- Home

- »

- Medical Devices

- »

-

U.S. Contrast Media Injectors Market, Industry Report, 2030GVR Report cover

![U.S. Contrast Media Injectors Market Size, Share & Trends Report]()

U.S. Contrast Media Injectors Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Injector Systems, Consumables), By Application (Radiology, Interventional Cardiology), By Type, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-231-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Contrast Media Injectors Market Trends

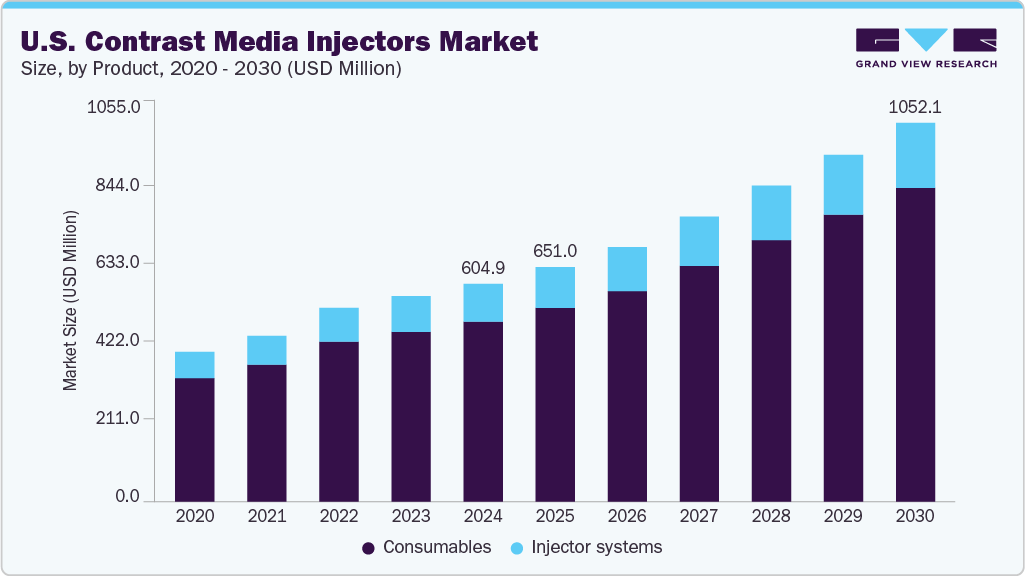

The U.S. contrast media injectors market size was estimated at USD 604.94 million in 2024 and is projected to grow at a CAGR of 10.08% from 2025 to 2030. The market growth is attributed to the rising incidence of chronic conditions such as cancer, cardiovascular diseases, and neurological disorders. The rising number of chronic diseases is driving the demand for diagnostic imaging tests that use conventional imaging methods such as X-rays and ultrasounds, along with advanced imaging techniques such as CT scans and MRIs.

The North America contrast media injectors industry is expected to grow significantly, driven by the rising demand for imaging procedures such as MRI, CT scans, and cardiovascular angiography. This surge is fueled by advancements in imaging technology, an aging population, increasing awareness of preventive healthcare, and the growing prevalence of chronic diseases. Medical imaging is critical in early detection, diagnosis, and treatment planning for a wide range of conditions. According to a study published by the National Library of Medicine in October 2023, nearly 40 million MRI scans are performed annually in the U.S.

In addition, data from the CDC in February 2024 revealed that approximately 129 million Americans are living with at least one major chronic illness. This substantial burden of chronic disease, combined with the high volume of imaging tests performed each year, highlights a strong and growing need for diagnostic imaging, further driving demand for contrast media injectors across the region. Hence, the increasing prevalence of long-term diseases and complex comorbidities is one of the major drivers, as it is leading to an increase in demand for contrast media injectors.

The growing number of product launches and regulatory approvals for contrast media injectors is expected to drive market growth significantly. Companies are introducing advanced technologies, including syringeless and multi-patient injectors, to improve efficiency and patient outcomes. These innovations enhance operational workflows and support better imaging practices, encouraging broader adoption of advanced imaging systems. As a result, the demand for reliable and effective contrast media delivery solutions continues to rise, further fueling market expansion.

Some of the recently launched and approved contrast media injectors are mentioned below:

Company Name

Product Name

Launch/Approval Date

KOLs

Bracco Diagnostics Inc.

