- Home

- »

- Medical Devices

- »

-

U.S. Catheter Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Catheter Market Size, Share, & Trends Report]()

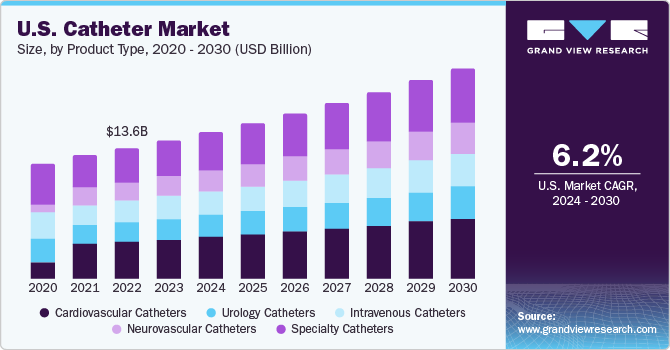

U.S. Catheter Market Size, Share, & Trends Analysis Report By Product Type (Cardiovascular Catheters, Intravenous Catheters, Neurovascular Catheters, Urology Catheters, Specialty Catheters), By End-use (Hospitals Stores, Retail Stores) And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-279-4

- Number of Report Pages: 112

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Catheter Market Size & Trends

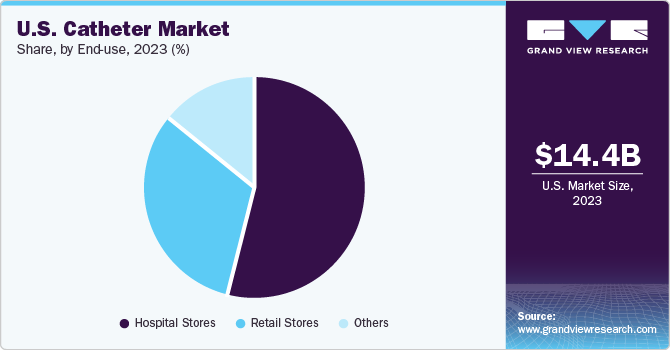

The U.S. Catheter market size was estimated at USD 14.4 billion in 2023 and is estimated to grow at a CAGR of 6.20% from 2024 to 2030. The increasing need for antimicrobial catheters, utilization of advanced materials in catheters, and rising incidence of cardiovascular, neurology, and urology conditions are key drivers propelling market expansion. Furthermore, the escalating preference for minimally invasive treatments is expected to enhance growth opportunities.

The U.S. Catheter market accounted for 50% share of the global catheters market. Patients undergoing elective surgeries with general anesthesia necessitate catheterization. Repeated catheter use can result in Catheter-associated Urinary Tract Infections (CAUTIs) and Central Line-associated bloodstream infections (CLABSIs). According to the article published by PubMed, CAUTIs contribute to approximately 1 million cases annually in the U.S. Major companies are enhancing catheters with extra functionalities to tackle challenges related to their usage, including reducing infection and thrombosis risks while ensuring optimal flow rates. These factors are expected to fuel market growth.

Companies utilize advanced materials like polyurethanes and polycarbonates in the production of catheters. Carbothane, known for its chemical resistance to substances like iodine, hydrogen peroxide, and alcohol, is specifically employed in catheter manufacturing to enhance its durability and longevity. Such trends further increase the demand for catheters.

Furthermore, there is a high emergence of cardiovascular, urologic, and neurologic diseases that contribute to mortality and morbidity. Individuals leading sedentary lifestyles are at a higher risk of developing conditions like diabetes. Peripheral diseases are connected to various chronic illnesses like diabetes. The increasing need for less invasive treatments is also influenced by recent technological advancements, such as incorporating antimicrobial coatings and smaller catheters, aimed at reducing the chances of restenosis. Thus, utilizing advanced technologies and modern coated catheters is expected to boost market growth.

Market Concentration & Characteristics

The presence of numerous specialized medical device manufacturers in the U.S. catheter industry results in a highly fragmented market landscape. The catheter industry is experiencing significant growth due to rising investments in research and development, increasing Merger and acquisition activities, and regulatory approvals.

Companies that heavily invest in advanced technologies and effectively leverage these innovations often secure a competitive advantage, propelling market growth. The advancements and innovations in catheters play a significant role in driving market expansion. For instance, in February 2024, CERENOVUS introduced a next-generation catheter designed for the revascularization of patients experiencing acute ischemic stroke. This innovative catheter, CEREGLIDE 71 Intermediate Catheter with TruCourse, offers enhanced flexibility and compatibility.

Mergers and acquisitions in the U.S. catheters industry have been on rise, with companies increasingly acquiring development-stage firms to enrich their product offerings and cater to a broader patient base. Additionally, these companies are integrating advanced facilities and establishing strategic alliances to leverage synergies in capabilities and resources, ultimately boosting their competitiveness within the industry. For instance, in January 2022, MMT announced an acquisition agreement of all R&D manufacturing operations from Biometrics. This acquisition marks a significant expansion of MMT's capabilities and product offerings in the catheter manufacturing sector.

Major companies are consistently striving to strengthen their industry sustainability by effectively operating through the introduction of various facilities in multiple locations to broaden their geographical presence and capture a greater industry share. For instance, in April 2023, Zeus announced its cutting-edge catheter manufacturing facility in Arden Hills, Minnesota, USA. This new facility would feature a cleanroom equipped with cutting-edge technologies for designing, developing, and validating new catheter prototypes.

