- Home

- »

- Medical Devices

- »

-

U.S. Defibrillator Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Defibrillator Market Size, Share & Trends Report]()

U.S. Defibrillator Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Implantable Cardioverter Defibrillators, External Defibrillators), By End-Use (Hospital, Pre-hospital), And Segment Forecasts

- Report ID: GVR-4-68040-277-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Defibrillator Market Size & Trends

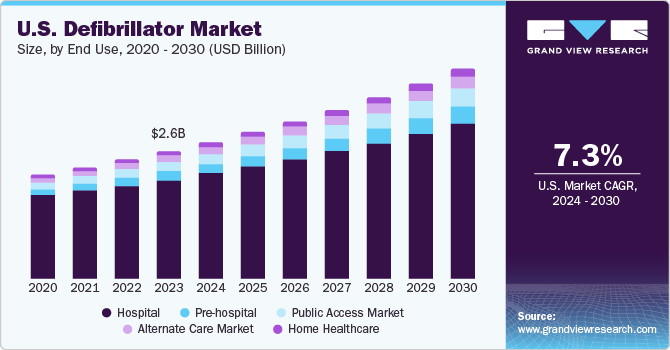

The U.S. defibrillator market size was estimated at USD 2.64 billion in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030. Increasing technological advancements, rising incidence of sudden cardiac arrests and CVDs, rising adoption of emerging applications, and supportive initiatives by governments & healthcare organizations are some key factors fueling industry growth. According to MyCPRNOW, integrating IoT and artificial intelligence with advanced diagnostics increases efficiency and effectiveness in managing disease outcomes and emergency conditions, preserving patients' lives.

The rising incidence of cardiovascular diseases in the U.S. is a major factor driving the U.S. market. According to Centers for Disease Control and Prevention, approximately 454,000 hospitalizations in the U.S. annually involve Atrial Fibrillation (AFib) as the primary diagnosis. This health condition is responsible for causing around 158,000 deaths annually. Atrial Fibrillation (AFib) significantly raises an individual's likelihood of experiencing a stroke. Even while considering standard stroke risk factors, AFib is linked to approximately five times higher chances of suffering an ischemic stroke. This increasing incidence of cardiovascular diseases is expected to fuel the market growth in the forecast period.

The growing geriatric population and technological advancements are anticipated to significantly influence market expansion. Elderly individuals, particularly those aged 65 years and above, are more susceptible to chronic ailments, such as cardiovascular diseases (CVDs). These conditions often necessitate defibrillators to restore normal heart rhythm through electric shocks. In November 2022, the article "Senior Population Statistics: A Portrait of Aging Americans" reported that around 54.1 million (16.3%) individuals in the U.S. are aged 65 years or above. Thus, the growing geriatric population contributes to the increasing product demand.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The U.S. market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in device hardware with the integration of AI and IoT and increasing real-time data transfer.

The U.S. market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new technologies and advanced features and increase the patients' quality of life.

The U.S. market is also subject to increasing regulatory scrutiny. This is due to concerns about the potential negative impacts, such as inadequate data validation and privacy and security concerns related to data in terms of remote patient monitoring. As a result, manufacturers are trying to adhere to the regulatory requirements, leading to increased investment in product development, ensuring their devices meet the standards and gain regulatory approval.

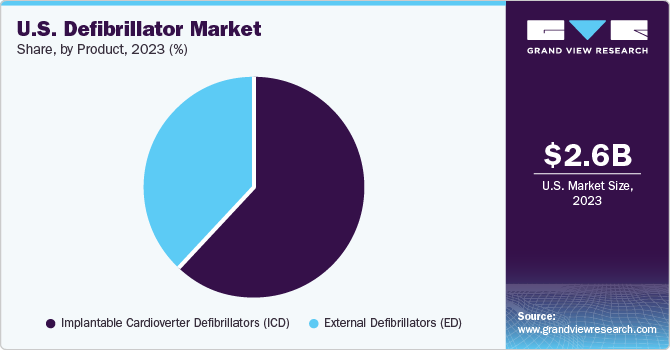

Product Insights

The implantable cardioverter defibrillators (ICDs) segment dominated the market with a share of more than 50% in 2023. The prominent factors driving the growth of this market segment include the increasing adoption due to the high prevalence of CVDs, a sizeable geriatric population in major markets, and the expanding range of product applications and technological advancements. In December 2021, Boston Scientific Corporation launched the MODULAR ATP clinical trial with the objective of evaluating the effectiveness, reliability, and overall efficiency of their mCRM Modular Therapy System. This trial focuses on ensuring the system's trustworthiness and optimal performance in addressing medical concerns. Two cardiac rhythm management devices were involved in the trial including the EMBLEM MRI S-ICD system. The primary objective of this trial was to assess the combined functionalities of these devices comprehensively.

The external defibrillators segment is estimated to record the fastest growth rate over the forecast period from 2024 to 2030 due to advancements in technology and initiatives sponsoring access to AEDs in public facilities. For instance, in March 2023, Safe Life completed the acquisition of Coro Medical and AED.US, a prominent player in the sales and services sector of Automated External Defibrillators (AEDs). This strategic move enhanced the accessibility of life-saving equipment and services across the U.S., contributing to a broader reach and improved public safety.

