U.S. Contract Glazing Market Size, Share & Trends Analysis Report By Product (Flat Glass, Others), By Application (Building & Construction, Automotive, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-515-1

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

U.S. Contract Glazing Market Size & Trends

The U.S. contract glazing market size was valued at USD 8.96 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030.Increasing demand for flat glass products in the construction industry on account of rising developments in the commercial sector of the country is anticipated to augment market growth.Increasing the construction of hotels, office buildings, and retail stores in the U.S. is accelerating the demand for contract glazing services. The U.S. hotel construction pipeline has been showing a positive trend past few years, which is expected to be seen during the forecast period as well.

Growing demand for flat glass products in the construction and automotive industries, on account of their characteristics, such as transparency, strength, workability, and transmittance is expected to positively influence the market growth. Building and construction is the key application segment and with a rising number of upcoming projects, such as Lincoln Yards in Chicago and River District in North Carolina, the construction spending in residential as well as commercial segments by private companies and government agencies is expected to increase. The growing number of construction projects is expected to boost the demand for glass, thereby driving the growth of the U.S. contract glazing market.

Glass is now being used in the construction industry as an insulation material in structural components and cladding systems. It is also used to make fenestrations on façade systems and conventional windows. Glass is constantly undergoing technological transformations owing to the increasing demand for green buildings across the U.S. Increasing construction spending, along with a rising number of infrastructural projects, in the U.S. is expected to fuel the demand for flat glass.

The building & construction industry is the major end-user of contract glazing services. This industry can be segregated into residential, commercial, and institutional segments, of which the commercial segment accounts for the largest market share. This segment comprises office buildings, hotels, and retail stores, which are expected to increase at a rapid rate. Upcoming projects in the commercial sector are likely to augment the demand for contract glazing in the country during the forecast period.

The demand in the automotive industry is expected to grow in the forthcoming years on account of the increasing number of road accidents, leading to the replacement of windshields and windows in vehicles. An average of 6 million car accidents are recorded in the U.S. every year. In addition, a rising number of old vehicles that require regular maintenance and repairs is anticipated to augment the automotive aftermarket segment in the near future. The lack of a skilled workforce in the country is anticipated to restrain the demand for contract glazing in the near future. Labor has been a top priority and challenge for construction companies and contract glaziers for past few years. The U.S. economy is facing a shortage of workers, which can be indicated by a higher number of job openings than the people looking for it.

The market is anticipated to hinder over the coming years owing to the lack of a skilled workforce. According to primary sources, labor has been a significant challenge for contract glaziers and construction companies for the past few years. The task of finding skilled labor in order to accomplish the desired construction or contract glazing project on time is becoming difficult. For instance, the hotel industry has been witnessing the tightest construction labor markets past few years, which is resulting in a delay in new construction activities or renovations and leading to higher costs.

Companies are facing a hard time finding all types of construction employees, especially field labor, carpenters, plumbers, and electricians. Industry leaders are rooting this problem back to 2008, when construction projects took a halt, forcing the workers to find other types of employment. Around 600 thousand workers left the industry during the recession and have not returned since then. The shortage of labor in the country has directly impacted the increase in construction costs, land costs, and raw material costs.

Application Insights

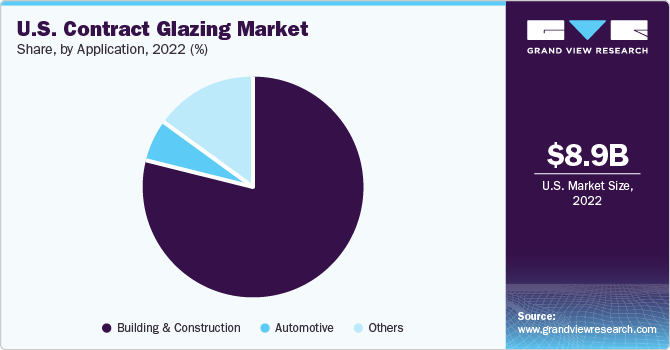

Based on application, the market is segmented into building and construction, automotive, and others. Building and construction was the largest segment in 2022 accounting for a revenue share of 78.9%. The growth is directly proportional to the increasing demand for glass in the country.

The other applications segment comprises the glass utilized and installed in the interiors of residential and non-residential sectors, such as partitions, shower walls, cubicles, doors, and various types of décors that involve glass. The demand for glass is increasing in bathrooms when it comes to the residential sector owing to benefits such as ease of cleaning, less space consumption, and less clutter. Unlike glass, the usage of other materials such as metallic or wooden barriers can get weathered and rotten away over time.

Product Insights

Based on product, the market is segmented into flat glass and others, where the former is further split into basic, laminated, tempered, and insulated. The insulated glass segment accounted for the largest revenue share of 64.0% in 2022 and is majorly used in the exterior of the buildings. Its demand persists owing to the excellent thermal and sound insulation properties it provides along with high strength against wind and snow loads when compared to single-pane glass. It is expected to grow at the fastest rate of 4.3% over the forecasted period.

