- Home

- »

- Homecare & Decor

- »

-

U.S. Cleaning And Hygiene Tools Market, Industry Report, 2030GVR Report cover

![U.S. Cleaning And Hygiene Tools Market Size, Share & Trends Report]()

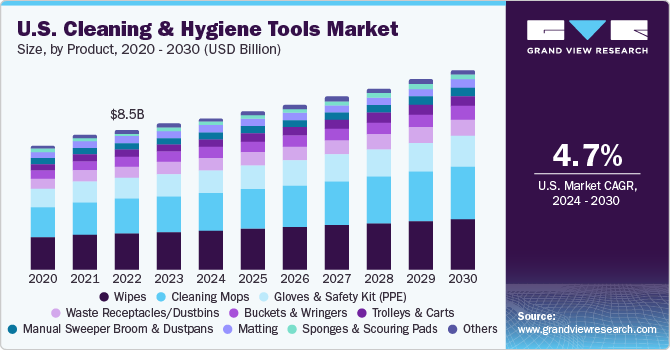

U.S. Cleaning And Hygiene Tools Market Size, Share & Trends Analysis Report By Product (Wipes, Sponges And Scouring Pads), By End-use (Healthcare, Hospitality), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-303-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Cleaning And Hygiene Tools Market Trends

The U.S. cleaning & hygiene tools market size was estimated at USD 8.81 billion in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030. The surge in large-scale leisure and hospitality building construction projects is anticipated to drive the demand for cleaning and hygiene tools in the U.S. These expansive ventures, marked by increased floor areas and diverse facilities, necessitate comprehensive cleaning and maintenance tools to ensure a pristine and welcoming environment for visitors.

The growing number of hotels, especially in the planning and construction phases, suggests a rising need for comprehensive cleaning and maintenance services. According to the quarterly United States Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of Q3 2022, Marriott International led the U.S. hotel construction pipeline with 1,385 projects, followed by Hilton Worldwide and InterContinental Hotels Group (IHG). These franchises represent 66% of total projects.

Compliance with stringent regulatory standards for healthcare and hospitality facilities serves as a key driver in the U.S. cleaning and hygiene tools market. With healthcare settings requiring rigorous sanitation protocols to prevent healthcare-associated infections and hospitality facilities emphasizing cleanliness for guest satisfaction and safety, there is a heightened demand for specialized cleaning tools and products that meet industry regulations. This drives innovation and investment in advanced cleaning technologies and solutions that are tailored to address the unique needs of these sectors, consequently driving market growth.

In response to COVID-19, the American Hotel and Lodging Association released enhanced industry-wide hotel cleaning and safety guidelines in 2021. Hospitality facilities in the U.S. need to comply with regulatory standards, such as those outlined by the Centers for Disease Control and Prevention (CDC) for cleaning and disinfection protocols in various settings in the U.S.

Strategic partnerships with cleaning service providers or facility management companies are a lucrative opportunity in this market as they can help manufacturers expand their market reach and enhance brand visibility. Manufacturers can extend partnerships with janitorial service providers in the U.S. and share enhanced training protocols to commercial settings, including general buildings, healthcare facilities, and hospitality establishments, to ensure continued sales of their products.

Market Concentration & Characteristics

Manufacturers are increasingly using biodegradable ingredients and recyclable packaging, responding to consumer demand for sustainable and green cleaning solutions. This shift helps reduce the environmental footprint of cleaning products and aligns with global sustainability goals.

The degree of innovation in the U.S. cleaning and hygiene market is high, characterized by advancements in product formulations, sustainable practices, and smart technologies. Companies are increasingly developing eco-friendly and biodegradable cleaning solutions in response to consumer demand for sustainable products. Innovations include the use of natural ingredients, enhanced disinfectant efficacy, and hypoallergenic formulations to cater to sensitive users.

Regulation significantly impacts the U.S. cleaning and hygiene market by setting stringent standards for product safety, efficacy, and environmental impact, which manufacturers must comply with to meet consumer and regulatory expectations. Agencies like the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) enforce guidelines on the use of labeling, and marketing claims, ensuring that products are safe for consumers and effective in maintaining hygiene. These regulations drive innovation as companies develop new formulations that meet regulatory requirements while being environmentally friendly and sustainable.

Hospitals, clinics, and other healthcare facilities are critical end-users, requiring stringent hygiene standards to prevent infections. This sector uses high volumes of disinfectants, sterilization products, and specialized cleaning tools designed to maintain sterile environments. Compliance with health regulations is paramount in this sector, driving demand for high-quality, certified products.

Product Insights

The wipes segment accounted for the revenue share of 26.2% in 2023. The demand for cleaning and hygiene wipes in the U.S. is driven by heightened awareness of personal and public health, particularly following the COVID-19 pandemic, which underscored the importance of regular disinfection to prevent disease spread. Consumers prioritize convenience and effectiveness, leading to the widespread use of wipes for various purposes, including surface cleaning, personal hygiene, and on-the-go sanitation. This trend is further bolstered by busy lifestyles that favor quick and efficient cleaning solutions. Additionally, marketing efforts emphasizing the safety, antimicrobial properties, and environmental friendliness of newer wipes contribute to their growing popularity. The increased focus on hygiene in workplaces, schools, and public spaces also plays a significant role in driving demand.

The cleaning mops is expected to grow at the fastest CAGR from 2024 to 2030. The demand for cleaning mops in the U.S. is driven by a combination of increasing awareness of household cleanliness, the convenience offered by innovative mop designs, and the growing trend of maintaining hygienic living spaces due to health concerns. Enhanced mop technologies, such as microfiber materials, spray mops, and self-wringing mechanisms, have made mopping more efficient and user-friendly, appealing to busy households seeking quick and effective cleaning solutions. The surge in home renovation and DIY cleaning projects, partly spurred by more people spending time at home, also contributes to this demand.

