- Home

- »

- Biotechnology

- »

-

U.S. Cell Culture Media Market Size, Industry Report, 2030GVR Report cover

![U.S. Cell Culture Media Market Size, Share & Trends Report]()

U.S. Cell Culture Media Market Size, Share & Trends Analysis Report By Product (Serum-free Media, Stem Cell Culture Media), By Type (Liquid Media, Semi-solid And Solid Media), By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-285-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Cell Culture Media Market Size & Trends

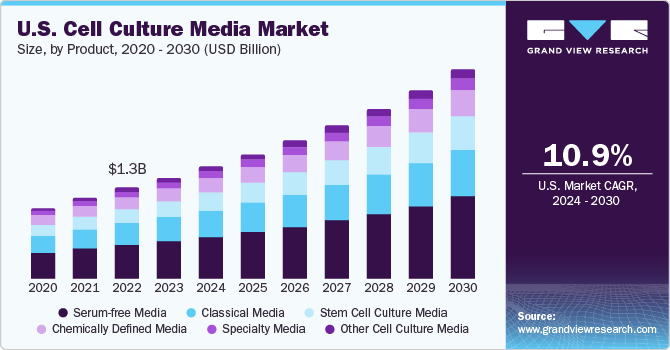

The U.S. cell culture media market size was estimated at USD 1.46 billion in 2023 and is expected to grow at a CAGR of 10.95% from 2024 to 2030 owing to continuously increasing use of cell culture technology. Furthermore, increased awareness about stem cells is driving the use of gene and cell therapy.

U.S. cell culture media market accounted for 31% of the global cell culture media market in 2023. One of the major factors is the presence of a well-established R&D infrastructure and favorable regulatory landscape, which is rapidly evolving to adapt to the ongoing research progress in this sector. The U.S. has three main Federal agencies-the Animal and Plant Health Inspection Service (APHIS), U.S. Environmental Protection Agency (EPA), and U.S. Department of Health and Human Services’ Food and Drug Administration (FDA)-which ensure safe use of genetically modified/engineered organisms.

In addition, supportive government policies and high healthcare expenditure are likely to favor market growth in this region. Investments by government and leading companies in the market in pharmaceuticals and biotechnology industries are growing. For instance, in November 2022, FUJIFILM Holdings Corporation announced the launch of a cell culture media manufacturing facility with an investment of USD 188 million in Research Triangle Park (RTP), North Carolina.

Cell culture-based viral vaccines are used worldwide to immunize humans against infections. The cell culture is a continuous process of the development of substrates for the safe production of viral vaccines. The increased demand and strict safety rules for novel vaccines to control and eradicate viral diseases have enforced manufacturers & researchers toward cell culture-based vaccines. Usage of cell culture technology is also included in developing other vaccines that are U.S.-licensed. This comprises vaccines for smallpox, rotavirus, rubella, hepatitis chickenpox, and polio. Development of superior biological models, optimization of cell culture growth medium, and reduction in animal-derived component dependencies endure to boost the rapidly developing cell-based vaccine development.

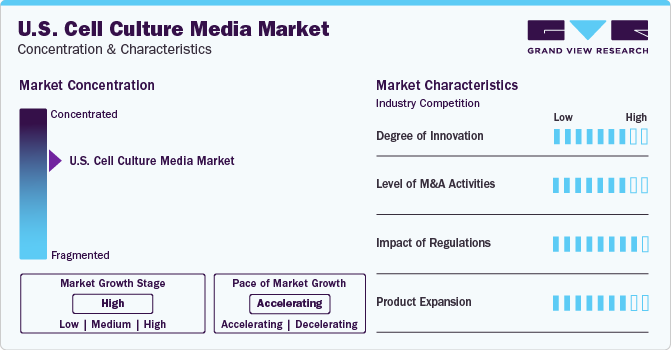

Market Concentration & Characteristics

The U.S. cell culture media industry is consolidated by nature owing to the local presence of key companies, such as Thermo Fisher Scientific, Inc. and Merck KGaA. Companies leverage strategies such as product launches, R&D activities, partnerships, collaborations, and mergers and acquisitions (M&A), to increase their manufacturing capabilities and increase the geographic outreach of their product offerings and maintain competition. Furthermore, investments by government and key companies in pharmaceuticals and biotechnology industries are growing.

The cell culture is a continuous process of the development of substrates for the safe production of viral vaccines.Key companies are expanding their production capabilities to meet the rising supply demand. In March 2023, WATERS Corporation announced the launch of easy-to-use walk-up solutions integrating Waters BioAccord LC-MS system and Andrew+ robot with upstream bioreactors to automate routine product quality and cell culture media analyses.

