- Home

- »

- Healthcare IT

- »

-

U.S. Dental Practice Management Software Market, Industry Report, 2030GVR Report cover

![U.S. Dental Practice Management Software Market Size, Share & Trends Report]()

U.S. Dental Practice Management Software Market Size, Share & Trends Analysis Report By Deployment Mode (On-premise, Web-based, Cloud-based), By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-249-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

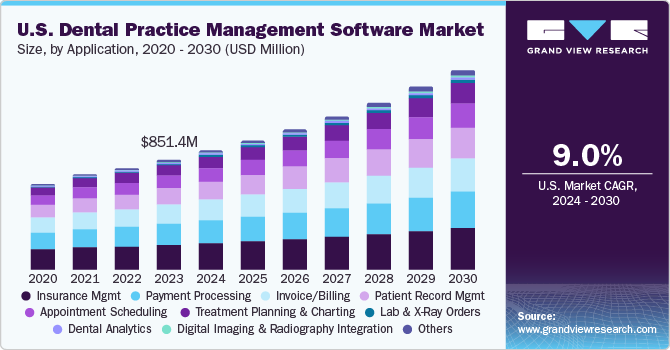

The U.S. dental practice management software market size was estimated at USD 851.4 million in 2023 and is expected to grow at a CAGR of 9.03% from 2024 to 2030. The growth is driven by a combination of factors such as the increasing number of dental practices and dental visits. A rise in sedentary lifestyles and consumption of junk food with high sugar content, especially among children, are some of the leading factors leading to a rise in the number of dental visits. As per the Dental Statistics 2022 USA by Express Dentist stated that around 64% of children aged 2-4 years, 92% of children aged 5-11 years, and 90% of adolescents aged 12-17 years visited a dentist in 2021. Hence, the surging patient volume is expected to improve the need for proper practice management software to manage patient flow & appointments, billing, treatment plans, and patient records, among others.

The market is witnessing a surge in integration and development of new technologies, such as Artificial Intelligence (AI) and cloud computing. The automation of processes enables healthcare facilities to efficiently oversee dental clinics and hospitals. For instance, in May 2021 , Henry Schein One enhanced its axiUm Dental Software by integrating Dental & Medical Patient Records. The new “Consistency of Care” module provides interoperability and exchange of information between dentistry and medicine Electronic Health Records (EHRs). This strategic approach will enable the organization to provide a service with a higher value to its patients.

According to the American Dental Association’s Health Policy Institute published a report in May 2023, there were over 3,000 dentists participated in the survey. The survey showed that 24.5% of participants were very confident about the recovery of dental practice in the coming six months. This shows the recovery of the dental practice due to the increase in dental visits.

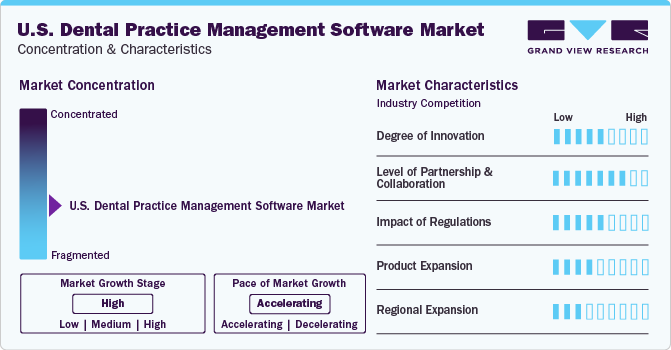

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, level of partnership & collaboration activities, impact of regulations, product substitutes, and geographic expansion. For instance, the U.S. dental practice management software industry is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is low, the level of partnership & collaboration activities is high, and product expansion is medium. The impact of regulations on the market is medium, and the geographic expansion is low.

The market is experiencing significant innovation as numerous players introduce new products and enhance existing solutions to boost their industry presence. In March 2022, Henry Schein, Inc.’s.dental analytics platform, Jarvis Analytics, was made available for private practices. This platform helps dental teams to make informed decisions by maximizing data for operational success.

