- Home

- »

- Medical Devices

- »

-

U.S. Deep Brain Stimulation In Parkinson’s Disease Market, Industry Report 2030GVR Report cover

![U.S. Deep Brain Stimulation In Parkinson’s Disease Market Size, Share & Trends Report]()

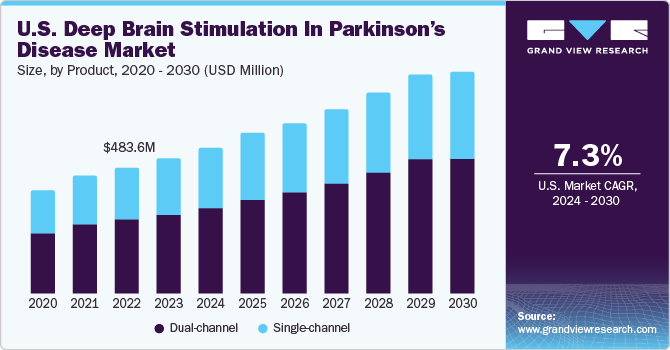

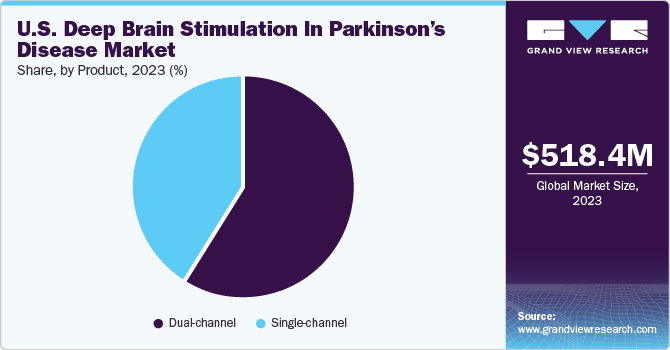

U.S. Deep Brain Stimulation In Parkinson’s Disease Market Size, Share & Trends Analysis Report By Product (Single-channel, Dual-channel), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-951-4

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. deep brain stimulation in parkinson’s disease market size was valued at USD 518.42 million in 2023 and is projected to grow at a CAGR of 7.29% from 2024 to 2030. The market is driven by numerous factors, such as technological advancements in deep brain stimulation devices, increasing prevalence of Parkinson’s disease (PD), and government funding for research and development. Through the allocation of funds to research initiatives, the governments actively support groundbreaking discoveries, foster technological innovations, and promote the development of more effective deep brain stimulation (DBS) technologies.

For instance, as per the data published in December 2023 by the National Institute of Neurological Disorders and Stroke (NINDS), PD research received support from NINDS with a contribution of approximately USD 125 million to the total funding of USD 259 million provided by the National Institutes of Health (NIH). This substantial financial support from NINDS highlighted the commitment to advancing research & understanding of PD, aiming to make strides in its diagnosis, treatment, and overall management.

Increasing government funding propels scientific advancements and encourages collaboration between researchers, medical professionals, and technology developers. The aim is to improve the lives of individuals suffering from PD by advancing the development of DBS therapies. In addition, government support can contribute to making DBS technology more accessible to a broader patient population. This may include initiatives to reduce costs, improve insurance coverage, or subsidize expenses associated with DBS procedures. It plays a pivotal role in catalyzing this progress, propelling the market growth, and creating a vibrant landscape for research & development endeavors.

Technological advancements in DBS which acts as a brain pacemaker for the treatment of PD are anticipated to propel the global deep brain stimulation in parkinson's disease market growth in the near future. Innovations, such as robot-assisted implantation, enhanced microelectrode designs, multitarget stimulation, rechargeable Implantable Pulse Generators (IPGs), personalized directed programming, and integration of Magnetic Resonance Imaging (MRI), are opening new possibilities. These breakthroughs not only enhance the precision and efficiency of DBS procedures but also pave the way for personalized & more effective treatments. Ongoing advancements in technology enhance DBS treatments, offering enhanced prospects for patients in search of neurostimulation therapies.

For instance, in July 2023, Boston Scientific Corporation obtained approval from the U.S. FDA for its innovative Vercise Neural Navigator 5 Software. This software, seamlessly integrated with Vercise Genus DBS Systems, provides clinicians with user-friendly and practical data. Streamlining the programming process significantly enhances efficiency of treating individuals having PD or essential tremor.

This approval marked a significant advancement in improving the quality of care for individuals affected by these debilitating conditions. Integration of the Vercise Neural Navigator 5 Software with DBS systems contributes to minimizing adverse effects and improving efficacy & symptomatic relief in patients with PD, surpassing outcomes achieved through traditional methods. This signifies a positive stride toward more effective and patient-friendly neurostimulation treatments.

