U.S. Cell Separation Market Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Cell Type (Human Cells, Animal Cells), By Technique (Centrifugation, Filtration), By Application (Cancer Research), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-248-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Cell Separation Market Size & Trends

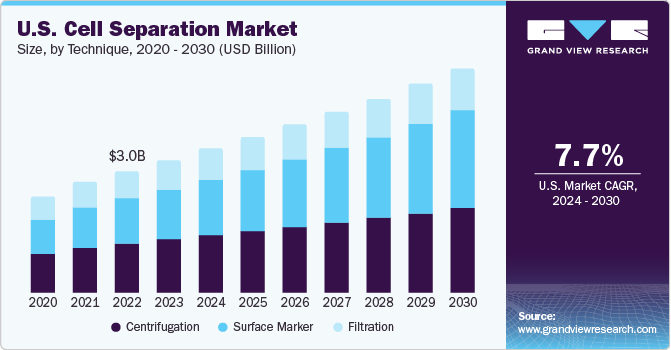

The U.S. cell separation market size was estimated at USD 3.30 billion in 2023 and is expected to grow CAGR of 7.7% from 2024 to 2030. Cell separation plays a crucial role in different applications such as in-vitro diagnostics, biologics designing and development, therapeutic protein production, and other research applications.

Increasing prevalence of chronic diseases, such as cancer, and extensive R&D activities by key companies to develop novel cell & gene therapies are expected to fuel the demand for cell separation solutions. As per the American Cancer Society’s estimates, in 2021, around 1.9 million new cases of cancer were estimated to be diagnosed in the U.S., with over 608,570 cancer-related deaths. Biologics is recognized as the fourth major method to treat cancer efficiently. Furthermore, biologics play a key role in the development of precision medicines. The U.S. has seen significant growth in biologics in recent years. It has exported 6,355 patents to China, 11,742 to Japan, and 72 to Germany over the past three decades. As a result, around 15 new biologics were approved by the U.S. FDA in 2022, including cancer therapeutics such as Kimmtrak, Opdualag, and Imjudo.

In 2023, the U.S. cell separation market accounted for over 36% of the global cell separation market. The presence of major companies such as Thermo Fisher Scientific, BD, & Danaher in the country and their strategic initiatives are anticipated to fuel the market growth. For instance, in February 2021, Thermo Fisher Scientific acquired cell sorting assets from Propel Labs. As per the deal, the company added a new Bigfoot Spectral Cell Sorter of Propel Labs to its capabilities.

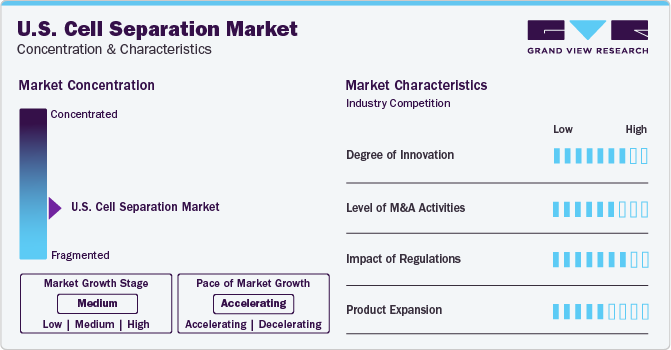

Market Concentration & Characteristics

Growing focus on biomolecule research, cell-based research, cancer research, and tissue regeneration for the treatment of severe chronic diseases, such as cancer, anemia, diabetes, & multiple sclerosis, is a major factor contributing to market growth.

An increasing number of people are opting for personalized medicine owing to growing awareness. Furthermore, emerging research areas in genomics, such as somatic mosaicism research are stimulating new developments in personalized medicine. These application areas are largely focused on single-cell technologies and offer promising growth potential for cell-based technologies in the near future. The rising adoption of next-generation sequencing for genetic mapping of patients by medical practitioners is also opportunistic for the industry growth.

This industry is characterized by a significant level of M&A and collaboration activities undertaken by key manufacturers. Numerous companies are collaborating with other relevant companies to strengthen their portfolio and expand their reach. For instance, in November 2022, Applied Cells, Inc. and GenScript USA Incorporated formed a collaborative partnership to provide integrated cell isolation solutions to assist with cell therapy drug development. GenScript would create and supply its patented research & cGMP grade CytoSinct reagents that are used in developing CAR-T as well as other cell therapy products using the Applied Cells MARS Platforms as part of this agreement.

