U.S. Cybersecurity Market Size, Share & Trends Analysis Report By Component, By Security Type, By Solution, By Services, By Deployment, By Organizational Size, By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-252-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Cybersecurity Market Size & Trends

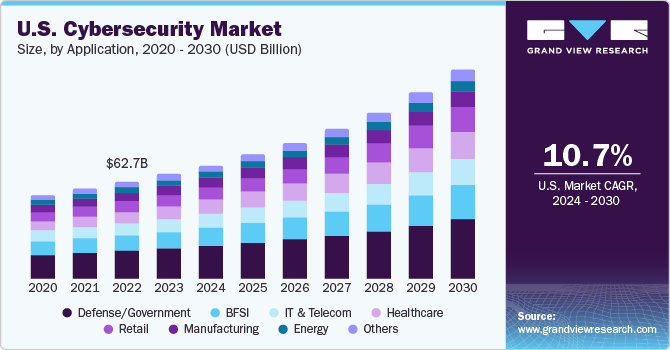

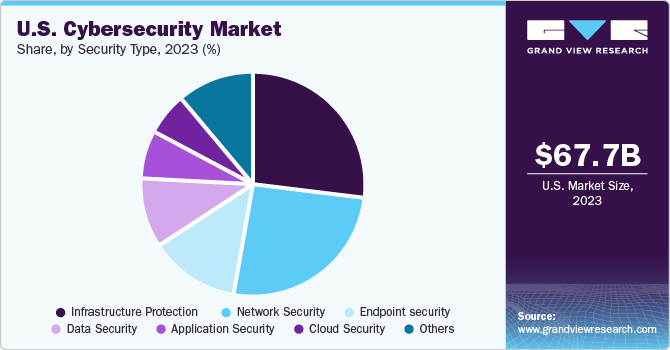

The U.S. cybersecurity market size was valued at USD 67.69 billion in 2023 and is projected to grow at a CAGR of 10.7% from 2024 to 2030. The U.S. accounted for 30.4% of the global customer experience management market. The cyber security market of the U.S. is anticipated to be driven by growing cyber threats and advanced malware threats across different verticals. Similarly, in the United States, new networks are being rolled out, and existing networks are being expanded; these networks are increasingly becoming vulnerable to cyber threats. As a result, the U.S. cybersecurity market is witnessing growth.

Moreover, in 2016, the U. S. government announced the implementation of the Cybersecurity National Action Plan (CNAP) to reinforce cybersecurity. It issued an executive order to create a commission on enhancing national cybersecurity as a central feature of the CNAP. The Cybersecurity Act of 2015 encourages the private sector and the U.S. government to responsibly and efficiently exchange cyber threat information. Meanwhile, the Cybersecurity Enhancement Act of 2014 facilitates voluntary public-private partnerships to improve cybersecurity and support the research and development on cybersecurity.

In addition, many U.S. businesses invest in cloud computing due to the evolution of cloud computing technology. Such cloud-based platforms are always vulnerable to cybercrimes and data breaches. Several enterprises are opting for cloud computing due to the high costs associated with on-premise solutions. As such, the adoption of cloud-based cybersecurity systems is expected to increase in line with the growing preference for cloud computing. These factors are expected to drive growth in the U.S. cybersecurity market over the forecast period.

Furthermore, large organizations often deal with a large network of servers and endpoints distributed across various locations. Cyber security solutions offer centralized management and reporting capabilities, allowing businesses to safeguard large networks and servers with real-time threat detection and response capabilities. Therefore, demand for cybersecurity solutions are driving the growth of the U.S. cybersecurity market.

However, the U.S. cybersecurity market involves challenges such as high costs in implementing cybersecurity solutions, which are anticipated to challenge market growth. With each emerging technology, companies must upgrade their infrastructure to blend in with new technology, creating loopholes that cybercriminals can exploit. For instance, the emergence of 5G technology requires telecom carriers to shift from hardware to software-based infrastructure. Transitioning to new technology renders the old security ineffective, creating a cyber-attack risk.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The U.S. cybersecurity market is fairly concentrated. With the cyber environment emerging as a highly integrated system, the need for an adaptive, multi-layered, and self-learning security system has become imperative, and there is a huge scope for innovation in cybersecurity. The U.S. market is ready to set an example in this domain and may witness growth in near future.

