- Home

- »

- Next Generation Technologies

- »

-

U.S. Control Tower Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Control Tower Market Size, Share & Trends Report]()

U.S. Control Tower Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Analytical, Operational), By Application (Supple Chain, Transportation), By End-use (Chemicals, Healthcare), And Segment Forecasts

- Report ID: GVR-4-68040-298-1

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Control Tower Market Size & Trends

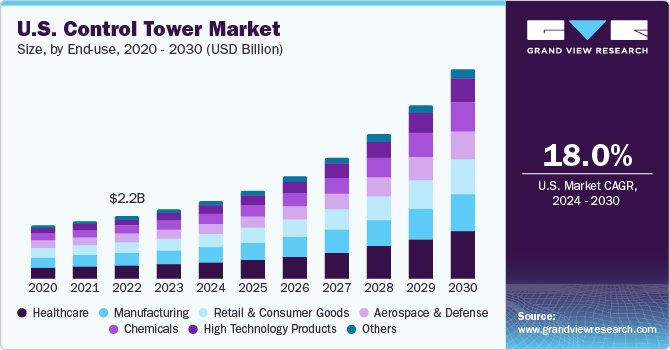

The U.S. control tower market size was estimated at USD 2.48 billion in 2023 and is anticipated to grow at a CAGR of 18.0% from 2024 to 2030. Supply chain and transportation infrastructures are well-established in the U.S. on account of the extensive growth of logistics and manufacturing sectors. As a result, control towers are increasingly becoming a vital presence in this ecosystem, as they have made it easy and convenient for end-users to track deliveries in real-time and add efficiency to the delivery process. For businesses, last-mile delivery remains a significant challenge, owing to issues stemming from a glaring lack of visibility, allocation, inefficiency, and speed of drivers. By creating an ecosystem focused on transparency, businesses can achieve better visibility concerning the real-time status of any particular order and mitigate risks of potential issues while also acquiring data on how to manage orders more competently.

The U.S. accounted for a revenue share of 29.70% in the global control tower market in 2023. Businesses in the country are becoming more aware of the multiple benefits of control towers, such as synthesizing important business data and improved forecasting accuracy. These advantages, along with enhanced supply chain visibility and Business Intelligence (BI), help optimize the supply chain, reduce wastage, and increase organizational revenue. Analytics obtained through control towers help enterprises identify business growth opportunities, and determine cost-saving areas. According to an article by Accenture, companies adopting supply chain control towers have observed increased value in both financial and operational sense. For instance, reduced lost sales can increase revenues by up to 1%, while logistics costs can be lowered by 3-5%. In addition, there are strategic and operational profits, including better decision-making and improved customer service through product visibility and traceability. These factors are expected to drive demand for control towers in the supply chain segment.

Furthermore, the rapidly growing adoption of technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) in transportation and supply chain functions is anticipated to encourage market expansion. An increasing technological proliferation has resulted in the large-scale adoption of IoT devices and increased original equipment manufacturer (OEM) customers' dependence on cloud-based platforms. Enhanced mobility and the ease of using cloud services have resulted in the aggressive deployment of control tower solutions on cloud-based platforms. The industry is extensively opting for big data analytics owing to its benefits, such as data safety and risk analysis. The emergence of generative AI is also expected to present growth opportunities for the market, as it can ensure smooth operations by identifying anomalies in the supply chain while also making market demand predictions based on external factors and patterns.

Technological innovations, such as Electronic Data Interchange (EDI) and web portal communication with logistics partners, are other notable reasons contributing to the growth of the market. Customers are opting for the integration of Transportation Management Systems (TMS) and Warehouse Management Systems (WMS) to obtain clearer operational views. Moreover, government regulations are compelling enterprises to ensure the security and privacy of data using cloud platforms, helping build consumer confidence in cloud solutions.