The level of partnerships & collaborations in the market is high due to several key industry players such as Nextgen Healthcare, Inc.; Henry Schein, Inc.; CD Newco, LLC (Curve Dental); and Carestream Dental, LLC engage in partnerships & collaboration activities to expand their market presence. For instance, in November 2022, Pearl and Curve Dental partnered to integrate Pearl’s Second Opinion disease detection abilities within Curve Dental’s SuperHero practice management system, providing Curve’s 70,000 users in the U.S. and Canada with FDA-cleared clinical AI capabilities.

Regulations greatly shape the industry by governing licensing, credentialing, and scope of practice. The industry is regulated under the Health Information Technology for Economic & Clinical Health (HITECH) Act and the Health Insurance Portability & Accountability Act (HIPAA). HIPAA rules for dental services are the same as those for Covered Entity (CE) and mandate HIPAA Protected Health Information (PHI) to be secured through physical, technical, and administrative standards.

The level of geographic expansion in the market is low due to the change in demand of target customers and continuous upgradation of regulatory frameworks by the U.S. government.

Deployment Mode Insights

The web-based segment dominated the market with a revenue share of over 52% in 2023. The growth is attributed to the rising adoption of software in oral practices for billing, patient charting, treatment planning, reporting, and scheduling. This makes them fiscally responsible for increased security, unrestricted storage space, low cost, and quick updates.

The cloud-based segment is expected to grow at the fastest CAGR from 2024 to 2030, owing to continuous technological advancements, favorable government initiatives, and an increase in the number of dental clinics. Cloud-based software can offer benefits such as shorter implementation time, no additional investment in hardware, low initial investment, and automatic software updates. Moreover, their user-friendly nature enables one to quickly access, edit, and share documents.

Application Insights

The insurance management segment dominated the market with a revenue share of over 22% in 2023. The growth is attributed to the continuous improvement of dental insurance coverage, along with a rise in the number of progressed claims after or during the process. With the rise in demand for going paperless with digital records, market players, hospitals and dental clinics are undertaking strategic initiatives to fulfill the demand. For instance, in January 2023, eAssist Dental Solutions, a subsidiary of Henry Schein, Inc., acquired a significant share of Unitas PPO Solutions. Unitas assists dental practitioners in setting competitive fee-for-service rates, assessing their commercial insurance participation, and negotiating contracted reimbursement with commercial insurers.

The dental analytics segment is expected to grow at the fastest CAGR during the forecast period. These tools help increase the understanding of dental processes and improve decision-making in dental practices. By leveraging dental analytics, the DPM software provides valuable insights and enables dentists to make data-driven decisions for better patient outcomes.

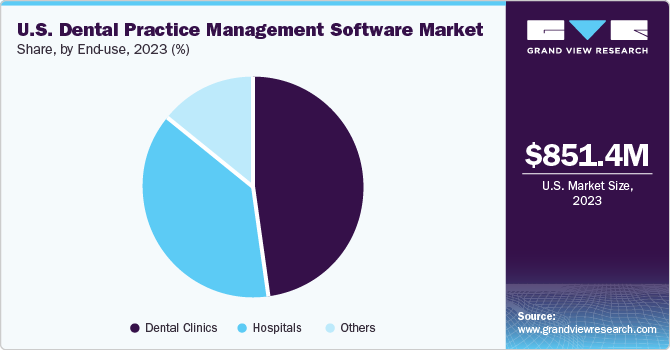

End-use Insights

The dental clinics segment accounted for the largest revenue share of over 47% in 2023. The growth of this segment is attributed to the rise in dental visits in the U.S. Along with a rise in demand for the software to manage treatment regimens and patient data.