Prominent cybersecurity companies in the U.S. have been actively acquiring, partnering, and collaborating with companies to enhance their capabilities and expand their market reach. These acquisitions focus on advanced technologies such as AI/ML, and data analytics to identify and mitigate cyber threats. For Instance, in December 2023, IBM Corporation announced a collaboration with Palo Alto Networks to strengthen the client's end-to-end postures and navigate the security threats.

The market is characterized as hyperactive and dynamic due to the ever-changing nature of the cybersecurity threat landscape, where business entities face complex and targeted attacks. Therefore, there is a great degree of potential for innovation in the market, and consequently, the U.S. cybersecurity market is becoming increasingly volatile due to the continuously developing world of cybersecurity.

Moreover, the U.S. market end-user concentration is high, and the market is competitive due to the presence of multiple service providers. In order to monitor the security standards, the U.S. Department of Commerce monitors the standards of cybersecurity software in light of competitiveness. As part of its regularization process, the company provides essential guidelines to reduce the risk of data privacy breaches and network breakdowns and strengthen security posture across remote and hybrid systems, promoting a trust-centered and safe business environment.

Component Insights

The services segment dominated the market and accounted for the highest revenue of USD 39.04 billion in 2023. Several organizations are incorporating cyber security services to ensure data security and mitigate future cyberattacks. As a result, consulting and support services for the cybersecurity domain are particularly gaining traction in the U.S.-based end-use industries as these services allow companies to focus on their workflows.

The hardware segment is anticipated to witness a significant CAGR of 12.1% from 2024 to 2030 in the U.S. cybersecurity market. With the growing number of cyber-attacks from anonymous networks, Internet Service Providers (ISP) and large and small & medium-sized businesses are expected to deploy next-generation security hardware. Such hardware assists organizations in upgrading their IT security by enabling real-time monitoring of threats and offering protection by preventing threats from entering computing systems. As a result, this sub-segment will drive the growth of the U.S. cybersecurity market in the forecast period.

Security Type Insights

Infrastructure Protection segment led the market and accounted highest revenue share of 26.6% in 2023. IT infrastructure protection involves countermeasures like vulnerability management, penetration testing, red teaming, intrusion prevention and detection, security monitoring, and configuration management. As a result, U.S. software companies invest heavily in infrastructure protection services to protect themselves from cyber threats, which drives the market demand for infrastructure protection services.

Cloud Security segment is anticipated to witness fastest CAGR of 14.1% from 2024 to 2030 in the U.S. cybersecurity market. The growing demand for managed security solutions and the increasing adoption of the cloud are expected to drive the demand for cloud security solutions. Furthermore, an increase in the number of remote workforces is expected to fuel the segment's growth. As a result, cloud security sub-segment is driving the growth during the forecast period.

Solution Insights

IAM segment led the market and accounted for the highest revenue of USD 6.35 billion in 2023. Identity and Access Management (IAM) offers solutions to identity theft through risk-based programs with features that focus on implementing logical access control and entitlement management. Increasing spending on security solutions by large-scale enterprises and government bodies to adhere to regulatory compliance and control identity theft is anticipated to boost the segment growth in the U.S. cybersecurity market.

The risk and compliance management segment is anticipated to witness the fastest CAGR of 12.2% from 2024 to 2030 in the U.S. cybersecurity market. As organizations become increasingly compliance-focused, the need to comply with U.S. government regulations will increase the demand for risk and compliance management solutions. Thus, risk and compliance management sub-segment is showcasing growth during the forecast period.

Services Insights

Professional services segment led the market and accounted highest revenue share of 75.3% in 2023. The increased adoption of professional services can be attributed to the growing demand for services such as enterprise risk assessment, penetration testing, physical security testing, and cyber security defense. Moreover, the lack of skilled IT security professionals is also driving the adoption of these services for employee training.

