- Home

- »

- Medical Devices

- »

-

U.S. Cleanroom Technology In Healthcare Market, Report, 2030GVR Report cover

![U.S. Cleanroom Technology In Healthcare Market Size, Share & Trends Report]()

U.S. Cleanroom Technology In Healthcare Market Size, Share & Trends Analysis Report By Product (Consumables, Equipment), By End-use (Pharmaceutical, Biotechnology), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-308-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

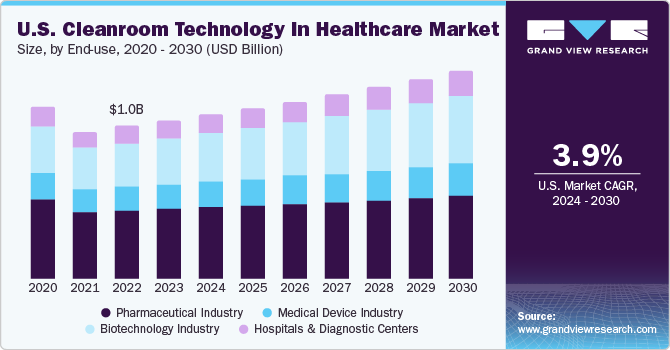

The U.S. cleanroom technology in healthcare market size was estimated at USD 1.02 billion in 2023 and is projected to grow at a CAGR of 3.97% from 2024 to 2030. This can be attributed to technological advancements in cleanroom construction, the growing pharmaceutical and biotechnology industry, stringent regulatory compliance & standards, and increasing incidence of hospital-acquired infections. According to the Centers for Disease Control and Prevention (CDC), it is estimated that 1 in 31 hospital patients in the U.S. contracts a Healthcare Associated Infection (HAI) on any given day.

Technological advancements such as the development of advanced materials, modular construction techniques, and energy-efficient HVAC systems have significantly impacted the market in healthcare. Advanced cleanroom designs offer better contamination control, enhanced user experience, and lower environmental impact, making them more attractive to healthcare providers. Additionally, the integration of automation and monitoring systems has improved the efficiency and accuracy of cleanroom operations. In March 2024, EdgeX launched Sense8, a temperature, humidity, and pressure differentials monitoring system to ensure regulatory compliance in operating rooms and pharmacy cleanrooms.

The pharmaceutical and biotechnology industry is a significant contributor to the market in healthcare. With the increasing demand for high-quality pharmaceutical products and cutting-edge biotechnological research, there is a growing need for advanced cleanroom solutions that cater to the stringent requirements of these industries.

Regulatory compliance and standards play a crucial role in driving the in healthcare. Various federal agencies, such as the FDA and USP, have established guidelines for cleanroom design and operation to ensure patient safety and product quality. Compliance with these standards requires healthcare providers to invest in advanced cleanroom technology solutions.

Moreover, the growing awareness of infection control in healthcare facilities has also contributed to the growth of the healthcare market. The COVID-19 pandemic has highlighted the importance of infection control measures in preventing the spread of infectious diseases. As a result, healthcare providers are investing in advanced cleanroom technology to ensure a safe and sterile environment for patients and staff. This includes the use of air filtration systems, positive pressure rooms, and other cleanroom technology designed to minimize the risk of infection.

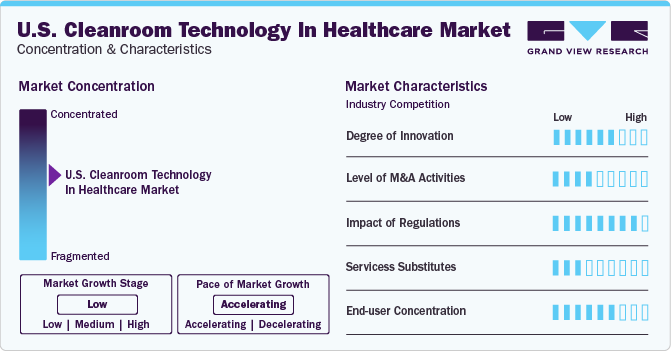

Market Concentration & Characteristics

The market growth stage is low, and the pace is accelerating. The market is characterized by a high degree of innovation owing to the increasing demands for cleanliness, safety, and infection control in healthcare facilities. These innovations include improvements in air filtration systems, sanitation methods, and monitoring technologies. Subsequently, innovative AI applications are constantly emerging, disrupting existing industries and creating new ones.

