- Home

- »

- Medical Devices

- »

-

U.S. Dental Service Organization Market, Industry Report, 2030GVR Report cover

![U.S. Dental Service Organization Market Size, Share & Trends Report]()

U.S. Dental Service Organization Market Size, Share & Trends Analysis Report By Service (Human Resources, Marketing & Branding, Medical Supplies procurement), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-295-8

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

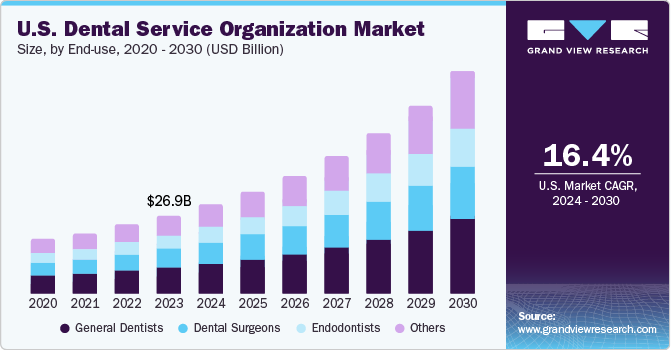

The U.S. dental service organization market size was estimated at USD 26.9 billion in 2023 and is projected to grow at a CAGR of 16.4% from 2024 to 2030. An increase in the number of patients with dental conditions, increasing expenditure on dental care, and improved efficiency in non-clinical business management by dental service organizations (DSOs) are some of the major factors driving the market growth.

Most dental practices are increasingly partnering with dental service organizations as they offload administrative burdens and provide access to top-tier technology, allowing the professionals to focus solely on patient care and achieve a better work-life balance. For instance, in December 2023, Heartland Dental, a dental service organization (DSO), partnered with VideaHealth made VideaAI available to support dental facilities to deliver better care through improved clinical operations.

The U.S. dental industry is experiencing significant growth, driven by factors such as increasing awareness of oral health, an aging population with more complex dental needs, and advancements in dental technology. This growth in the dental industry has led to an increased demand for dental services, contributing to the expansion of the dental service organization market. Moreover, these organizations provide dentists with an opportunity to focus on clinical work while benefiting from the business expertise and support offered by them. This partnership allows dentists to concentrate on their core competencies, leading to increased job satisfaction and improved patient care.

Advancements in dental technology have led to the development of new procedures, equipment, and software to improve patient outcomes and streamline dental practice management. Dental service organizations can facilitate the adoption of these technologies across their network of dental practices, providing a competitive advantage and driving growth in the market. According to an article published in November 2023, Dental Service Organization (DSO) University announced its opening in Arizona. This is done with the aim of releasing its new cutting-edge training management software platform and continue its education service for dental service organizations and their staff.

The drivers of the dental service organization market include the growing dental industry, increased dentist entrepreneurship, technology adoption, managed care and dental insurance, enhanced practice management, dental talent recruitment and retention, and the emergence of telehealth and remote dental service. These factors contribute to the continued growth and development of the market. Moreover, several steps are being taken to support and recognize the significant contributions to quality dental care and enhanced patient health. In March 2024, Pacific Dental Services (PDS), which is a dental support organization in the country, celebrated the annual Dental Assistants Recognition Week with the American Dental Assistants Association (ADAA).

Market Concentration & Characteristics

Market growth stage is high, and the pace of market growth is accelerating. Dental service organizations provide centralized management for multiple dental practices, allowing for streamlined operations, improved efficiency, and cost savings. This centralized approach enables these organizations to provide better support to dental practices, leading to increased growth and profitability.

The U.S. market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, in 2020, Smile Brands acquired Midwest Dental, a dental service organization. This merger was carried out with the aim of expanding the company, Smile Brands. Moreover, in December 2022, MemorialCare, a nonprofit integrated health system from Southern California integrated health system, partnered with Pacific Dental Services to bring dentists and physicians together to offer patients comprehensive whole-person health.

The dental service organization (DSO) market is regulated by various regulatory bodies and laws to ensure the protection of patients, maintain professional standards, and promote fair competition. It is governed by various regulatory bodies and laws, including the Federal Trade Commission, healthcare regulatory agencies, state dental boards, HIPAA, OSHA, EEOC, Sarbanes-Oxley Act, and the Securities and Exchange Commission.

Regional expansion is an important factor in the growth of U.S. dental service organizations (DSOs) market as it provides benefits such as, increased accessibility, enhanced operational efficiency, and professional development opportunities. For instance, in March 2023, United Dental Corporation acquired its second tranche of dental practices across the U.S. that included seven clinics located in Georgia, Arizona, and California.

End-use Insights

The general dentists segment dominated the market in 2023 and is expected to grow at the fastest CAGR over the forecast period. General dentists often struggle with managing the administrative aspects of dental practice, such as accounting, human resources, and marketing. The dental service organization can provide such administrative support, allowing dentists to focus on patient care and clinical work, improving their overall job satisfaction. DSOs can also negotiate better prices for supplies, equipment, and insurance due to their size and purchasing power. The general dentists demand these organizations due to the administrative support, economies of scale, advanced technology, shared knowledge and expertise, access to specialty services, and succession planning benefits provided by DSOs.

