- Home

- »

- Automotive & Transportation

- »

-

U.S. Charging As A Service Market, Industry Report, 2030GVR Report cover

![U.S. Charging As A Service Market Size, Share & Trends Report]()

U.S. Charging As A Service Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Subscription, Hosted), By Charging Station (AC Charging, DC Charging), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-275-7

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Charging As A Service Market Trends

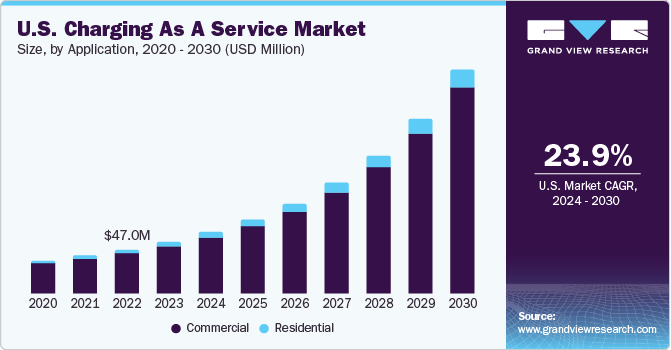

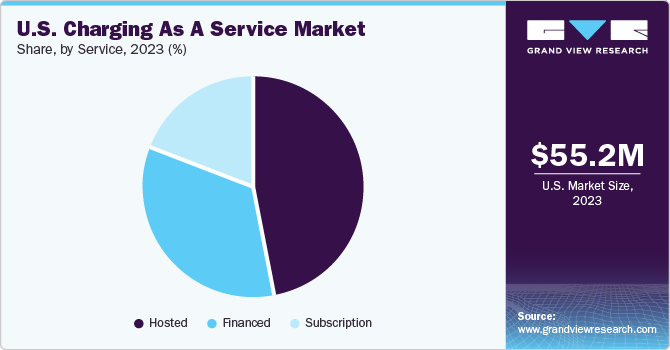

The U.S. charging as a service market size was valued at USD 55.2 million in 2023 and is anticipated to grow at a CAGR of 23.9% from 2024 to 2030. The rapidly growing adoption of electric vehicles in the United States has created significant need for efficient and intelligent charging solutions. However, there has been a simultaneously rising demand for making EV charging accessible and reliable for vehicle owners, which has led to the expansion of the charging-as-a-service (CaaS) segment. CaaS addresses the challenges involved in the setup and maintenance of EV charging infrastructure by providing EV drivers and charging station owners with subscription-based programs. With the U.S. government encouraging citizens to shift toward electric mobility, advancements in the charging-as-a-service model are expected to accelerate this push and help create a more sustainable transportation system.

The U.S. accounted for a revenue share of 19.38% in the global charging as a service market in 2023. According to estimates from Kelly Blue Book, a Cox Automotive company, 1.2 million new EVs were sold in the country in 2023, with the share of these vehicles climbing to 7.6%, growing from a 5.9% share in 2022. Another study from Wards Intelligence, published by the U.S. Energy Information Administration, stated that the total sales from battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid vehicles accounted for 16.3% of the overall sales of new light-duty vehicles. These numbers highlight a healthy demand for EVs from consumers, consequently driving the need for supportive charging infrastructure and services. As consumers increasingly embrace EVs, convenient and accessible charging solutions become paramount, thereby leading to the emergence of innovative charging-as-a-service models, whereby service providers offer charging solutions to address evolving needs of EV owners.

Well-developed charging networks help address range anxiety, which is a primary concern of prospective EV buyers in the country. As such, the rollout of convenient and easily accessible charging options across urban centers and highways becomes vital to encourage EV adoption. Stakeholders in the EV ecosystem have realized that the current disparity in charging station availability is contributing to longer wait times at charging stations, causing inconveniences to EV users. As per the Department of Energy’s Alternative Fuels Data Center, while California has the highest number of public charging stations (>40,000), states such as Alaska and Wyoming have fewer than 100 stations. Thus, the absence of a standardized charging infrastructure can potentially restrain the adoption of EVs. Charging-as-a-service can play a prominent role in this regard by bridging the gap between the growing number of EVs and relatively slower rollout of charging points.