The market is characterized by a moderate level of merger and acquisition (M&A) activity among market players. These players have actively engaged in M&A to expand product portfolios, enhance technological capabilities, increase market share, and drive innovation. For instance, in January 2024, Modular Devices, a provider of modular and mobile cleanroom solutions, partnered with Supply and Technical Air Products and Flow Cleanrooms.

The level of regulatory scrutiny in the market is high. The healthcare industry is subject to stringent regulations by agencies like the Food and Drug Administration, the Centers for Disease Control, and other regulatory bodies. Compliance with Good Manufacturing Practices (GMP), ISO standards, and other quality control measures is essential to ensure the safety and efficacy of healthcare products manufactured in cleanroom environments. Any deviations from these regulations lead to severe consequences, including product recalls and fines.

There are a limited number of direct substitutes for cleanroom technology in healthcare. While cleanrooms remain the gold standard for maintaining a controlled environment in healthcare settings, alternative solutions such as isolators, RABS, isolator hybrids, modular cleanrooms, and HEPA filtration systems can provide viable options when cleanroom technology is unavailable or too costly.

End-user concentration is a significant factor in the market. There are several end-user driving demand for cleanroom technology such as hospitals, medical device manufacturers, and the pharmaceutical and biotechnology industry. The high concentration of demand drives innovation. It also provides opportunities for suppliers to differentiate themselves and meet the diverse needs of a varied customer base.

Product Insights

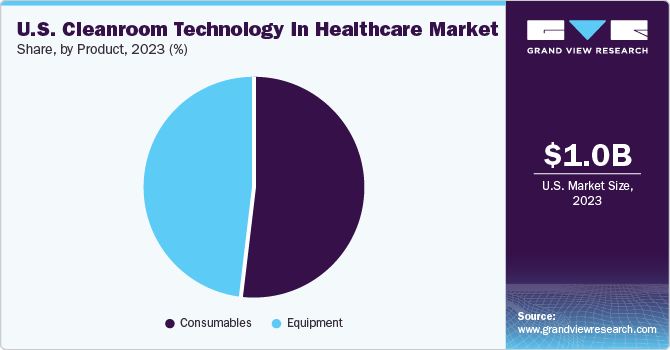

Consumables dominated the market and accounted for a revenue share of over 50% in 2023. This high percentage can be attributed to the frequent use of consumables such as gloves, wipes, disinfectants, and other cleaning products, which are sold in large volumes. Moreover, cleanroom technology necessitates the use of consumables to reduce contamination and infections, driving demand for such products. For instance, in July 2023, Berry Global Inc. launched a new range of sustainable professional wipe materials for hard surface disinfection. The range includes Spunlace, SMS, Scrubby, and Spunbound.

The equipment sector is anticipated to register the fastest CAGR from 2024 to 2030 owing to increasing regulatory compliance, research and development, demand for sterile products, and technological advancements. For instance, in October of 2023, Sensata Technologies, Inc. released a new UL-certified leak detection sensor that is capable of detecting multiple A2L refrigerant gases used in heating, ventilation, and air conditioning (HVAC) equipment.

End-use Insights

Pharmaceutical industry accounted for the largest revenue share in 2023. This is attributed to increasing stringent regulations, advancements in pharmaceutical research and development. Furthermore, technological advancements in cleanroom equipment, such as modular cleanrooms, isolators, and automated monitoring systems have made it easier for pharmaceutical companies to maintain controlled environments efficiently. These innovations have driven the industry's demand for modern cleanroom equipment. For instance, in August 2023, Alpha Teknova, Inc. opened a new modular manufacturing facility in Hollister, California, to produce high-quality life sciences reagents. It has ISO-certified cleanrooms that comply with GMP standards, resulting in a three-fold increase in manufacturing capacity.

The biotechnology industry is expected to register the fastest CAGR from 2024 to 2030 owing to rising focus on contamination control, process efficiency, increasing R&D activities, and technological advancements. Moreover, the biotechnology industry is highly regulated, with stringent guidelines from regulatory bodies such as the Food and Drug Administration (FDA) and Environmental Protection Agency (EPA). Cleanrooms are essential for compliance with Good Manufacturing Practices (GMP) and other regulatory requirements to ensure that biotechnological products meet quality standards and are safe for use.

