- Home

- »

- Medical Devices

- »

-

U.S. Dental Implants Market Size, Industry Report, 2033GVR Report cover

![U.S. Dental Implants Market Size, Share & Trends Report]()

U.S. Dental Implants Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Titanium, Zirconia), By Fixture Surface Treatments (Anodized Surfaces, Nano-Textured Surfaces), By Implant Design (Tapered, Parallel-Walled), And Segment Forecasts

- Report ID: GVR-4-68040-197-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Dental Implants Market Summary

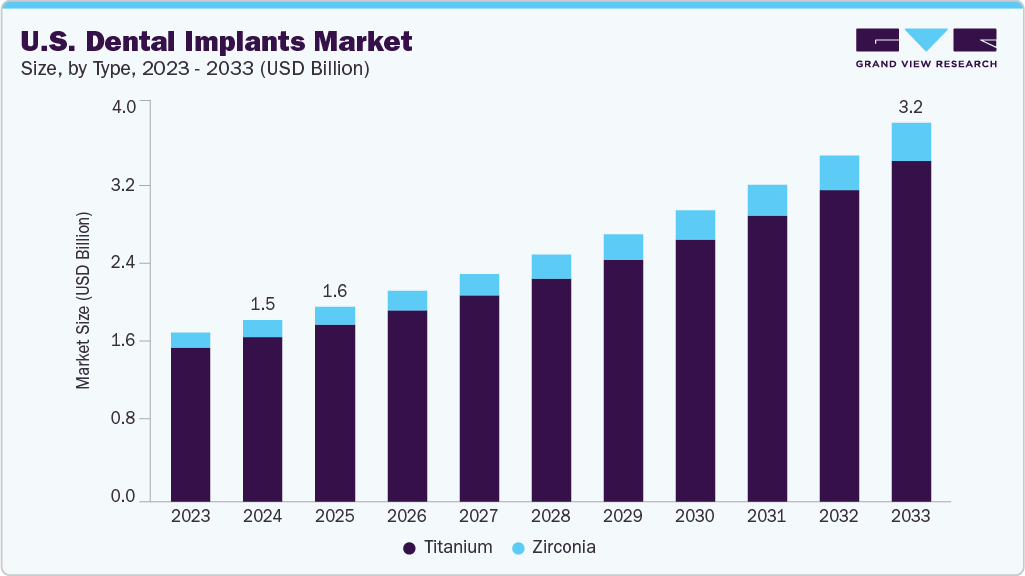

The U.S. dental implants market size was estimated at USD 1.54 billion in 2024 and is projected to reach USD 3.22 billion by 2033, growing at a CAGR of 8.6% from 2025 to 2033. This growth is attributed to the growing geriatric population prone to tooth loss, rising consumer awareness about oral health and aesthetics, and increasing preference for long-lasting, natural-looking tooth replacements.

Key Market Trends & Insights

- By type, the titanium implants segment held the largest share in the U.S. market in 2024.

- By fixture surface treatments, the SLA and SLActive segment led the market with the largest revenue share in 2024.

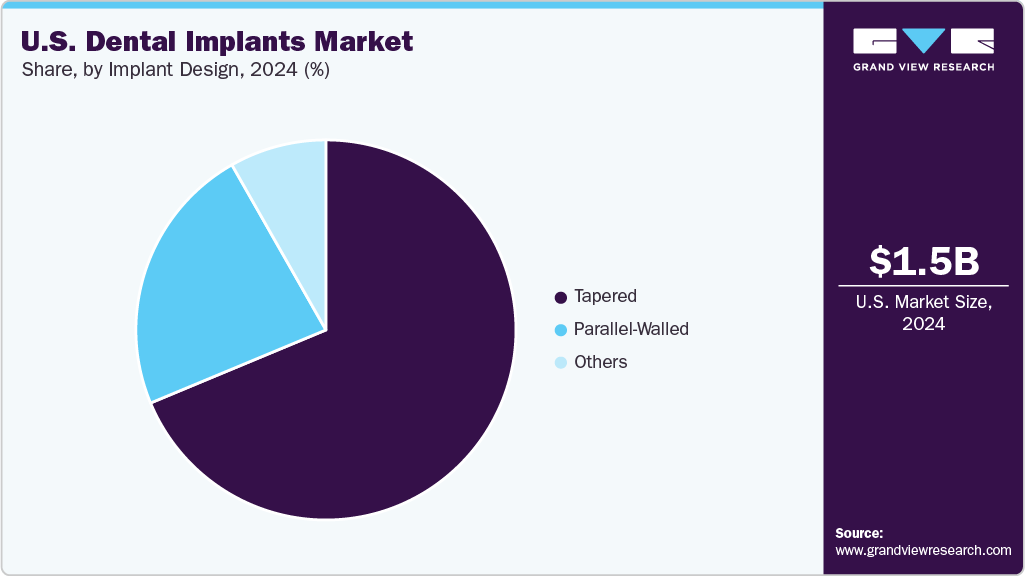

- By implant design, the tapered segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.54 Billion