Tempered and laminated glasses are widely preferred in the automotive industry owing to their characteristics that meet the safety demand. As a result, these glasses are categorized as safety glasses in the industry. Their demand is increasing on account of the rising number of road accidents in the country.

Fiberglass also has applications in the automotive industry especially in aftermarket body kits, such as front and rear bumpers and bonnets. The increasing willingness of consumers to customize and create a unique look that is different from an assembly-line vehicle is expected to boost the demand for aftermarket body kits, in turn, is likely to propel the product demand.

Regional Insights

The Southeast U.S. dominates the market and is anticipated to register the highest growth rate across the forecast period. The high potential for the construction industry to flourish in the region on account of factors such as steady population growth, ample availability of land, low cost of living, and ambient climate, is expected to provide a boost to the contract glazing market. States including Florida, Tennessee, and Georgia are expected to witness a widespread expansion of the construction market in the coming years.

Furthermore, growing road accidents in states like Florida, South Carolina, Alabama, and Kentucky are giving opportunities to the repair and replacement auto part service industry, thus propelling market growth. According to the Insurance Institute for Highway Safety, in 2021, the number of fatal car crashes in Florida reached 3,451, much higher than the number of car crashes (1,229) in Tennessee.the increasing number of accidents in this region is likely to boost the need for the repair and replacement of auto parts. This is likely to propel the market growth during the forecast period.

The northeast region is anticipated to witness the highest growth rate in the country over the coming years. The region is densely populated by culturally diverse people with high economic indicators, which invites more advanced infrastructure projects. Moreover, the presence of the nation’s biggest metropolitan area New York in the region gives further aid to the development of the construction industry.

Key Companies & Market Share Insights

The industry is characterized by intense competition among both domestic and internationally reputed market participants. Market players are facing tough competition from foreign companies that are bidding at extremely low prices to gain projects. Along with the foreign companies, the glaziers in the country are facing intense competition from companies that specialize only in the fabrication and distribution of glass products.

The fabricating companies are adopting strategies such as mergers and acquisitions in order to increase their market share in the industry and to cater their products to potential customers. For instance, in January 2020, American Insulated Glass, LLC. -a leading glass fabricator and distributor in Southeast U.S.-acquired A.L. Smith Glass Company, a glass fabricator and distributor in Ijamsville, Maryland. The acquisition was intended to meet the needs of the commercial construction sector.

Key U.S. Contract Glazing Companies:

- Benson Industries, Inc.

- snswanger Glass

- Crown Corr, Inc.

- Enclos Corp.

- Gamma

- Harmon Inc.

- Massey’s Glass

- Permasteelisa S.p.A

- W&W Glass, LLC

- Walters & Wolf

Recent Development

-

In May 2023, TOPGLASS INDUSTRIES Ltd. successfully obtained project contracts valued at over USD 3.8 million. These projects encompass various locations, such as Ballymena, involving developments like a library and a lifeguard station in Bettystown, along with the refurbishment of the Collcutt Building. These achievements signify significant milestones for TOPGLASS INDUSTRIES Ltd. in their ongoing ventures.

-

In March 2021, HORN Glass Industries AG revealed its acquisition of JSJ Jodeit GmbH's melting technology division, which officially took effect on April 1st, 2021. This strategic step is anticipated to enable the company to enhance its capabilities in both gas-oxygen and electrically heated melting plants.

-

In February 2022, KPS Capital Partners announced it had completed the acquisition of Oldcastle Building Envelope Inc. for USD 3.45 billion in cash. The agreement is expected to help KPS Capital Partners in the fabrication and distribution of hardware and glazing systems in the U.S. and Canada.

U.S. Contract Glazing Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 12.47 billion |

|

Growth rate |

CAGR of 4.2% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

October 2023 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Country scope |

U.S. |

|

Regional scope |

Northeast; Southwest; West; Southeast; Midwest |

|

Key companies profiled |

Benson Industries, Inc.; Binswanger Glass; Crown Corr, Inc.; Enclos Corp; Gamma |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Contract Glazing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. contract glazing market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flat Glass

-

Basic

-

Tempered

-

Laminated

-

Insulated

-

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Northeast

-

Southwest

-

West

-

Southeast

-

Midwest

-

-

Frequently Asked Questions About This Report

b. The U.S. contract glazing market size was estimated at USD 8.96 billion in 2022 and is expected to reach USD 8.95 billion in 2023

b. The U.S. contract glazing market is expected to grow at a compound annual growth rate of 4.2% from 2023 to 2030 to reach USD 12.47 billion by 2030.

b. Building & construction dominated the U.S. contract glazing market with a share of 78.9 % in 2022. This is attributable to the increasing demand for glass in the country for residential, commercial, and institutional construction.

b. Some key players operating in the U.S. contract glazing market include Benson Industries, Inc., Binswanger Glass, Crown Corr Inc, Enclos Corp., Gamma, Harmon Inc., Massey’s Glass, Permasteelisa S.p.A, W&W Glass, LLC, and Walters & Wolf.

b. Key factors that are driving the market growth include increasing demand for flat glass products in the construction industry on account of rising developments in the commercial sector of the U.S.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."