- Home

- »

- Biotechnology

- »

-

U.S. Cell & Gene Therapy Manufacturing Market, Industry Report, 2030GVR Report cover

![U.S. Cell And Gene Therapy Manufacturing Market Size, Share & Trends Report]()

U.S. Cell And Gene Therapy Manufacturing Market (2024 - 2030) Size, Share & Trends Analysis Report By Therapy Type (Cell Therapy Manufacturing, Gene therapy manufacturing), By Scale, By Mode, By Workflow, And Segment Forecasts

- Report ID: GVR-4-68040-237-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. Cell and gene therapy manufacturing market was valued at USD 3.89 billion in 2023. It is anticipated to experience a CAGR of 27.1% from 2024 to 2030. Advanced therapies have significantly impacted the treatment of numerous rare and life-threatening diseases and revolutionized the biopharmaceutical sector. The accelerated development of the advanced therapy industry is a crucial driving force for the market's growth. The market is witnessing substantial growth owing to key market players, including CDMOs offering GMP manufacturing services and adopting highly innovative manufacturing technologies for production. Major players are undertaking various strategic initiatives to boost their market presence, leading to market growth in the country. For instance, in January 2021, Fujifilm invested USD 40 million to develop a new manufacturing facility for viral vectors and innovative therapy products.

The National Cell Manufacturing Consortium (NCMC) has been established through collaboration between 15 academic institutes, more than 25 companies, and government agencies to enable cost-effective, large-scale manufacturing of cell therapies. This consortium is focused on developing, maturing, and implementing innovative technologies for cell therapy manufacturing. With the presence of a high number of contract manufacturers and research organizations, the market space is highly competitive. In addition, the entry of new players and facility expansion by existing players has intensified the competition in the U.S. market.

In 2023, the U.S. cell & gene therapy manufacturing market accounted for a revenue share of over 38% in the global cell & gene therapy manufacturing market. This market's Major players include Thermo Fisher Scientific, Inc.; Fujifilm Diosynth Biotechnologies; Lonza; Merck; and Catalent, Inc. These companies undertake various strategies to strengthen their market presence. For instance, in March 2022, FUJIFILM Corporation announced the acquisition of Shenandoah Biotechnology, Inc. to strengthen its presence in cell culture solutions for cell & gene therapy manufacturing. Thus, such initiatives undertaken by key players are anticipated to impact market growth in the upcoming years positively

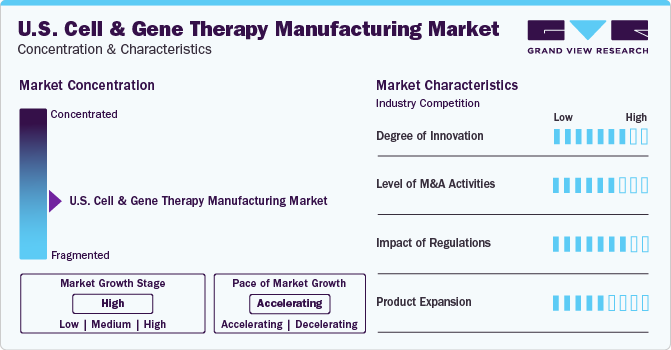

Market Concentration & Characteristics

The industry growth stage is high and the pace of the growth depicts an accelerating trend. The U.S. cell & gene therapy manufacturing industry is moderately fragmented, marked by many companies competing for a higher revenue share. The industry is in a high growth stage and will continue its trajectory in the coming 5-6 years.

In the past few years, with a better scientific and clinical understanding of safety risks related to applying gene & cell therapy products for various diseases, the clinical success to the number of clinical trials ratio has improved. This includes understanding the pattern of viral vectors, immunogenicity, modified delivery mechanisms, and improved technology. Advancements in manufacturing include improved accuracy of oligo synthesis, new chemistry, manufacturing, and control regulations. Thus, the cell and gene therapy industry has grown tremendously.

The U.S. cell & gene therapy manufacturing industry is characterized by substantial M&A and collaboration activities undertaken by key manufacturers. Numerous players in the country are collaborating with other relevant companies to strengthen their portfolios and expand their reach. For instance, in January 2021, Thermo Fisher Scientific announced that it had acquired Novasep's viral vector manufacturing business-Henogen S.A.-to enhance its viral vector manufacturing capabilities.