Moreover, growing incidence of Parkinson’s disease plays a significant role in driving market for DBS devices. This condition results from a combination of genetic factors, such as mutations in the alpha-synuclein gene, and environmental influences, including repeated head injuries. Age remains a primary risk factor for the development of PD, highlighting the importance of addressing this health concern. For instance, according to Parkinson's Foundation's 2022 estimates, number of individuals living with PD was projected to reach 1.2 million by 2030. In the U.S., 90,000 people received PD diagnosis, surpassing numbers for muscular dystrophy, multiple sclerosis, and amyotrophic lateral sclerosis combined. Furthermore, approximately 60,000 new cases of PD are identified each year in the U.S. Rising incidence of Parkinson's Disease (PD) has led to an increased need for DBS as a viable treatment option. DBS has proven essential in providing effective solutions for managing and relieving PD symptoms.

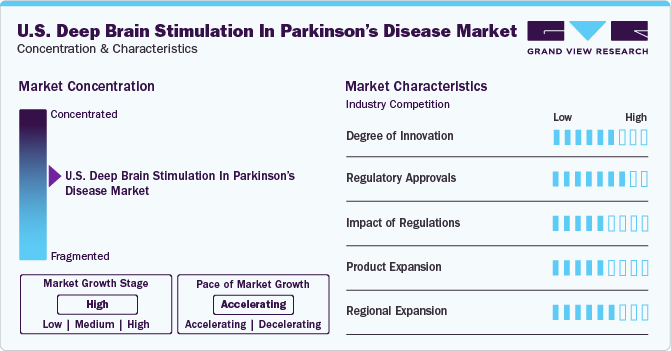

Market Concentration & Characteristics

The market growth stage is high, and the pace of its growth is accelerating. The market is characterized by increasing cases of PD, technological advancements, and increasing regulatory approval for novel product launches.

Key strategies implemented by major players and government entities are increasing clinical studies for assessments for PD, acquisitions, partnerships, collaborations, etc. In November 2023, Surgical Information Systems (SIS) revealed a novel dubbed VISION (NCT05774041), a post-marketed clinical study focusing on exploring the potential of SIS visualization technology to enhance the precision of DBS for people dealing with PD. The main goal was to evaluate how well this technology can improve the accuracy of DBS procedures, by offering notable advancements in the treatment of PD. This research aimed to contribute valuable insights into refining methods and effectiveness of DBS, ultimately benefiting individuals affected by PD

Innovation in the precision of electrode placement through advanced targeting techniques and imaging technologies helps optimize therapeutic outcomes and minimize side effects enhancing the degree of innovation

The major regulatory authority overseeing medical devices in the U.S. is the FDA. In the case of DB devices, which act as a brain pacemaker intended for treating PD, FDA approval is a prerequisite before these devices can be sold and employed for clinical applications

Continuous regulatory oversight involves ongoing surveillance of the safety and performance of DBS devices post-market release. This monitoring is essential for ensuring the long-term safety of patients. Regulatory bodies set forth guidelines for the proper use and labeling of DBS devices, aiming to provide healthcare professionals and patients with precise information

Manufacturers may develop electrodes with enhanced designs to enhance accuracy and effectiveness in targeting specific regions of the brain. Upgrades to programming software can provide healthcare providers with additional customization options, allowing them to optimize therapy more precisely based on individual patient responses

The market is characterized by high concentration, with a few key players accounting for the majority of market share. These players typically hold strong positions due to factors, such as established brand recognition, extensive distribution networks, and significant investments in R&D. The market concentration has led to intense competition among these companies, driving innovation and the development of new technologies. It also influences pricing strategies, with companies often leveraging their market dominance to maintain premium pricing for their products. However, regulatory scrutiny and potential for disruptive innovations could impact the market concentration in future

The U.S. has a significant population of target patients, contributing to a substantial market for DBS as a treatment option. Advances in DBS technology, including improvements in electrode design, programming algorithms, and surgical techniques, can impact market growth

Product Insights

The dual-channel segment dominated the market in 2023 and is expected to register the fastest CAGR of 7.87% from 2024 to 2030. Dual-channel systems can target multiple brain regions simultaneously. This can be beneficial for patients with complex movement disorders or those experiencing a range of symptoms that may require separate stimulation parameters. Dual-channel DBS offers greater flexibility in adjusting and optimizing therapy for patients with diverse & evolving symptoms. Like single-channel systems, dual-channel DBS allows for personalized treatment approaches. Flexibility to stimulate different brain regions independently can be valuable in tailoring therapy to the specific needs of each patient. Moreover, growing adoption of double-channel DBS for treating Parkinson’s disease is one of the key factors driving segment growth.

