- Home

- »

- Medical Devices

- »

-

U.S. Dental 3D Printing Market Size, Industry Report, 2030GVR Report cover

![U.S. Dental 3D Printing Market Size, Share & Trends Report]()

U.S. Dental 3D Printing Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Orthodontics, Prosthodontics), By Technology (Selective Laser Sintering), By Material (Photopolymer, Ceramic), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-307-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Dental 3D Printing Market Size & Trends

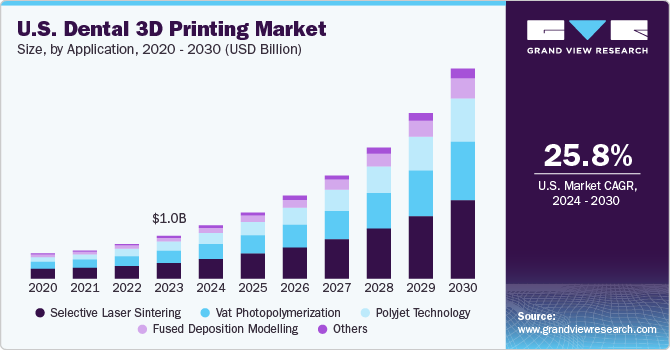

The U.S. dental 3D printing market size was estimated at USD 1.2 billion in 2024 and is projected to grow at a CAGR of 26.2% from 2025 to 2030. The increasing demand for customized treatments, advancements in materials, and increased cost efficiency and time reduction are the key drivers for the market growth. According to the American Dental Association (ADA), approximately 17.0% of dentists adopted 3D printing technology in their practices in 2023. It also stated that about 67.0% of dentists were utilizing this technology for a relatively short period. Specifically, less than two years implies the rising adoption of dental 3D printing in the U.S.

The U.S. held a dominant position in the global dental 3D printing market in 2024. Several factors contributing to the growth include the escalating demand for cosmetic dentistry, technological advancements, and an increasing consciousness among individuals regarding the importance of oral health maintenance. In addition, the rising geriatric population, growing healthcare expenditure, favorable government policies, and enhancements in healthcare infrastructure also create a favorable market outlook.

The market is growing significantly and is expected to grow further in emerging economies. The American College of Prosthodontists stated that about 15.0% of the edentulous population makes dentures each year. Edentulism affects the most vulnerable populations, economically challenged and aging populations. Approximately 120 million individuals are affected by tooth loss, with at least one missing tooth, while over 36 million Americans face the challenge of complete edentulism or the absence of natural teeth. Over the next two decades, it is anticipated that the number of people in the U.S. experiencing tooth loss, including both partial and complete edentulism, is likely to increase. Consequently, a significant proportion of the aging population and younger individuals opt for dental procedures with dental implants as a viable solution for addressing their dental needs.

COVID-19 caused a massive disruption in the supply chain of the overall medical device industry. The outbreak decreased the number of procedures performed, leading to a decline in the market. It also negatively impacted the demand and sale of dental equipment and procedures owing to the restrictions imposed in the country. In addition, many manufacturers shifted their focus on fighting the COVID-19 disease, which further affected market growth. For instance, in March 2020, Formlabs, a U.S.-based 3D printer company, reported using over 250 in-house 3D printers at its printing facility in Ohio to produce up to 150,000 COVID-19 test swabs a day.

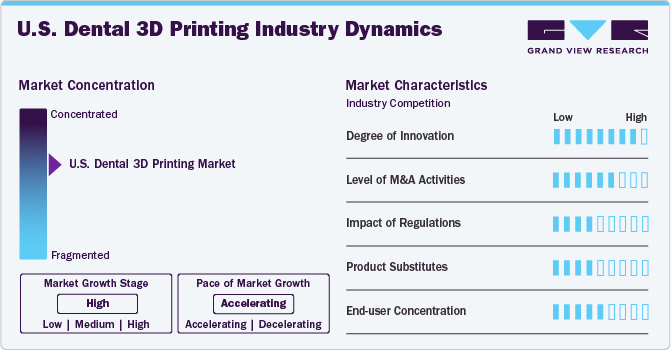

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The U.S. dental 3D printing market is characterized by high innovation due to the R&D in dental materials and dental 3D printing technology. Research on high-quality materials that can mimic the properties of natural teeth and improve their appearance is the motivating factor for research and development in the market.

