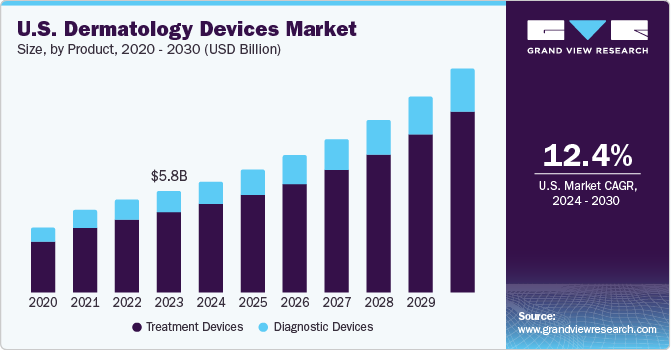

The U.S. dermatology devices market size was estimated at USD 5.77 billion in 2023 and is projected to grow at a CAGR of 12.4% from 2024 to 2030. The increasing incidence rate of skin diseases and skin cancer is driving the market growth. According to the Skin Cancer Foundation, between 2014 and 2024, there was a 32% annual rise in newly diagnosed invasive melanoma cases in the U.S.

A report published by the American Society of Plastic Surgeons (APAS) in 2022 revealed that the year witnessed over 2 million cosmetic procedures, with a significant portion focusing on skin-related treatments including, resurfacing and tightening. This trend highlights the increasing importance placed on appearance. The growing focus on personal appearance is further influenced by the impact of social media platforms, which often lead individuals to feel self-conscious about their body image. According to the Department of Dermatology at Broward Health in Florida and other studies, social media strongly influences many individuals to consider cosmetic surgeries.

There has been an upward trend regarding the adoption of technologically advanced equipment in the dermatology branch. Microdermabrasion devices are becoming increasingly popular for non-invasive exfoliation. Acne and anti-aging treatments have been raising the demand for LED light therapy devices due to their efficacy in these treatments.

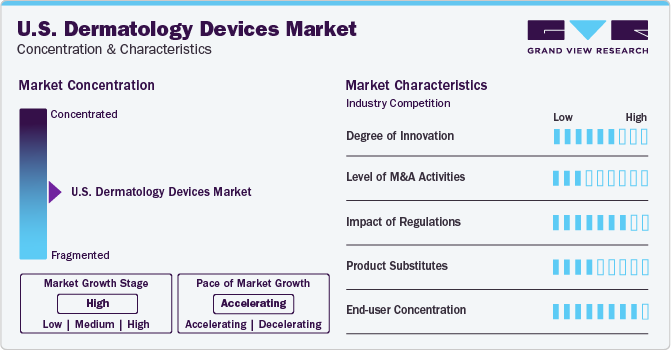

Market Concentration & Characteristics

Dermatology devices have witnessed a revolution due to innovations in imaging technologies. High-resolution imaging breakthroughs such as optical coherence tomography and confocal microscopy have aided significantly in more accurate and earlier detection of skin abnormalities by delivering more detailed insights into skin structures. As a result, the precision of diagnosis and, subsequently, treatment planning has risen considerably.

Acquisitions, collaborations, and new product launches are some of the key strategies undertaken by the market players in the U.S. dermatology devices industry. In 2021, Alma Lasers, a global leader in medical and aesthetics solutions, launched the AlmaPrimeX, a non-invasive platform for skin tightening and body contouring, that is beneficial in smoothening the experience of professional medical practitioners.

The FDA requires companies to submit pre-market applications, comply with quality system regulations, and conduct clinical trials. Strict regulatory policies for medical devices in the country influence the demand for dermatology devices. Manufacturers need help in terms of bringing their products to market due to regulations aimed at ensuring the quality, safety, and effectiveness of medical devices. The FDA approvals ensure the safety of patients and ultimately benefit the market.

Substitutes such as manual examination, traditional methods for treatment such as electrolysis and chemical peels, among others, topical treatments, home remedies, and oral medications pose a moderate to low degree of threat to the dermatology devices industry in the U.S. Chemical peels, a substitute for laser treatments to address uneven skin tone, acne scars, and wrinkles, offer less invasive options to patients. However, their effectiveness tends to be milder and requires multiple applications in some cases.