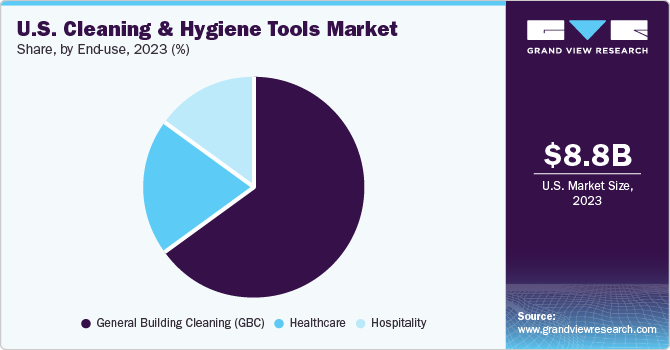

End-use Insights

General building cleaning end-use segment accounted for a market share of 69.4% in 2023. Businesses, schools, healthcare facilities, and public spaces are increasingly prioritizing regular and thorough cleaning protocols to ensure the well-being of occupants and comply with regulatory guidelines. The ongoing emphasis on creating a safe and hygienic workplace to boost employee confidence and productivity also plays a crucial role. Additionally, advancements in cleaning technology and the development of more effective, sustainable cleaning products contribute to the growing demand, as organizations seek to enhance cleaning efficiency and environmental responsibility.

The hospitality segment is projected to grow at the fastest CAGR from 2024 to 2030. Ensuring a sterile environment is crucial to preventing healthcare-associated infections (HAIs), which drive the need for advanced cleaning technologies and tools. The COVID-19 pandemic has further underscored the importance of rigorous cleaning protocols, leading to increased investments in high-quality disinfectants and sanitation equipment. Additionally, regulatory requirements and standards in the healthcare sector mandate regular and thorough cleaning, necessitating specialized tools designed to meet these stringent guidelines.

Key U.S. Cleaning And Hygiene Tools Company Insights

The market is highly competitive with the presence of both large and small-scale manufacturers. Prominent players have been adopting strategies, such as mergers & acquisitions, partnerships, product launches, innovation, and promotions, to stay competitive in the market.

Key U.S. Cleaning And Hygiene Tools Companies:

- 3M Company

- Newell Brands Inc. (Rubbermaid Commercial Products)

- The Clorox Company

- Diversey Holdings, Inc.

- Ecolab Inc.

- W. W. Grainger, Inc.

- Unger Global

- Remco Products

- The Libman Company

- Carolina Mop

Recent Developments

-

In February 2024, W. W. Grainger, Inc., a prominent distributor of maintenance, repair, and operating (MRO) products catering to businesses and institutions, announced its plan to establish a 1.2 million-square-foot distribution center (DC) in Hockley, Texas, by 2026. Named the "Houston Texas Distribution Center," this new facility aims to enhance Grainger's capacity for delivering next-day orders to its customers.

-

In January 2024, The Libman Company, known for its household and commercial cleaning product manufacturing in the U.S., broadened its range with a new line of cleaning tools designed to expedite the cleanup of spills and messes. Libman's innovative Rinse 'N Wring Mop System can be used for wet or dry cleaning and is tailored to clean spills and messes on a variety of surfaces, including wood, laminate, ceramic tile, vinyl, and linoleum.

U.S. Cleaning And Hygiene Tools Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.17 billion

Revenue forecast in 2030

USD 12.06 billion

Growth rate (Revenue)

CAGR of 4.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment covered

Product, end-use

Country scope

U.S.

Key companies profiled

3M Company; Newell Brands Inc. (Rubbermaid Commercial Products); The Clorox Company; Diversey Holdings, Inc.; Ecolab Inc.; W. W. Grainger, Inc.; Unger Global; Remco Products; The Libman Company; Carolina Mop

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cleaning And Hygiene Tools Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cleaning and hygiene tools market report based on product and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wipes

-

Disposable Wipes

-

Reusable Wipes

-

-

Sponges and Scouring Pads

-

Trolleys and Carts

-

Cleaning Mops

-

Reusable

-

Disposable

-

-

Buckets and Wringers

-

Manual Sweeper Broom and Dustpans

-

Gloves & Safety Kit (PPE)

-

Matting

-

Waste Receptacles/Dustbins

-

Others (Duster, Squeegees, etc.)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Hospitality

-

General Building Cleaning (GBC)

-

Frequently Asked Questions About This Report

b. The U.S. cleaning and hygiene tools market was estimated at USD 8.81 billion in 2023 and is expected to reach USD 9.17 billion in 2024.

b. The U.S. cleaning and hygiene tools market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 12.06 billion by 2030.

b. The general building cleaning end-use segment had a market share of 65% in 2023. Businesses, schools, healthcare facilities, and public spaces are increasingly prioritizing regular and thorough cleaning protocols to ensure the well-being of occupants and comply with regulatory guidelines, likely favoring the segment's growth.

b. Some of the key players operating in the U.S. cleaning and hygiene tools market include 3M Company; Newell Brands Inc. (Rubbermaid Commercial Products); The Clorox Company; Diversey Holdings, Inc.; Ecolab Inc.; W. W. Grainger, Inc.; Unger Global; Remco Products; The Libman Company; and Carolina Mop.

b. Key factors that are driving the U.S. cleaning and hygiene tools market growth include the growing urbanization, increased awareness about hygiene, and The heightened focus on cleanliness and hygiene, particularly post-pandemic, is a significant driver for market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."