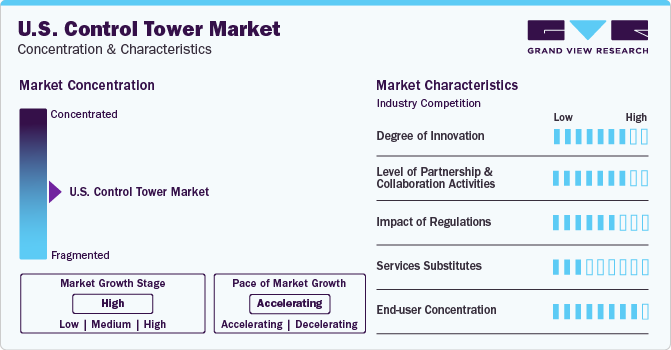

Market Concentration & Characteristics

The market growth stage is high, and pace of market growth is accelerating. The market is being driven by innovations that can ensure optimum operational efficiency and minimized costs for customers. Subsequently, companies are launching advanced solutions that integrate technologies such as ML and AI. For instance, in December 2022, o9 Solutions, a Dallas-based provider of enterprise AI software platforms, announced an extension of its collaboration with project44, which specializes in logistics and supply chain visibility. As per the agreement, o9 Solutions would be offering its Supply Chain Control Tower in integration with the real-time transportation visibility data from project44. This solution enables clients to identify supply chain risks and make informed decisions to mitigate these issues.

Companies involved in the market are focusing on product developments and collaborations with other supply chain solution providers to boost their industry presence. Partnerships with healthcare institutions, chemical organizations, and manufacturing facilities to address their supply chain issues through provision of services is another notable strategy to generate revenues. The Luminate Control Tower by Blue Yonder makes use of advanced technologies such as AI and machine learning to address supply chain challenges in industries such as manufacturing, retail, and grocery & pharmacy.

Solution providers in the United States are required to abide by regulations governing supply chain management activities. In the country, supply chain-related solution providers operating in the healthcare vertical are required to comply with the Unique Device Identification System and Drug Supply Chain Security Act (DSCSA). In addition, companies operating in California are required to comply with the California Consumer Privacy Act (CCPA). Such regulations are expected to shape the designing and functionality of services in the coming years. Data security is another area that companies are focusing on, through focus on cloud security and data encryption techniques that can ensure safety from cyberattacks.

The risk of substitutes is expected to remain moderate in the coming years. Traditional freight management acts as a cost-effective substitute for highly advanced control towers. However, the emergence of industry-specific analytics solutions offered by current control towers is likely to surpass traditional management solutions. Major logistics players are widely preferring collaborative and automation solutions. Moreover, differentiated and customized solutions have lowered the threat of substitutes.

Several major industries, including healthcare, manufacturing, retail, and chemicals, are leading adopters of control tower solutions, as supply chain management is critical in these areas. This leads to enhanced end-to-end visibility of their processes and business intelligence for improving decision-making capabilities.

End-use Insights

Based on end-use, the healthcare segment accounted for the largest market share in 2023. The issue of drug counterfeiting in the U.S. has led to an increasing demand for efficient systems that can ensure end-to-end visibility, e-pedigree, and track & trace capabilities in the pharmaceutical supply chain. According to the CDC, around 1% of drugs sold in the country are counterfeit, highlighting the need for technologies such as control towers to enable real-time product visibility throughout the supply network. Hospitals in the country have also leveraged technological advances to implement control centers that help achieve better patient management. The COVID-19 pandemic has highlighted the importance of having a seamless solution that can identify medical resource status within a hospital, predict patient volume, and provide real-time insights for medical staff to conduct processes efficiently.

Meanwhile, the high-technology products segment is expected to advance at the fastest growth rate through 2030 in the market. These products require the use of advanced science and technological expertise, often involving a high degree of investment in research and development. High technology products are complex to move and hence demand better visibility and tracking, which is expected to strengthen demand for control towers in this area. The presence of control towers helps organizations in improving customer satisfaction and reducing helps organizations improve customer satisfaction and reduce operational costs. The United States is a leading global market in manufacturing advanced products using capabilities such as machine learning and AI. Thus, growing demand and the increasing rate of import and export of advanced, high-technology offerings are expected to drive segment growth during the assessment period.