Product Insights

The treatment devices segment led the market with the largest revenue share of 79.5%in 2023. New product launches, especially in laser devices, coupled with the growing demand for treatments for melanoma and non-melanoma skin cancer, are driving factors for the growth of this segment in the U.S. In March 2022, Reveal Lasers LLC. announced the launch of Attiva, a device equipped with mini canula-delivered intelligent radiofrequency (iRF) that enhances the structure of the skin on the body and skin with high efficacy and precision.

The diagnostic devices segment accounted for a considerable market share in 2023. The presence of clinical chemistry analyzers and immunoassays in these devices aids them in diagnosing a range of skin conditions with remarkable accuracy in the early stages. This high degree of accuracy helps contribute to better patient outcomes through timely intervention and treatment. It is expected to drive the demand for diagnostic devices over the forecast period.

The growing prevalence of skin diseases such as melanoma and non-melanoma skin cancers is expected to fuel the demand for diagnostic devices. For instance, approximately 5.4 million new cases of non-melanoma skin cancer are diagnosed every year in the U.S. as per the Skin Cancer Foundation.

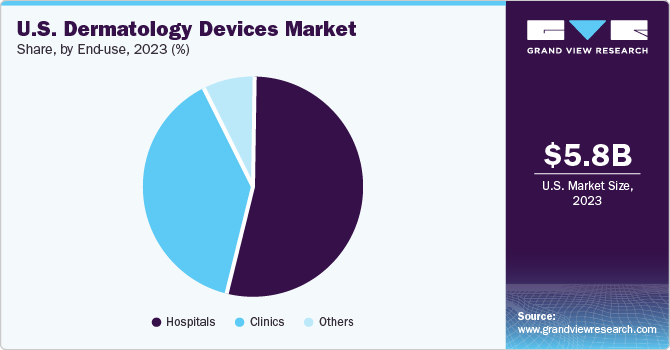

End-use Insights

Based on end-use, the hospital segment led the market with the largest revenue share of 53.8% in 2023 and is projected to grow at the fastest CAGR over the forecast period. The presence of specialized and advanced equipment coupled with established infrastructure for advanced treatments are key factors that are expected to continue to drive the growth of this sub-segment.

The clinics segment is projected to witness at the fastest CAGR over the forecast period. More than 5,000 dermatology clinics were registered in the U.S. in 2022. The rising prevalence of skin cancers and the growing demand for cosmetic surgeries are expected to drive the market growth during the forecast period.

Application Insights

Based on application, the treatment segment accounted for the largest market share in 2023, due to the high demand for hair removal procedures, skin rejuvenation procedures, and skin resurfacing, among others. For instance, according to the results of procedural research carried out by American Society of Plastic Surgeons (ASPS), there were 26.2 million surgical and minimally invasive reconstructive and cosmetic procedures performed in 2022.

The diagnostics segment held a considerable market share in 2023 and is estimated to grow at the fastest CAGR over the forecast period. The growth in the geriatric population is expected to contribute to the demand for diagnostics due to the susceptibility of older adults to skin conditions. As per the Population Reference Bureau, the geriatric population in the U.S. is projected to increase by 47% by the year 2050, racking up the population number to 82 million.

Key U.S. Dermatology Devices Company Insights

Some of the key players operating within the market include Cutera, Inc., Candela Medical Corporation, and Bausch Health Companies Inc.

-

Cutera, Inc. is a public company engaged in the manufacture of energy devices focusing on integrating dermatology and aesthetics. The firm has multiple energy products to its name that aid in skin treatment, such as acne, skin revitalizing, hair removal, tattoo removal, and scar revisions, among others. The company has its headquarters in the U.S. and has offices in several other countries, such as Australia, Belgium, France, Switzerland, Spain, Japan, and the UK

-

Candela Corporation is a medical aesthetic device company owned by Apax Partners, a global private equity advisory firm. The company manufactures medical aesthetic lasers, IPL, and R.F. micro-needling machines. The company has a wide distribution network covering over 65 countries and multiple continents. The company's products cater to a range of treatments, such as skin rejuvenation, skin resurfacing, vascular treatments, scars, stretch marks, hair removal, tattoo removal, and pigmented lesions, among others

-

Bausch Health Companies Inc. is a company that develops and manufactures a variety of medical products, primarily in neurology, gastroenterology, international pharmaceuticals, and dermatology. The company also manufactures a wide range of generic and branded pharmaceuticals and over-the-counter (OTC) products directly and indirectly across 90 nations and regions, including the U.S., Europe, Latin America, Canada, Africa, the Middle East, and Asia Pacific

Key U.S. Dermatology Devices Companies:

- Cutera, Inc.