The Center for Biologics Evaluation and Research (CBER) is the regulatory authority for human gene therapy, cellular therapy products, and devices related to gene and cell therapies. Moreover, CBER offers proactive scientific and regulatory advice to medical manufacturers and researchers and regulatory support for clinical studies. The number of cell & gene therapies entering clinical trials and gaining marketing authorization from the regulatory bodies is increasing yearly. The FDA has planned to approve up to 20 products per year from 2025. Such supportive government initiatives are opportunistic for the players in the industry.

Therapy Type Insights

The cell therapy manufacturing segment dominated the market with a revenue share of 56.9% in 2023. With the growing number of ongoing clinical trials and products entering the market, cell therapy is gradually gaining importance in immuno-oncology. Only a few CAR T-cell therapies have been approved by the U.S. FDA. Over 250+ clinical trials studying CAR T-cell and other cell therapies indicate that potential indications are broadening to include solid & liquid tumors. Thus, the demand for advanced cell manufacturing services will increase in the coming years. As many cell therapy products are allogeneic and expected to have large market sizes, there is a growing need for commercial-scale production.

The gene therapy segment is expected to grow significantly during the forecast period. With many products in clinical trials, production process improvement is a major need for the gene therapy manufacturing sector. With increased investments from players and the clinical success of more products, several gene therapy companies are focusing on manufacturing & commercialization. Evaluating the existing process & its scalability and deciding on in-house or outsourced manufacturing are some of the major factors to be considered while designing the manufacturing process for gene therapy products.

Scale Insights

Pre-commercial/ R&D scale manufacturing captured a significant revenue share of 72.0% in 2023. The rapidly changing market environment for cell and gene therapies is the main contributing factor for innovation in R&D about gene & cell therapy. The pre-commercial manufacturing segment is anticipated to grow as the market witnesses more positive data from ongoing clinical trials. More than 400 companies in North America were actively developing cell and gene therapy products for various diseases.

Commercial scale manufacturing segment is projected to garner the fastest CAGR during the forecast period. Large biopharmaceutical companies, such as Bristol-Myers Squibb (BMS), Novartis AG, and Merck KGaA, are investing significant money in cell & gene therapy programs and manufacturing facilities. These companies have capabilities, resources, and skilled professionals, enabling quicker entry into clinical trials and shorter time to market. Such companies are expected to propel the market for commercial-scale manufacturing by the increasing number of products entering the market.

Mode Insights

The contract manufacturing segment held the highest revenue share of 65.7% in 2023. With the increasing demand for cell & gene therapies, the challenges with adequate manufacturing capacity have created opportunities for contract manufacturing service providers. With the rapid transformation in the industry, outsourcing services is projected to deliver a competitive edge to market participants in terms of expertise and experience.

The in-house manufacturing segment is projected to exhibit the fastest CAGR during the forecast period. Building a small in-house manufacturing facility can be a suitable option for gene therapy companies having difficulty finding contract manufacturing service partners or securing production time slots in the required time frame. However, the capital associated with building a manufacturing facility for a single cell or gene therapy product can be challenging for emerging & small pharmaceutical or biotechnology firms.

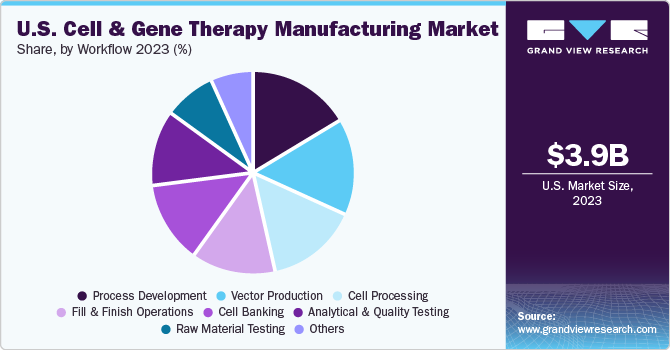

Workflow Insights

The process development segment had a significant revenue share of 16.6% in 2023. The surge in therapies transiting from clinical trials to receiving regulatory approvals is significantly driving the segment growth. The development of robust and organized methods for cell therapy production has become crucial. Process development strategies deliver efficiency while enhancing candidate programs' safety and quality profiles.

