- Home

- »

- Medical Devices

- »

-

U.S. Clinical Trials Supply And Logistics Market Report, 2033GVR Report cover

![U.S. Clinical Trials Supply And Logistics Market Size, Share & Trends Report]()

U.S. Clinical Trials Supply And Logistics Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Logistics & Distribution, Storage & Retention, Packaging, Labeling & Blinding), By Phase, By Therapeutic Area, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-228-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Clinical Trials Supply & Logistics Market Summary

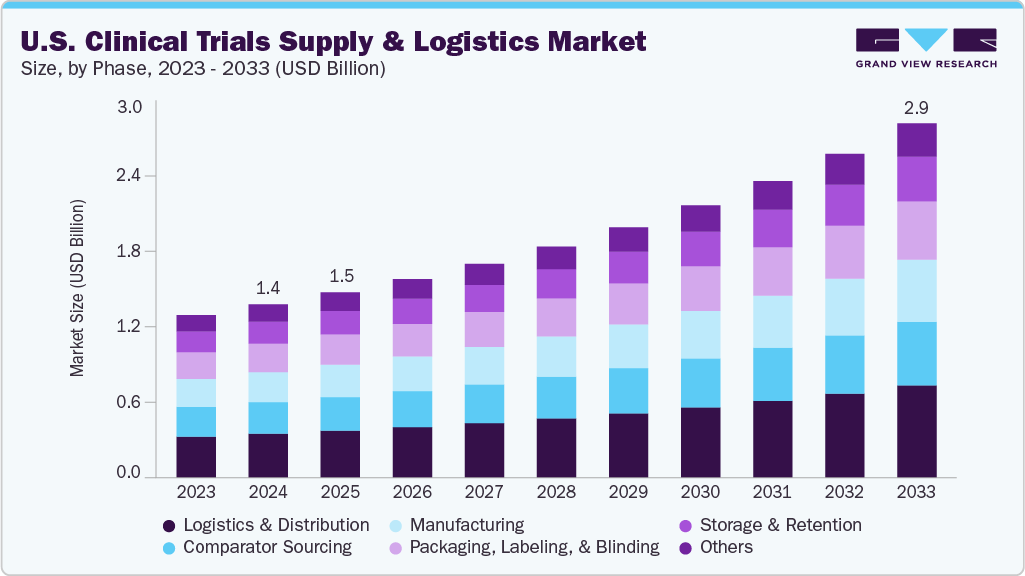

The U.S. clinical trials supply and logistics market size was estimated at USD 1.40 billion in 2024 and is projected to reach USD 2.87 billion by 2033, growing at a CAGR of 8.45% from 2025 to 2033. The market has experienced robust growth driven by research and development activities for innovative therapeutic areas such as oncology, rare diseases, and cell and gene therapies.

Key Market Trends & Insights

- The U.S. clinical trials supply & logistics in the North America are expected to grow significantly over the forecast period.

- Based on service, the logistics & distribution segment held the highest market share in 2024.

- By phase, the phase III segment held the highest market share of 43.64% in 2024.

- Based on therapeutic area, the cardiovascular diseases segment held the highest market share in 2024.

