- Home

- »

- Organic Chemicals

- »

-

U.S. Chromatography Resin Market Size, Report, 2030GVR Report cover

![U.S. Chromatography Resin Market Size, Share & Trends Report]()

U.S. Chromatography Resin Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Technique (Ion Exchange, Affinity), By End-use (Food & Beverage, Pharmaceutical & Biotechnology), And Segment Forecasts

- Report ID: GVR-4-68040-330-0

- Number of Report Pages: 79

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Chromatography Resin Market Trends

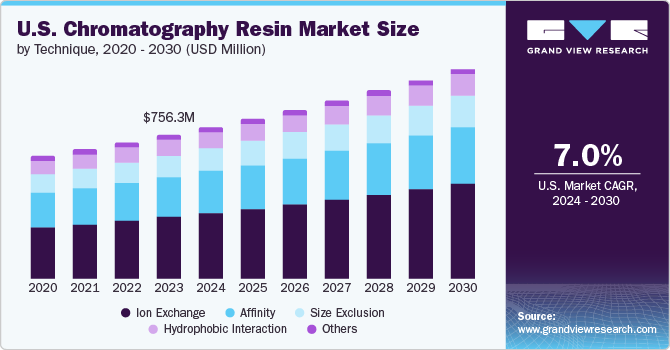

The U.S. chromatography resin market size was estimated at USD 756.3 million in 2023 and is anticipated to grow at a CAGR of 7.0% from 2024 to 2030. The increasing need for chromatography techniques across various sectors such as healthcare, chemicals, food & beverages is fueling market growth. The industry's substantial investments in research and development have led to the creation of numerous products, resulting in enhanced productivity compared to traditional products.

Chromatography resin, also referred to as media, is the substance used to capture and refine mAbs, antibody fragments, vaccines, and other biomolecules during chromatography separations. In the process of using chromatography resin, the media is packed and retained in a column during the stationary phase.

The U.S., being the headquarters of several international pharmaceutical firms like GE HealthCare and Thermo Fisher, is adapting to pricing structure changes by relocating production from the U.S. to other regions. Moreover, the country presents an excellent market for chromatography resin due to its advanced pharmaceutical industry and growing application in end-use industries, coupled with the availability of a highly skilled workforce and increasing R&D efforts to promote innovative product application.

The U.S. is anticipated to continue being a significant consumer in the industry as it is the base of most of the pharmaceutical companies. This region has experienced robust growth owing to the government's concentrated spending on research and development. The increase in disposable income has also led to a rise in expenditure on essential and preventive healthcare services, thereby enhancing product usage.

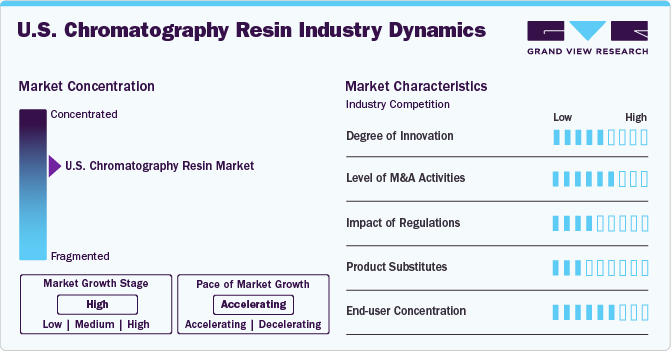

Market Concentration & Characteristics

The U.S. market for chromatography resins is characterized by a moderate degree of innovation. While research and development in chromatography technologies are ongoing, groundbreaking, or disruptive innovations are relatively rare compared to other sectors. Nonetheless, gradual enhancements and progress in resin formulations and chromatography methods do take place, contributing to a moderate level of innovation.

The market witnesses a high frequency of merger and acquisition activities. Firms in the market regularly participate in mergers and acquisitions, as well as strategic alliances, to broaden their product range, penetrate new markets, and improve their competitive standing. Consolidation is a common occurrence as companies aim to fortify their position in the intensely competitive market. For example, in November 2022, an Ecolab company “Purolite”, and a top manufacturer of agarose and synthetic-based resins utilized in the bioprocessing sector, broadened, and extended its contract with Repligen Corporation, a life sciences company, until 2032 to supply five ligands.