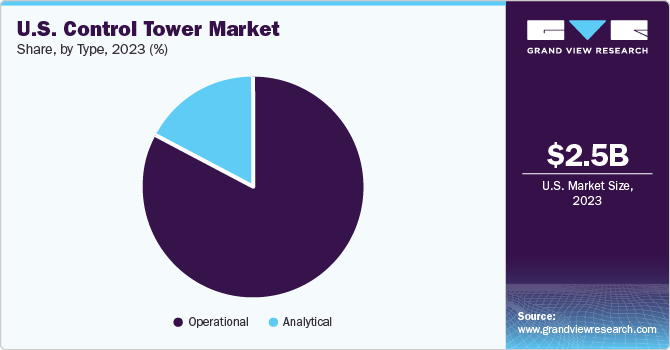

Type Insights

The operational segment held the largest revenue market share in 2023. The growing demand for flexible solutions across sectors to ensure better customer relationships and control over product portfolios is expected to drive demand for operational control towers. In this system, every trading partner present in the supply chain manages their daily supply chain execution operations to enable the generation of high-quality data. As industries increasingly focus on getting real-time analytics and visibility to address potential issues instantaneously, the need for operational control towers has risen substantially. The continued focus on developing solutions that leverage AI and machine learning to improve process efficiency and mitigate disruptions is expected to drive market growth in this area.

The analytical segment is expected to advance at the fastest CAGR during the projection period. Analytical control towers can offer real-time analytics, which is a major market driver. The growing need to identify bottlenecks and inefficiencies across the supply chain and identify cost-saving opportunities and strategies to improve customer service is poised to drive demand for such control towers. They can be used to conveniently collect and analyze large volumes of data, after which automated decision-making can be achieved through predictive analytics. For instance, supplier performance can be analyzed by tracking vital metrics such as order accuracy and on-time delivery rate, which can then be used to help those suppliers improve their output or find other suppliers that can address business requirements.

Application Insights

In terms of application, the supply chain segment held a dominant revenue share of 61.27% in 2023 and is expected to grow at the fastest CAGR during the forecast period. There is constant pressure on supply chain executives to provide quality service to customers while achieving cost-savings and optimizing supply operations. Supply chain visibility often gets impaired while working with multiple third-party logistics providers and leaves companies struggling to gather the data necessary to resolve exceptions, initiate corrective actions, and improve processes. Supply chain control towers empower companies to gather and evaluate real-time, end-to-end supply chain data that benefit from cloud-based AI-based solutions. The integration of live data from remote sensors, IoT devices, and better data analytics delivered through cloud can provide more visibility and context into the supply chain operations. These factors are anticipated to drive segment demand over the forecast period.

The transportation segment is expected to contribute significantly to market revenue during the forecast period. Transportation control towers offer logistics intelligence in real-time and help organizations augment productivity, improve quality, and save costs through better traceability automation. These systems particularly provide insights into inbound and outbound shipments and visibility into deliveries, tracking, tracing, on-time delivery, freight spending, and other related aspects. Control towers can be used to improve freight visibility by gathering data from various sources in the transport supply chain, such as warehouses, carriers, and forwarders. Using technologies such as IoT and GPS has further helped ensure segment growth, as they can lead to instantaneous collection and sharing of information via dashboards with different stakeholders. One Network has an advanced Logistics Solution Suite enables 3PLs and shippers to receive real-time optimization, information, and collaboration across different trading partners. Similar solutions by other organizations are aiding segment expansion.

Key U.S. Control Tower Company Insights

The market is defined by the presence of several established and emerging companies aiming to boost their footprint in the country. This is achieved mainly through strategic initiatives such as partnerships to leverage resources and technologies and provide advanced solutions for customers. In order to improve customer experience, companies are turning towards trending technologies such as AI and blockchain. They are focused on launching offerings that can address the growing demand from enterprises for higher operational efficiency and improved work conditions.