The merger and acquisition activity in the market is high, as it creates opportunities to introduce innovative and advanced products to increase the customer base. For instance, in February 2023, an engineering technologies firm, Renishaw, formed a strategic partnership with medical devices expert Permedica, aiming to advance the adoption of additive manufacturing processes for the large-scale production of medical components in the healthcare sector, thus fostering industry innovation.

The market is subject to regulatory scrutiny by country regulatory authorities. The Food and Drug Administration does not directly regulate 3D printing, a type of additive manufacturing, but the medical products produced via these devices. The regulations related to these products depend upon the type of the product and its intended use. In addition, manufacturers must receive clearance from the FDA to commercialize their products, which affects product availability in the country. For instance, in December 2023, Align Technology, Inc. received FDA 510(k) clearance for its Align’s IPE system. The clearance is expected to help make the product available for a broad patient pool, including growing children, teens, and adults.

Dental 3D printing has limited substitutes, such as dental milling. 3D printing has become a preferred solution in dentistry in recent years. However, dental milling technology also holds significance regarding the choice of material and durability.

The end user concentration is a significant factor in the market. The increasing preference for aesthetic surgeries drives the demand for 3D printing among end users, such as dental laboratories and clinics.

Application Insights

The orthodontics segment held the largest revenue share of 39.7% in 2024 and is expected to grow at a significant rate of 25.9% during the forecast period. The growth is attributed to the rising number of cases of misalignment and gaps in the teeth. In addition, the American Association of Orthodontists (AAO) has advised that children should have their initial orthodontic evaluation before age 8, increasing its demand. The rising demand and need for orthodontics treatment are driving the industry's overall growth.

The prosthodontics segment is estimated to witness the fastest growth from 2025 to 2030 due to increasing edentulism and tooth decay cases. For instance, as per the information published by the National Institute of Dental and Craniofacial Research, tooth decay continued to be one of the most widespread chronic conditions affecting adults and children in the U.S.

Technology Insights

The selective laser sintering segment dominated the market with the largest share in 2024 due to its benefits, such as superior chemical resistance, biocompatibility, and outstanding surface finishing. Selective laser sintering, a revolutionary additive manufacturing technology, allows the creation of complex 3D objects from various materials, such as nylon, polyamide, and even metal powders. Such factors are contributing to segment growth.

The other technological segment is expected to register a significant CAGR from 2025 to 2030. This is driven by the increasing research and development investments to advance the dental industry, such as electron beam melting, material jetting, and binder jetting methods. The application frequency of Fused Deposition Modeling (FDM) is increasing owing to the extensive availability of robust, biocompatible, and sterilizable thermoplastics. The FDM's affordability and versatility in creating intricate shapes and designs make it the most popular method.

Material Insights

The photopolymer segment held the largest revenue share in 2024. The photopolymer resin is specifically designed for dental applications. These resins are dental 3D printing materials or biocompatible resins and are formulated to closely mimic natural teeth' mechanical, optical, and thermal properties. Such features of these resins are leading to the surge in demand for photopolymer resin and are expected to boost market growth. The natural appearance of the teeth due to photopolymer resin is expected to increase the demand in the population and potentially drive segment growth.

The ceramic segment is estimated to grow fastest from 2025 to 2030. This is attributed to some of the benefits of ceramic materials, such as high efficiency, aesthetics, and the ability to create complex shapes. The new product approvals and launches in the U.S. market are further expected to drive the segment demand. For instance, in November 2021, Desktop Metal, Inc. received FDA 510(k) clearance for Flexcera Base hybrid ceramic resin to be used in the 3D fabrication of high-quality dental prosthetics.

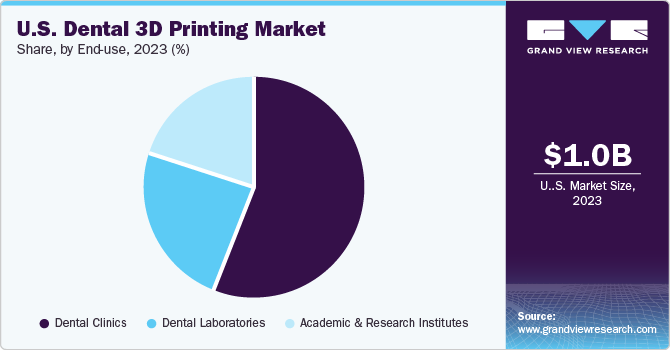

End Use Insights

The dental laboratories segment dominated the market with the largest revenue share in 2024 and is expected to grow at the fastest CAGR from 2025 to 2030. The rising adoption of advanced technologies in the U.S. dental laboratories is supplementing the segment growth. Moreover, the rise in the number of dental laboratories, increasing outsourcing of different manufacturing functions to dental laboratories in the country, and increased demand and preference for customized dental framing solutions for several applications fuel the demand for dental 3D printing technologies.