There is a low availability of service substitutes for chromatography resins, which are crucial components used in various sectors including biotechnology, pharmaceuticals, research labs, and food & beverages among others, have few alternatives. While there might be other separation techniques or technologies, chromatography resins continue to be the preferred option for many applications due to their efficiency and specificity.

The market tends to have a high rate of product expansion as companies continually invest in research and development to broaden their product range, enhance the quality and performance of resins, and meet the changing needs of the customers. The launch of new products, including new resin formulations and specialized chromatography media, is a common strategy to drive market growth.

Type Insights

The natural type dominated the market with a revenue share of 52.7% in 2023. The growth is attributed to its widespread application in size exclusion chromatography and paper chromatography across various industries. The growth of the pharmaceutical and biomedical sectors, spurred by increased healthcare spending and rising demand from the food and beverage industry, are primary factors propelling the natural resin market. The allocation of government funds towards the research and development of more efficient chromatography resin is expected to further stimulate the demand for natural resin in diverse applications and end-uses.

The synthetic segment also captured a substantial market share in 2023. This growth can be attributed to its extensive substitution of natural resin to enhance production levels. The industry is anticipated to transform with the recent advancements in synthetic resin manufacturing, which are predicted to significantly increase the market share of the synthetic resin segment in the forthcoming years.

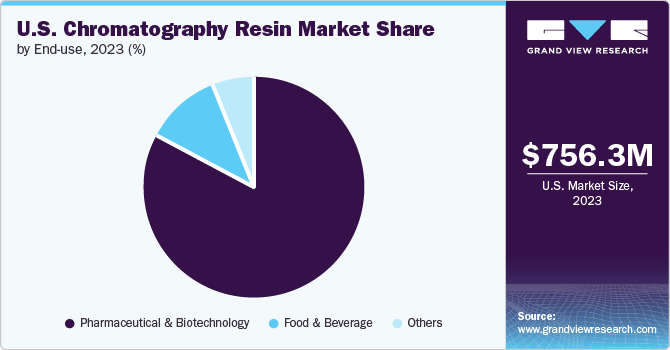

End-use Insights

The pharmaceutical & biotechnology end-use dominated the market with a revenue share of 83.0% in 2023. This growth is due to the extensive use of resin in pharmaceutical procedures for the production of highly pure materials in bulk and for the inspection of these purified substances for impurities. Additionally, the increasing application of monoclonal antibodies in key therapeutic areas such as tuberculosis, cancer, and autoimmune disorders is expected to boost the demand for chromatography resin.

The food and beverage sector also experienced considerable growth in 2023. This growth is attributed to the growing public consciousness about food product quality and safety, which is prompting food producers to strictly adhere to the guidelines set by food regulatory bodies. Furthermore, the tightening of regulations by these authorities is expected to propel the market growth of the food and beverage end-use segment.

Techniques Insights

The Ion exchange technique dominated the market with a revenue share of 42.8% in 2023. The growth in Contract Research Organizations (CRO) and Contract Manufacturing Organizations (CMO) is projected to stimulate the chromatography resin market, particularly the demand for ion exchange chromatography resin. In addition, the rising use of monoclonal antibodies is a key factor driving market expansion.

The affinity segment also held a considerable market share in 2023. This growth is attributed to the high demand for processes involving protein and nucleic acid purification. The biotechnology industry's demand for chromatography resin is primarily met by affinity resin. The increasing use of monoclonal antibodies in treatments is anticipated to fuel the affinity resin market.

Moreover, the size exclusion segment saw significant market growth due to its increasing application in biochemical processes and polymer synthesis. Size exclusion chromatography (SEC) resin, used in the pharmaceutical industry for the purification and analysis of biological and synthetic polymers like polysaccharides and nucleic acids, contributed to this growth.

Key U.S. Chromatography Resin Company Insights

Major companies such as W. R. Grace & Co., THERMO FISHER SCIENTIFIC INC., and Agilent Technologies are implementing a variety of growth organic as well as inorganic strategies including expanding their capacity, engaging in mergers and acquisitions, and forming joint ventures, all to preserve and increase their market dominance.

Key players in the market include Bio-Rad Laboratories, Inc.; GE Healthcare; and Danaher Corporation.

-

Bio-Rad Laboratories, Inc. is a provider of a variety of products for sectors such as healthcare, life science, and analytical chemistry. The company also develops systems for the separation, analysis, and purification of multifaceted biological and chemical materials. Its operations are split into two divisions: life science and chemical diagnostics.