Notable advances in EV charging management software platforms are opening up significant growth opportunities for the charging-as-a-service market in the country. These developments are particularly allowing market players to introduce innovative service models, optimize charging station operations, offer real-time monitoring, facilitate predictive maintenance and seamless billing, and subsequently enhance efficiency and user experience. Smart algorithms facilitate load balancing, ensuring optimal energy distribution and reducing grid strain. Similarly, user-friendly interfaces and remote accessibility can simplify customer interactions and foster widespread adoption. Companies such as EV Connect and Eaton have introduced advanced offerings that aim to mitigate issues concerning operational control, accessibility, and monetization in charging operations, creating strong growth potential for the market.

Market Concentration & Characteristics

The market growth stage is high, and pace of market growth is accelerating. As the EV charging industry is witnessing healthy growth, there are several innovative solutions launched by both established and emerging companies in recent years. For instance, the presence of fast and ultra-fast charging solutions to address range anxiety is expected to be increasingly adopted by service providers to boost their customer reach. Moreover, the development of charging technologies such as smart EV charging, plug & charge system, wireless charging, and vehicle-to-grid (V2G) technology is also expected to provide opportunities for companies to expand their offerings and generate higher revenues. The Open Charging Point Protocol (OCPP) 2.0.1, which supports features such as improved data collection, enhanced security, and more efficient charging network management, is further expected to create growth avenues.

Collaborations and partnerships play an important role in the industry expansion, as automakers aim to expand their footprint in the U.S. by teaming up with CaaS providers. For instance, ChargePoint Holdings, Inc., along with Mercedes-Benz and MN8 Energy, a provider of renewable energy and stationary power, announced plans to expand access to Direct Current (DC) fast charging. This would be achieved by constructing more than 400 charging stations across Canada and the U.S., using the ChargePoint network. Similar initiatives by other companies such as Enel X Way, WattLogic, and Blink Charging are aiding the expansion of charging-as-a-service solutions in the country.

The U.S. Department of Transportation’s Federal Highway Administration (FHWA) NEVI (National Electric Vehicle Infrastructure) Formula Program plays a significant role in the accelerated rollout of EV charging infrastructure by allocating funds to states. This helps in ensuring a wider launch for charging stations, while guidelines for providing contactless payment options and features to enhance vehicle owner convenience are helping to shape the country’s CaaS market. In February 2023, the Biden-Harris Administration allocated USD 7.5 billion in EV charging programs to support climate crisis-specific objectives, which is expected to encourage further improvements in charging-as-a-service models.

The adoption of home charging stations and emergence of battery swapping technology is expected to challenge the growth of the CaaS industry in the U.S. Ample is a leading company involved with developing the battery swapping technology in the country. However, the long-term benefits of CaaS in addressing concerns regarding high maintenance and installation costs are expected to gradually reduce the threat of alternatives, marking the risk of substitutes as moderate.

The charging-as-a-service market not only supports the growth of the electric vehicle industry but also contributes to a more sustainable and accessible future. The end-use applications in the commercial and residential sectors are pivotal entities directly benefiting from charging-as-a-service offerings. Commercial sectors, including hospitality, parking garages, and office buildings, can leverage CaaS to cater to employee/customer EV charging needs, thus promoting sustainability and potentially attracting environmentally conscious customers. In the residential end use, charging-as-a-service offers homeowners a better EV charging experience owing to the lack of hassles regarding installation or maintenance. Thus, there is an extensive adoption potential of this solution among end-users.

