U.S. Customer Relationship Management Market Size, Share & Trends Analysis Report By Solution, By Deployment (On-premise, Cloud), By Application, By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-129-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

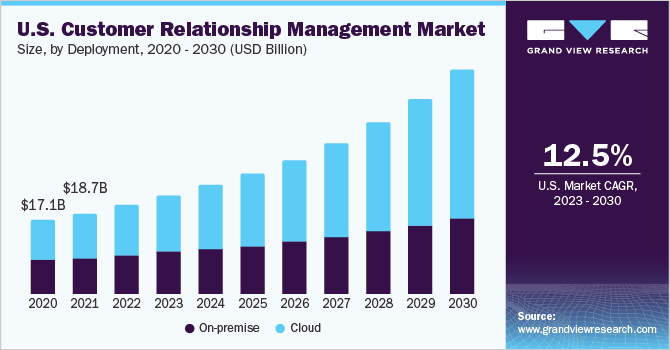

The U.S. customer relationship management market size was evaluated at USD 20.50 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.5% from 2023 to 2030. The increasing adoption of mobile CRM and cloud-enabled social solutions is expected to fuel the growth of the U.S. market during the forecast period. Customer Relationship Management (CRM) solutions are also anticipated to be more widely adopted in the U.S. as businesses increasingly recognize the growing significance of these solutions for B2B and B2C business processes. The entry of new market players with an innovative approach toward offering value-based results to end-users is triggering market demand.

For instance, an increased number of CRM solutions that focus on user-friendliness are being introduced in the market, and the rising adoption of such solutions is boding well for the market. It is also estimated that AI-enabled customer relationship management software, which offers benefits such as the quicker implementation of repetitive and mundane tasks, improved customer retention, and lead customization, would result in high revenue generation in the next few years.

The market offers substantial growth opportunities owing to the presence of several well-established players, well-developed business ecosystems, and the existence of a highly consumerist culture. There is a high impetus by solution providers for training and certification programs to create a technically sound workforce with CRM functionalities and operations. CRM applications integrated with wearable devices are being touted as the next big thing in the field. If these applications are embedded within wearable computing devices, businesses can modify and improve their customer relationship management strategy based on real-time information about customers and can engage with them on a more personalized level.

A key trend in the market is the increased adoption of social and mobile solutions. This can be attributed to the fact that several mobile customer relationship management solutions in the market deliver a wide range of capabilities on any device connected to the network. Real-time access to such solutions is another major advantage offered by mobile CRM. In addition, the number of smartphone users is increasing exponentially globally, consequently widening the potential customer base of these solutions.

However, not all businesses may benefit from CRM software. This is especially true for businesses that work on a highly standardized customer interaction model. For instance, a process-driven sales channel might not be a major concern for a small-scale organization. Similarly, a large-scale organization may demand a robust CRM capable of driving the business as well as addressing customer queries. In addition, security concerns are likely to exist in a centralized data server environment, which may discourage businesses dealing with critical business or consumer data from adopting such solutions. For instance, the General Data Protection Regulation (GDPR) regulation levies heavy penalties on organizations if they cannot provide privacy protections to all their customers.

Deployment Insights

The cloud segment accounted for the largest market share of 56.5% in 2022. This is owing to rising awareness regarding the benefits of cloud in terms of cost and flexibility. It offers seamless access to the system from any point or device that proves beneficial for any large-scale business. Owing to the rising focus of U.S.-based companies on developing an automated and customized customer management approach, the development and deployment of cloud software services are expected to rise at a promising pace in the country in the next few years.

The on-premise segment is anticipated to grow at a CAGR of 9.1% during the forecast period owing to a rise in the number of paid subscriptions. It involves a system database to be installed on the internal server of the end-user, wherein security levels are to be managed completely at the organizational level. In addition to offering the versatility to upgrade to the newest versions of software as and when needed, this mode proves to be a cost-effective investment. These factors fuel the demand for on-premise deployment, resulting in significant growth prospects.

Solution Insights

The customer service segment accounted for the largest market share of 23.5% in 2022. The growing adoption of customer service teams to track customer interactions, manage support tickets, and resolve issues efficiently is expected to fuel the demand of the market in future years. CRM software enables agents to access customer data, history, and preferences, allowing them to provide personalized and timely support. With the adoption of CRM tools, customer service representatives can handle inquiries, address concerns, and resolve problems effectively, leading to higher customer satisfaction.

The social media monitoring segment is anticipated to grow at a CAGR of 15.0% during the forecast period. Social media marketing is essential to customer relationship management (CRM) strategies. CRM systems can be integrated with social media platforms to enhance marketing efforts and strengthen customer relationships. CRM systems can integrate with social media advertising tools, allowing businesses to target specific audience segments, track leads, and capture customer information directly into the CRM database. These benefits have boosted the adoption of social media marketing solutions, thereby leading to market growth.