-

GE Healthcare, a division of the American multinational conglomerate General Electric, specializes in the life science sector. It manufactures and supplies medical diagnostic equipment and patient monitoring systems. Additionally, the company offers tools and expertise for various applications, including disease research, drug discovery, cell & protein research, and biopharmaceutical manufacturing.

Purolite Corporation; Pall Corporation and PerkinElmer Inc. are the other participants operating in the U.S. chromatography resins market

-

Pall Corporation offers innovative solutions designed to address the critical needs of various industries, including food and beverage, power generation and utilities, oil and gas, industrial manufacturing, and others. The company's operations are divided into two main groups: Life Sciences and Industrial.

Key U.S. Chromatography Resin Companies:

- Bio-Rad Laboratories, Inc.

- GE Healthcare

- W. R. Grace & Co.

- Danaher Corporation

- THERMO FISHER SCIENTIFIC INC.

- Purolite Corporation

- PerkinElmer Inc.

- Agilent Technologies

- Pall Corporation

Recent developments

-

In February 2024, Purolite, together with Repligen Corporation, a NASDAQ-listed company specializing in bioprocessing technology, unveiled Praesto CH1. This is a novel 70μm agarose-based affinity resin engineered to purify unique mAbs like bispecifics and recombinant antibody fragments. This cutting-edge solution, commercialized by Purolite under a long-term strategic alliance with Repligen, merges Purolite's proprietary Jetted beads manufacturing technique with Repligen's superior ligand technology to tackle unaddressed issues in specialized mAb purification.

-

In February 2024, Thermo Fisher Scientific Inc. introduced the Thermo Scientific Dionex Inuvion Ion Chromatography (IC) system to facilitate a broader spectrum of ion chromatography analysis with a single device. This new analytical tool is designed for easy reconfiguration, offering a comprehensive solution for consistent and reliable ion analysis for those who need to determine ionic and small polar compounds. The Dionex Inuvion system caters to labs' efficiency needs with easily adjustable workflows and a compact design.

-

In December 2023, PerkinElmer, a global leader in analytical services and solutions, announced its acquisition of Covaris, a prominent solution developer for life science innovations. This merger is set to boost Covaris' growth prospects and broaden PerkinElmer's existing life sciences portfolio into the rapidly expanding diagnostics market. New Mountain Capital predominantly owns both companies, but the transaction terms were not revealed.

U.S. Chromatography Resin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 810.4 million

Revenue forecast in 2030

USD 1,215.0 million

Growth rate

CAGR of 7.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand liters, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, technique

Key companies profiled

Bio-Rad Laboratories, Inc.; GE Healthcare; W. R. Grace & Co.; Danaher Corporation; THERMO FISHER SCIENTIFIC INC.; Purolite Corporation; PerkinElmer Inc.; Agilent Technologies; Pall Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Chromatography Resin Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. chromatography resins market report based on type, end-use, and technique:

-

Type Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

Inorganic Media

-

-

End-use Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology

-

Food & Beverage

-

Others

-

-

Technique Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

Ion Exchange

-

Affinity

-

Hydrophobic Interaction

-

Size Exclusion

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. chromatography resin market size was estimated at USD 756.3 million in 2023 and is expected to reach USD 810.4 million in 2024.

b. The U.S. chromatography resin market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 1,215.0 million by 2030.

b. Natural type dominated the U.S. chromatography resin market with a share of 52.7% in 2023. This is attributable to its widespread application in size exclusion chromatography and paper chromatography across various industries. The growth of the pharmaceutical and biomedical sectors, spurred by increased healthcare spending and rising demand from the food and beverage industry, are primary factors propelling the natural resin market.

b. Some key players operating in the U.S. chromatography resin market include Bio-Rad Laboratories, Inc.; GE Healthcare; W. R. Grace & Co.; Danaher Corporation; THERMO FISHER SCIENTIFIC INC.; Purolite Corporation; PerkinElmer Inc.; Agilent Technologies; and Pall Corporation.

b. Key factors that are driving the market growth include the increasing need for chromatography techniques across various sectors such as healthcare, chemicals, food & beverages. The industry's substantial investments in research and development have led to the creation of numerous products, resulting in enhanced productivity compared to traditional products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.