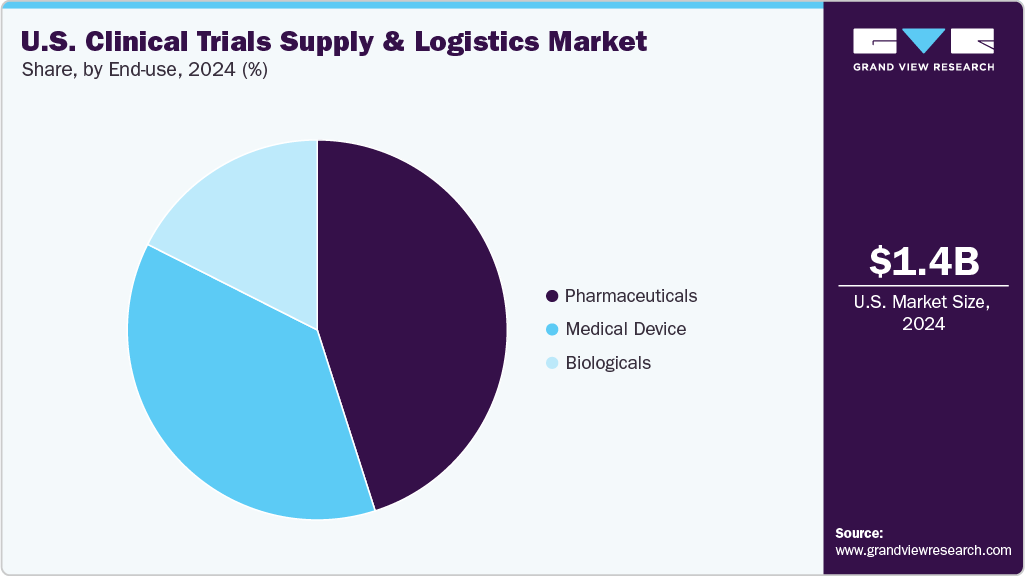

- By end use, the pharmaceuticals segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.40 Billion

- 2033 Projected Market Size: USD 2.87 Billion

- CAGR (2025-2033): 8.45%

- Phase III: Largest market in 2024

- Cardiovascular Diseases: Fastest growing market

Besides, the growing complexity of trial designs and regulatory requirements for patient safety and product integrity has led to the need for advanced supply chain models. Further, the adoption of decentralized trials and direct-to-patient delivery solutions has highlighted the significance of flexible and compliant logistics networks. In addition, increased investment from pharmaceutical and biotech companies has enhanced the demand for efficient packaging, temperature-controlled storage, and distribution services essential for timely trial execution.

Moreover, most clinical trials across various phases have been supported by specialized supply solutions such as cold chain distribution, comparator sourcing, clinical packaging, and return management. Smaller batch distributions with tight timelines have been effectively managed for early-phase studies through adaptable supply models, while large-scale Phase III trials benefit from comprehensive global depot networks. Besides, the expanding pipeline of biologics, biosimilars, and advanced therapies has further boosted the need for ultra-low temperature handling and specialized transportation solutions. As trials broaden in scope and geographical reach, supply and logistics providers have become crucial in ensuring the continuous availability of investigational products. Their role has been vital in fueling market expansion by minimizing delays, ensuring compliance, and enhancing trial efficiency.

Furthermore, established market players are pursuing strategic initiatives, including acquisitions, service expansions, and investments in digital platforms to enhance visibility and tracking. Collaborations with sponsors and contract research organizations (CROs) are being accelerated, focusing on increasing cold chain capacity in the U.S. to address the challenges posed by growing trial complexity. Such factors are expected to drive the market over the estimated timeframe.

Opportunity Analysis

The U.S. clinical trials supply and logistics market presents significant growth opportunities due to several factors, including the increasing complexity of clinical studies and the rise of decentralized and adaptive trial models. Besides, the growing demand for biologics and personalized therapies is expected to drive the market over the estimated period. In addition, innovating cell & gene therapies ideally requires specialized packaging, cold chain management, and ultra-low temperature logistics, which further support the providers with the necessary infrastructure. Moreover, growing digital advancements along with technologies like real-time monitoring, blockchain, and AI-driven are expected to improve efficiency and visibility in the supply chain. Also, the regulatory emphasis on transparency and data integrity creates new growth opportunities for compliant, technology-based service providers.

Furthermore, most pharmaceutical and biotech sponsors seek integrated, end-to-end supply solutions from clinical packaging to direct-to-patient delivery. Market leaders can set themselves apart by blending scales with flexibility. Besides, there is an increasing focus on sustainability, as sponsors demand greener logistics options. Thus, the U.S. market provides a promising landscape for established players and innovators to leverage specialized, tech-focused service niches.

Impact of U.S. Tariffs on the Clinical Trials Supply & Logistics Market

Imposing U.S. tariffs has created significant challenges for the clinical trials supply and logistics market. These tariffs have resulted in bottlenecks in importing essential raw materials, active pharmaceutical ingredients, and specialized investigational product packaging and distribution equipment. As a result, there have been notable cost increases and customs delays that disrupted the timely availability of critical supplies. This issue is particularly acute in therapeutic areas, where clinical trials often necessitate the use of advanced biologics and sensitive drug formulations.

