- Home

- »

- Medical Devices

- »

-

U.S. Condom Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Condom Market Size, Share & Trends Report]()

U.S. Condom Market (2024 - 2030) Size, Share & Trends Analysis Report By Material Type (Latex, Non-latex), By Product (Male Condoms, Female Condoms), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-277-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Condom Market Size & Trends

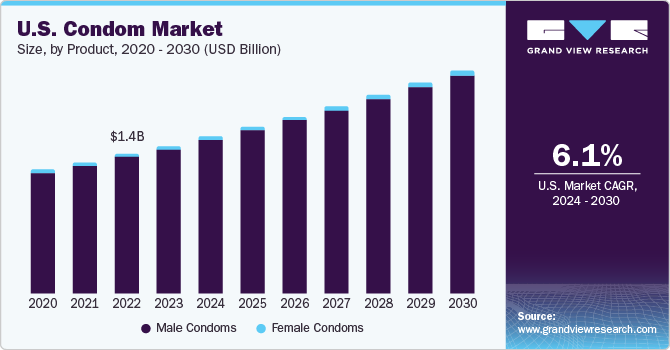

The U.S. condom market size was estimated at USD 1.42 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. The growing population and the need for family planning have led to increased demand for condoms as a means of birth control. Moreover, they are an effective method to prevent sexually transmitted infections (STIs), including HIV/AIDS. Sex education programs and public health campaigns promote the use of condoms to reduce the risk of STIs and unplanned pregnancies. Sexually transmitted infections, such as chlamydia, gonorrhea, and syphilis, are growing at an alarming rate in the U.S. According to the Centers for Disease Control and Prevention (CDC), in 2022, approximately 2.5 million cases of syphilis, gonorrhea, and chlamydia were reported in the U.S.

The government is undertaking initiatives to raise awareness about preventive measures in the younger generation to control the epidemic of HIV and other STIs and avoid unintended pregnancies. According to the National Library of Medicine, in August 2020, the prevention of unintended pregnancy and STIs, such as HIV infection, was a U.S. public health priority, particularly among adolescents. The consistent and correct use of condoms provides effective protection against unplanned pregnancies and sexually transmitted diseases (STDs) including HIV. International and national health agencies, such as the World Health Organization (WHO) and the CDC, play an important role in raising awareness about product usage.

Market Concentration & Characteristics

Market growth stage is moderate, and the pace of its market growth is accelerating. A rise in sexual health awareness and education has led to increased knowledge about the importance of safe sex practices. This is anticipated to drive product demand as a reliable method of birth control and protection against STIs.

The global condom market is also characterized by a high level of merger and acquisition (M&A) and FDA approvals. For instance, in February 2022, the U.S. FDA approved the first condom that is specifically indicated efficient for anal intercourse. It is approved useful as a contraceptive and to reduce STIs.

In recent times, the U.S. government has been supporting global family planning and reproductive health efforts. It is one of the top purchasers and distributors of contraceptives globally. In June 2020, the Department of Health in New York launched a free home delivery service of safe sex products, such as condoms, lubricant packs, etc.

Material Type Insights

The latex material type segment dominated the market and accounted for a share of around 90% in 2023. Latex is a biocompatible material and is less likely to cause allergic reactions or irritation. However, a small percentage of the population may have latex allergies, which can cause discomfort or more severe reactions. Moreover, latex condoms are highly effective in preventing pregnancies and the transmission of STIs, including HIV/AIDS, when used correctly. These types of condoms are generally more affordable compared to other products made using materials, such as polyurethane or lambskin.

The non-latex material type segment is expected to register the fastest CAGR during the forecast period as these condoms are thin, odorless, and non-allergic. Moreover, they are biodegradable and do not contain synthetic materials. These are preferred by individuals with latex allergies due to their enhanced sensitivity & unique textures. Moreover, rising environmental concerns are also likely to boost the demand for non-latex materials.

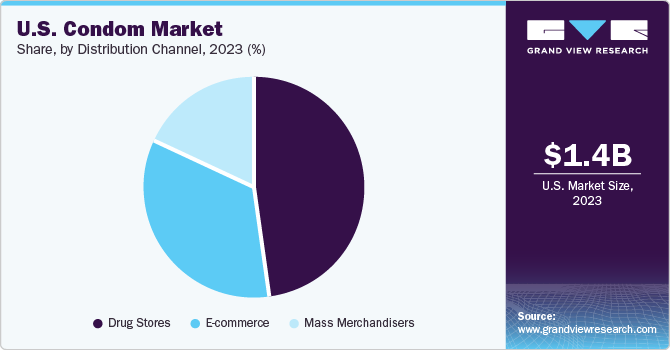

Distribution Channel Insights

The drug stores segment dominated the market in 2023. Drug stores are generally easily accessible, and located in residential areas. Moreover, these stores typically offer a wide range of condom brands, types, and sizes, catering to different preferences and needs. This allows customers to choose the most suitable product as per their requirements.