Furthermore, new product launches and technological advancements are facilitating segment growth. For instance, in January 2024, Medtronic Plc revealed the U.S. FDA endorsement for its groundbreaking Percept RC DBS system. As the latest addition to Medtronic Percept portfolio, comprising BrainSense technology, Percept PC neurostimulator, and SenSight directional leads, this rechargeable neurostimulator sets a new standard in sensing-enabled DBS systems. Uniquely personalized for patients with movement disorders like PD, essential tremor, dystonia, and epilepsy, the Percept portfolio empowers physicians to tailor treatments. The Percept RC is the most compact and delicate dual-channel neurostimulator in this market. The product is readily available across the U.S., and it is further supported by obtaining CE Mark approval for distribution in Europe. In addition, it is accessible in the Japanese market.

Key U.S. Deep Brain Stimulation In Parkinson’s Disease Company Insights

LivaNova PLC and Functional Neuromodulation, Ltd. are some of the emerging players in the U.S. DBS in Parkinson’s disease market. The market has experienced a notable expansion in recent years, propelled by technological advancements, rising PD prevalence, and a growing elderly demographic. DBS, a surgical intervention, entails the implantation of a device similar to a pacemaker within the brain, administering electrical impulses to mitigate Parkinson's symptoms, including tremors and rigidity. New entrants are leveraging technological advancements to introduce innovative solutions and gain a competitive edge.

Start-ups and smaller companies are actively engaged in R&D to bring forth novel therapies and enhance existing treatment options. Moreover, growing patient pool and rising awareness about the benefits of DBS have created opportunities for market entry. Companies are focusing on strategic collaborations, partnerships, and mergers to strengthen their industry position and expand their product portfolios. In addition, increasing investments in clinical trials and regulatory approvals are helping emerging players navigate the complex landscape of the market.

Key U.S. Deep Brain Stimulation In Parkinson’s Disease Companies:

- ABBOTT

- Medtronic

- Boston Scientific Corporation

Recent Developments

-

In March 2023, Michigan Tech researchers successfully advanced the field of DBS systems for Parkinson's patients by integrating neuromorphic computing. This innovative approach aimed to enhance the efficiency and energy utilization of DBS systems, crucial for managing Parkinson's disease. Neuromorphic computing, often referred to as brain-inspired or neuroscience-powered artificial intelligence (AI), employs microchips and algorithms to replicate the functionality of a nervous system. The application of this technology marks a significant evolution in optimizing the therapeutic capabilities of DBS systems while concurrently addressing energy consumption concerns

-

In April 2022, Boston Scientific Corp. introduced the company’s latest image-guided programming software, Vercise Neural Navigator with STIMVIEW XT, marking a significant development in the field of DBS. The software was designed to provide clinicians with real-time visualization capabilities for lead placement and stimulation modeling in patients living with Parkinson's disease. This advancement was expected to have a notable impact on the U.S. DBS market

-

In January 2021, Medtronic initiated the ADAPT-PD trial, assessing the safety and efficacy of Adaptive DBS (aDBS) for Parkinson's disease. This investigational feature, part of the Percept PC device, was expected to enable automated brain stimulation adjustments based on a patient's clinical state, potentially revolutionizing personalized therapy if approved

-

In January 2020, Medtronic’s Percept PC neurostimulator received CE mark approval. This DBS system was the device to be launched in Europe with BrainSense technology that can record and sense brain signals while delivering therapy to patients with Parkinson’s disease

U.S. Deep Brain Stimulation In Parkinson’s Disease Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 556.79 million

Revenue forecast in 2030

USD 849.50 million

Growth rate

CAGR of 7.29% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product

Country scope

U.S.

Key companies profiled

ABBOTT; Medtronic; Boston Scientific Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Deep Brain Stimulation In Parkinson’s Disease Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. deep brain stimulation in parkinson’s disease market report based on product:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-channel

-

Dual-channel

-

Frequently Asked Questions About This Report

b. The U.S deep brain stimulation in Parkinson's disease market size was estimated at USD 518.42 million in 2023 and is expected to reach USD 556.79 million in 2024.

b. The U.S deep brain stimulation in Parkinson's disease market is expected to grow at a compound annual growth rate of 7.29% from 2024 to 2030 to reach USD 849.50 million by 2030.

b. Dual-channel segment dominated the U.S deep brain stimulation in Parkinson's disease market with a share of 58.71% in 2023. Dual channel DBS offers the best overall support, exhibiting greater effectiveness in reducing patient tremors and enhancing the quality of life.

b. There are three major players in the market—Medtronic, Abbott, and Boston Scientific—with FDA-approved DBS systems for Parkinson’s disease. Among these, Medtronic has been in the market for a longer duration compared to Abbott and Boston Scientific. All three players give unique service and product offerings such as greater stimulation, increased contact points, greater battery life, and ease of implantation, catering to a broad range of patients affected with PD.

b. The major factors impacting the growth of the U.S deep brain stimulation devices in Parkinson's disease market are introduction of technologically advanced products, increasing incidence of chronic diseases such as PD and supportive government initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."