- 2033 Projected Market Size: USD 3.22 Billion

- CAGR (2025-2033): 8.6%

Advances in digital dentistry, such as CAD/CAM technology, cone-beam CT imaging, and 3D printing, have enhanced implant precision, reduced surgery time, and improved clinical outcomes, further boosting adoption among dental professionals. In addition, innovations in implant materials like titanium alloys and zirconia, and immediate-loading and minimally invasive techniques are expanding treatment options. Higher disposable income increased dental insurance coverage and the growing number of trained dental practitioners also contribute to market growth.The growing number of research studies evaluating dental implants' diverse potential applications is expected to significantly drive market growth. While traditionally used to treat tooth loss, dental implants are increasingly being assessed in clinical settings for a broader range of conditions, including oral cancer and dental ankylosis.

For instance, in July 2023, the State University of New Jersey sponsored a clinical trial exploring a novel approach for treating dental ankylosis. In this study, participants were instructed to use an electric toothbrush handle to vibrate the ankylosed tooth for 15 to 60 seconds daily over five days, followed by several clinical follow-ups. If the ankylosed tooth was permanent and the vibration therapy proved ineffective, the participants were to undergo a six-week orthodontic treatment involving the placement of a mini-implant near the affected tooth, with monthly follow-up visits extending up to five months. Approximately 20 individuals were enrolled in this trial. This research underscores the growing interest in expanding the therapeutic applications of dental implants, a trend that is expected to propel market growth in the coming years.

The introduction of innovative dental implant technologies continues to play a pivotal role in driving the growth of the market. Industry players are actively launching advanced implant systems to improve clinical outcomes and procedural efficiency.

For instance, in April 2025, ZimVie Inc. launched its Immediate Molar Implant System in the U.S. market. This new system features specially engineered instrumentation to streamline site preparation following molar extraction, enabling a more controlled and predictable surgical procedure. It also includes optimized wide-diameter implants that provide a better fit within the molar socket, offering superior primary stability. Notably, the system incorporates ZimVie's proprietary DAE coronal surface technology, potentially reducing the risk of peri-implantitis by up to 20%. Moreover, unlike traditional treatment protocols that typically require a healing period of several months after molar extraction before implant placement, this system enables immediate placement and restoration, cutting treatment time by nearly half. The result is a simplified, efficient, and more predictable clinical workflow.

“The launch of our Immediate Molar Dental Implant System marks a significant milestone in our commitment to advancing dental technology. We have expanded the offering of our implant systems to address the unique challenges of molar tooth restoration and provide patients shorter and more cost-effective treatment while delivering a more predictable, lasting outcome.” said ZimVie CEO Vafa Jamali.

Such advancements in implant design and surgical protocols are expected to significantly enhance the adoption of dental implants, further fueling market expansion.

The rising demand for prosthetics and restorative dentistry is expected to be a key driver of growth in the dental implant market over the coming years. A growing emphasis on aesthetic appearance and smile enhancement is significantly influencing patients' treatment decisions, leading to increased adoption of procedures such as dental implants, crowns, and dentures.

As individuals become more conscious of their dental aesthetics and oral health, the demand for stable, durable, and natural-looking restorative solutions has surged. Dental implants, in particular, are increasingly favored due to their ability to securely support prosthetic restorations, including crowns, bridges, and dentures, offering superior functionality, stability, and longevity compared to traditional methods. According to a study published by Twin Dental New York in June 2025, approximately 5 million new dental implants are placed annually in the U.S. Moreover, data released by Total Health Dental Care in April 2025 revealed that nearly 15 million adults in the U.S. have received crown and bridge replacements for missing teeth.

Some of the key opinions:

Company

KOLs

Verticals

ZimVie Inc.