Besides, the interruptions in cold chain logistics and the rising input costs have led to delays in study timelines, hindering patient recruitment and prolonging development cycles. Further, clinical trials are inherently complex and resource-intensive, and have been hit especially hard, facing extended clearance times and higher sourcing costs for specialized devices and comparator drugs. Moreover, the tariffs have injected volatility into the U.S. clinical trial supply and logistics landscape. They have increased costs, lengthened lead times, and prompted sponsors to rethink their sourcing strategies. In response, logistics providers have had to adapt, diversifying supplier networks, utilizing regional depots more effectively, and emphasizing technology-driven transparency to minimize risks. Market participants have focused on building resilient supply chains through reshoring, near-shoring, and enhancing digital integration. While these short-term disruptions have slowed trial execution, they have also accelerated innovation, creating opportunities for providers that offer agile, compliant, and cost-efficient logistics solutions.

Technological Advancements

The U.S. clinical trials supply & logistics market has witnessed the rising adoption of technology as it has become crucial for managing the increasing complexity and ensuring reliability in operations. Besides, real-time monitoring, powered by IoT-enabled sensors, provides continuous visibility into the location, temperature, and handling of investigational products, which not only reduces risks but also helps in maintaining regulatory compliance. Blockchain technology is widely utilized to enhance data integrity by offering tamper-proof records and transparent audit trails. It strengthens trust among sponsors, contract research organizations (CROs), and regulatory bodies. In addition, artificial intelligence and predictive analytics are key in more intelligent demand forecasting, optimizing inventory levels, and enabling proactive risk management.

This ensures that investigational products are available when needed while minimizing waste. Moreover, advanced cold chain and cryogenic technologies are vital for preserving biologics, cell therapies, and gene therapies, which require ultra-low temperature handling to maintain product integrity. Furthermore, digital platforms integrating packaging, distribution, labeling, and returns enhance efficiency through centralized workflows and data-driven coordination. Thus, these technological advancements are transforming trial supply chains, leading to greater efficiency, improved compliance, and enhanced responsiveness to the complexities of clinical research.