Several prominent companies are acquiring smaller players, intending to strengthen their market position. Strategies like this enable these companies to grow capabilities, expand product portfolios, and improve competencies. For instance, in January 2022, Thermo Fisher Scientific Inc. announced the acquisition of PeproTech. The company’s recombinant proteins range complements the cell culture media products of Thermo Fisher Scientific, Inc. and allows it to offer substantial benefits through a combined offering to the customers.

Biotechnology industry regulations in the U.S. are governed by Coordinated Framework for Regulation of Biotechnology established in 1986. In particular, the U.S. FDA is primarily responsible for ensuring safety, efficacy, proper labeling, and other attributes of human food, animal feed, and all plant-derived foods & feeds. Robust legal frameworks for patents and intellectual property protection encourage innovation by giving companies the confidence to invest in R&D activities.

Product Insights

The serum-free media segment witnessed the highest revenue share of 37.20% in 2023 owing to the expanding scope of applications and benefits offered by serum-free culture processes. It offers consistent performance, easier purification & downstream processing, higher precision in evaluation of cellular function, and better detection of cellular mediators. Features as such, makes it highly suitable for producing biopharmaceutical-grade products. Moreover, lack of undefined serum components, media definition can be enhanced, enabling regulatory compliance fulfillment for cell and gene therapy manufacturing. Such factors are also expected to boost further demand for serum-free media over the forecast period.

The stem cell culture media segment is projected to register a considerable CAGR from 2024 to 2030. Increasing demand for stem cell therapies and growing research studies on stem cell applications in regenerative medicine have driven the demand for stem cell culture products. Stem cell culture media offers specialized formulations required for differentiation, expansion, or maintenance of pluripotency in stem cells. These factors are expected to drive the market growth in the forthcoming years.

Application Insights

The biopharmaceutical production segment registered the highest revenue share of 43.00% in 2023. Rising demand for reproducible and better-defined media for meeting expanding production levels and reduction in contamination risk in downstream processes is contributing highly to the increasing demand for this segment. Moreover, strategic initiatives by prominent biopharmaceutical companies are also driving the segment growth.

The diagnostics segment is expected to witness a considerable CAGR during the forecast period. Cell cultures can be used in metabolomics for identification of biomarkers of pathologically relevant conditions. Moreover, metabolic pathways leading to production of such biomarkers can be identified to determine underlying metabolic disorders. Single cell cultures are used for cultivating a broad spectrum of viruses for producing high-titer virus materials for antibody testing. This enhances the diagnostic virology applications of cell culture media, which is expected to boost market growth during the forecast period.

Type Insights

The liquid media segment witnessed the highest revenue share of 63.2% in 2023 owing to a rising number of producers of biosimilars and biologics along with growing preferences for liquid media intending to limit the growth of mycobacteria. Moreover, liquid media eliminates requirement of mixing containers, scales, and the installation of a Water for Injections (WFI) circuit required to mix the powder media.

The semi-solid and solid segment is expected to register a considerable CAGR from 2024 to 2030 as it contains solidifying agents and is usually prepared as agar plates or as slab deeps. These culture media are comparatively inexpensive and can be stored for a longer term than liquid media. In addition, advancements in technology have led to production of granulated culture media from powdered dry media, which dissolves rapidly when WFI is mixed and eliminates any clump formation. This is projected to boost the segment’s growth during the forecast period.

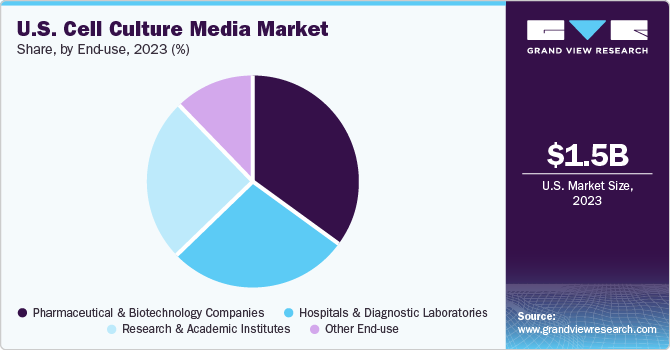

End-use Insights

The pharmaceutical & biotechnology segment registered the highest revenue share of 34.91% in 2023 owing to introduction and advent of biosimilar or generic innovative therapeutics. Increasing number of clinical trials treatments for life-threatening diseases by pharmaceutical and biotechnology companies is further driving the demand for cell culture media. Moreover, investments by several companies are significantly increasing in R&D activities, which is further boosting the demand for cell culture media.