Managed services segment is anticipated to witness fastest CAGR of 10.6% from 2024 to 2030 in the U.S. cybersecurity market. Managed services are witnessing increased demand due to IT security services requiring monitoring and managing their security solutions. Similarly, managed services are a cost-effective alternative to having internal teams manage the company's IT security workload. As a result, managed services sub-segment is driving market growth during the forecast period.

Deployment Insights

On premise segment led the market and accounted highest revenue of USD 37.84 billion in 2023. Several large organizations prefer having complete ownership of solutions and upgrades as they possess critical business information databases. This helps them to ensure an optimum level of data security, due to on-premise cybersecurity solutions provide better data privacy.

Cloud segment is anticipated to witness significant CAGR of 11.5% from 2024 to 2030 in the U.S. cybersecurity market. As cloud computing continues to evolve, cloud-based platforms are becoming more vulnerable to cybercrimes and data breaches. Several companies and banks are opting for cloud computing owing to the high costs associated with on-premise solutions across the United States. Thus, cloud sub-segment is showcasing growth during the forecast period.

Organization Size Insights

Large enterprises segment led the market and accounted for the largest revenue share of 66.5% in 2023. Large businesses face various risks, such as data breaches and hacking, that come with the use of advanced technologies. Moreover, several large companies adopting hybrid work models, anonymous networks, and the use of personal devices pose a high-security risk to large enterprises. Hence, the high demand among large companies for cybersecurity solutions is expected to contribute to segment growth over the forecast period.

Small and Medium Sized Enterprises (SMEs) segment is anticipated to witness a significant CAGR of 11.3% from 2024 to 2030 in the U.S. cybersecurity market. Due to budget constraints, small and medium-sized businesses are more vulnerable to cyber-attacks owing to their low level of security. Moreover, a lack of security policies and employee skills also makes them prone to cyber-attacks. As a result, SMEs will drive the U.S. cybersecurity market growth in the forecast period.

Application Insights

Defense/Government segment accounted for the largest market revenue of 19.31 billion in 2023. Cybersecurity solutions offer network integrity solutions to defense and government agencies, enabling them to ensure the security of their intellectual property, sensitive data & communications, and other intangible assets. Therefore, effective and multi-dimensional cybersecurity measures are necessary to prevent data breach threats in these areas. As a result, it is expected to boost the demand for cyber security solutions in the defense/government sectors over the forecast period.

Healthcare segment is expected to register the fastest CAGR of 12.4% during the forecast period. Healthcare is an appealing target for cyber-attacks as medical data is more valuable than credit card or banking information. In addition, the recent digital transformation of the healthcare industry has increased the frequency of cyber-attacks. This has encouraged healthcare entities to invest and adopt cybersecurity solutions, which are key drivers in the U.S. cybersecurity market.

Key U.S. Cybersecurity Company Insights

Microsoft Corporation, Cisco Systems, Inc., IBM Corporation, and others are some of the prominent participants operating in the U.S. cybersecurity market.

-

Cisco Systems, Inc. is a technology solutions and service provider. The company operates via three business segments: Product and licenses, Security Subscriptions, and Software Updates and maintenance. The security product and solution offerings include network security, identity and access management, advanced threat protection, industrial security, and user device security

-

The company offers consulting and hosting services and specializes in cloud-based services, cognitive analytics, security, consulting, research, Internet of Things (IoT), technology support, and industry solutions, among others.

Some of the emerging companies operating in the market include McAfee Corp., Fortinet, Inc., Trend Micro Inc., and others.

-

McAfee Corp. offers various solutions such as McAfee Antivirus, McAfee Mobile Protection, McAfee PC Optimizer, McAfee Safe Connect, McAfee Techmaster, and McAfee+. These security solutions help the education sector, government, organizations, and independent clients in the early detection and prevention of security threats, data loss, and saving devices and applications from malware and viruses.

