- Home

- »

- Next Generation Technologies

- »

-

U.S. Contract Cleaning Services Market, Industry Report, 2030GVR Report cover

![U.S. Contract Cleaning Services Market Size, Share & Trends Report]()

U.S. Contract Cleaning Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service Type (Window Cleaning, Floor & Carpet Cleaning, Upholstery Cleaning), By End-use (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-225-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

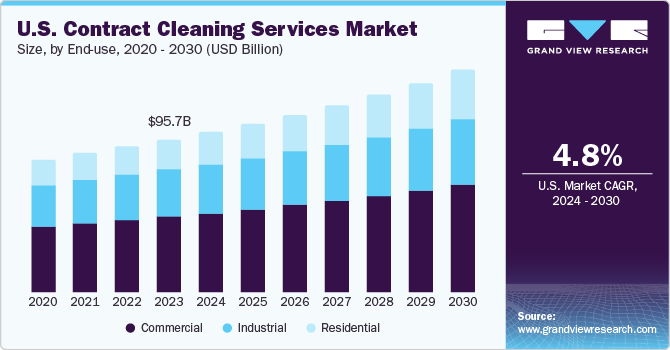

The U.S. contract cleaning services market size was estimated at USD 95.66 billion in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. The increasing awareness about hygiene in the workplace and the gradual increase in residential/domestic customers outsourcing cleaning tasks to third-party service providers is driving the market growth for these services. Cleaning services, which cover floor, carpet, upholstery, and window dusting, are primarily undertaken by commercial and industrial establishments to keep the premises clean and healthy.

In 2023, the U.S. market accounted for approximately 26.35% share of the global contract cleaning services industry. The contract cleaning services involve outsourcing the cleaning tasks to third-party service providers. The primary clientele of the service providers includes commercial and industrial establishments. However, there has been a gradual rise in residential/domestic customers outsourcing cleaning tasks to third-party service providers. These services in the residential/domestic sector have increased in popularity due to several factors such as work from home trend, an increase in real estate investment, a change in consumer lifestyle, increasing in the aging population, a high number of dual-income households, and a rise in the number of working women. With the growing demand for a hygienic environment in workplaces, several service providers have altered their service delivery plans and packages and offer customized cleaning service packages for commercial as well as residential end-users. Therefore, the growth of contract cleaning services has seen an upward rise in the U.S. market.

In recent years, several contract cleaning service providers are increasingly shifting towards the adoption of a green cleaning concept, which includes the use of natural products such as lemons, vinegar, and baking soda, among others for cleaning the premises. Moreover, a critical concern for health in large commercial establishments is enhancing and maintaining indoor air quality (IAQ). Air pollution continues to have a substantial impact on health, especially in urban areas, according to the U.S. Environmental Protection Agency (EPA). Therefore, several commercial facilities are opting for greener and environment-friendly cleaning products and methods, which eliminate chemical residues that can affect the air quality. The green cleaning trend has opened up lucrative opportunities for commercial contract cleaning services companies who want to offer green cleaning as a value-added service or specialize in it.

The industrial cleaning sector helps prevent health risks for various working environments, but the sector itself has its own set of hazards. As workers can move from one workplace to another, it becomes challenging for employers to control hazards caused due to hazardous materials, ventilation, and confined spaces. Several cleaning chemicals contain a mixture of ingredients that may be toxic and harmful to health if inhaled or touched. Furthermore, the tools and equipment used in the cleaning service can also be harmful to workers. Since cleaning tasks require extensive repetitive movements and continuous exposure to regular bending, heavy lifting, and prolonged standing, it can affect workers' physical strength and reduce their working efficiency. On the contrary, the introduction of automated cleaning robots, that leverage Artificial Intelligence (AI) capabilities to perform dusting chores is expected to challenge the market growth to a certain extent.

Market Concentration & Characteristics

The stage of growth is low for the U.S. contract cleaning services industry. The rate of growth is accelerating. The market is highly fragmented with the presence of a large number of service providers. To gain significant revenue share and strengthen their position in the market, market incumbents are undertaking various growth strategies, including strategic acquisitions and partnerships to expand their reach by leveraging each other’s expertise.