Hospitals & diagnostic laboratories segment is expected to register a considerable CAGR from 2024 to 2030 as they are primary care settings for diagnosis & treatment of medical conditions. A major part of a diverse population relies on such long-standing facilities for diagnosis, treatment, and management of diseases. With ongoing changes in the healthcare industry, need for hospitals with advanced facilities has increased. Rise in the number of hospitals and diagnostic laboratories is also leading to segment growth.

Key U.S. Cell Culture Media Company Insights

Some prominent U.S. cell culture media market companies include Sartorius AG; Danaher Corporation Thermo Fisher Scientific, Inc.; Merck KGaA; Lonza; Cell Biologics, Inc.; and PromoCell GmbH. Key market companies such as Thermo Fisher Scientific, Inc. and Danaher Corporation have dedicated stem cell culture media portfolios, which are expected to drive market growth.

With the expansion of biosimilars and biologics market, key biopharmaceutical companies are adopting robust cell culture technologies to meet the increasing demand, thereby driving the market growth. For instance, in June 2022, FUJIFILM Corporation invested USD 1.6 billion to expand and improve the manufacturing services of cell culture in Texas.

Key U.S. Cell Culture Media Companies:

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- FUJIFILM Corporation

- Lonza

- BD

- STEMCELL Technologies

- Cell Biologics, Inc.

- PromoCell GmbH

Recent Developments

-

In July 2023, Merck KGaA announced plans for expanding its facility located in Lenexa, USA, which is expected to create an additional 9,100 square meters of laboratory space and will boost production capacity to manufacture cell culture media in the country

-

In May 2023, Lonza announced the launch of TheraPEAK® T-VIVO® Cell Culture Medium which is a novel chemically defined formulation that has been developed for the optimization and streamlining of CAR T-cell manufacturing

-

In February 2022, Cytiva partnered with NecstGen, aiming n to develop new gene and cell therapies where Cytiva would provide its services, solutions, and technologies to NecstGen. Both companies are working to fast-track the development of gene and cell therapies using their manufacturing proficiencies

Cell Culture Media Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.46 billion

Revenue forecast in 2030

USD 3.04 billion

Growth rate

CAGR of 10.95% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, type, end-use

Country scope

U.S.

Key companies profiled

Sartorius AG; Danaher Corporation; Merck KGaA; Thermo Fisher Scientific, Inc.; FUJIFILM Corporation; Lonza; BD; STEMCELL Technologies; Cell Biologics, Inc.; PromoCell GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cell Culture Media Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cell culture media market report based on product, application, type, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Serum-free Media

-

CHO Media

-

BHK Medium

-

Vero Medium

-

HEK 293 Media

-

Other Serum-free media

-

-

Classical Media

-

Stem Cell Culture Media

-

Specialty Media

-

Chemically Defined Media

-

Other Cell Culture Media

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Production

-

Monoclonal Antibodies

-

Vaccines Production

-

Other Therapeutic Proteins

-

-

Diagnostics

-

Drug Screening And Development

-

Tissue Engineering And Regenerative Medicine

-

Cell And Gene Therapy

-

Other Tissue Engineering And Regenerative Medicine Applications

-

-

Other Applications

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Media

-

Semi-solid And Solid Media

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical And Biotechnology Companies

-

Hospitals And Diagnostic Laboratories

-

Research And Academic Institutes

-

Other End-use

-

Frequently Asked Questions About This Report

b. The U.S. cell culture media market size was estimated at USD 1.46 billion in 2023 and is expected to reach USD 1.63 billion in 2024.

b. The U.S. cell culture media market is expected to witness a compound annual growth rate of 10.95% from 2024 to 2030 to reach USD 3.04 billion in 2030.

b. The biopharmaceutical production segment dominated the U.S. cell culture media market in 2023. The biopharmaceutical industry’s demand for more reproducible and better-defined media to meet the expanding production levels while reducing the risk of contamination in the downstream processes is significantly increasing the demand for this market.

b. The key players competing in the U.S. cell culture media market include Sartorius AG; Danaher Corporation; Merck KGaA; Thermo Fisher Scientific, Inc.; FUJIFILM Corporation; Lonza; BD; STEMCELL Technologies; Cell Biologics, Inc.; PromoCell GmbH

b. The major factors driving the growth of the market are the growing demand for biopharmaceuticals, favorable governmental policies, and increasing investment in R&D.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."