Charging Station Insights

The AC charging segment accounted for a larger revenue share of 53.62% in the U.S. charging as a service market in 2023. AC charging stations offer an economical and convenient solution for EV owners. Compared to DC charging stations, their AC counterparts are easier to install and maintain due to lower equipment costs and wide-scale availability of the underlying technology. The steady growth in sales of residential EV chargers and increasing establishment of public charging stations in the country have created a healthy demand for AC charging stations. As businesses integrate smart technologies into AC charging solutions, factors such as remote monitoring, billing efficiency, and user-friendly interfaces become pivotal for driving customer satisfaction. There are a variety of business models in this segment, such as subscription-based services, pay-per-use, and collaborations with property owners, driving market growth.

On the other hand, the DC charging segment is projected to advance at the fastest CAGR through 2030. The growth of the Direct Current (DC) charging segment can be attributed to the increasing demand for rapid charging solutions for EVs in the United States. DC charging stations, characterized by higher charging speeds as compared to AC charging stations, are pivotal in addressing range anxiety concerns of EV owners, making them indispensable for long-distance travel. Understanding the rising demand for faster vehicle charging that can be easily addressed by DC chargers, companies are introducing novel services to address consumer requirements. For instance, in March 2023, SparkCharge announced the countrywide availability of its SparkCharge Fleet CaaS option for businesses to have immediate access to charging networks. Such developments are expected to drive segment expansion in the coming years.

Application Insights

Based on application, the commercial segment dominated the U.S. market for charging as a service in 2023. This can be attributed to the increasing corporate adoption of sustainable practices and the expanding fleet of electric vehicles. Businesses across various sectors, including retail, hospitality, and corporate, are strategically investing in EV charging infrastructure to cater to employee and customer needs. A survey conducted by Deloitte in 2022 found that 40% of respondents rejected a job because it did not address their climate concerns. Moreover, younger workers content with the environmental impact of their employers were more likely to remain in the organization for over 5 years. Thus, the availability of on-premise EV charging has become an effective retention and recruitment tool for companies. As the commercial EV charging market matures, service providers are innovating to offer scalable solutions, along with integrating smart technologies for efficient management and user-friendly experiences.

The residential segment is poised to witness a substantial growth rate during the forecast period. The convenience and reliability offered by residential charging solutions have led to a steadily growing demand for affordable and efficient EV charging services. Service providers are focusing on offering user-friendly and aesthetically pleasing charging solutions, usually integrated into smart home systems. The increasing development of residential properties in the U.S. has created opportunities for collaborations between real estate developers and energy companies, offering potential for market advancement. In August 2023, Duke Energy launched an EV charging subscription service, in association with General Motors, Ford Motor Company, and BMW, for residential customers in North Carolina. The pilot program involved participants choosing their desired time to reach a particular charging state, and automakers optimizing their charging schedule to meet their demands while avoiding charging attempts during peak grid hours. Similar initiatives and collaborations are expected to boost demand for CaaS in the country.

Service Insights

In terms of service, the hosted segment held the largest revenue share in the market in 2023. The hosted business model involves third-party providers that install and operate EV charging stations at locations owned by other entities. This allows owners of shopping centers, parking facilities, or businesses to offer EV charging services without directly installing charging stations on their premises. The provision of this CaaS model offers various benefits to the site host, such as retaining or attracting EV-driving customers or employees, as well as providing an added revenue stream. Hosted charging stations are strategically placed in high-traffic areas to maximize accessibility for EV users. By employing a hosted model, providers can benefit from leveraging existing infrastructure, gaining visibility in key locations, and contributing to the demand for EV charging systems.

On the other hand, the subscription segment is expected to advance at the highest CAGR during the projection period. Subscription-based charging-as-a-service offers customers the convenience of charging on a monthly or yearly payment basis. It helps customers by eliminating the upfront cost of buying a charging station and the need for installing charging stations at their premises. The increasing collaboration between market players and investors to provide subscription-based services is anticipated to fuel segment growth during the projection period. Several emerging companies have also entered the subscription-based service space in recent years. For instance, in October 2022, EVCS, a California-based provider of fast-charging networks, added new tiers to its EV subscription charging plan that removed hidden fees and lowered the total cost of ownership for gig drivers and high-mileage commuters, ensuring effective management of charging budget.

