U.S. Custom Software Development Market Size, Share & Trends Analysis Report By Solution, By Deployment (Cloud, On-premise), By Enterprise Size, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-254-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

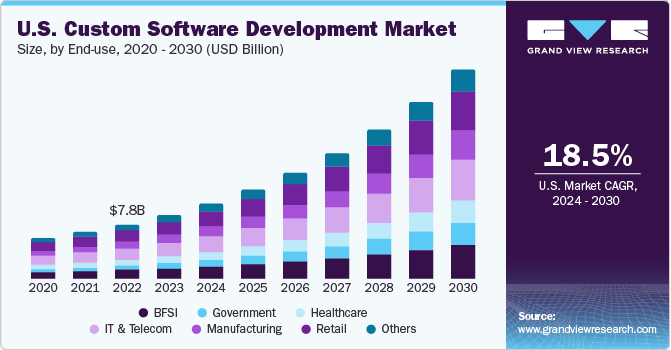

The U.S. custom software development market size was valued at USD 9.08 billion in 2023 and is projected to grow at a CAGR of 18.5% from 2024 to 2030. The U.S. accounted for 25.6% of the global custom software development market. The growth of the U.S. custom software development market can be attributed to addressing specific business needs and providing a competitive advantage by automating and streamlining various processes, improving overall efficiency, reducing errors, and enhancing customer satisfaction. Custom software development allows businesses the flexibility to make changes to their software solutions as per their evolving business needs. As a result, the U.S. market is witnessing the growth of custom software.

The adoption of cloud-based custom software development services is gaining traction against the backdrop of the increasing demand for digital transformation and the need for flexible and scalable solutions. Cloud-based platforms allow businesses to access software and services on demand, which are typically more cost-effective and efficient than traditional on-premises solutions. In addition, the increasing prevalence of remote work and the need for collaboration tools have led to the increased adoption of cloud-based solutions.

In addition, ongoing industry trends such as Industry 4.0, smart manufacturing, automation, and robotics drive the demand for sophisticated, high-performance enterprise software. Enterprise software plays a crucial role in integrating different processes, applications, and tasks within an organization. It facilitates efficient monitoring and utilization of organizational resources, automates manual processes, and helps in reducing operational expenses. These factors are expected to drive growth in the U.S. custom software development market over the forecast period.

Furthermore, personalized customer experiences in the retail industry are increasing due to the smart use of mobile devices while shopping on e-commerce platforms, and the need for efficient inventory and supply chain management are some of the primary factors driving the demand for custom software development services in retail industries in the United States. Retailers are also exploring innovative technologies, including artificial intelligence, machine learning, and big data analytics, to gain insights into customer behavior and preferences, which is expected to drive the growth of the U.S. custom software development market.

However, the costs associated with developing custom software are high for businesses. Custom software development incurs higher costs than packaged software due to various factors. Some of them include proficient data management and robust security measures. In addition, tailored software is developed for the specific business models and processes while prioritizing the needs of core end users. Additionally, the maintenance and support costs further contribute to the expenses of custom software. Thus, factors such as high cost and technical expertise required in developing custom software could hamper the growth of the custom software development market.

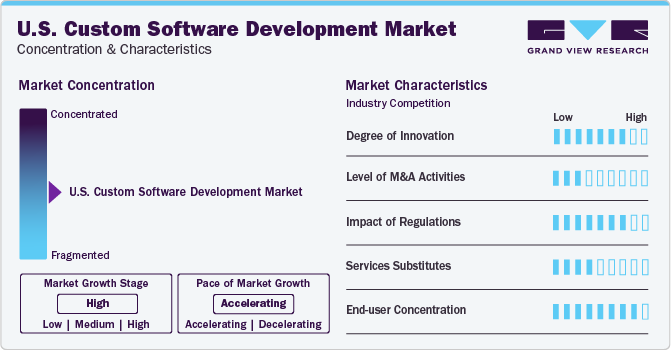

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The U.S. Custom Software Development Market is relatively fragmented. In the near future, demand for custom software may increase due to software covering a wide range of tools, solutions, and applications designed to enhance automation in business processes, improve efficiency, and facilitate decision-making in areas such as HRM, finance, CRM, retail e-commerce, and supply chain management. As a result, it is likely to generate growth opportunities in the U.S. custom software development market.

The U.S. custom software development market is characterized by the presence of several privately and publicly held companies across the United States. Trigent Software, Inc., Brainvire Infotech Inc., and other global software development companies are operating in the U.S. market. These companies offer system architecture design, User Interface (UI) & User Experience (UX) design, and custom software development to suit end-use applications and customer requirements.

There is a scope for strategic partnerships and joint ventures in custom software development; in the U.S., companies are aggressively pursuing various initiatives, such as strategic partnerships, mergers & acquisitions, expansion, and new product launches, as part of the efforts to expand their customer base in the United States. For instance, in December 2023, Brainvire Infotech Inc. partnered with CrowdSky Solutions to empower the company with a highly customizable AI-driven platform.