Max 3, a Rapid Exchange and Syringeless Injector

FDA Approval Date: December 2024

"This clearance underscores Bracco's commitment to pushing the boundaries of innovation in 2024 and beyond while implementing sustainable production in all aspects of our business model," said Fulvio Renoldi Bracco, Vice Chairman & Chief Executive Officer of Bracco Imaging S.p. A.

Bayer

MEDRAD Centargo CT Injection System

FDA Approval Date: November 2024

“Since its launch in 2020, Centargo has served approximately seven million patients across 49 markets worldwide. The FDA clearance further demonstrates our nearly 40 years of CT innovation and commitment to delivering effective technologies to improve diagnostic imaging for patients,” said Sven Schmidt, Head of Region Americas Radiology at Bayer.

Source: Bayer, Bracco Diagnostics Inc., Grand View Research Analysis

The rising prevalence of chronic diseases, particularly cancer and cardiovascular conditions, is expected to drive the demand for contrast media injectors in the U.S. These devices are essential in diagnostic imaging, as they deliver contrast agents that enhance visualization of blood flow and tissue structures, resulting in more precise and more accurate images. This improved imaging capability is vital for the early detection and monitoring of various chronic illnesses.

In addition, the growing incidence of heart-related conditions such as stroke, coronary artery disease (CAD), and heart failure is further fueling the need for advanced imaging solutions. According to data published by the National Library of Medicine in May 2025, the prevalence of CAD among U.S. adults rose from 4.6% in 2019 to 4.9% in 2022. This upward trend highlights the increasing demand for contrast media injectors as part of comprehensive diagnostic and treatment strategies.

Market Concentration & Characteristics

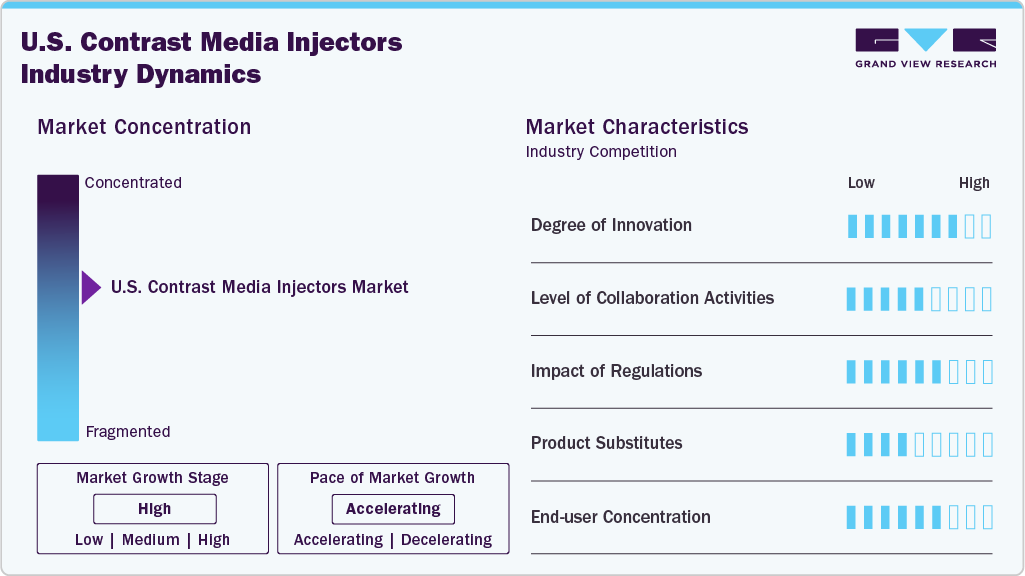

The U.S. contrast media injectors industry demonstrates a high degree of innovation, driven by rapid technological advancements and growing clinical demands for improved diagnostic accuracy and workflow efficiency. Companies are actively developing next-generation injectors with features such as syringeless designs, dual-head systems, automated dose control, and integration with imaging software. These innovations enhance patient safety, minimize contrast media waste, and streamline radiology department operations. In addition, incorporating AI and real-time monitoring in injector systems further elevates precision and personalization compared to delivery.