The dental clinics segment is estimated to grow significantly from 2025 to 2030. This is attributed to some benefits, such as customized treatment, reduced time, cost efficiency, and the development of biocompatible and high-performance 3D printing materials. The application of 3D printing in dental clinics in the U.S. has been increasing due to its numerous advantages and the high preferences of dentists among the population. Further, the 3D printing technology in U.S. dental clinics enables dentists to create models, surgical guides, and other visual aids that help patients better understand their treatment plans, improving communication and patient confidence.

Key U.S. Dental 3D Printing Company Insights

Some key players operating in the market include 3D Systems, Stratasys Ltd, EnvisionTEC, and Dentsply Sirona.

-

3D Systems provides 3D printing solutions, offering dental 3D printers, materials, and software, such as the DMP 8500 and D2P 2500.

-

Stratasys Ltd. offers dental 3D printers, including the Objet30 OrthoDesk 3D Printer and the J750 Dental 3D Printer, along with materials suitable for dental applications.

Formlabs, DWS GmbH., and Markforged are some of the other market participants.

-

Formlabs provides the Form 3B and Form 3L 3D printers, which are famous for dental laboratories and clinics due to their precision and affordability.

-

DWS GmbH manufactures the Ceramill Map 400 3D Printer, a ceramic 3D printer designed for dental applications.

Key U.S. Dental 3D Printing Companies:

- 3D Systems

- Stratasys Ltd.

- EnvisionTEC

- Straumann

- Dentsply Sirona

- Renishaw plc

- Carbon3D

- Argen X

- Asiga

- Formlabs

- DWS GmbH

- Markforged

Recent Developments

-

In March 2023, 3D Systems introduced significant advancements to fortify its digital dentistry portfolio, including the launch of two new materials, NextDent Base and NextDent Cast, and a printing platform, the NextDent LCD1.

-

In December 2022, Stratasys and 3Shape jointly introduced an innovative automated digital color workflow designed specifically for dental 3D printing to streamline the color customization process in dental applications, enhancing efficiency and accuracy.

-

In September 2019, Dentsply Sirona and Carbon jointly introduced a new 3D printed denture workflow and material system, enhancing the denture manufacturing process by bringing together Carbon's innovative Digital Light Synthesis (DLS) technology and Dentsply Sirona's dental expertise to improve the quality and efficiency of denture production.

-

In February 2018, EnvisionTEC launched a high-speed 3D printer with an impressive build size and introduced new dental materials designed to enhance the quality and realism of dental models and restorations.

U.S. Dental 3D Printing Market Report Scope

Report Attribute

Details

Market Size in 2025

USD 1.5 billion

Revenue forecast in 2030

USD 4.96 billion

Growth rate

CAGR of 26.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, technology, material, end use

Key companies profiled

3D Systems; Stratasys Ltd.; EnvisionTEC; Straumann; Dentsply Sirona; Renishaw plc; Carbon3D; Argen X; Asiga; Formlabs; DWS GmbH; Markforged

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental 3D Printing Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest vertical trends in each sub-segment from 2018 to 2030. For this report, Grand View Research has segmented the U.S. dental 3D printing market research report based on the application, technology, material, and end use:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthodontics

-

Prosthodontics

-

Implantology

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Vat Photopolymerization

-

Stereolithography

-

Digital Light Processing

-

-

Polyjet Technology

-

Fused Deposition Modelling

-

Selective Laser Sintering

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metals

-

Photopolymer

-

Ceramic

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Clinics

-

Dental Laboratories

-

Academic and Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. dental 3D printing market size was estimated at USD 1.2 billion in 2024 and is expected to reach USD 1.5 billion in 2025.

b. The U.S. dental 3D printing market is projected to grow at a compound annual growth rate (CAGR) of 26.2% from 2025 to 2030 to reach USD 4.96 billion by 2030.

b. The selective laser sintering segment dominated the market, with the largest share in 2024, due to its benefits over other technologies, such as superior chemical resistance, biocompatibility, and outstanding surface finishing.

b. Some of the key players operating in the market include 3D Systems, Stratasys Ltd, EnvisionTEC, and DentsPly Sirona.

b. The key drivers of the U.S. dental 3D printing market are the increasing demand for customized treatments, advancements in materials, and increased cost efficiency and time reduction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.