- Home

- »

- Medical Devices

- »

-

U.S. Compound Management Market, Industry Report, 2030GVR Report cover

![U.S. Compound Management Market Size, Share & Trends Report]()

U.S. Compound Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Sample (Chemical Compounds, Biosamples), By Application (Drug Discovery, Gene Synthesis, Biobanking), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-230-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Compound Management Market Trends

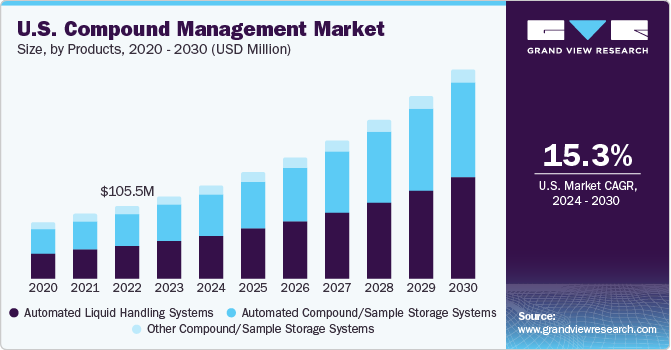

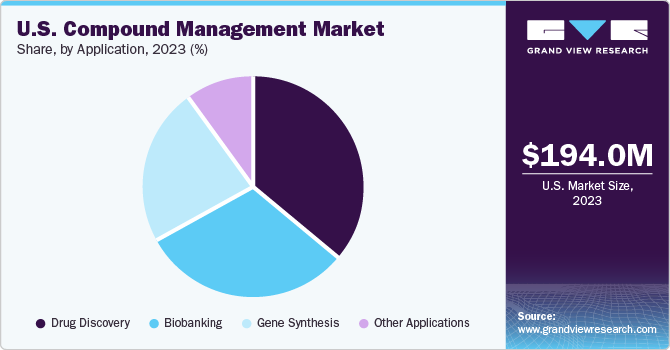

The U.S. compound management market size was estimated at USD 194.04 million in 2023 and is expected to grow a CAGR of 15.3% from 2024 to 2030. Increasing drug discovery activities and growth in the pharmaceutical and biotechnology sectors are propelling market growth. With a large volume of patients suffering from chronic diseases, biopharmaceutical companies are investing more in drug development. This, in turn, boosting the demand for compound management services.

A Life Science Strategy Group survey of 120 clinical development decision-makers in the U.S., Europe, and China reveals that industry professionals are making significant strategic changes to maintain market share amid the unpredictable post-COVID-19 scenario. The pharmaceutical industry has undergone major transformations in the past two decades, including a shift toward biologics, patent expiration, and significant internal discovery downsizing.

To ensure productivity of drugs and biologics, numerous leading pharmaceutical and biopharmaceutical companies have established storage facilities domestically. The diverse population also makes it easier to identify and acquire relevant chemical compounds for drug discovery, leading to faster drug development processes. For instance, the rising prevalence of cancer and “Orphan Diseases” in the global population is driving the demand for effective treatments.

The costly, complex drug development process has highlighted the need for advanced techniques, leading to increased R&D investment, outsourcing due to time and cost constraints, and patent expiration. Consequently, the demand for compound management services in the country is rising due to the escalating drug research activities. Government organizations prefer collaborating with CROs for cutting-edge services, further fueling market growth.

Market Concentration & Characteristics

The industry is characterized by a high degree of innovation, owing to growth in public and private investment in pharmaceutical research. The presence of more patients with specific diseases is most likely to encourage biopharmaceutical companies to invest more in drug discovery and development, leading to an increase in demand for compound management services.

Growing drug discovery collaborations between public and private entities are expected to boost global demand for compound management services. For instance, in February 2021, SPT Labtech announced its acquisition of a robotics automation provider BioMicroLab, to strengthen its capabilities in automatic sample management.

The regulations related to the U.S. compound management industry are governed by Food & Drugs Administration (FDA). The regulations include Food & Drugs Act: 1906, Federal Food, Drug, and Cosmetic Act (1938), and Medical Device Amendments to Federal Food, Drug, and Cosmetic Act (FD&C Act): 1976. The impact of these regulations on compound management companies in the USA is significant, as they must adhere to strict quality and safety standards to ensure the success of drug discovery and development.

In January 2022, pharmaceutical company AstraZeneca expanded its (AI)-powered drug discovery partnership with BenevolentAI to discover drugs for diseases such as systemic lupus erythematosus and heart failure. Partnerships such as this one are propelling industry growth and expanding the scope of services offered.

Prominent players in the industry have opened domestic facilities in the U.S. to utilize the supportive regulatory framework in the country. For instance, in June 2023, Azenta, Inc. unveiled the establishment of a new 40,000-square-foot facility in Billerica, MA, marking its entry into the Boston market for global sample storage services, boasting advanced automation and software solutions for efficient sample management to offer enhanced services and cater to a broader clientele, thereby contributing to the growth and innovation in the industry.

Application Insights

Drug discovery dominated the application segment in 2023, commanding over 35.0% of the market revenue. Robust collaboration between academia and industry accelerates drug target development, streamlines the drug creation process, and fosters innovation. The outsourcing trend driven by cost and time constraints, coupled with government support for R&D activities, significantly contributes to the growth of drug discovery in the U.S.

The increasing popularity of biobanking is aided by the rise in pharmaceutical and biopharmaceutical outsourcing. The segment is thus expected to register the highest growth from 2024 to 2030. Different biospecimen stored at biobanks are observing significant demand due to the developments in cell-based research activities. This is supporting market growth.