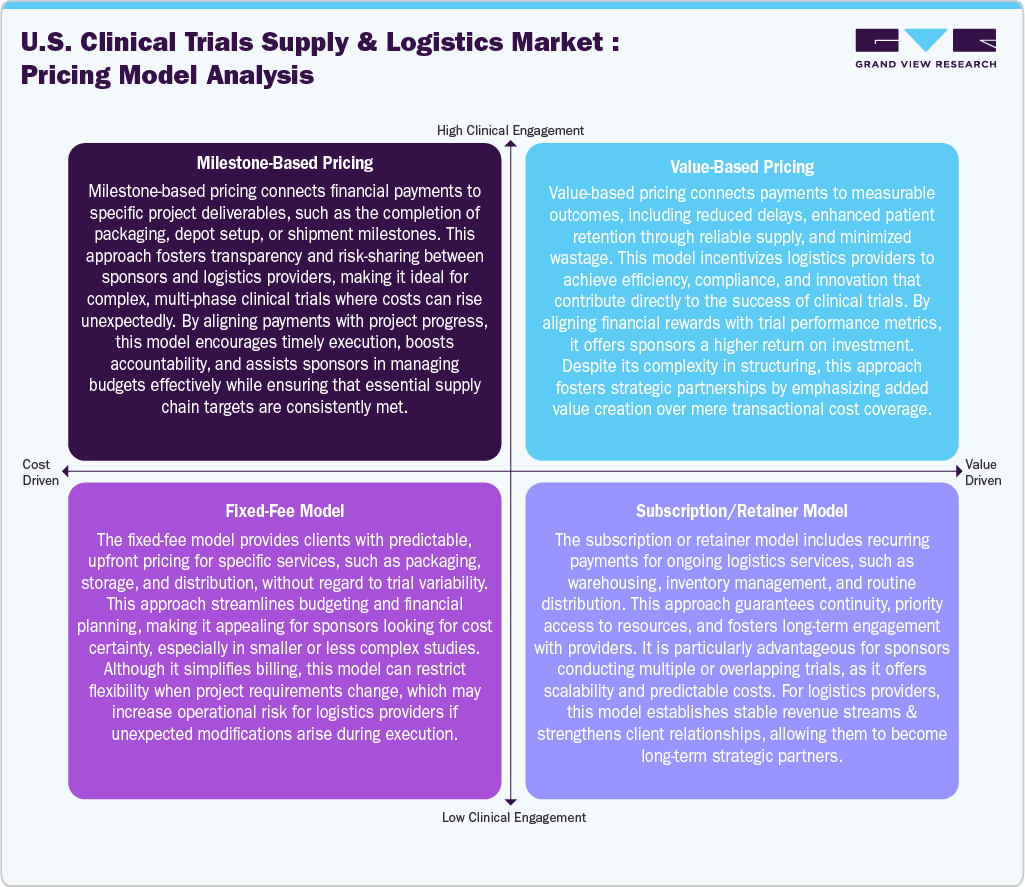

Pricing Model Analysis

In the U.S. clinical trials supply and logistics market, various pricing models are utilized to meet sponsor needs and the complexity of projects. Milestone-based pricing connects payments to defined deliverables such as packaging, depot readiness, or shipment completion, helping to ensure accountability and align costs with progress. Fixed-fee models offer predictable, upfront pricing for specified services, which simplifies budgeting but also places the operational risk on providers if trial requirements change.

Value-based pricing focuses on performance outcomes, tying payments to efficiency improvements, waste reduction, or enhanced compliance, thus encouraging collaboration and shared value. The subscription or retainer model provides recurring payments for ongoing services like warehousing, inventory control, and distribution, promoting cost predictability for sponsors handling multiple or long-term trials. Each pricing model addresses different sponsor priorities from transparency and cost control to innovation and continuity, illustrating the evolving strategic connection between pricing structures and the increasingly complex landscape of clinical trial supply chains.

Market Concentration & Characteristics

The U.S. clinical trials supply & logistics market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

Innovation is high, driven by the adoption of IoT, blockchain, AI-based forecasting, and advanced cold chain technologies. Digital platforms integrating end-to-end supply management enhance transparency, efficiency, and compliance, positioning innovation as a critical differentiator in competitive U.S. clinical trial logistics.

M&A activity is robust, with players acquiring specialized packaging, distribution, and bio services firms to expand capabilities and geographic reach. Consolidation enables integrated service offerings, strengthens cold chain capacity, and enhances technology adoption, ensuring competitiveness in meeting the growing complexity of U.S. clinical trials.

Strict FDA, GxP, and ICH guidelines shape supply chain processes, emphasizing traceability, temperature control, and patient safety. Regulations drive investment in compliant technologies, audit-ready systems, and documentation frameworks, ensuring logistics providers align operations with evolving standards across all phases of clinical trials.

Service portfolios are expanding to include decentralized trial support, direct-to-patient delivery, comparator sourcing, and advanced cryogenic solutions. Logistics providers enhance value through digital visibility platforms and customized packaging, positioning themselves as end-to-end partners in clinical development rather than transactional service providers.

Regional expansion strategies focus on strengthening U.S. depot networks, establishing proximity to trial sites, and integrating with global distribution hubs. Providers are investing in cold chain infrastructure, local partnerships, and technology-enabled networks to improve speed, reduce risk, and support multinational clinical programs.

Service Insights

On the basis of service segment, in 2024, the logistics and distribution segment held the largest market share in the market, accounting for a revenue share of 25.41%. The logistics and distribution segment forms the backbone of the U.S. clinical trials supply chain, ensuring investigational products, comparators, and ancillaries are delivered securely and compliantly. Besides, the segment growth is driven by increasing decentralized trials, demand for direct-to-patient delivery, and reliance on temperature-controlled networks. In addition, real-time monitoring, global depot connectivity, and specialized courier services have strengthened efficiency, minimizing disruptions and delays. As trial complexity rises, the segment is evolving into a strategic enabler, offering scalability, compliance, and agility across diverse therapeutic and trial phases, which are expected to drive the market over the estimated period.