The e-commerce sector is projected to grow at the fastest CAGR over the forecast period. E-commerce platforms often provide competitive pricing and exclusive deals, which make the products more affordable for customers. These websites enable customers to compare different brand and product options, read reviews from other users, and make informed decisions.

Product Insights

The male condom product segment accounted for the largest revenue share in 2023. Male condoms are culturally accepted and are commonly discussed in sexual health education and conversations. Male condoms are typically easier to use and dispose of while female condoms are more complex and may require additional efforts. Moreover, male condoms are generally more affordable than female condoms, making them a more attractive option for people on a budget.

The female condom product segment is expected to register the fastest CAGR during the forecast period. Female condoms are being accepted for reducing the risk of STDs and unplanned pregnancies by many women in the country. Some of the brands of female condoms in the U.S. are FC2 condoms, VA W.O.W, and Pasante, Ormelle.

Key U.S. Condom Company Insights

Some of the key companies operating in the U.S. condom market include Church & Dwight Co.; Fuji Latex Co. Ltd., Reckitt Benckiser Group, Veru Inc., Mayer Laboratories, and Lelo.

- Lelo, a Swedish company, specializes in designing and manufacturing luxury intimate products, condoms, lubricants, and other adult products. They are known for their sleek, high-quality, and innovative designs

Key U.S. Condom Companies:

- Church & Dwight Co., Inc.

- Fuji Latex Co., Ltd.

- Reckitt Benckiser Group

- Karex Berhad

- Lelo

- LifeStyles Healthcare Pvt. Ltd. (acquired by Linden)

- Veru, Inc.

- Mayer Laboratories, Inc.

- Okamoto Industries, Inc.

- Cupid Limited

Recent Developments

-

In October 2023, ONE Condoms launched the world’s first-ever graphene condom. It provides incredible thinness, strength, flexibility, and heat transfer

-

In December 2022, Linden acquired LifeStyles Healthcare Pvt. Ltd. This acquisition was aimed at expanding the company’s consumer healthcare sector

-

In February 2022, ONE brand condoms received its first FDA approval as a safe and effective label for anal intercourse. This launch was aimed to expand the "intended use" claim of its ONE Condoms

-

In July 2018, Lifestyles Condoms introduced ZERO, the thinnest latex condom. This launch was aimed at developing innovations in the broad portfolio of condoms

-

In June 2018, Skyn Condoms launched a global ‘Save Intimacy’ campaign. The campaign was launched to strengthen the innovations of SKYNFEEL, a novel technology that created innovative ultra-soft and thin non-latex condom material

U.S. Condom Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.14 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, product, distribution channel, region

Country scope

U.S.

Key companies profiled

Church & Dwight Co., Inc.; Fuji Latex Co., Ltd.; Reckitt Benckiser Group; Karex Berhad; Lelo; LifeStyles Healthcare Pte. Ltd.; Veru, Inc.; Mayer Laboratories, Inc.; Okamoto Industries, Inc.; Cupid Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Condom Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. condom market report based on material type, product, distribution channel, and region:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Latex

-

Non-latex

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Male Condoms

-

Female Condoms

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass Merchandisers

-

Drug Stores

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. condom market size was estimated at USD 1.42 billion in 2023 and is expected to reach USD 1.50 billion in 2024.

b. The U.S. condom market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 2.14 billion by 2030.

b. The latex condom segment dominated the U.S. condom market with a share of 89.47% in 2023 owing to the high availability of these types of condoms by the major players in the market and high durability, flexibility, and effective protection against STDs.

b. Some key players operating in the U.S. condom market include Church & Dwight Co., Inc., Reckitt Benckiser Group, LifeStyles Healthcare Pte Ltd., Veru, Inc., Lelo, Karex Berhad, and MAYER LABORATORIES, INC.

b. Key factors that are driving the U.S. condom market growth include the increasing prevalence of HIV infections and STDs, favorable government initiatives, and increasing penetration of online retailers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.