Regulatory frameworks are pivotal in shaping the U.S. contrast media injectors industry, balancing patient safety with innovation. The U.S. Food and Drug Administration (FDA) classifies contrast media injectors as Class II medical devices, typically requiring a 510(k) premarket notification. This process ensures that new devices are substantially equivalent to existing ones, facilitating market entry while maintaining safety standards. However, the 510(k) pathway does not necessitate extensive clinical trials, which can sometimes lead to concerns about device safety and efficacy, especially if post-market surveillance is insufficient. Recent FDA approvals have introduced innovations such as AI-powered injectors and eco-friendly systems, aiming to enhance precision and reduce waste. Furthermore, stringent sterilization protocols and reporting requirements have increased operational costs and compliance burdens for manufacturers. These regulatory measures, while essential for patient safety, can delay product launches and may disproportionately affect smaller companies with limited resources. Overall, while regulations ensure high standards in patient care, they also present challenges that manufacturers must navigate to bring innovative contrast media injectors to market.

The U.S. contrast media injectors industry is characterized by moderate collaboration activities. This trend is driven by several strategic factors, including the need for companies to gain a competitive advantage, consolidate their positions in a rapidly expanding industry, and broaden their product portfolios and geographical reach. For instance, recent developments include strategic agreements between major industry players to market and distribute branded contrast media injectors within the U.S. For instance, in November 2023, ulrich GmbH & Co. KG, a German medical device manufacturer specializing in contrast media injectors and spinal implants, has partnered with Bracco Imaging S.p.A., Together, they have announced the launch of Bracco-branded, state-of-the-art MRI injectors (Max 3 MRI injector) manufactured by Ulrich Medical for the U.S. market.

In the U.S. contrast media injectors industry, direct product substitutes primarily involve alternative diagnostic imaging modalities that do not require contrast agents. These include various forms of Magnetic Resonance Imaging (MRI) performed without contrast, leveraging techniques like non-contrast Magnetic Resonance Angiography (MRA) such as 4D ASL MRA, Fresh Blood Imaging, or Time-SLIP, which visualize blood flow using endogenous signals. Ultrasound is another significant substitute, offering real-time imaging without radiation or contrast, often used as a first-line diagnostic tool.

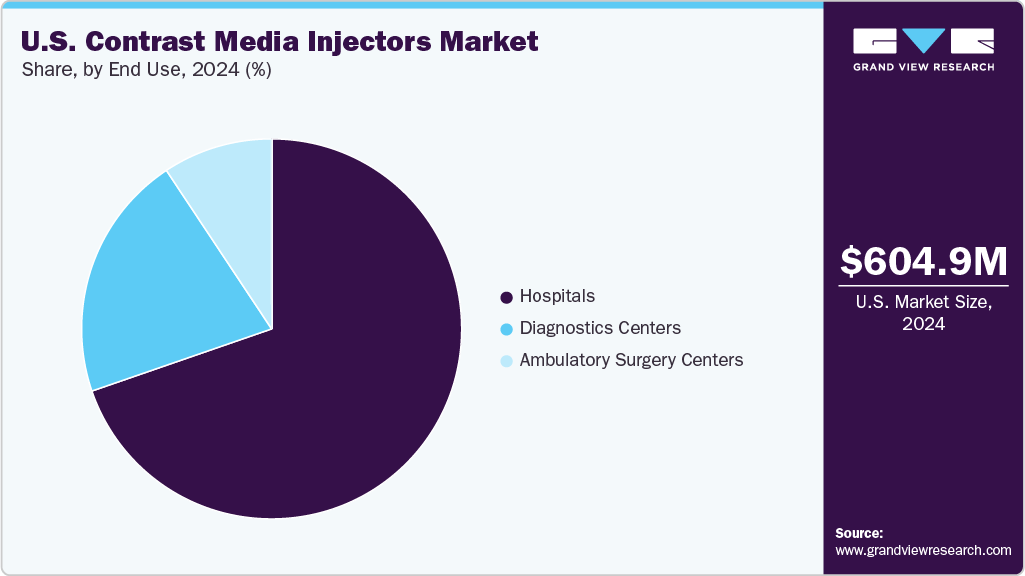

In the U.S. contrast media injectors industry, the end user concentration is primarily dominated by hospitals, which consistently account for the largest share of the market due to their high patient volumes, extensive diagnostic imaging capabilities (including radiology, interventional radiology, and interventional cardiology procedures), and significant investments in advanced medical technologies. Diagnostic centers also represent a substantial segment, driven by the increasing demand for early diagnoses and specialized imaging. In addition, Ambulatory surgery centers (ASCs) contribute to the market, especially as there's a growing trend towards outpatient procedures.