The packaging, labeling, and blinding segments are expected to grow significantly during the forecast period. Packaging, labeling, and blinding services protect trial integrity and ensure patient safety within the U.S. clinical trials supply and logistics market. The demand for these services is increasing due to strict FDA regulations, the prevalence of multi-country trials, and a growing emphasis on patient-centric designs. Providers are responding with innovations such as adaptive packaging, just-in-time labeling, and digital randomization systems to adapt to the evolving needs of trials. Moreover, the primary objective is to guarantee product stability, preserve confidentiality, and facilitate various trial designs. As the complexity of protocols and global distribution networks continues to rise, this segment is anticipated to drive the market over the estimated timeframe.

Phase Insights

On the basis of phase segment, in 2024, the phase III segment held the largest market share in the market. The segment growth is primarily due to large-scale patient enrollment, broad geographic outreach, and substantial need for comparator sourcing, cold chain logistics, and bulk packaging solutions. Besides, logistics providers play a significant role in navigating the complexities involved, ensuring continuous drug availability and managing extensive depot networks effectively, further fueling phase III clinical trials. Besides, increased investments in real-time monitoring, global distribution capabilities, and adherence to regulatory compliance enhance reliability in this sector, supporting the segment growth. Thus, the segment will witness new growth opportunities over the estimated period.

The phase I segment is expected to grow significantly during the forecast period. The segment growth is driven by the increase in early-stage studies for innovative therapies, such as biologics, treatments for rare diseases, and gene therapies. These trials require small-batch, flexible supply solutions, quick packaging, and specialized temperature-controlled logistics. Moreover, to address these challenges, providers are adopting adaptive supply models and employing advanced digital forecasting techniques to reduce waste and adhere to tight deadlines. Moreover, the expanding pipeline of groundbreaking drug candidates has led to increased focus on phase I, further emphasizing the need for agile, technology-driven logistics strategies to ensure the success of trials. Such factors are expected to drive the market.

Therapeutic Area Insights

On the basis of the therapeutic area segment, the cardiovascular diseases segment accounted for the largest market share in 2024. The U.S. clinical trials supply and logistics market for cardiovascular diseases is driven by the growing prevalence of the condition and the ongoing demand for innovative therapies. Besides, the large patient populations involved in these trials and their long duration necessitate reliable distribution methods, temperature stability, and adaptable packaging solutions. Logistics providers are focusing on aspects such as comparator sourcing, risk management, and expanding depots to meet the global demands of these trials. While oncology research leads in terms of innovation, cardiovascular studies consistently drive logistics demand, contributing to a strong market presence through steady trial volumes and stable supply chain needs across various study phases. Such factors are expected to drive the market.

The oncology segment is expected to grow at the highest CAGR during the forecast period. The segment growth is driven by rising demand for immunotherapies, targeted therapies, and personalized medicine. These trials mostly require sophisticated cold chain logistics, comparator sourcing, and complex blinding procedures, further supporting segment growth. Besides, the rising number of ongoing oncology studies creates strong demand for flexible logistics solutions, adaptive packaging options, and global distribution capabilities. Thus, providers are focusing on enhancing oncology-specific infrastructure and developing digital supply platforms to keep up with this rapid growth. These factors are expected to support the market.

End-use Insights

On the basis of the end use segment, the pharmaceuticals segment held the largest market share in 2024. Pharmaceuticals constitute a major segment in the U.S. clinical trials supply and logistics market, characterized by extensive outsourcing of packaging, labeling, distribution, and returns management. Besides, pharmaceutical companies are increasingly searching for compliant and cost-effective partners to handle the rising volumes of clinical trials and the broader geographic reach, which contributes to market growth. Some other factors fueling the segment growth are the rising need for comparator drugs, intricate blinding processes, and efficient direct-to-site distribution. Logistics providers are collaborating with pharmaceutical sponsors using digital platforms, milestone-based partnerships, and global depot connectivity to ensure reliable service. The pharmaceutical segment continues to generate significant revenue, reflecting ongoing investments in clinical development, which is expected to drive the market over the estimated timeframe.