Regulations play a vital in the approval of effectiveness and safety of medical devices. Medical device manufacturers are obligated to adhere to stringent quality and safety regulations set by regulatory bodies like the U.S. FDA. Compliance with specific guidelines is necessary for manufacturers to obtain regulatory clearance for their intravenous catheters. Consequently, the increasing regulatory approvals enhance the product portfolios of industry key players through the introduction of novel products.

End-use Insights

Hospital stores held the largest share in 2023. The favorable healthcare facilities, rising number of cardiovascular, neurologic, & urologic disorders, and an increasing number of minimally invasive procedures led to a rise in hospital admissions. For instance, according to American Hospital Association (AHA) data, approximately 33,679,935 hospital admissions were reported in 2022. Moreover, there are over 6,200 hospitals and 400 healthcare systems available in the country. Thus, the presence of well-established hospitals, coupled with a notable increase in, significantly drive the growth of this segment.

The other segment is expected to grow at the fastest CAGR of 7.2% over the forecast period. This segment comprises non-retail and e-commerce sales channels. Favorable discount rates and affordable prices play a crucial role in enhancing the appeal of e-commerce platforms among end users, contributing to the increasing growth opportunities over the forecast period.

Product Insights

Cardiovascular catheters dominated the market with a share of 29% in 2023. This growth can be attributed to the rising occurrence of cardiovascular diseases and growing need for interventional cardiac procedures, along with increasing utilization of cardiac catheters. Accelerated demand for these catheters is linked to the growing prevalence of cardiac conditions like coronary artery disease, congenital heart issues, and cardiac arrhythmias are projected to drive the expansion of the cardiovascular catheters market.

The specialty catheters segment is anticipated to witness growth at the fastest CAGR from 2024 to 2030 owing to rising demand for minimally invasive procedures, and the growing prevalence of chronic diseases. Moreover, technological advancements are expected to play a significant role in driving market growth. For instance, in May 2023, Advanced Medical Balloons announced the launch of high-tech thin polyurethane (PUR) balloon catheter systems in the U.S. This innovative catheter has been approved by the U.S. FDA.

Key U.S. Catheter Company Insights

Key companies in the U.S. ophthalmic device market include Biotronik, Cardinal Haelth, Cerenovus, MMT, Biomerics and Smith Medical among others.

The competition is driven by the increasing prevalence of conditions like urinary incontinence, cardiovascular diseases, and neurovascular disorders, which further accelerate the demand for catheters. Companies are prioritizing the development of user-friendly and effective catheters to meet the rising demand for patient-centric healthcare solutions. Moreover, the increasing utilization of catheters in home healthcare services is a significant driver fueling the market growth

Key U.S. Catheter Companies:

- Edwards Lifesciences Corporation

- Cure Medical LLC

- Cardinal Health

- Hollister Incorporated

- Boston Scientific Corporation

- Smith Medical

- Biotronik

- Biometrics

- Cerenovus

- MMT

Recent Developments

-

In February 2024, BIOTRONIK collaborated with IMDS to introduce a groundbreaking Micro Rx Catheter to the market. The novel rapid exchange microcatheter, known as the Micro Rx catheter, is specifically designed to facilitate and improve guidewire support during percutaneous coronary interventions (PCI).

-

In September 2023, Biomerics, announced a significant expansion of its operations in Brooklyn Park, Minnesota, USA, adding 100,000 square feet to its facility. This would allow the enhancement of the company's engineering Centers of Excellence, focusing on extrusions, laser processing, catheters, steerable, and final assembly operations.

U.S. Catheter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.3 billion

Revenue forecast in 2030

USD 21.9 billion

Growth rate

CAGR of 6.20% from 2024 to 2030

Actual estimates

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use

Country scope

U.S.

Key companies profiled

Edwards Lifesciences Corporation; Cure Medical LLC; Cardinal Health; Hollister Incorporated; Boston Scientific Corporation; Smith Medical; Biotronik; Biometrics; Cerenovus; MMT

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Catheter Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. catheter marketbased on product type, and end-use:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Catheters

-

Electrophysiology Catheters

-

PTCA Balloon Catheters

-

IVUS Catheters

-

PTA Balloon Catheters

-

-

Urology Catheters

-

Hemodialysis Catheters

-

Peritoneal Catheters

-

Foley Catheters

-

Intermittent Catheters

-

External Catheters

-

-

Intravenous Catheters

-

Peripheral Catheters

-

Midline Peripheral Catheters

-

Central Venous Catheters

-

-

Neurovascular Catheters

-

Specialty Catheters

-

Wound/Surgical Catheters

-

Oximetry Catheters

-

Thermodilution Catheters

-

IUI Catheters

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Stores

-

Retail Stores

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. catheter market size was estimated at USD 14.4 billion in 2023 and is expected to reach USD 15.3 million in 2024.

b. The U.S. catheter market is expected to grow at a compound annual growth rate of 6.20% from 2024 to 2030 to reach USD 21.9 billion by 2030.

b. Cardiovascular catheters dominated the market with a share of 29% in 2023. This growth can be attributed to the rising occurrence of cardiovascular diseases and the growing need for interventional cardiac procedures, along with the increasing utilization of cardiac catheters.

b. Edwards Lifesciences Corporation; Cure Medical LLC; Cardinal Health; Hollister Incorporated; Boston Scientific Corporation; Smith Medical Biotronik; Biometrics; Cerenovus; MMT

b. The increasing need for antimicrobial catheters, the utilization of advanced materials in catheters, and the rising incidence of cardiovascular, neurology, and urology conditions are key drivers propelling market expansion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."