-

Trend Micro Incorporated is specializing in cloud security, mobile security, virtualization security, data security, content security, server security, antivirus software, and secure online data storage & synchronization, among others. It offers layered content security for endpoints, mobile devices, gateways, the cloud, and servers. These solutions assist organizations in protecting their applications, cloud resources, and data centers from sophisticated and targeted attacks.

Key U.S. Cybersecurity Companies:

- A10 Networks

- BAE Systems

- Broadcom

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- CrowdStrike

- CyberArk

- Fortinet, Inc.

- IBM Corporation

- Lockheed Martin Corporation

- LogRhythm, Inc.

- McAfee, Corp.

- Microsoft Corporation

- Oracle Corporation

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Rapid7

- Sophos Ltd.

- Tenable, Inc.

- Trend Micro Inc.

Recent Developments

-

In December 2023, IBM Consulting and Palo Alto Networks Announced partnership for expansion for strategic cybersecurity domain. This partnership aims strategic partnership to better enable clients to strengthen their end-to-end security postures and navigate evolving security threats.

-

In December 2023, Splunk announced a collaboration with the National Cybersecurity Center of Excellence (NCCoE) at the National Institute of Standards and Technology (NIST). In partnership with experts from industry and government, the NCCoE provides practical solutions to businesses' most pressing cybersecurity problems using commercially available technologies.

-

In June 2023, Check Point Software Technologies Ltd., a cybersecurity solution provider, and Everphone, a Device as a Service (DaaS) provider, announced a collaboration for advanced threat prevention for corporate smartphones. This collaboration will provide a Mobile Threat Defense (MTD) solution that provides comprehensive protection against a wide range of cyber threats.

U.S. Cybersecurity Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 73.42 billion |

|

Revenue forecast in 2030 |

USD 135.34 billion |

|

Growth Rate |

CAGR of 10.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, security type, solution, services, deployment, organizational size, application |

|

Country scope |

U.S. |

|

Key companies profiled |

A10 Networks; BAE Systems; Broadcom; Check Point Software Technologies Ltd.; Cisco Systems, Inc.; CrowdStrike; CyberArk; Fortinet, Inc.; IBM Corporation; Lockheed Martin Corporation; LogRhythm, Inc.; McAfee, Corp.; Microsoft Corporation; Oracle Corporation; Palo Alto Networks, Inc.;Proofpoint, Inc.; Rapid7; Sophos Ltd.; Tenable, Inc.; Trend Micro Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Cybersecurity Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cybersecurity market report based on component, security type, solution, services, deployment, organizational size, and application.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Security Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Endpoint security

-

Cloud Security

-

Network Security

-

Application Security

-

Infrastructure Protection

-

Data Security

-

Others

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Unified threat management

-

IDS/IPS

-

DLP

-

IAM

-

SIEM

-

DDoS

-

Risk and compliance management

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional services

-

Managed services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium-Enterprise (SME)

-

Large Enterprise

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

Retail

-

BFSI

-

Healthcare

-

Defense/Government

-

Manufacturing

-

Energy

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cybersecurity market size was estimated at USD 67.69 billion 2023 and is expected to reach USD 73.42 billion in 2024

b. The U.S. cybersecurity market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 135.34 billion in 2030.

b. Professional services segment led the market and accounted highest revenue share of 75.3% in 2023. The increased adoption of professional services can be attributed to the growing demand for services such as enterprise risk assessment, penetration testing, physical security testing, and cyber security defense.

b. Some key players operating in the U.S. cybersecurity market are A10 Networks; BAE Systems; Broadcom; Check Point Software Technologies Ltd.; Cisco Systems, Inc.; CrowdStrike; CyberArk; Fortinet, Inc.; IBM Corporation; Lockheed Martin Corporation; LogRhythm, Inc.; McAfee, Corp.; Microsoft Corporation; Oracle Corporation; Palo Alto Networks, Inc.;Proofpoint, Inc.; Rapid7; Sophos Ltd.; Tenable, Inc.; and Trend Micro Inc among others.

b. The cyber security market of the U.S. is anticipated to be driven by growing cyber threats and advanced malware threats across different verticals.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."