“The rising adoption of dental implants presents a significant growth opportunity, and with it, a clear need for more efficient, accurate, and integrated treatment workflows. Digital dentistry is at the forefront of this shift, quickly establishing itself as the new standard in implantology. We have seen tremendous traction in other markets with RealGUIDE and Implant Concierge and are excited to expand into yet another growing and increasingly sophisticated market.” Said ZimVie CEO Vafa Jamali.

In June 2025, ZimVie Inc. launched its RealGUIDE Software Suite and Implant Concierge service in Japan, expanding access to a fully integrated digital implant ecosystem. RealGUIDE offers cloud-based modules for implant planning, surgical guide creation, and restorative design, enhancing precision and workflow efficiency. Integrated with ZimVie’s Dental Technology Institute and CAD/CAM systems, it delivers seamless case planning to final restoration.

BioHorizons

“Backed by more than 30 years of research, Tapered Pro Conical’s unique Laser-Lok microchannels create a connective tissue attachment and retain crestal bone, thus allowing better control of clinical and esthetic outcomes. We recognize the importance of immediate and predictable solutions for implant therapy and are pleased to deliver enhanced functionality with this new implant.” Said Steve Boggan, President & CEO, BioHorizons.

In June 2024, BioHorizons introduced its first dental implant featuring a deep conical connection, Tapered Pro Conical. This innovation underscores BioHorizons’ commitment to advancing implant technology that supports surgical efficiency and predictable outcomes. The implant combines the successful macro design of the Tapered Pro with the patented CONELOG connection, offering a comprehensive solution for immediate treatments ranging from single-tooth replacements to full-arch restorations.

Source: BioHorizons, ZimVie Inc., GVR Analysis

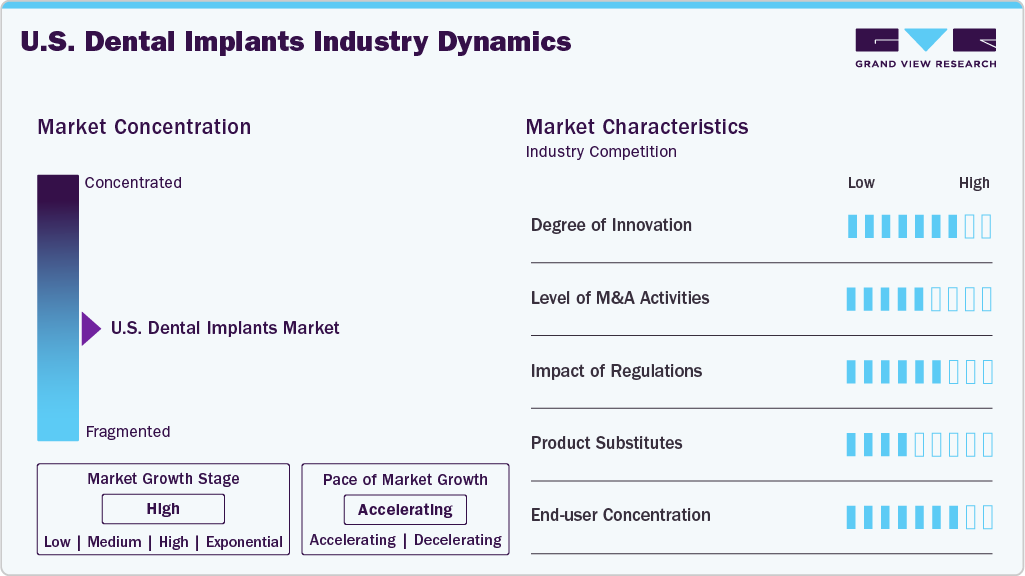

Market Concentration & Characteristics

The U.S. market for dental implants demonstrates a high degree of innovation, driven by advancements in biomaterials, digital dentistry, and surface modification technologies. Manufacturers are increasingly integrating computer-aided design and manufacturing (CAD/CAM), 3D printing, and AI-assisted implant planning to improve precision and clinical outcomes. Innovations such as zirconia and hybrid titanium-ceramic implants, nanostructured and bioactive coatings, and immediate-load implant systems are transforming treatment efficiency and patient comfort. Moreover, the rise of customized, patient-specific implants and innovative connectivity features in dental workflows further highlights the market’s technological maturity and commitment to minimally invasive, durable, and aesthetic restorative solutions.