Key U.S. Cleanroom Technology In Healthcare Company Insights

Some key companies operating in the market include Terra Universal; Clean Air Technology, Inc., Kimberly-Clark Corporation; DuPont; Berkshire Corporation; Texwipe, and ICLEAN Technologies.

-

Terra Universal, Inc. has 40 years of experience designing and fabricating critical environment applications for cleanroom-related industries. The company offers a wide range of products, including air filtration systems, lighting, and cleanroom furniture. Its portfolio also includes Stick-Built Cleanrooms, Hardwall Cleanrooms, Softwall Cleanrooms, BioSafe Cleanrooms, Compounding Cleanrooms, and USP Compounding Cleanrooms.

-

Clean Air Technology, Inc. designs, manufactures, and builds modular, portable cleanrooms. It provides cleanroom solutions for healthcare applications, including pharmaceutical manufacturing, medical device production, and laboratory research. Its portfolio includes Modular Hardwall Cleanrooms, Modular Softwall Cleanrooms, HAVC, and Blower/Flow systems.

-

Berkshire Corporation provides contamination control products and cleanroom supplies globally for critical and controlled environments. Its portfolio includes cleanroom apparel, mats, mops, paper, swabs, wipes, and disinfectants.

-

Texwipe specializes in cleanroom consumables and contamination control products for the healthcare sector. Its product line includes wipes, swabs, and mops that are crucial for ensuring cleanliness and sterility in healthcare cleanrooms.

Key U.S. Cleanroom Technology In Healthcare Companies:

- Terra Universal. Inc.

- Clean Air Technology, Inc.

- Kimberley-Clark Corporation

- DuPont

- Labconco

- Clean Room Depot

- ICLEAN Technologies

- Abtech

- Berkshire Corporation

- Texwipe

- Micronova Manufacturing

Recent Developments

-

In January 2024, Ahlstrom, a company focusing on sustainable specialty materials, invested in a new production line for molecular filtration media to expand its product offerings, specifically for HVAC, cleanrooms, and indoor air quality.

-

In October 2023, Aircuity launched a new adaptive airflow for cleanrooms with ISO Class 7 and 8, which enables carbon reduction and energy savings while offering precise control over indoor air quality (IAQ).

-

In March 2023, Germfree announced the launch of its new bioGO cGMP Mobile Cleanroom. The innovative bioprocessing platform was created to address the logistical challenges faced by the cell and gene therapy industry.

U.S. Cleanroom Equipment In Healthcare Market Report Scope

Report Attribute

Details

Revenue forecast in 2024

USD 1.06 billion

Revenue forecast in 2030

USD 1.34 billion

Growth rate

CAGR of 3.97% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Key companies profiled

Terra Universal. Inc.; Clean Air Technology, Inc.; Kimberley-Clark Corporation; DuPont; Labconco; Clean Room Depot; ICLEAN Technologies; Abtech; Berkshire Corporation; Texwipe; Micronova Manufacturing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cleanroom Technology In Healthcare Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cleanroom technology in healthcare market report based on product and end-use.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Equipment

-

Heating Ventilation and Air Conditioning System (HVAC)

-

Cleanroom air filters

-

Air shower and diffuser

-

Laminar air flow unit

-

Others

-

-

Consumables

-

Gloves

-

Wipes

-

Disinfectants

-

Apparels

-

Cleaning Products

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical industry

-

Medical device industry

-

Biotechnology industry

-

Hospitals and diagnostic centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. cleanroom technology in healthcare market size was valued at USD 1.02 billion in 2023 and is expected to reach USD 1.06 billion in 2024.

b. The U.S. cleanroom technology in healthcare market is projected to grow at a compound annual growth rate (CAGR) of 3.97% from 2024 to 2030 to reach USD 1.34 million by 2030.

b. Consumables dominated the market and accounted for a share of over 50% in 2023. This high percentage can be attributed to the frequent use of consumables such as gloves, wipes, disinfectants, and other cleaning products sold in large volumes.

b. Some of the key companies operating in the U.S. cleanroom technology in healthcare market include Terra Universal; Clean Air Technology, Inc., Kimberly-Clark Corporation; DuPont; Berkshire Corporation; Texwipe, and ICLEAN Technologies.

b. The growth of U.S. cleanroom technology in the healthcare market can be attributed to technological advancements in cleanroom construction, the growing pharmaceutical and biotechnology industry, stringent regulatory compliance and standards, and the increasing incidence of hospital-acquired infections.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."