- Home

- »

- Homecare & Decor

- »

-

U.S. Culinary Tourism Market Size, Industry Report, 2030GVR Report cover

![U.S. Culinary Tourism Market Size, Share & Trends Report]()

U.S. Culinary Tourism Market (2025 - 2030) Size, Share & Trends Analysis Report By Activity, By Booking Mode (Direct Travel, Tour Operators, Online Travel Agencies), By Tourist Type, And Segment Forecasts

- Report ID: GVR-4-68040-484-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Culinary Tourism Market Size & Trends

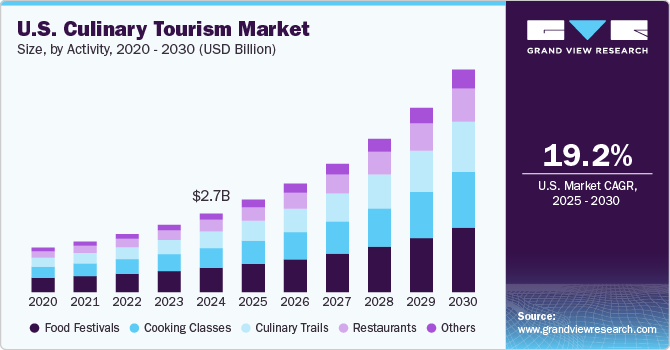

The U.S. culinary tourism market size was estimated at USD 2698.7 million in 2024 and is projected to grow at a CAGR of 19.2% from 2025 to 2030. The growing interest in unique and authentic food experiences as part of cultural exploration fuels the demand for culinary tourism. Travelers seek opportunities to immerse themselves in local cuisines, and food-related activities such as food festivals, cooking classes, and visits to farms or vineyards have become popular attractions. The U.S. offers a diverse culinary landscape, with various regional cuisines that reflect its multicultural heritage, making it a prime destination for food enthusiasts.

Moreover, the consumer trend of culinary tourism has been significantly influenced by celebrity chefs and media exposure. Travelers are increasingly drawn to destinations featured on television, such as MasterChef and the Food Network, and social media, seeking to replicate the culinary experiences as shown on media. With the prevalence of social media, individuals share their dining adventures while on holiday, inspiring others to do the same.

This trend has also sparked the rise of peer-to-peer dining apps, which capitalize on the desire for authentic culinary experiences and further fuel the popularity of culinary tourism. These platforms offer users the opportunity to dine in local homes, sample homemade dishes, and engage in cultural exchanges, providing a more immersive and authentic dining experience to travelers compared to traditional restaurant dining.

According to American Express Travel’s 2023 Global Travel Trends Report, food plays a pivotal role in travel experiences, with travelers often organizing vacations around culinary activities such as dining at acclaimed restaurants or participating in cooking classes. Approximately 81% of respondents prioritize exploring local foods and cuisines as the highlight of their travels. In addition, 72% indicated their desire to visit international destinations specifically to indulge in diverse culinary offerings from other cultures. Furthermore, around 37% of travelers intentionally planned an entire trip to visit a particular restaurant.

Furthermore, there is a rise in health-conscious and sustainable food movements. Many travelers are interested in farm-to-table dining, organic food production, and sustainable agriculture, which have become central to the culinary tourism experience. The demand for local, fresh, and ethically sourced ingredients is driving visitors to regions known for their agricultural practices and food traditions. This aligns with the broader trend of experiential travel, where tourists seek more than just relaxation and aim to engage deeply with local cultures through food.

Activity Insights

The food festivals category accounted for about 30.8% of the market in 2024. These festivals provide a platform for tourists to explore a variety of cuisines, local specialties, and innovative dishes, often highlighting regional and cultural food traditions. Additionally, the rise of experiential travel has encouraged people to participate in interactive activities like tastings, cooking demonstrations, and chef showcases.Food festivals across the U.S. showcase the nation's diverse culinary scene, spanning from local gatherings to large-scale, nationally recognized events drawing in crowds of food enthusiasts from around the world. Some of the popular food festivals are the Taste of Chicago, the Maine Lobster Festival spotlighting the state's renowned seafood, and the Gilroy Garlic Festival, celebrating California's affinity for garlic.

The culinary trails segment is expected to grow at a CAGR of about 20.4% from 2024 to 2030. Culinary trails allow visitors to explore a region's food offerings through guided or self-directed routes that highlight local farms, artisanal producers, wineries, and unique restaurants. These trails offer a deeper connection to the area's food heritage, promoting local ingredients and traditional cooking methods. For instance, In November 2023, the West Virginia Department of Tourism introduced a culinary trail initiative designed to spotlight select top-tier restaurants across the state endorsed by the inaugural cohort of West Virginia Chef Ambassadors. The Culinary Trail aims to inspire visitors to include a delectable detour in their upcoming excursions by showcasing the array of exceptional and distinctive dining venues accessible to travelers within West Virginia.

Booking Mode Insights

The direct travel booking mode segment accounted for a significant share of the U.S. culinary tourism market in 2024. The rising demand for personalization in their travel experiences and greater control over travel plans fuels the market for direct booking. By booking directly with service providers such as restaurants, local food tours, or culinary events, tourists can tailor their itineraries to match their specific culinary interests. This method often allows for better flexibility, access to exclusive offers, and more personalized interaction with local businesses. Additionally, advancements in technology, including user-friendly websites and mobile apps, have made it easier for travelers to bypass third-party platforms and book directly, leading to a more seamless and customized travel experience.

