U.S. Clinical Oncology Next Generation Sequencing Market Size, Share & Trends Analysis Report By Workflow (NGS Pre-Sequencing, NGS Sequencing, NGS Data Analysis), By Technology, By Application, By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-168-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. clinical oncology next-generation sequencing market size was estimated at USD 214.0 million in 2024 and is expected to grow at a CAGR of 15.04% from 2025 to 2030. The key factors attributed to the growth of the clinical oncology next-generation sequencing (NGS) market are increasing adoption of NGS, increasing healthcare spending, and the rise in the prevalence of cancer. Moreover, the growth in clinical applications of NGS in precision oncology is expected to propel market demand over the forecast period.

The COVID-19 pandemic has significantly influenced the market. During the COVID-19 pandemic, private participants and government administrations focused on next-generation sequencing technology as a diagnostic instrument in the industry. For instance, in August 2020, the U.S. Food and Drug Administration authorized liquid biopsy NGS companion diagnostic tests to determine mutations in BRCA2 and BRCA1 genes and help treat patients with metastatic castration-resistant prostate cancer. These aspects supported the market demand during the COVID-19 pandemic.

Moreover, the rising number of cancer cases in the country is the major factor propelling the market. The American Cancer Society estimated that over 1.9 million new cancer patients will be diagnosed in the U.S. in 2023. Moreover, as per the U.S. Department of Health & Human Services, in 2020, the country reported 1,603,844 new cancer cases and 602,347 deaths. It further reports that around 20% of deaths in the U.S. causes due to cancer. NGS helps determine novel and rare cancer mutations, identifies familial cancer mutation carriers, and helps find suitable targeted treatments. Therefore, it is anticipated that an upsurge in cancer cases and patients across the globe can drive the demand for clinical oncology in NGS in the country market.

In addition, the increasing healthcare spending in the U.S. is expected to propel the demand for clinical oncology NGS market. According to the Journal published by the National Library Of Medicine in May 2022, cancer care spending in the country surpassed USD 200 billion in 2020. Moreover, every year pocket spending on cancer care is estimated to be around USD 16 billion. This increased spending on cancer care is anticipated to boost the research and development activities related to NGS-based diagnostics and treatments for cancer patients.

Moreover, the increasing adoption of NGS and its clinical applications in precision oncology is anticipated to propel the market growth over the forecast period. Various companies are launching platforms that use NGS for precision oncology and genomic insights. For instance, in June 2021, OmniSeq and LabCorp, the U.S.-based life science company, introduced OmniSeq INSIGHTsm, a next-generation sequencing test designed to advance precision oncology. Moreover, in April 2023, the U.S.-based company Agilent Technologies Inc. introduced Agilent Sure Select Cancer CGP Assay, based on NGS, for advancing precision oncology. Thus, the increasing focus of industry participants on NGS for precision oncology is expected to boost the market demand.

Technology Insights

Based on the technology, the market is segmented into targeted sequencing & resequencing, whole genome sequencing, and whole exome sequencing. The targeted sequencing & resequencing segment accounted for the largest revenue share of 72.51% in 2024. In January 2024, QIAGEN Digital Insights (QDI) has launched an upgraded QIAGEN CLC Genomics Workbench Premium with LightSpeed technology for next-generation sequencing (NGS) in somatic cancer analysis. This software quickly converts raw FASTQ sequencing data into interpretable VCF files, offering faster results at a lower cost. The increased utility of targeted panels to detect malignant tumors and the advantages associated with this technology, such as reduced cost, time, and amount of data analyzed during the sequencing, can be attributed to the segment's dominance.

Whole-genome sequencing (WGS) is expected to grow at the fastest CAGR over the forecast period in the technology segment. The segment's growth can be attributed to various factors, such as its ability to get a base pair resolution of an entire genome in a single run and its utility in differentiating and comparing tumor tissues from normal tissues. Moreover, whole genome sequencing of cancer patients provides a complete view of the genomic alterations and unique mutations in cancer tissue. These benefits associated with WGS are anticipated to propel the segment growth over the forecast period.

Workflow Insights

The market is segmented based on workflow into NGS sequencing, NGS pre-sequencing, and NGS data analysis. NGS sequencing held an enormous share of 56.65% in 2024 in the workflow segment, and it is anticipated to expand at the highest CAGR from 2025 to 2030. The segment's dominance is due to the rising focus of industry players on NGS technology for oncology treatments, and NGS sequencing is an important step in the complete workflow.

NGS data analysis is anticipated to increase at a significant rate. The rising research and development activities to develop innovative solutions coupled with the increasing prevalence of cancer are expected to boost segment growth over the forecast period. In addition, the technological advancements and increasing efforts by industry participants to introduce novel platforms further propel the market growth. For instance, in March 2023, Illumina Inc., a provider of DNA sequencing technologies, introduced the cloud-based software Connected Insights for the tertiary analysis of clinical NGS. data

Application Insights

Screening accounted for an enormous revenue share of over 79.94% in 2024. The increasing use of NGS in cancer screening worldwide can be attributed to the largest share of the screening segment. Next-generation sequencing provides benefits in sensitivity, accuracy, and speed to notably influence the oncology field. Moreover, it does not require numerous tests to recognize the causative mutation, as NGS can evaluate myriad genes in a single assay. These advantages associated with the NGS are anticipated to support the segment growth over the forecast period.

The companion diagnostics segment is expected to register the highest CAGR of 20.12% over the forecast period. Constant partnerships & collaborations, and product developments, among the major players, are expected to boost the adoption of next-generation sequencing for companion diagnostics. In addition, the regulatory authorities are also supporting product launches in this segment. For instance, in August 2022, the Food and Drug Administration approved a next-generation sequencing-based companion diagnostic test from Thermo Fisher Scientific to help patients suffering from lung cancer. Similarly, in September 2024, Illumina's IVD biomarker test has become the first FDA-approved pan-cancer companion diagnostics kit.