The U.S. market for dental implants has witnessed a moderate-to-high level of merger and acquisition (M&A) activity, as major dental technology companies and private equity firms pursue consolidation to expand their product portfolios and strengthen distribution networks. Strategic acquisitions have focused on integrating digital dentistry platforms, guided surgery systems, and biomaterial innovations to offer comprehensive implant solutions. Larger players are acquiring niche innovators and regional manufacturers to enhance market penetration, access proprietary surface technologies, and accelerate innovation cycles. This trend reflects an industry shift toward vertical integration, where companies aim to control every stage of the implant value chain-from design and manufacturing to digital workflow and aftercare services.

Regulations are pivotal in shaping the U.S. dental implants market by ensuring product safety, efficacy, and quality through stringent oversight from the U.S. Food and Drug Administration (FDA) and other regulatory bodies. Dental implants are classified as Class II or Class III medical devices, requiring compliance with rigorous premarket notifications (510(k)) or premarket approvals (PMA), depending on the risk profile. These regulations drive manufacturers to maintain high standards in biocompatibility testing, clinical validation, and post-market surveillance. While compliance increases development costs and time-to-market, it also fosters trust among clinicians and patients, encouraging adoption of advanced, evidence-based implant systems. In addition, harmonization with ISO and ADA standards supports innovation while maintaining patient safety and product reliability across the industry.

In the U.S. market, several product substitutes compete as alternative tooth replacement solutions, including dental bridges, removable partial dentures, and full dentures. These options are often preferred by patients seeking lower-cost or less invasive treatments, especially in cases where bone grafting or surgical procedures are not viable. Advances in prosthetic materials and adhesive technologies have improved the aesthetics and functionality of these substitutes, further strengthening their market presence. However, unlike implants, these alternatives generally offer shorter lifespans, reduced stability, and potential for bone loss, which limits their long-term effectiveness. Despite this, the continued innovation in digital dentures and hybrid bridge systems maintains moderate competitive pressure on the dental implant segment.

Type Insights

The titanium implants segment held the largest share in the U.S. market in 2024. This dominance is attributed due to their proven biocompatibility, mechanical strength, and high success rates in osseointegration. Titanium’s ability to form a stable interface with bone tissue makes it the preferred material among clinicians for long-term implant stability and load-bearing performance. In addition, continuous advancements such as surface-treated and anodized titanium implants have enhanced tissue integration and reduced healing time. Their cost-effectiveness, clinical reliability, and versatility across various dental procedures have further solidified titanium’s dominance over alternative materials like zirconia in general and specialized implant dentistry.

Zirconia is expected to grow at the fastest CAGR over the forecast period due to the rising demand for metal-free, highly aesthetic, and biocompatible solutions. Their natural tooth-like color and resistance to corrosion and plaque accumulation make them increasingly preferred for patients with metal sensitivities or high esthetic requirements, particularly in anterior restorations. Advances in monolithic zirconia materials and CAD/CAM fabrication have improved their strength, durability, and precision, addressing earlier limitations related to brittleness. Moreover, the growing trend toward minimally invasive and holistic dentistry and patient awareness of non-metal alternatives are accelerating the adoption of zirconia implants in the premium segment of the market.

Fixture Surface Treatments Insights

The SLA and SLActive segment dominated the U.S. market in 2024 due to its proven ability to enhance osseointegration, healing speed, and long-term implant stability. SLA (Sandblasted, Large-grit, Acid-etched) surfaces provide an optimized micro-roughness that promotes strong bone-to-implant contact, while SLActive builds on this by incorporating hydrophilic surface chemistry that accelerates early bone healing and reduces healing time. These technologies are widely adopted by clinicians for their clinical reliability, high success rates, and predictable outcomes, particularly in patients with compromised bone conditions. Their extensive use in premium and mainstream implant systems has made them the benchmark for surface innovation in the U.S. dental implant industry.

Nano-textured surfaces are expected to grow at the fastest CAGR over the forecast period. They represent the next generation of surface engineering to enhance cellular response and accelerate osseointegration at the nanoscale level. These surfaces mimic the natural structure of bone, promoting superior osteoblast adhesion, proliferation, and differentiation compared to conventional micro-roughened designs. Advances in nanocoating’s, plasma treatments, and laser modification technologies have enabled the creation of highly controlled surface topographies that improve biological integration and reduce infection risks. Growing clinical evidence supporting faster healing, better bone contact, and long-term stability, along with rising demand for advanced, high-performance implants, is driving the strong adoption of nano-textured implants across U.S. dental practices and research institutions.