End-use Insights

The large enterprises segment accounted for a market share of 63.1% in 2022. thanks to the rising need for the adoption of customer relationship management platforms to enhance customer engagement. In addition, several key benefits offered by these platforms, such as improvement in internal business processes and customer relationship management approach, are also encouraging small- and medium-sized businesses (SMBs) to use CRM services and solutions in the U.S. Furthermore, customer relationship management solutions have also enabled manufactures and service providers to effectively communicate and work with a large number of business in emerging economies across regions.

The SMBs segment is anticipated to grow at a CAGR of 14.1% during the forecast period. Declining prices of cloud-based CRM solutions are also a key factor driving SMEs' adoption of customer relationship management solutions in the U.S. As a result, SMBs are anticipated to emerge as the fastest-growing segment during the forecast period owing to the increasing rate of digitization in businesses and the growing importance of customer engagement. SMBs also increasingly acknowledge the importance of a robust CRM platform to complement their sales strategy.

Application Insights

The retail segment accounted for the largest market share of 23.35% in 2022. The emergence of artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) technologies are trending in the retail industry in the U.S. Advantages such as easy access to newer markets, seamless customer experience across channels, and capability of building an interpersonal relationship with customers are helping drive the adoption of CRM solutions in the retail sector in the country.

The telecom & IT segment is anticipated to grow at a CAGR of 14.3% during the forecast period. Factors such as the availability of high-speed wireless internet infrastructure and services and the booming IT industry are expected to further fuel the growth of the segment. For instance, software-as-a-service (SAAS) for CRM deployment enables companies to own multiple datasets from discrete systems to enhance decision-making and customer service delivery. This approach facilitates various organizations with a vertical-specific CRM to serve a dedicated purpose.

Key Companies & Market Share Insights

The key players operating in the U.S. customer relationship management market include Adobe Systems Inc.; Copper CRM, Inc.; Creatio; Genesys; HubSpot Inc.; IBM; Insightly, Inc.; Microsoft Corporation; Nimble; Oracle Corporation; SAP SE; Salesforce.com, Inc.; SugarCRM Inc.; Verint Systems Inc.; and Zoho Corp. To broaden their product offering, industry companies utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. In June 2021, Salesforce.com, Inc. unveiled new digital 360 capabilities to help businesses improve their digital operations and provide the newest in digital marketing, commerce, and experiences. Some prominent players in the U.S. customer relationship management market include:

-

Adobe Systems Inc.

-

Copper CRM, Inc.

-

Creatio

-

Genesys

-

HubSpot Inc.

-

IBM

-

Insightly, Inc.

-

Microsoft Corporation

-

Nimble

-

Oracle Corporation

-

SAP SE

-

Salesforce.com, Inc.

-

SugarCRM Inc.

-

Verint Systems Inc.

-

Zoho Corp.

U.S. Customer Relationship Management Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 51.53 billion |

|

Growth rate |

CAGR of 12.5% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

May 2023 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, deployment, application, end-use |

|

Key companies profiled |

Adobe Systems Inc.; Copper CRM, Inc.; Creatio; Genesys; HubSpot Inc.; IBM; Insightly, Inc.; Microsoft Corporation; Nimble; Oracle Corporation; SAP SE; Salesforce.com, Inc.; SugarCRM Inc.; Verint Systems Inc.; Zoho Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Customer Relationship Management Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. customer relationship management market report based on solution, deployment, application, and end-use:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customer Service

-

Customer Experience Management

-

Analytics

-

Marketing Automation

-

Salesforce Automation

-

Social Media Monitoring

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail

-

Healthcare

-

Telecom & IT

-

Discrete Manufacturing

-

Government & Education

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMBs

-

Frequently Asked Questions About This Report

b. The global U.S. customer relationship management market size was estimated at USD 20.50 billion in 2022 and is expected to reach USD 22.59 billion in 2023.

b. The global U.S. customer relationship management market is expected to grow at a compound annual growth rate of 12.5% from 2023 to 2030 to reach USD 51.53 billion by 2030.

b. The retail segment dominated the market in 2022 with a market share of more than 23.35%. Advantages such as easy access to newer markets, seamless customer experience across channels, and capability of building an interpersonal relationship with customers are helping drive the adoption of CRM solutions in the retail sector in the country.

b. Some of the key vendors in the market are Adobe Systems Inc., Copper CRM, Inc., Creatio, Genesys, HubSpot Inc., IBM, Insightly, Inc., Microsoft Corporation, Nimble, Oracle Corporation, SAP SE,Salesforce.com, Inc., SugarCRM Inc., Verint Systems Inc., and Zoho Corp.

b. The growing adoption of cloud-enabled social and mobile CRM solutions is expected to boost the growth of the U.S. market during the forecast period. In addition, companies are now acknowledging the growing importance of these solutions for B2B and B2C business processes, which is also expected to fuel the adoption of customer relationship management solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."