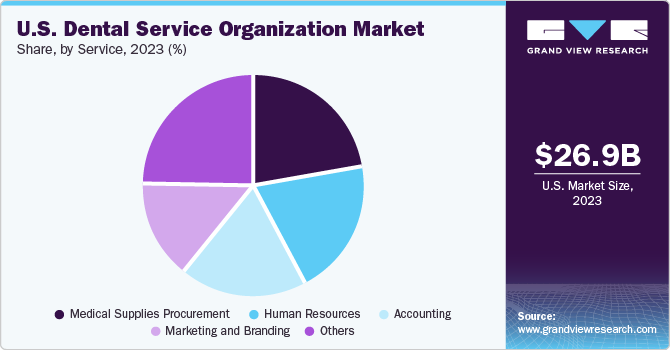

Service Insights

Medical supplies procurement held a significant share in the market and accounted for a share of over 20% in 2023. Centralized procurement of medical supplies by DSOs allows for better price negotiations with suppliers, leading to cost savings. Moreover, efficient procurement of medical supplies helps DSOs maintain a consistent inventory of essential items across their affiliated practices. This streamlined approach reduces the risk of supply shortages, minimizes operational disruptions, and ensures that dental professionals have the necessary tools to provide quality care. As DSOs expand their network of dental practices, efficient procurement of medical supplies becomes crucial for maintaining consistent care standards and ensuring that new practices can quickly integrate into the organization.

The human resources segment is expected to register the fastest CAGR during the forecast period. The dental service organizations require a constant influx of skilled professionals, such as dentists, hygienists, assistants, and administrative staff. Human resources play a crucial role in attracting and selecting the right talent to ensure the delivery of high-quality dental care services and are responsible for fostering a positive work environment, promoting employee engagement, and addressing any workplace issues. Human resource is highly demanded in dental service organizations due to its crucial role in recruitment, selection, training, performance management, employee engagement, retention, benefits and compensation, compliance, labor relations, and employee wellness.

Key U.S. Dental Service Organization Company Insights

Some of the key companies operating in the U.S. market include Pacific Dental; Heartland Dental, Aspen Dental; and DentalCare Alliance

-

Pacific Dental is a dental support organization that partners with dentists and clinicians to provide business support to their dental practice.

-

Heartland Dental, LLC provides dental practice management services and offers dentures, fresh breath, invisalign, laser cavity finder, oral cancer screening, smile makeover, sterilization, teeth whitening, treating gum disease treatment, and laser dentistry services.

42North Dental, Colosseum Dental Group, GSD Dental Clinics, Dentelia, Inc. are some of the other market participants in the U.S. dental service organization market.

Key U.S. Dental Service Organization Companies:

- Pacific Dental

- Heartland Dental

- Aspen Dental

- DentalCare Alliance

- 42North Dental

- Colosseum Dental Group

- GSD Dental Clinics

- Dentelia

- MB2 DENTAL

Recent Developments

-

In December 2023, Pacific Dental Services partnered with MemorialCare and announced the opening of its first co-located dental-medical practice. It is the first collaboration between a regional healthcare system in the U.S. and a national dental support organization.

-

In September 2023, 42 North Dental, in collaboration with the Massachusetts Dental Society, launched ‘beyond traditional leadership’. It aimed to broaden the view of emerging leaders in the network by providing insights into the dental industry.

-

In February 2023, RevBio, Inc. received an investment from a dental support organization, Pacific Dental Services. It supported the clinical development of bone adhesive biomaterial for implant dentistry and stabilized dental implants and treatments.

-

In July 2022, 123Dentist, Lapointe Group, and Altima Dental entered a merger agreement aiming to create one of the largest dental support organizations in Canada, further leading to their expansion.

-

In May 2021, Heartland Dental and American Dental Partners Incorporated (ADPI) entered into a partnership to expand doctors within the Heartland Dental community and offer support in providing high-quality oral health care to its patients.

-

In March 2019, DSO Market Watch introduced its DSO connection service. The new services are aimed at helping transitioning dentists connect with DSOs interested in onboarding or acquiring them for support services.

-

In January 2019, Mid-Atlantic Dental Service Holdings LLC acquired Birner Dental. This acquisition supported practices with practice information, marketing, financial, and other business services to help dentists focus on delivering the highest quality care.

U.S. Dental Service Organization Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 76.2 billion

Growth rate

CAGR of 16.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, region

Country scope

U.S.

Key companies profiled

Pacific Dental; Heartland Dental; Aspen Dental; DentalCare Alliance; 42North Dental; Colosseum Dental Group; GSD Dental Clinics; Dentelia; MB2 DENTAL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental Service Organization Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dental service organization market report based on service, end-use, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Human Resources

-

Marketing & Branding

-

Accounting

-

Medical Supplies Procurement

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dental Surgeons

-

Endodontists

-

General Dentists

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. dental service organization market size was valued at USD 26.9 billion in 2023.

b. The U.S. dental service organization market is projected to grow at a compound annual growth rate (CAGR) of 16.4% from 2024 to 2030 to reach USD 76.2 billion by 2030

b. Medical supplies procurement held a significant share in the market and accounted for a share of over 20% in 2023. Centralized procurement of medical supplies by DSOs allows for better supplier price negotiations, leading to cost savings.

b. Some of the key companies operating in the U.S. dental service organization market include Pacific Dental; Heartland Dental, Aspen Dental; and DentalCare Alliance.

b. An increase in the number of patients with dental conditions, increasing expenditure on dental care, and improved efficiency in non-clinical business management by dental service organizations (DSOs) are some of the major factors driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."