However, U.S. market players must adhere to the standards drafted by various international regulatory bodies while designing, developing, and maintaining the software. Regulations have become important to combat cyber threats and ensure data privacy in custom software. The U.S. market's growth will be determined by the demand for custom software development based on end-user requirements.

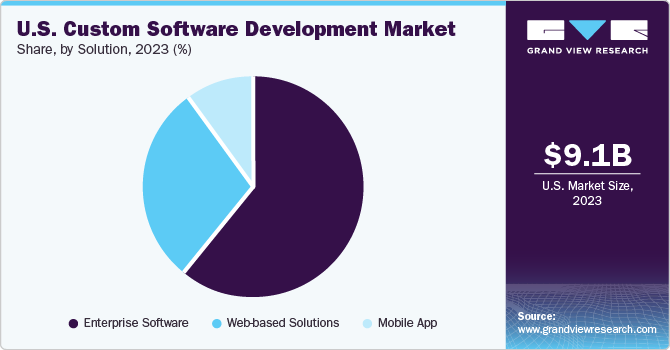

Solution Insights

Enterprise software segment dominated the market and accounted for the highest revenue share of 61.1% in 2023. The enterprise software sub-segment is projected to experience significant growth in U.S. The driving factors are streamlined workflows and enhanced communication across various departments; organizations seek centralized systems. Custom enterprise software addresses this need by offering tailored functionalities and seamless integration capabilities, unlike off-the-shelf solutions. As a result, enterprise software component demand in the U.S. custom software development market is growing.

Web-based solutions segment is anticipated to witness a significant CAGR of 17.1% from 2024 to 2030 in the U.S. custom software development market. Web-based solutions offer seamless accessibility, allowing users to access applications from any device with a stable internet connection and fostering remote work and collaboration practices, which is critical to today's globalized business environment. Web-based solutions also help to reduce extensive hardware and software installation costs. Therefore, the increasing adoption of cloud computing technologies is propelling the web-based solution segment to become a dominant force within the U.S. custom software development market.

Deployment Insights

Cloud segment led the market and accounted highest revenue share of 57.5% in 2023. Businesses are increasingly embracing digital transformation. As a result, there exists a strong demand for tailored software solutions that can seamlessly integrate with cloud infrastructure, offer scalability and flexibility, and are cost-efficient. Moreover, the proliferation of cloud-native technologies and platforms has empowered developers to leverage advanced tools and frameworks, accelerating the development cycle and driving innovation. As a result, cloud segment has a significant market share in the U.S. custom software development market.

On-premise segment is anticipated to witness a CAGR of 16.9% from 2024 to 2030 in the U.S. custom software development market. On-premise deployments offer physical location and security in a controlled manner, which is beneficial for businesses prioritizing data security and regulatory compliance. In addition, industries such as manufacturing sectors with limited or unreliable internet connectivity find on-premise solutions more reliable. As a result, on premise sub-segment is showcasing stable growth during the forecast period.

Enterprise Size Insights

Large enterprises segment led the market and accounted for the highest global revenue share of 59.9% in 2023. Large enterprises strategically leverage custom software to gain a competitive edge. This software caters to their specific needs, ensuring optimal performance in accordance with their unique operational processes. Moreover, the intricate nature of large enterprises necessitates software that seamlessly integrates with existing systems, fostering efficient data flow and streamlined workflows. Thus, the growing number of large firms in U.S. drive the custom software market during the forecast period.

Small and Medium Sized Enterprises (SMEs) segment is anticipated to witness a significant CAGR of 20.0% from 2024 to 2030 in the U.S. custom software development market. SMEs are increasingly realizing the need to digitalize their processes in order to remain competitive in today's market landscape. As a result, the demand for custom software solutions has increased. Unlike off-the-shelf software, custom solutions offer SMEs the flexibility to efficiently address unique challenges, optimize processes, and scale operations. In addition, advancements in development platforms, low-code/no-code tools, and affordable cloud services have paved the way for SMEs to leverage custom software development in U.S.

End-use Insights

IT & Telecom segment accounted for the largest market revenue share of 21.6% in 2023. IT and telecom companies in the U.S. are opting for custom software development as a crucial growth strategy, and the emergence of 5G, IoT, AI, and edge computing lays the foundation for their innovation. Custom software developers are capitalizing on these technologies to explore their transformative potential, solidifying the IT and telecom sub-segment as a key driver in the U.S. custom software development market.

Government segment is expected to register the fastest CAGR of 21.8% during the forecast period. Governments worldwide are taking cognizance of the potential transformation that technology can effectuate, which can translate into improved citizen services, operational efficiencies, and thriving economies. Custom software solutions tailored to the unique needs of U.S. government agencies are becoming indispensable tools for modernizing legacy systems, automating processes, and fostering transparency and accountability. As a result, this segment is driving the growth of the U.S. custom software development market.