The hospitals segment is expected to grow at the fastest CAGR during the forecast period. Hospitals are increasing their focus on providing high-quality services to a larger patient pool across the U.S. Investment by hospitals in advanced DPM software, such as Dentex, Tab32, and Planet DDS, for handling billing, appointment scheduling, & insurance claims has increased in recent years. These key advantages are driving the increasing demand for DPM software adoption in the market.

Key U.S. Dental Practice Management Software Company Insights

The market is fragmented, with the presence of many players. With the growing aging population and the need for mobile health, a few smaller competitors are entering the industry and are expected to gain a significant share of the market. Some emerging companies offering DPM software include Oryx Dental Software LLC, iDentalSoft, and tab32.

Key U.S. Dental Practice Management Software Companies:

- ACE Dental

- CareStack (Good Methods Global Inc.)

- Carestream Dental, LLC

- CD Newco, LLC (Curve Dental)

- Datacon Dental Systems, Inc.

- Dental Intelligence, Inc

- DentiMax, Practice-Web, Inc.

- Henry Schein, Inc.

- Jarvis Analytics

- Nextgen Healthcare, Inc. (NXGN Management, LLC)

- Practice Analytics

Recent Developments

-

In January 2024, CD Newco, LLC, a cloud-based practice management software provider, and Patient Prism, an AI technology provider, entered into a partnership to launch an advanced integration that aims to accelerate the growth in dental practices nationwide. This partnership aims to provide end-to-end funnel metrics driven by Curve data.

-

In November 2023, Thoma Bravo acquired NextGen Healthcare, a cloud-based healthcare technology solutions provider, for USD 1.8 billion. This move is expected to strengthen further Thoma Bravo’s position in the software investment industry.

-

In May 2023, P1 Dental Partners selected Henry Schein, Inc.’s software: Dentrix Ascend, a cloud-based dental practice management software, and Jarvis Analytics, a dental analytics tool, to provide its partner dentists with a seamless practice management workflow across over 40 practices, helping elevate patient care and drive practice success.

U.S. Dental Practice Management Software Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.6 billion

Growth rate

CAGR of 9.03% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, application, end-use

Country scope

U.S.

Henry Schein, Inc.; Carestream Dental, LLC; DentiMax; Practice-Web, Inc.; Nextgen Healthcare, Inc. (NXGN Management, LLC); ACE Dental; Datacon Dental Systems, Inc.; CareStack (Good Methods Global Inc.); CD Newco, LLC (Curve Dental); Dental Intelligence, Inc.; Jarvis Analytics; Practice Analytics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental Practice Management Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dental practice management software market report based on deployment mode, application, and end-use:

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Web-based

-

Cloud-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Insurance Management

-

Payment Processing

-

Invoice/Billing

-

Patient Record Management

-

Appointment Scheduling

-

Treatment Planning and Charting

-

Lab & X-Ray Orders

-

Dental Analytics

-

Digital Imaging and Radiography Integration

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Clinics

-

Hospitals

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. dental practice management software market size was estimated at USD 851.4 million in 2023 and is expected to reach USD 924.0 million in 2024.

b. The U.S. dental practice management software market is expected to grow at a compound annual growth rate of 9.03% from 2024 to 2030 to reach USD 1.6 billion by 2030.

b. The web-based segment dominated the U.S. dental practice management software market with a revenue share of over 52% in 2023. This can be attributed to

b. Key players in the U.S. dental practice management software market are Henry Schein, Inc., Carestream Dental, LLC, DentiMax, Practice-Web, Inc., Nextgen Healthcare, Inc. (NXGN Management, LLC), ACE Dental, Datacon Dental Systems, Inc., CareStack (Good Methods Global Inc.), CD Newco, LLC (Curve Dental), Dental Intelligence, Inc, Jarvis Analytics, and Practice Analytics.

b. Key factors that are driving the U.S. dental practice management software market growth include an increase in the number of dental practices & dentists in the U.S. and growing adoption of cloud technology platform for practice management.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."