For instance, in February 2024, Bayer Crop Sciences announced that it had selected One Network Enterprises (ONE) to power the former’s Logistics and Supply Chain Control Tower. As per the deal, Bayer would become a part of the Digital Supply Chain Network, thus enabling agility, reliability, predictability, and efficiency to enhance Bayer’s supply chain operations globally. Such initiatives are expected to act as a major driver for market growth.

Key U.S. Control Tower Companies:

- Blue Yonder Group, Inc.

- e2open, LLC

- Elementum

- Infor

- Kinaxis

- Coupa Software

- One Network Enterprises

- SAP

- Viewlocity Technologies Pty Ltd.

- RXO, Inc.

Recent Developments

- In February 2024, One Network Enterprises (ONE) announced the beta release of NEO Assistant, the first-ever AI-powered supply chain assistant. The service aims to realize better organizational decision-making through real-time actionability, Smart Prescriptions, adaptive flows, and interactive visualizations. The NEO Assistant is built on ONE’s Digital Supply Chain Network and leverages NEO’s current AI and ML capabilities.

-

In October 2023, e2open announced that Scan Global Logistics, a freight forwarder, had selected its cloud-based Transportation Management solution to optimize the latter’s transportation operations globally. As per the deal, Scan Global Logistics would leverage e2open’s cloud offering to enhance its operations across ocean, air, and rail services. This would allow the company to improve transportation efficiency, reduce operational and freight costs, and elevate the end-user experience.

-

In October 2023, SAP announced innovations concerning business AI and user experience in its end-to-end business network and spend management solutions. These initiatives are expected to help customers control costs, mitigate risks, and increase productivity. Included in this announcement was the SAP Spend Control Tower solution that integrates advanced AI features and the capability to view complete spend to aid customers in discovering cost-saving opportunities and process improvements.

-

In May 2023, Blue Yonder announced that it would collaborate with Accenture to provide organizations with resilient, responsive, and sustainable supply chains. Accenture would leverage its cloud-native platform expertise to define, engineer, and build advanced solutions on Blue Yonder’s ‘Luminate’ platform. the company would also allow Blue Yonder to access emerging technologies such as generative AI and process mining. The partnership aims to provide clients with a more modular, less centralized, and digitally-enabled supply chain.

U.S. Control Tower Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 7.52 billion

Growth rate

CAGR of 18.0% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use

Key companies profiled

Blue Yonder Group, Inc.; e2open, LLC; Elementum; Infor; Kinaxis; Coupa Software; One Network Enterprises; SAP; Viewlocity Technologies Pty Ltd.; RXO, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Control Tower Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the U.S. control tower market report based on type, application, and end-use:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Analytical

-

Operational

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Supply Chain

-

Transportation

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Aerospace & Defense

-

Chemicals

-

Retail & Consumer Goods

-

Healthcare

-

Manufacturing

-

High Technology Products

-

Others

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the rising adoption of big data and real-time analytics across industries in the U.S. and growing need to improve operational and supply chain efficiencies.

b. The U.S. control tower market size was estimated at USD 2.48 billion in 2023 and is expected to reach USD 2.78 billion in 2024.

b. The U.S. control tower market is expected to grow at a compound annual growth rate of 18.0% from 2024 to 2030 to reach USD 7.52 billion by 2030.

b. The operational segment dominated the U.S. control tower market with a share of 83.41% in 2023. The growing demand for flexible solutions across sectors to ensure better customer relationships and control over product portfolios is expected to drive demand for operational control towers.

b. Some key players operating in the U.S. control tower market include Blue Yonder Group, Inc.; e2open, LLC; Elementum; Infor; Kinaxis; Coupa Software; One Network Enterprises; SAP; Viewlocity Technologies Pty Ltd.; RXO, Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.