The vector production segment is estimated to register the fastest CAGR during the forecast period. Viral vectors are being increasingly adopted for treating multiple health conditions, including metabolic, muscular, infectious, cardiovascular, hematologic, and ophthalmologic, as well as various types of cancer. The most widely deployed viral vectors are adenoviral, lentiviral, AAV, retroviral, and herpes simplex virus. Viral vectors are manufactured using different cell lines with unique growth and transfection characteristics.

Key U.S. Cell And Gene Therapy Manufacturing Company Insights

Key U.S. cell & gene therapy manufacturing companies include Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd, and Lonza among others. Several strategic initiatives such as partnerships, product launches, mergers, and acquisitions are being undertaken by the key market players to expand their market presence. There have been several noteworthy mergers and acquisitions in the market in recent years.

Key U.S. Cell And Gene Therapy Manufacturing Companies:

- Lonza

- Bluebird Bio Inc.

- Catalent Inc.

- F. Hoffmann-La Roche Ltd

- Samsung Biologics

- Boehringer Ingelheim

- Cellular Therapeutics

- Hitachi Chemical Co., Ltd.

- Takara Bio Inc.

- Miltenyi Biotec

- Thermo Fisher Scientific

- Novartis AG

- Merck KGaA

- Wuxi Advanced Therapies

Recent Developments

-

In April 2022, Novartis expanded its manufacturing capacity for its gene therapy product Zolgensma. The company has been granted commercial licensure approval by the U.S. FDA multi-product gene therapy manufacturing facility in Durham, NC. This marked the second manufacturing facility for the company.

-

In February 2022, Thermo Fisher Scientific, Inc. launched a new service for cell and gene therapy manufacturing, named Patheon Commercial Packaging Services. The service offers end-to-end solutions for cryogenic packaging and global distribution, accelerating the commercial launch of therapies in the U.S. & Europe. The initiative strengthened the company’s offerings in this domain.

-

In January 2022, Thermo Fisher announced the acquisition PeproTech, a key manufacturer of recombinant proteins including cytokines. The deal value was worth over USD 1.85 billion.

U.S. Cell And Gene Therapy Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.89 billion

Revenue forecast in 2030

USD 21.13 billion

Growth rate

CAGR of 27.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Therapy type, scale, mode, workflow

Country Scope

U.S.

Key companies profiled

Lonza; Bluebird Bio; Catalent Inc.; F. Hoffmann-La Roche Ltd.; Samsung Biologics; Boehringer Ingelheim; Cellular Therapeutics; Hitachi Chemical Co., Ltd.; Bluebird Bio Inc.; Takara Bio Inc.; Miltenyi Biotec; Thermo Fisher Scientific; F. Hoffmann-La Roche Ltd; Novartis AG; Merck KGaA; Wuxi Advanced Therapies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cell & Gene Therapy Manufacturing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cell & gene therapy manufacturing market report based on therapy type, scale, mode, and workflow:

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell therapy manufacturing

-

Stem cell therapy

-

Non-stem cell therapy

-

-

Gene therapy manufacturing

-

-

Scale Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-commercial/ R&D scale manufacturing

-

Commercial scale manufacturing

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract manufacturing

-

In-house manufacturing

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell processing

-

Cell banking

-

Process development

-

Fill & finish operations

-

Analytical and quality testing

-

Raw material testing

-

Vector production

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cell and gene therapy manufacturing market size was estimated at USD 3.89 billion in 2023

b. The U.S. cell and gene therapy manufacturing market is expected to grow at a compound annual growth rate of 27.1% from 2024 to 2030 to reach USD 21.13 billion by 2030.

b. Based on therapy type, cell therapy manufacturing segment dominated the market with revenue share of 56.9% in 2023.

b. Some of the key players in the market are and Lonza; Bluebird Bio; Catalent Inc.; F. Hoffmann-La Roche Ltd.; Samsung Biologics; Boehringer Ingelheim; Cellular Therapeutics; Hitachi Chemical Co., Ltd.; Bluebird Bio Inc.; Takara Bio Inc.; Miltenyi Biotec; Thermo Fisher Scientific; F. Hoffmann-La Roche Ltd; Novartis AG; Merck KGaA; and Wuxi Advanced Therapies.

b. Some of the key factors driving the market include growing pipeline of cell and gene therapy, supportive regulatory bodies, and increase in investment by government and private players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.