Key U.S. Custom Software Development Company Insights

Brainvire Infotech Inc., Trigent Software, Inc., and others are some of the prominent participants operating in the U.S. custom software development market.

-

Brainvire Infotech Inc. is a global information technology, consulting, and outsourcing company. The company is known for providing end-to-end Information Technology (IT), consulting, and outsourcing solutions and services to the incumbents of advertising, finance, education, healthcare, life sciences, hospitality, media, entertainment, mobile and wireless, and retail, among other industries and industry verticals. The company specializes in custom software development services, such as custom web development, API development, system integration, application maintenance, application development, API integration, UX/UI designing, and third-party application enhancement.

-

Trigent Software, Inc. is a provider of custom software development services with a significant focus on innovation and technology. The company offers application development and maintenance, enterprise application and integration, data engineering, software product engineering, and quality assurance and engineering. The company leverages cloud-based development to support designing, coding, integration, and testing for cloud-native and on-premises applications.

Some of the emerging companies operating in the market include Chetu, Inc., Iflexion and others

-

Chetu is a US-based software development company specializing in custom technology solutions. Chetu delivers enterprise-grade solutions through its technical expertise, domain-specific experience, and passion for excellence as a mobile and web-based application development company.

-

Iflexion is a software development company with expertise in developing custom software. The company's team of skilled developers is committed to creating custom software solutions that meet each client's unique needs. The company's areas of expertise include web development, mobile app development, IoT, and AI, among others.

Key U.S. Custom Software Development Companies:

- AltSource Software

- Brainvire Infotech Inc.,

- Capgemini America, Inc.

- Chetu, Inc.

- Designli

- Iflexion

- Infosys

- Intellectsoft

- Itransition

- Kanda Software

- MojoTech

- Tata Consultancy Services Limited

- Trigent Software, Inc.

- Troy Web Consulting

Recent Developments

-

In January 2024, Brainvire, a technology consulting company, has partnered with a leading adhesive and sealant industry player to customize their Magento platform. Integrated SAP ERP aims to streamline business processes and create an eCommerce system that can address diverse needs in various sectors. The collaboration between Brainvire and the adhesive industry player is focused on successfully selling a range of diversified products.

-

In December 2023, Itransition announced a partnership with NetSuite Solution. This strategic partnership enables the delivery of complete NetSuite cloud solutions, from consulting and selling NetSuite licenses to implementation, customization, and support. This is an excellent opportunity for the company to expand its ERP expertise and offer clients more solution options and business value.

-

In October 2023, Chetu, the company announced a partnership with NetSuite software at SuiteWorld to deliver the latest optimization capabilities with NetSuite's leading platforms to help NetSuite users in U.S.

-

In April 2023, Kanda and Microsoft Solutions Partner for Digital & App Innovation (Azure), allowing clients to develop, operate, and manage applications on multiple clouds, on-premises, and at the edge, using various tools and frameworks.

U.S. Custom Software Development Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.70 billion |

|

Revenue forecast in 2030 |

USD 29.67 billion |

|

Growth rate |

CAGR of 18.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, deployment, enterprise size, end-use |

|

Country scope |

U.S. |

|

Key companies profiled |

AltSource Software, Brainvire Infotech Inc.; Trigent Software, Inc.; Chetu, Inc.; Iflexion; Itransition; Designli; MojoTech; Infosys; Intellectsoft; Troy Web Consulting; Capgemini America, Inc.; Kanda Software; Tata Consultancy Services Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Custom Software Development Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Custom Software Development Market report based on solution, deployment, enterprise size, and end-use:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based Solutions

-

Mobile App

-

Enterprise Software

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium-Enterprise (SME)

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. custom software development market size was estimated at USD 9.08 billion 2023 and is expected to reach USD 10.7 billion in 2024

b. The U.S. custom software development market is expected to grow at a compound annual growth rate of 18.5% from 2024 to 2030 to reach USD 29.67 billion in 2030.

b. Enterprise software segment dominated the market and accounted for the highest revenue share of 61.1% in 2023. The enterprise software sub-segment is projected to experience significant growth in U.S. The driving factors are streamlined workflows and enhanced communication across various departments; organizations seek centralized systems.

b. Some key players operating in the U.S. custom software development market are AltSource Software, Brainvire Infotech Inc.; Trigent Software, Inc.; Chetu, Inc.; Iflexion; Itransition; Designli; MojoTech; Infosys; Intellectsoft; Troy Web Consulting; Capgemini America, Inc.; Kanda Software; and Tata Consultancy Services Limited among others.

b. The growth of the U.S. custom software development market can be attributed to addressing specific business needs and providing a competitive advantage by automating and streamlining various processes, improving overall efficiency, reducing errors, and enhancing customer satisfaction.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."