Product Insights

The consumables segment dominated the market in 2024. This is due to every contrast-enhanced diagnostic procedure, whether a CT scan, MRI, or angiography, necessitates using new, sterile consumables to ensure patient safety and maintain hygienic conditions, thereby preventing cross-contamination. With the increasing volume of diagnostic imaging procedures driven by the rising prevalence of chronic diseases and the growing emphasis on early detection, the demand for these single-use items is continuously high and recurring, making the consumables segment highly lucrative and a primary driver of market growth.

Key factors driving the dominance of the consumables segment include:

Factor

Description

Frequent Replacement Needs

Consumables like syringes and tubing are single-use, leading to constant and high-volume demand as compared to injector systems.

Safety and Infection Control

Disposable consumables help prevent cross-contamination and meet strict hygiene standards post-COVID.

Cost Efficiency and Workflow Simplicity

Proprietary consumables reduce contrast media waste, ensure accurate dosing, and simplify imaging workflows.

Rising Imaging Volumes

Increasing use of CT, MRI, and angiography drives higher demand for contrast media and associated consumables.

Various Product Availability

For instance,

- Dual MR Syringe with single check valve Y-tubing and filling spikes (by Guerbet LLC)

- Single CT Syringe with coiled tubing and filling spike (by Guerbet LLC)

- MR Syringe Compatible with EZEM EmpowerMR Contrast Media Injector (by Shenzhen Antmed Co., Ltd.)

- MustKit MR (by Bracco Diagnostics Inc.)

Source: Bracco Diagnostics Inc., Bayer, Shenzhen Antmed Co., Ltd., Grand View Research Analysis

Type Insights

Single head injectors led the market and held more than 43% share in 2024. The market dominance of these injectors is attributed to the emergence of more advanced technologies that have simplicity, cost-effectiveness, and versatility. They are widely used across various diagnostic imaging procedures like CT scans, MRIs, and angiography, particularly favored in smaller healthcare settings or for procedures requiring only one contrast agent. Their lower initial cost and ease of integration into existing systems make them an accessible and reliable choice for many facilities, solidifying their significant market share.

The syringeless injectors segment is anticipated to grow at the fastest CAGR during the forecast period. This growth is attributed to their compelling efficiency, safety, and waste reduction advantages. These systems eliminate the need for individual syringes by drawing contrast directly from larger multi-use containers, significantly reducing contrast media waste and associated costs (estimated savings of over $8 per patient by some sources). They also streamline workflow by reducing preparation time and eliminating the need for frequent syringe reloading, leading to improved technologist efficiency and faster patient throughput.

Application Insights

Radiology led the market and accounted for more than 44% share in 2024. Radiology involves the use of noninvasive imaging technologies such as CT and MRI scans to create comprehensive images. CT scanning involves using X-ray equipment to build a structure of cross-sectional pictures of the body to detect the source of a medical condition, especially in soft tissues. In contrast, MRI technology involves the application of a magnetic field to create images of the inside of a patient’s body. These injectors are used with MRI and CT to identify a broad range of health conditions such as breast cancer, heart diseases, gastrointestinal conditions, fractures, colon cancer, and blood clots. In addition, this segment is projected to grow at a lucrative rate owing to the non-invasive nature of radiology techniques and a rise in the prevalence of chronic diseases.

Interventional cardiology is anticipated to witness the fastest growth over the forecast period, owing to the rising prevalence of cardiac conditions such as coronary artery disease, heart valve disease, and peripheral vascular disease, among others. In addition, increasing technological advancements, along with rising hospital admissions, coupled with increasing adoption of interventional cardiology for the treatment of acute myocardial infarction, will further drive the segment growth.

End Use Insights

Hospitals led the market and accounted for a share of more than 69% in 2024 and are also expected to witness the fastest growth over the forecast period. This growth is attributed to the increasing admissions of patients suffering from cardiovascular diseases, cancer, and neurological disorders. Hospitals are primary end users of contrast media injectors, owing to their wide range of applications in radiology, interventional radiology, and interventional cardiology. In addition, increasing focus on the development of healthcare infrastructure is expected to propel the segment's growth.

The diagnostics centers segment is anticipated to be among the fastest-growing segments over the forecast period. The rising number of private imaging centers, owing to the increased demand for early diagnosis, and the shortage of imaging modalities in small and mid-scale hospitals, is are significant factors driving the segment growth. The demand for angiography operations, which are utilized for diagnosis, treatment planning, and prevention of chronic illnesses, is expected to increase as people become more aware of these conditions.