In Vitro Diagnostics (IVDs) is defined in section 201(h) of the Federal Food, Drug, and Cosmetic Act and are subject to premarket & post market controls. These devices are also generally categorized under the Clinical Laboratory Improvement Amendments (CLIA '88) of 1988. Medical devices, including IVD products, are categorized into Class I, II, or III as per the degree of regulatory control required for ensuring safety and effectiveness. Furthermore, IVD products are subject to additional labeling requirements as per the Subpart B of 21 CFR 809 under the In Vitro Diagnostic Products for Human Use guidelines. To ensure compliance, FDA coordinates with manufacturers throughout the life cycle of products and offers assistance & feedback.

Product Insights

Consumables antibodies held the largest share of 60.2% in 2023 and this is also expected to witness the fastest growth rate over the forecast period. The growth is attributed to the recurrent purchases of consumables. In addition, increased R&D expenditure by biotechnology & biopharmaceutical businesses to develop sophisticated biologics, such as monoclonal antibodies & vaccines responsible for its high share.

The consumables segment is further categorized into reagents, kits, media, & sera; beads; and disposables. Several leading vendors, including Thermo Fisher Scientific, Merck KGaA, and R&D Systems, Inc., provide technologically advanced reagents & kits for single marker depletion, single marker positive selection, and full lineage depletion. For instance, R&D Systems, Inc. offers Human/Mouse CD44 Antibody for detecting mouse and human CD44 in flow cytometry. Merck offers Accuspin system histopaque, which is used to separate mononuclear cells from bone marrow or human peripheral blood.

Cell Type Insights

Animal cells held the largest market share of 52.4% in 2023. Drug discovery and development involve the use of animal cells to examine preliminary toxicity, efficacy, and pharmacokinetics of new drug molecules. Dynabeads Mouse CD43 (Untouched B Cells), manufactured by Thermo Fisher Scientific, Inc., helps isolate viable and pure untouched B cells by negative isolation from mouse lymphoid organs. Similarly, EasySep Mouse B Cell Isolation Kit, marketed by STEMCELL Technologies, Inc., assists in the separation of B cells from single-cell suspensions of splenocytes or other tissues through the use of negative selection.

Human cells are anticipated to grow at a significant rate during the forecast period. There has been a rise in the demand for cell-based research for disease diagnosis due to surge in the incidence of chronic diseases, such as cancer, and other infectious diseases. Moreover, increasing investments by the government in research focusing on cancer & human stem cell research has further motivated R&D in cell isolation process. This has led to the introduction of various technologically advanced products in human cell isolation. For instance, the human T-cell isolation product by Thermo Fisher Scientific is an affordable, pure, and easy-to-use product involving untouched & viable cells.

Technique Insights

Centrifugation held the largest market share of 40.6% in 2023. Cell separation often involves the use of differential centrifugation and density gradient centrifugation. Whereas differential centrifugation employs a lysate to tear cell membranes to separate particles, density gradient centrifugation utilizes the molecular weights of the particles to be separated. To ensure successful cell isolation in the media, both methods require a variety of consumables, including reagents & disposables.

Surface marker is expected to grow at the fastest CAGR from 2024 to 2030. Surface markers are typically useful for characterization and identification of different subpopulations of leucocytes. The identification of cell surface markers allows various kinds of cells to be identified, resulting in characterization of cells for drug discovery. This identification is vital for developing drugs to treat various diseases, such as cancer and HIV. With the advent of personalized medicines, drugs are designed based on genetics, which allows higher drug efficacy.

Application Insights

Biomolecule isolation held the largest market share of 28.1% in 2023. The segment is also expected to exhibit the fastest growth rate during the forecast period. Biomolecule isolation is essential in the development of various biosimilars and biopharmaceuticals. Lipids, carbohydrates, nucleic acids, and proteins are the major classes of biomolecules.

Typically, proteins and nucleic acids are used to manufacture biopharmaceuticals and biosimilars. With an increasing demand for these biomolecules, there is a need for cell isolation techniques, thereby accelerating market growth. Biomolecule isolation generally involves centrifugation, adsorption, filtration, and magnetic separation techniques.