Implant Design Insights

The tapered segment held the largest share in the U.S. market in 2024. This dominance is attributed to its superior primary stability and versatility across a wide range of clinical scenarios. The conical design of tapered implants closely mimics the natural shape of tooth roots, allowing for better engagement with the surrounding bone and minimizing stress during insertion. This makes them particularly effective in immediate placement and extraction socket cases, where bone density may vary.

Parallel-walled are expected to grow at the fastest CAGR over the forecast period, owing to their excellent load distribution, simplified placement, and adaptability to diverse bone conditions. Their cylindrical geometry allows for uniform stress transfer along the implant body, reducing the risk of crestal bone loss and improving long-term stability. These implants are increasingly favored in dense bone regions and full-arch restorations, where controlled insertion torque and predictable outcomes are critical. Furthermore, the integration of modern surface treatments and digital-guided surgery systems has enhanced their clinical performance, making them a preferred choice among practitioners seeking precision and biomechanical reliability. The growing focus on standardized, easy-to-place implant designs continues to drive their rapid adoption across U.S. dental practices.

Key U.S. Dental Implants Company Insights

The industry players are undertaking several strategic initiatives such as acquisitions, partnerships and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the U.S. market for dental implants.

Key U.S. Dental Implants Companies:

- Dentsply Sirona

- Institut Straumann AG

- Nobel Biocare Services AG

- ZimVie Inc.

- BioHorizons

- Dentium USA

- Neoss

- Bicon

- Dentis Co., Ltd.

- Kyocera Medical Corporation (Kyocera Corporation)

- Noris Medical

Recent Developments

-

In March 2025, Dentsply Sirona announced its participation in the Academy of Osseointegration’s (AO) Annual Meeting 2025, scheduled for March 27-29 in Seattle, WA. At the event, the company showcased its newest innovation, the MIS LYNX implant, and host a Corporate Forum centered on the continued evolution of implant dentistry.

-

In February 2025, Dentsply Sirona has announced the U.S. launch of MIS LYNX, a premium yet cost-effective all-in-one dental implant solution designed to deliver high performance, streamlined workflows, and enhanced clinical efficiency for dental professionals.

-

In June 2025, ZimVie Inc. announced the launch of its RealGUIDE Dental Implant Software Suite and Implant Concierge service in Japan. This introduction enhances Japanese dentists’ access to a comprehensive digital dental implant ecosystem-covering everything from implant planning to placement-with fully integrated, end-to-end solutions. Given the substantial market opportunity in Japan, which is ZimVie's largest in the APAC region, this expansion marks a significant milestone for the company.

U.S. Dental Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.66 billion

Revenue forecast in 2033

USD 3.22 billion

Growth rate

CAGR of 8.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Segments covered

Type, fixture surface treatments,implant design

Regional scope

U.S.

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

Dentsply Sirona; Institut Straumann AG; Nobel Biocare Services AG; ZimVie Inc.; BioHorizons; Dentium USA; Neoss; Bicon; Dentis Co., Ltd.; Kyocera Medical Corporation (Kyocera Corporation); Noris Medical

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental Implants Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. dental implants market report based on type, fixture surface treatments, and implant design:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Titanium

-

Zirconia

-

-

Fixture Surface Treatments Outlook (Revenue, USD Million, 2021 - 2033)

-

SLA and SLActive

-

Anodized Surfaces

-

Nano-Textured Surfaces

-

Others

-

-

Implant Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Tapered

-

Parallel-Walled

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. dental implants market is estimated at USD 1.54 billion in 2024 and is expected to reach USD 1.66 billion in 2025.

b. The U.S. dental implants market is expected to grow at a CAGR of 8.6% from 2025 to 2033 to reach USD 3.22 billion in 2033.

b. Titanium implants led the dental implant market with a revenue share of 90.89% in 2024, and is anticipated to grow significantly over the forecast period.

b. Some of the key players operating in the U.S. dental implants market include Dentsply Sirona; Institut Straumann AG; Nobel Biocare Services AG; ZimVie Inc.; BioHorizons; Dentium USA; Neoss; Bicon; Dentis Co., Ltd.; Kyocera Medical Corporation (Kyocera Corporation); Noris Medical.

b. Key driving factors include the growing geriatric population prone to tooth loss, rising consumer awareness about oral health and aesthetics, and increasing preference for long-lasting, natural-looking tooth replacements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.