Key U.S. Contrast Media Injectors Company Insights

Some of the key companies include Shenzhen Boon Medical Supply Co., Ltd.; Bracco Diagnostics Inc.; Bayer; Guerbet LLC; ulrich GmbH & Co. KG; B.Braun SE; Shenzhen Antmed Co., Ltd.; Ecomed Solutions; and Siemens Medical Solutions USA, Inc. (Siemens Healthineers AG), among others. They provide a broad range of advanced injector solutions through their strong distribution and supply channels across the world. Leading companies are involved in new product launches, strategic collaborations, mergers & acquisitions, and regional expansions to gain the maximum revenue share in the industry. Mergers & acquisitions help companies expand their businesses and market presence.

Key U.S. Contrast Media Injectors Companies:

- Shenzhen Boon Medical Supply Co., Ltd.

- Bracco Diagnostics Inc.

- Bayer

- Guerbet

- ulrich GmbH & Co. KG

- B.Braun SE

- Shenzhen Antmed Co., Ltd.

- Ecomed Solutions

- Siemens Medical Solutions USA, Inc. (Siemens Healthineers AG)

Recent Developments

-

In December 2024, Bracco Diagnostics Inc., the U.S. subsidiary of Bracco Imaging S.p.A., a prominent global leader in diagnostic imaging, announced the approval of the Bracco-branded Max 3, a Rapid Exchange and Syringeless Injector designed for magnetic resonance imaging (MRI) procedures. This development was made in collaboration with ulrich GmbH & Co. KG, a well-known German medical device manufacturer specializing in contrast media injectors and spinal implants.

-

In November 2024, Bayer announced that its MEDRAD Centargo CT Injection System has received 510(k) clearance from the U.S. Food and Drug Administration (FDA). This innovative multi-patient injector enhances workflow efficiency through design features that seamlessly integrate with Bayer’s product portfolio, particularly in high-volume CT environments. The MEDRAD Centargo system offers significant value to radiology departments as the U.S. faces a shortage of radiology technologists alongside increasing demand for medical imaging.

-

In November 2023, ulrich GmbH & Co. KG, a German medical device manufacturer specializing in contrast media injectors and spinal implants, partnered with Bracco Imaging S.p.A., a global leader in diagnostic imaging and a multinational life sciences company. Together, they have announced the launch of Bracco-branded, state-of-the-art MRI injectors (Max 3 MRI injector) manufactured by Ulrich Medical for the U.S. market.

U.S. Contrast Media Injectors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 651.01 million

Revenue forecast in 2030

USD 1,052.05 million

Growth Rate

CAGR of 10.08% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, and end use

Country scope

U.S.

Key companies profiled

Shenzhen Boon Medical Supply Co., Ltd.; Bracco Diagnostics Inc.; Bayer; Guerbet LLC; ulrich GmbH & Co. KG; B.Braun SE; Shenzhen Antmed Co., Ltd.; Ecomed Solutions; and Siemens Medical Solutions USA, Inc. (Siemens Healthineers AG)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Contrast Media Injectors Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. contrast media injectors market report based on product, type, application, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Injector Systems

-

CT injector systems

-

MRI injector systems

-

Cardiovascular/angiography injector systems

-

-

Consumables

-

Tubing

-

Syringe

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Head Injectors

-

Dual-Head Injectors

-

Syringeless Injectors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiology

-

Interventional Cardiology

-

Interventional Radiology

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics Centers

-

Ambulatory Surgery Centers

-

Frequently Asked Questions About This Report

b. The U.S. contrast media injectors market size was estimated at USD 401.8 million in 2023 and is expected to reach USD 423.4 million in 2024.

b. The U.S. contrast media injectors market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 622.5 million by 2030.

b. Injector systems led the market and accounted for a share of 60.3% in 2023. Contrast agents are delivered into the bloodstream of patients during CT, MRI, and angiography, enabling enhanced visualization of contrast of fluids within the body.

b. Some prominent players in the U.S. contrast media injectors market include Bayer AG; Bracco Imaging S.p.A.; Ulrich medical; Guerbet; MEDTRON AG; Nemoto Kyorindo Co., Ltd.; Hong Kong Medi Co Limited.

b. The growth of the market is attributed to the increasing prevalence of chronic disorders, technological advancements, along with growing demand for minimally invasive surgical procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.