- Genesis Biosystems, Inc.

- Cytrellis, Inc.

- Candela Medical Corporation

- Bausch Health Companies Inc.

- DermLite.

- Cynosure Inc.

- Avita Medical, Inc,

- Skin Science Solutions, Inc.

- Canfield Scientific, Inc.

Recent Developments

-

In June 2022, Cynosure Inc. launched the PicoSure Pro device, marking the debut of the sole 755nm picosecond laser endorsed by the FDA (Food and Drug Administration). Operating at an incredibly rapid rate, the laser administers energy in durations of a trillionth of a second. It employs pressure rather than heat to provide secure and efficient procedures for skin rejuvenation and the correction of unwanted pigmentation across various skin types

-

In April 2022, Skin Science Solutions, Inc. announced the launch of one roboderm, a device that makes use of cellular technology to deliver non-invasive and painless facial and body rejuvenation. The device aids in providing treatments such as cellulite reduction, body reshaping, skin tightening, stretch mark reduction, wrinkle reduction, face lifts, and body reshaping, among others

-

In December 2021, Canfield Scientific, Inc. announced the establishment of Canfield Scientific s.r.l., created as a result of the company’s acquisition of Medici Medical s.r.l. The latter is a company that has created multiple recognized products in dermoscopy. Canfield Scientific, Inc. has expanded its operations through this acquisition and acquired a larger customer base while leveraging the value obtained from both the companies’ technological prowess and expertise

U.S. Dermatology Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.32 billion

Revenue forecast in 2030

USD 12.73 billion

Growth rate

CAGR of 12.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, company ranking, trends, and growth factors

Segments covered

Product, application, end-use, region

Key companies profiled

Cutera, Inc.; Genesis Biosystems, Inc.; Candela Medical Corporation; Bausch Health Companies Inc.; DermLite.; Cynosure Inc.; Avita Medical, Inc,; Skin Science Solutions, Inc.; Canfield Scientific, Inc.

Customization scope

Free customization of report (equivalent to up to 8 analyst’s working days) with purchase. Alteration or addition to country, regional & segment scope.

Purchase and pricing options

Avail customizable purchase options to obtain your exact research needs. Explore purchase options

U.S. Dermatology Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. dermatology devices market report based on product, patient type, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Devices

-

Dermatoscopes

-

Microscopes

-

Other Imaging Devices

-

Biopsy Devices

-

-

Treatment Devices

-

Light Therapy Devices

-

Lasers

-

Electrosurgical Equipment

-

Liposuction Devices

-

Microdermabrasion Devices

-

Cryotherapy Devices

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics Application

-

Skin Cancer Diagnosis

-

Other

-

-

Treatment Application

-

Hair Removal

-

Skin Rejuvenation

-

Acne, Psoriasis, and Tattoo Removal

-

Wrinkle Removal and Skin Resurfacing

-

Body Contouring and Fat Removal

-

Cellulite Reduction

-

Vascular and Pigmented Lesion Removal

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. dermatology devices market size was valued at USD 5.77 billion in 2023 and is expected to reach USD 6.32 billion in 2024

b. The U.S. dermatology devices market is projected to grow at a compound annual growth rate (CAGR) of 12.4% from 2024 to 2030 to reach USD 12.73 billion by 2030

b. The treatment devices segment dominated the market in the year 2023, accounting for around 80% of the market share. New product launches, especially in laser devices, coupled with the growing demand for treatments for melanoma and non-melanoma skin cancer, are driving factors for the growth of this segment in the U.S.

b. Some of the key players operating within the market include Cutera, Inc., Candela Medical Corporation, and Bausch Health Companies Inc., among others.

b. The increasing incidence rate of skin diseases and skin cancer is driving the growth of the market. According to the Skin Cancer Foundation, between 2014 and 2024, there was a 32% annual rise in newly diagnosed invasive melanoma cases in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.