The online travel agencies (OTAs) segment is projected to grow at a CAGR of approximately 24.3% from 2024 to 2030. OTAs provide a one-stop platform where tourists can easily compare prices, read reviews, and book culinary experiences such as food tours, cooking classes, and dining events alongside accommodations and transportation. The ability to access curated culinary packages and recommendations tailored to specific interests makes OTAs an appealing choice. Moreover, OTAs often offer exclusive deals and promotions, making it more cost-effective for travelers. Their user-friendly interfaces and mobile accessibility further drive their popularity among culinary tourists seeking ease and efficiency in planning their trips.

Tourist Type Insights

Existential tourist types accounted for a significant share of the U.S. culinary tourism market in 2024. Existential tourists are driven by a desire to connect deeply with the culture and traditions of the destinations they visit, and food serves as a powerful medium for this connection. These travelers are interested in more than just sampling dishes but in understanding the stories, history, and cultural significance behind the food. This shift towards more immersive, reflective experiences aligns with broader trends in experiential and slow travel, where tourists prioritize authentic interactions and personal growth through travel.

The diversionary tourist type segment is expected to grow significantly from 2024 to 2030. As more travelers seek to escape from their everyday routines and immerse themselves in new, enjoyable experiences centered around food, the demand for diversionary tourism is increasing. Diversionary tourists prioritize relaxation and entertainment, and culinary experiences offer them a way to indulge in local flavors, participate in fun food-related activities, and enjoy a break from their regular lifestyles. The rise in stress from modern life has driven more people to seek out these leisure-focused, distraction-oriented culinary adventures, making diversionary tourism a growing trend in the U.S. culinary tourism market.

Key U.S. Culinary Tourism Company Insights:

Some of the key companies include Butler Lighting USA., EGLO Leuchten GmbH (Austria); Signify Holding. (Philips Lighting); Inter IKEA Systems B.V.

-

Abercrombie & Kent USA, LLC is a luxury travel company that specializes in creating personalized and high-end travel experiences, including culinary tourism. Abercrombie & Kent offers exclusive, immersive food and wine journeys that take travelers to some of the country’s finest culinary destinations. Their services include curated food tours, private dining experiences, visits to local farms, and cooking classes led by renowned chefs. These itineraries often focus on exploring regional specialties, from farm-to-table dining experiences to wine tastings at prestigious vineyards, all while providing luxurious accommodations and expert-guided travel services that emphasize comfort and exclusivity.

-

Classic Journeys, LLC is a travel company known for offering guided, small-group tours that focus on immersive cultural experiences, including culinary tourism. The company provides carefully curated itineraries that highlight the local food culture of various regions. Their culinary tours often include hands-on cooking classes with local chefs, visits to farmers' markets, and opportunities to sample regional specialties at renowned restaurants. Travelers are introduced to the stories behind the dishes, connecting with local artisans and food producers, all while enjoying luxury accommodations and expert-guided experiences. Classic Journeys’ focus on blending cultural exploration with culinary discovery makes them a prominent player in this niche travel segment.

Key U.S. Culinary Tourism Companies:

- Abercrombie & Kent USA, LLC

- Greaves Travel Ltd

- Taste Carolina Gourmet Food Tours

- Classic Journeys, LLC

- The FTC4Lobe Group

- The Travel Corporation

- Gourmet on Tour

- Culinary Adventures International

- Culinary Tours

- Butterfield & Robinson Inc.

Recent Developments

- In October 2024, Traveling Spoon announced the expansion of its offerings with new culinary experiences in the U.S. and internationally. These experiences include cooking classes, market tours, and dining with local families, aiming to provide travelers with a deeper understanding of local food cultures. The expansion includes both new destinations in the U.S. and several countries abroad, allowing travelers to explore a variety of cuisines and traditions in unique settings.

U.S. Culinary Tourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,173.7 million

Revenue forecast in 2030

USD 7,638.0 million

Growth rate (Revenue)

CAGR of 19.2% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Activity, booking mode, tourist type

Country scope

U.S,

Key companies profiled

Abercrombie & Kent USA, LLC; Greaves Travel Ltd.; Taste Carolina Gourmet Food Tours; Classic Journeys, LLC; The FTC4Lobe Group; The Travel Corporation; Gourmet on Tour; Culinary Adventures International; Culinary Tours; Butterfield & Robinson Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Culinary Tourism Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. culinary tourism market report based on activity, booking mode and tourist type.

-

Activity Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Festivals

-

Cooking Classes

-

Culinary Trails

-

Restaurants

-

Others

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Travel

-

Tour Operators

-

Online Travel Agencies

-

-

Tourist Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Existential

-

Experimental

-

Diversionary

-

Recreational

-

Frequently Asked Questions About This Report

b. The U.S. culinary tourism market was estimated at USD 2,698.7 million in 2024 and is expected to reach USD 3,173.7 million in 2025.

b. The U.S. culinary tourism market is expected to grow at a compound annual growth rate of 19.2% from 2025 to 2030 to reach USD 7,638.0 million by 2030.

b. The food festivals category accounted for about 30.8% of the market in 2024 due to its ability to offer travelers a concentrated experience of local flavors, diverse food traditions, and cultural engagement all in one setting.

b. Key players in the U.S. culinary tourism market are Abercrombie & Kent USA, LLC; Greaves Travel Ltd.; Taste Carolina Gourmet Food Tours; Classic Journeys, LLC; The FTC4Lobe Group; The Travel Corporation; Gourmet on Tour; Culinary Adventures International; Culinary Tours; Butterfield & Robinson Inc.

b. Key factors that are driving the U.S. culinary tourism market growth include travelers' desire for immersive food experiences, the influence of social media on culinary exploration, and the increasing appeal of regional and local food cultures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.