The degree of innovation is moderate in the industry. However, cleaning robots have evolved and now play a vital role in the commercial cleaning industry. From supporting staff with repetitive and mundane work to offsetting labor, robotics technology continues to impact the cleaning industry. The robotic machines are equipped with advanced sensors, artificial intelligence, and cutting-edge algorithms, allowing them to navigate complex environments, identify and address dirt, dust, and grime, and even interact safely with human occupants.

To meet criteria laid down by the regulatory rating organizations and remain compliant with standards from agencies such as the Occupational Safety and Health Administration (OSHA), contract cleaning companies are increasingly focusing on using green and sustainable products, technologies, and processes that meet the health and safety standards established for commercial and industrial end-users.

There are no direct substitutes for the contract cleaning services. Robotic automation has emerged as a substitute for certain cleaning services; however, due to its current limitations it can be used in only specific areas of cleaning, and not all tasks of cleaning services can be automated. Hence, the threat of substitution is low in this industry.

Service Type Insights

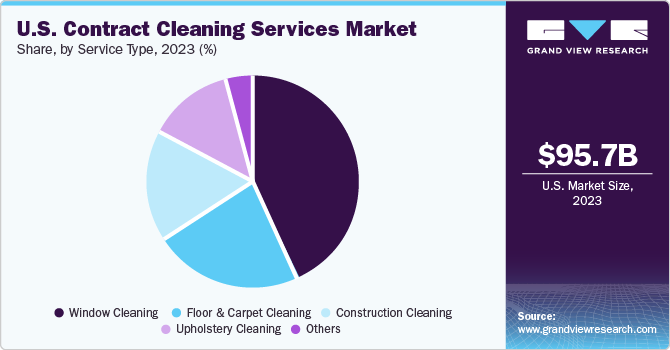

In terms of service type, the market is classified into window cleaning, floor & carpet cleaning, upholstery cleaning, construction cleaning, and others segments. The floor & carpet cleaning segment dominated the market in 2023 with a revenue share of 32.0%. Floor & carpet cleansing is a laborious and time-consuming task as the floor area is very large in corporate office/manufacturing facilities. Therefore, the service contractors for this service charge higher as compared to other services. However, the charges for these services vary depending on factors such as time, area, frequency, and complexity, among others. Moreover, floor cleansing is a pre-requisite for any commercial and industrial establishment and is therefore mostly outsourced to skilled contractors.

The upholstery cleaning segment is anticipated to grow at the fastest CAGR of 6.4% from 2024 to 2030. The cleaning services offered by the vendors include window, upholstery, and construction cleaning, among others. Among these, the upholstery cleaning services are anticipated to register the fastest growth over the forecast period, primarily because, upholstery includes sofas/couches and padded chairs, which is one of the products exposed to direct human contact. Therefore, corporate offices are increasingly availing these services to maintain the hygiene and safety of employees during and after the COVID-19 pandemic outbreak.

End-use Insights

In terms of end-use, the market is classified into residential, industrial, and commercial segments. The commercial segment dominated the market in 2023 with the largest revenue share of 49.1%. Commercial sector, which primarily includes office buildings invest significantly in keeping the premises clean and sanitized. Furthermore, the increasing projects in the construction and real estate sectors have resulted in the rising number of commercial buildings, which is the key factor for the high share of this segment. The growing demand for cleaning services from workplaces, educational institutes, movie theatres, hospitals, airports, restaurants, and shops can contribute to the expansion of this industry. The need for daily, weekly, and monthly cleaning services from a variety of businesses in the commercial sector will continue to rise in the coming years.

The residential sector is anticipated to register the fastest CAGR of 6.2% over the forecast period. These services in the residential/domestic sector have increased in popularity due to several factors such as work from home trend, an increase in real estate investment, a change in consumer lifestyle, increasing in the aging population, a high number of dual-income households, and a rise in the number of working women. The market growth potential for this segment is positive in the coming years.

Key U.S. Contract Cleaning Services Company Insights

Some of the key companies in the U.S. market are ABM Industries Incorporated; Pritchard Industries.; and Sodexo, among others.

-

ABM Industries has been leading the United States’ professional cleaning market since 1909. In its 100-year history, the company has grown from a single-person window washing service to a corporate cleaning giant servicing more than four billion square feet of buildings each day. The publicly traded company operates more than 350 offices across North America, Canada, Puerto Rico, Central America, North Africa, the Middle East, and Europe. It serves more than half of the world’s most profitable Fortune 500 companies.