End-Use Insights

The hospitals segment held the largest revenue share in 2023 owing to the higher volume of cardiac cases in hospitals and surgeries performed in hospital settings. Both ICDs and external defibrillators are widely used in hospitals to deliver treatment to patients of sudden cardiac arrest and for other indications. In March 2024, McLaren Flint became one of the first hospitals in the U.S. to have implanted a unique defibrillator in patients, which is expected to offer a less risky option to treat patients with fast heart rhythms that can lead to sudden cardiac arrest (SCA).

In addition, implantable cardioverter-defibrillators (ICDs) also help in treating patients with life-threatening heart rhythm disorders, such as ventricular tachycardia and ventricular fibrillation. According to the Centers for Disease Control and Prevention, it is projected that by the year 2030, approximately 12.1 million individuals in the U.S. are expected to be diagnosed with Atrial Fibrillation (AFib), which is further expected to add to the segment growth.

The public access market segment is expected to grow at the fastest CAGR from 2024 to 2030 owing to the growing efforts to increase the availability of public Automated External Defibrillators (AEDs), enhance response to sudden cardiac arrest situations, and trained personnel, further increasing the demand for these devices. Factors contributing to this heightened demand include the expansion of awareness campaigns, strategic placement of AEDs in heavily frequented public areas, and the adoption of public facilities defibrillation programs. The steps for making AEDs more accessible to the general public is in line with a broader objective of improving emergency response capabilities and reducing response times during critical cardiac events is expected to contribute to the segment growth.

Key U.S. Defibrillator Company Insights

Some of the key companies operating in the U.S. market include Medtronic, Boston Scientific Corporation, Abbott, Koninklijke Philips N.V., ZOLL Medical Corporation (Asahi Kasei), and Nihon Kohden Corporation. These players are opting for strategies such as new product development, approval, and mergers & acquisition to gain higher share in the market.

-

Medtronic is a global player operating in the medical technology industry. Medtronic offers a range of implantable cardioverter-defibrillator (ICDs) devices including Paradym ICM, Versa ICM, Advisor MRI, Viva MRI, Evera MRI, Revo MRI, and Percepta.

-

Boston Scientific Corporation is a medical device company that manufactures and markets various types of ICDs and CRT-Ds, along with wearable cardioverter-defibrillators (WCDs). Some of these brand names include Emblem MRI ICD, Fortifyand Fortify ST ICDs, Prizm, and Prizm XR ICDs.

Key U.S. Defibrillator Companies:

- Medtronic

- Abbott

- Boston Scientific Corporation

- BIOTRONIK SE & Co. KG

- MicroPort Scientific Corporation

- Koninklijke Philips N.V.

- Stryker

- ZOLL Medical Corporation (Asahi Kasei)

- Nihon Kohden Corporation

- Siemens Healthineers

Recent Developments

-

In February 2024, BIOTRONIK, a prominent company in the field of implantable medical devices, declared their decision to exclusively provide their innovative DX models for future single-chamber ICD implantations.

-

In October 2023, Medtronic received FDA approval for the Aurora EV-ICD™ system specialized for treatment of abnormal heart rhythms and sudden cardiac arrest.

U.S. Defibrillator Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.32 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

U.S.

Key companies profiled

Medtronic; Abbott; Boston Scientific Corporation; BIOTRONIK SE & Co. KG; MicroPort Scientific Corporation; Koninklijke Philips N.V.; Stryker, ZOLL Medical Corporation (Asahi Kasei); Nihon Kohden Corporation; Siemens Healthineers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Defibrillator Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. defibrillator market report based on product and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implantable Cardioverter Defibrillators (ICD)

-

S-ICD

-

T-ICD

-

Single Chamber

-

Dual Chamber

-

CRT-D

-

-

-

External Defibrillators (ED)

-

Manual ED

-

Automated ED

-

Wearable Cardioverter Defibrillators

-

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Pre-hospital

-

Public Access Market

-

Alternate Care Market

-

Home Healthcare

-

Frequently Asked Questions About This Report

b. The U.S. defibrillator market size was estimated at USD 2.64 billion in 2023 and is expected to reach USD 3.3 billion in 2024.

b. The U.S. defibrillator market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 4.32 billion by 2030.

b. Implantable cardioverter defibrillators (ICDs) dominated the market with a share of over 52.03% in 2023. Key factors driving this segment growth include rising adoption of these devices due to the high prevalence of CVDs, high geriatric population in key markets, and growing product improvements by major companies.

b. Some key players operating in U.S. defibrillator market are Medtronic; Abbott; Boston Scientific Corp.; BIOTRONIK SE & Co. KG; MicroPort Scientific Corp.; Koninklijke Philips N.V.; Stryker; ZOLL Medical Corp. (Asahi Kasei); Nihon Kohden Corp.; Schiller AG

b. The increasing prevalence of CVDs, specifically the significant contribution of sudden cardiac arrest to cardiovascular-related deaths, is a major factor propelling advancements in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.