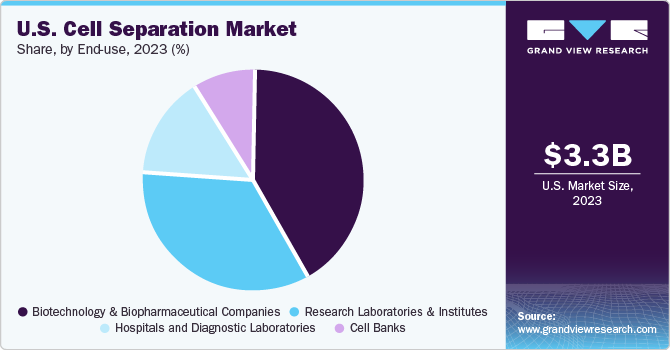

End-use Insights

Biotechnology and biopharmaceutical companies occupied the largest revenue share of 42.1% in 2023. The segment is also expected to exhibit the fastest growth rate during the forecast period. These companies are involved in extensive R&D efforts in new-generation therapeutics that require cell separation techniques, protein therapeutics, monoclonal antibodies, stem cells, cryobanking, and cell-based assays.

Increasing preference for personalized medicines is widening the growth prospects for this segment. Antibodies are efficiently identified by cell separation techniques and play an indispensable role in development of personalized medicine. Hence, increasing R&D activities by these companies is expected to propel the market over the forecast period.

Key U.S. Cell Separation Company Insights

Key U.S. cell separation companies include Thermo Fisher Scientific, Inc.; BD; and Danaher among others. The market is highly competitive with several leading and emerging companies. The observed growth in this particular sector can be attributed to the implementation of comprehensive expansion strategies, new product development, geographical expansions, and mergers & acquisitions. Companies in the market have been proactive in adopting such strategies to enhance their market presence and drive growth.

Key U.S. Cell Separation Companies:

- Thermo Fisher Scientific, Inc.

- BD

- Danaher

- Terumo Corp.

- STEMCELL Technologies Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Agilent Technologies, Inc.

- Corning Inc.

- Akadeum Life Sciences

Recent Developments

-

In May 2023, BD announced the commercial introduction of a new cell sorting tool that combined two ground-breaking technological advancements that allowed researchers see data concerning cells that had been concealed in conventional flow cytometry tests.

-

In May 2023, Akadeum Life Sciences announced the launch of T-cell activation/expansion and Leukopak human immune cell isolation kits for cell therapy R&D. With the help of this launch, the company planned to strengthen their Leukopak cell isolation product lines.

U.S. Cell Separation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 3.30 billion |

|

Revenue forecast in 2030 |

USD 5.58 billion |

|

Growth rate |

CAGR of 7.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, cell type, technique, application, end-use |

|

Country scope |

U.S. |

|

Key companies profiled |

Thermo Fisher Scientific, Inc.; BD; Danaher; Terumo Corp.; STEMCELL Technologies Inc.; Bio-Rad Laboratories, Inc.; Merck KgaA; Agilent Technologies, Inc.; Corning Inc.; Akadeum Life Sciences |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Cell Separation Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cell separation market report based on product, cell type, technique, application, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Reagents, Kits, Media, and Sera

-

Beads

-

Disposables

-

-

Instruments

-

Centrifuges

-

Flow Cytometers

-

Filtration Systems

-

Magnetic-activated Cell Separator Systems

-

-

-

Cell Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Cells

-

Animal Cells

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Centrifugation

-

Surface Marker

-

Filtration

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomolecule Isolation

-

Cancer Research

-

Stem Cell Research

-

Tissue Regeneration

-

In Vitro Diagnostics

-

Therapeutics

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Laboratories and Institutes

-

Biotechnology and Biopharmaceutical Companies

-

Hospitals and Diagnostic Laboratories

-

Cell Banks

-

Frequently Asked Questions About This Report

b. The U.S. cell separation market size was estimated at USD 3.30 billion in 2023.

b. The U.S. cell separation market is expected to register a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030 to reach USD 5.58 billion by 2030.

b. Consumables antibodies held the largest share of 60.2% in 2023, which is also expected to witness the fastest growth rate over the forecast period.

b. Key U.S. cell separation companies include Thermo Fisher Scientific, Inc.; BD; and Danaher among others. The market is highly competitive, with several leading and emerging companies.

b. The increasing prevalence of chronic diseases, such as cancer, and extensive R&D activities by key companies to develop novel cell & gene therapies are expected to fuel the demand for cell separation solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."