-

Pritchard Industries is the largest privately-held facility maintenance company and is headquartered in New York. Pritchard Industries provides full-service care of facilities, from daily maintenance and cleaning, with disinfecting as specified, to precision building services. Pritchard provides reliable, trusted services for commercial office buildings, major corporate facilities, financial institutions, industrial and manufacturing plants, data centers, educational facilities, medical complexes, and sports and entertainment arenas.

Allied Facility Care and Tailos are some of the emerging companies in the U.S. market.

-

Allied Facility Care (AFC) is a Texas-based facility care firm providing various janitorial and mechanical services through their team of cleaning professionals and a network of local and national companies specializing in various trades. AFC specializes in commercial cleaning, floor care, office care, green cleaning, and janitorial services, and most often cleans office spaces, school and educational institutions, healthcare facilities, and industrial warehouses.

-

Tailos is a fast-growing robotics company based in Austin, Texas that provides AI-driven automation solutions for the world’s largest, labor-intensive industries like hospitality. Tailos improves the efficiency of housekeeping staff and reduces work-related injuries while empowering management with actionable insights. Tailos is revolutionizing the commercial cleaning industry by leaving dull, dirty, and dangerous tasks to autonomous solutions.

Key U.S. Contract Cleaning Services Companies:

- ABM Industries Incorporated

- Jani-King International Inc.

- ISS Facility Services, Inc.

- Sodexo Group

- Pritchard Industries Inc.

- Vanguard Cleaning Systems Inc.

- Stanley Steemer International Inc.

- Cleaning Services Group, Inc.

- The ServiceMaster Company, LLC

Recent Developments

-

In October 2023, BradyIFS, a distributor of foodservice disposables and janitorial and sanitation products, and Envoy Solutions, a provider of JanSan products, foodservice disposables, industrial packaging, and marketing execution, jointly announced the merger of their companies. Terms of the Merger were not disclosed. The combination of BradyIFS and Envoy Solutions will result in one of the country's most balanced providers of food service disposables and JanSan products and will expand BradyIFS' reach into industrial packaging.

-

In August 2023, CleanTelligent Software announced a new corporate identity. The company will now be known as Otuvy, which stands for “Outcomes to Verify.” As part of the updated corporate identity, the company also launched Otuvy Frontline, a new software platform for cleaning professionals to manage their duties.

U.S. Contract Cleaning Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 100.49 billion

Revenue forecast in 2030

USD 139.37 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Historic data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Service type, end-use

Country scope

U.S.

Key companies profiled

ABM Industries Incorporated; Jani-King International Inc.; ISS Facility Services, Inc.; Sodexo Group; Pritchard Industries Inc.; Vanguard Cleaning Systems Inc.; Stanley Steemer International Inc.; Cleaning Services Group, Inc.; The ServiceMaster Company, LLC; Coverall

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Contract Cleaning Services Market Report Segmentation

This report forecasts revenue growth at a country level and offers analysis of the latest qualitative as well as quantitative market trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. contract cleaning services market report based on service type and end-use:

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Window Cleaning

-

Floor & Carpet Cleaning

-

Upholstery Cleaning

-

Construction Cleaning

-

Others

-

-

End-use Outlook(Revenue, USD Billion, 2017 - 2030)

-

Residential

-

Industrial

-

Commercial

-

Healthcare & Medical Facilities

-

Educational Institutions

-

Hotels & Restaurants

-

Retail Outlets

-

Corporate Offices

-

Financial Institutions

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. contract cleaning services market was estimated at USD 95.66 billion in 2023 and is expected to reach USD 100.49 billion in 2024.

b. The U.S. contract cleaning services market is expected to progress at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 139.37 billion in 2030.

b. The floor & carpet cleaning segment accounted for the largest revenue share of more than 30% in 2023 in the U.S. Contract Cleaning Services market. It will maintain its dominance over the forecast period owing to laborious and time-consuming tasks as the floor area is very large in corporate office/manufacturing facilities.

b. The key players operating in the U.S. contract cleaning services market include ABM Industries Incorporated, Pritchard Industries.; and Sodexo, among others.

b. Key factors driving the U.S. contract cleaning services market include increasing awareness about hygiene in the workplace and the gradual increase in residential/domestic customers outsourcing cleaning tasks to third-party service providers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.