Key U.S. Charging As A Service Company Insights

The U.S. market for charging as a service has witnessed a strong growth in recent years, with several companies establishing their dominance through the integration of advanced charging technologies. New companies are also emerging at a rapid pace, aiming to offer innovative solutions and services to EV owners. The intensifying competition has led to the adoption of strategies such as partnerships and expansions to address the rising demand. Companies are aiming to introduce advancements that can improve the reliability, accessibility, and cost-effectiveness of the charging process, leading to enhanced consumer convenience and experience.

Key U.S. Charging As A Service Companies:

- ChargePoint Holdings, Inc.

- Shell Recharge Solutions

- EV Connect

- EV Safe Charge Inc.

- Blink Charging Co.

- Lightning eMotors

- Electrify America

- EVgo

- WattLogic, LLC

- bp pulse

Recent Developments

-

In October 2023, bp pulse announced a USD 100 million deal to purchase ultra-fast charging hardware units from Tesla Inc. Through this investment, bp pulse aims to fuel the development of its public network throughout the United States, while also facilitating the expansion of charging support for electric vehicle fleet customers through the deployment of chargers at their private depots

-

In October 2023, Blink Charging Co. announced that it had been awarded a contract to serve as the official electric vehicle (EV) charging provider for the City of Miami Beach in Florida. This agreement has helped in establishing a foundation for Blink Charging Co. and the City of Miami Beach to implement electrification initiatives for city fleets and offer charging solutions for employees, residents, and visitors

-

In September 2023, WattLogic and Würth Industrial US, an inventory management service provider, entered into a partnership to complete an innovative project featuring cutting-edge EV charging stations. Under this partnership, six EV charging stations were strategically deployed to address the growing demand from EV drivers, in line with Würth Industrial’s sustainability objectives for the country

-

In August 2023, EV Connect introduced the EV Connect Service Platform, which has been strategically designed to cater to the growing number of companies venturing into or expanding their presence in the EV charging market. The platform offers versatile monetization options, allowing companies to build, scale, and manage their EV charging operations efficiently

U.S. Charging As A Service Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 236.7 million

Growth rate

CAGR of 23.9% from 2024 to 2030

Historical data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, charging station, application

Key companies profiled

ChargePoint Holdings, Inc.; Shell Recharge Solutions; EV Connect; EV Safe Charge Inc.; Blink Charging Co.; Lightning eMotors; Electrify America; EVgo; WattLogic, LLC; bp pulse

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Charging As A Service Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. charging as a service market report based on service, charging station, and application:

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Subscription

-

Hosted

-

Financed

-

-

Charging Station Outlook (Revenue, USD Million, 2017 - 2030)

-

AC Charging

-

DC Charging

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Hospitality

-

Parking Garage

-

-

Frequently Asked Questions About This Report

b. The U.S. charging as a service market size was estimated at USD 55.2 million in 2023 and is expected to reach USD 65.4 million in 2024.

b. The U.S. charging as a service market is expected to grow at a compound annual growth rate of 23.9% from 2024 to 2030 to reach USD 236.7 million by 2030.

b. The AC charging segment dominated the U.S. charging as a service market with a share of 53.60% in 2023. AC charging stations offer an economical and convenient solution for EV owners. Compared to DC charging stations, their AC counterparts are easier to install and maintain due to lower equipment costs and wide-scale availability of the underlying technology.

b. Some key players operating in the U.S. charging as a service market include ChargePoint Holdings, Inc.; Shell Recharge Solutions; EV Connect; EV Safe Charge Inc.; Blink Charging Co.; Lightning eMotors; Electrify America; EVgo; WattLogic, LLC; bp pulse.

b. Key factors that are driving the market growth include growing demand and sales of EVs in the U.S. and increasing requirement of public charging infrastructure at lower costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.