Type Insights

The products segment dominated the market revenue by a landslide, accounting for over 60.0% share in 2023. The growing demand for automation to manage compounds and libraries is expected to propel the segment. Automated liquid handlers and compound storage equipment can enable plate stamping, compound tracking, and reformatting. This technology improves efficiency and reliability, freeing up time for higher-value activities.

Compound management services in the U.S. are anticipated to grow at the fastest rate from 2024 to 2030. The rising complexity of drug discovery and development, cost pressures on pharmaceutical and biotech firms, advancements in automation technologies, and the globalization of drug development have collectively driven the demand for specialized compound management service providers. These service providers offer efficient expertise, cost reduction, scalability, and geographic access to compounds and expertise.

Sample Insights

Chemical compound management dominated the segment with over 50.0% share in 2023, owing to increasing demand for novel drugs and the need to identify lead compounds quickly and efficiently. With the growing complexity of drug discovery and the increasing number of compounds to be screened, managing these compounds effectively becomes a challenge for the industry. As a result, there is a need for specialized companies that can provide high-quality compound management services.

Biosample compound management is anticipated to register the fastest CAGR over the forecast period. The increasing demand for biologics in drug discovery and development led to a growing need to effectively manage these compounds. This resulted in the growth of the biosample compound management market as companies look for efficient and cost-effective ways to store & manage their biologic compounds.

End-use Insights

In 2023, pharmaceutical companies were the largest end-users of compound management services/products in the U.S., accounting for over 30.0% of the market revenue share. The large pharmaceutical and biopharma industry in North America drives the demand for compound management services, as these companies engage in extensive drug discovery activities that require maintaining substantial chemical libraries. Moreover, the growing trend of outsourcing compound management services to third-party providers offers expertise and cost-effective solutions for pharmaceutical companies, biopharmaceuticals, and CROs.

Biopharmaceutical companies are increasingly outsourcing compound management tasks and are thus anticipated to register a lucrative CAGR during the forecast period. These companies require high-throughput screening and rapid access to several compounds to identify potential drug candidates. Thus, outsourcing these tasks helps to improve the efficiency and effectiveness of the drug discovery process, ensures faster development of new drugs and therapies, and mandates proper regulatory compliance, which is critical for the success of biopharmaceutical companies.

Key U.S. Compound Management Company Insights

The U.S. compound management market is highly competitive due to leading industry players’ dominance, expertise, and innovative strategies. Varied strategic movements such as acquisition, collaborations, and partnerships are evident to gain market share, moving the market closer to consolidation. Their initiatives drive market evolution, set industry standards, and cater to pharmaceutical and biotechnology sectors effectively.

Thedesire for companies to expand service offerings, access new markets, achieve economies of scale, and strengthen competitive positions is high. Market participants are collaborating with regional players and expanding globally to expand their service offerings. Prominent companies in the U.S. compound management market include Azenta US, Inc.; Tecan Trading AG; Hamilton Company; and BioAscent.

Key U.S. Compound Management Companies:

- Azenta US, Inc.

- Tecan Trading AG

- Hamilton Company

- BioAscent

- Titian Service Limited

- Evotec

- Beckman Coulter Inc.

- LiCONiC AG

- AXXAM S.p.A.

- SPT Labtech LTD.

Recent Developments

-

In February 2024, SPT Labtech introduced Firefly+, expanding its genomics liquid handling platform with an on-deck thermocycler and increased labware capacity for hands-free Next-Generation Sequencing (NGS) library preparation.

-

In December 2023, Biosero, a BICO company, signed an agreement with a global life science company to develop an automated R&D platform and accelerate drug development workflows.

-

In May 2023, Hamilton and Biosero, a developer of laboratory automation solutions, entered a co-marketing agreement aiming to streamline automated liquid handling workflows. This partnership leverages Hamilton’s state-of-the-art automated platforms and Biosero’s innovative Green Button Go® Software Suite to increase lab efficiency.

-

In September 2022, BioAscent launched Compound Connect, a web-based user interface that provides customers secure access to a customized online inventory and ordering system to manage their compound needs and libraries.

U.S. Compound Management Market Report Scope

Report Attribute

Details

Market size in 2024

USD 222.39 million

Market size in 2030

USD 526.6 million

Growth rate

CAGR of 15.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, sample, application, end-use

Country scope

U.S.

Key companies profiled

Azenta US, Inc.; Tecan Trading AG; Hamilton Company; BioAscent; Titian Service Limited; Evotec; Beckman Coulter Inc.; LiCONiC AG; AXXAM S.p.A.; SPT Labtech LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Compound Management Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. compound management market report based on type, sample, application, and end-use.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Products

-

Automated Compound/Sample Storage Systems

-

Automated Liquid Handling Systems

-

Other Compound/Sample Storage Systems

-

-

Services

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical Compounds

-

Biosamples

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery

-

Gene Synthesis

-

Biobanking

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Contract Research Organizations

-

Other End-users (Research And Academic Institutes)

-

Frequently Asked Questions About This Report

b. The U.S. compound management market size was estimated at USD 194.04 million in 2023 and is expected to reach USD 222.39 million in 2024.

b. The U.S. compound management market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030 to reach USD 526.6 billion by 2030.

b. The product segment dominated the U.S. compound management market with a share of over 61.0% in 2023. This is attributable to rising adoption of automated Liquid Handling Systems healthcare awareness coupled with supportive healthcare infrastructure.

b. Some key players operating in the U.S. compound management market include Azenta US, Inc.; Tecan Trading AG; Hamilton Company; BioAscent; Titian Service Limited; Evotec; Beckman Coulter, Inc.; LiCONiC AG; AXXAM S.p.A.; SPT Labtech LTD.

b. Increasing drug discovery activities; growth in the pharmaceutical and biotechnology industries; and increasing demand for outsourcing these services are some of the key factors driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.