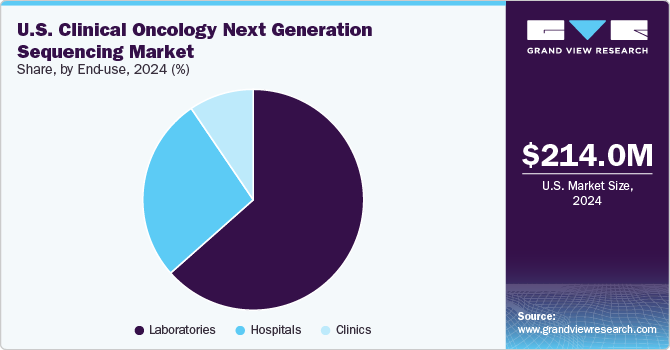

End Use Insights

The laboratories segment held the largest market share, with a revenue share of over 63.47% in 2024. In the U.S., various governing authorities regulate clinical laboratories. The organizations such as the College of American Pathologists (CAP) and the American College of Medical Genetics and Genomics (ACMG) have designed the guidelines for clinical laboratories. Moreover, the U.S. FDA regulates the NGS-based clinical diagnostics test. Such guidelines and recommendations help increase the use of NGS technologies in laboratories. In September 2024, NeoGenomics announced the launch of its new RaDaR technology and the resolution of the RaDaR 1.0 litigation.

As an end use, clinics are expected to witness the highest CAGR over the forecast period due to the increasing prevalence of cancer nationwide and rising research and development activities. Next-generation sequencing has transformed from research to clinical use. Moreover, the increasing number of clinics using NGS for cancer treatment is anticipated to propel the segment growth. For instance, In December 2022, Mayo Clinic Laboratories introduced MayoComplete oncology next-generation sequencing (NGS) panels for comprehensive care.

Key U.S. Clinical Oncology Next Generation Sequencing Company Insights

Numerous participants operate in the market. Firms in the industry are undertaking numerous strategies, such as launching novel products, partnerships, and collaborations, to maintain their market presence.

Key U.S. Clinical Oncology Next-generation Sequencing Companies:

- Illumina, Inc.

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies

- Myriad Genetics

- Beijing Genomics Institute (BGI)

- Perkin Elmer

- Foundation Medicine

- Pacific Bioscience

- Oxford Nanopore Technologies Ltd.

- Macrogen, Inc.

- Qiagen

Recent Developments

-

In July 2024, Thermo Fisher Scientific announced advanced clinical research and treatment for myeloid cancers by utilizing next-generation sequencing technology

-

In June 2023, PreCheck Health Services Inc., a U.S.-based company, introduced a comprehensive cancer panel utilizing Next Generation Sequencing technology.

-

In June 2023, Invivoscribe, the U.S.-based provider of oncology testing products and services, collaborated with Complete Genomics, a provider of DNA sequencing solutions, to design biomarker tests for oncology and cancer research. In this partnership, Complete Genomics is offering NGS platforms.

U.S. Clinical Oncology NGS Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2025 |

USD 248.4 million |

|

Revenue forecast in 2030 |

USD 500.4 million |

|

Growth rate |

CAGR of 15.04% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, workflow, application, end use, region |

|

Country scope |

U.S. |

|

Key companies profiled |

Illumina, Inc., Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Agilent Technologies, Myriad Genetics, Beijing Genomics Institute (BGI), Perkin Elmer, Foundation Medicine, Pacific Bioscience, Oxford Nanopore Technologies Ltd., Qiagen , Macrogen, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

U.S. Clinical Oncology NGS Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the clinical oncology next generation sequencing market based on technology, workflow, application, end use.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Whole Genome Sequencing

-

Whole Exome Sequencing

-

Targeted Sequencing & Resequencing Centrifuges

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-Sequencing

-

Sequencing

-

Data Analysis

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Screening

-

Sporadic Cancer

-

Inherited Cancer

-

-

Companion Diagnostics

-

Other Diagnostics

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Laboratories

-

Frequently Asked Questions About This Report

b. The U.S. clinical oncology next generation sequencing market size was estimated at USD 214.0 million in 2024 and is expected to reach USD 248.4 million in 2025.

b. The U.S. clinical oncology next generation sequencing market is expected to grow at a compound annual growth rate of 15.04% from 2025 to 2030 to reach USD 500.4 million by 2030.

b. Targeted sequencing and re-sequencing dominated the U.S. clinical oncology NGS market with a share of 72.51% in 2024 as this technology enables higher throughput at a reduced price per sample. Targeted RNA sequencing provides a platform that offers enhanced coverage for robust transcript assembly, accurate gene quantification, and sensitive gene discovery.

b. Some key players operating in the U.S. clinical oncology NGS market include Illumina Inc., Roche, Agilent Technologies, Knome Inc. Genomatix Software GmbH, GATC Biotech Ag, Oxford Nanopore Technologies Ltd, Macrogen Inc., Life Technologies Corp, DNASTAR Inc, Exosome Diagnostics, Biomatters Ltd, CLC Bio, BGI, Qiagen NV, Perkin Elmer, Inc, Pacific Bioscience, Inc, Partek, Inc, GnuBIO, Foundation Medicine, Paradigm, Caris Life Sciences and Myriad Genetics.

b. Key factors that are driving the market growth include exponentially decreasing costs for genetic sequencing, growing related advancement of personalized medicine, rise in competition amongst prominent market entities, growing healthcare expenditure triggering the development of effective PM diagnostic & therapeutic procedure for cancer, increasing prevalence of cancer, and Growing adoption of NGS over single-gene testing.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."