The biologicals segment is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the growing expansion of monoclonal antibodies, vaccines, and advanced therapies. These products require ultra-low temperature logistics, specialized cryogenic solutions, and adherence to strict regulatory standards. In response, providers are investing in advanced cold chain networks, real-time monitoring systems, and just-in-time supply methods to maintain product integrity. As biologics continue to dominate the research and development pipeline, logistics providers that offer scalable, technology-enabled cold chain solutions are well-positioned for significant growth. This segment is essential for driving innovation and facilitating future expansion within the industry. Such factors are expected to drive the market over the estimated time period.

Key U.S. Clinical Trials Supply And Logistics Company Insights

The key players operating across the market are adopting inorganic strategic initiatives such as partnerships, mergers, acquisitions, service launches, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in March 2024, Myonex mentioned the acquisition of Creapharm’s Clinical Packaging & Distribution, Commercial Packaging, and Bioservices divisions in France with additional operations in the U.S. This strategic move enhances Myonex’s market position by bridging service gaps, expanding capabilities, and offering integrated expertise with a strong commitment to client-focused solutions.

Key U.S. Clinical Trials Supply And Logistics Companies:

- Thermo Fisher Scientific Inc.

- UPS Healthcare

- Piramal Pharma Solutions

- DHL

- Parexel International

- Almac Group

- UDG Healthcare

- FedEx

- Catalent, Inc.

Recent Developments

-

In June 2024, Thermo Fisher Scientific launched a new ultra-cold facility in Bleiswijk, Netherlands. The cGMP-compliant site supports cell and gene therapies, biologics, antibodies, and vaccines, enhancing contract manufacturing and specialty logistics. It offers biorepository solutions and critical material storage, catering to biotech and pharmaceutical firms across all clinical trial phases.

U.S. Clinical Trials Supply And Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.50 billion

Revenue forecast in 2033

USD 2.87 billion

Growth rate

CAGR of 8.45% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, phase, therapeutic area, end-use

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific Inc.; UPS Healthcare; Piramal Pharma Solutions; DHL; Parexel International; Almac Group; UDG Healthcare; FedEx; Catalent, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Clinical Trials Supply And Logistics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. clinical trials supply & logistics market report based on service, phase, therapeutic area, and end-use.

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Logistics & Distribution

-

Storage & Retention

-

Packaging, Labeling, and Blinding

-

Manufacturing

-

Comparator Sourcing

-

Other Services

-

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Cardiovascular Diseases

-

Respiratory Diseases

-

CNS And Mental Disorders

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceuticals

-

Biologicals

-

Medical Device

-

Frequently Asked Questions About This Report

b. The U.S. clinical trial supply and logistics market size was estimated at USD 1.40 billion in 2024 and is expected to reach USD 1.50 billion in 2025.

b. The U.S. clinical trial supply and logistics market is expected to grow at a compound annual growth rate of 8.45% from 2025 to 2033 to reach USD 2.87 billion by 2033.

b. Logistics and distribution dominated the U.S. clinical trial supply and logistics market with a share of 25.41% in 2024. The logistics and distribution segment forms the backbone of the U.S. clinical trials supply chain, ensuring investigational products, comparators, and ancillaries are delivered securely and compliantly. Some other factors contributing to segment growth are increasing decentralized trials, demand for direct-to-patient delivery, and reliance on temperature-controlled networks.

b. Some key players operating in the U.S. clinical trial supply and logistics market include Thermo Fisher Scientific Inc., UPS Healthcare, Piramal Pharma Solutions, DHL, Parexel International, Almac Group, Movianto, UDG Healthcare, FedEx, and Catalent, Inc., among others.

b. Key factors driving the U.S. clinical trial supply and logistics market growth are the rising research and development activities for innovative therapeutic areas such as oncology, rare diseases, and cell and gene therapies. Besides, the growing complexity of trial designs and regulatory requirements for patient safety and product integrity has led to the need for advanced supply chain models, which is anticipated to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.