- Home

- »

- Medical Devices

- »

-

U.S. Cardiovascular & Soft Tissue Repair Patch Market, Industry Report, 2030GVR Report cover

![U.S. Cardiovascular And Soft Tissue Repair Patch Market Size, Share & Trends Report]()

U.S. Cardiovascular And Soft Tissue Repair Patch Market Size, Share & Trends Analysis Report By Application (Cardiac Repair, Vascular Repair, Pericardial Repair), By Raw Material (ePTFE, Biomaterial, Tissue Engineered Material), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-231-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

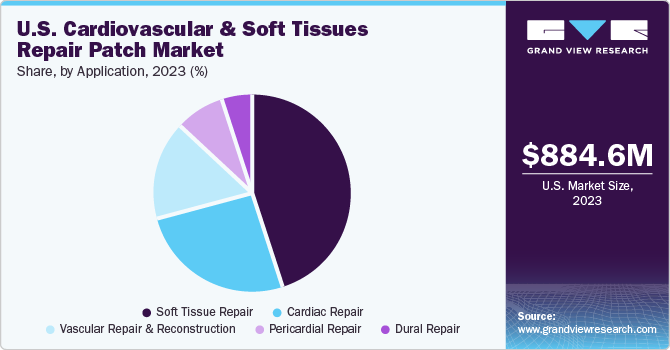

The U.S. cardiovascular and soft tissue repair patch market size was valued at USD 884.6 million in 2023 and is and is estimated to grow at a CAGR of 7.6% from 2024 to 2030. The increasing prevalence of cardiac diseases owing to sedentary lifestyle, junk food, alcohol consumption, tobacco consumption, and substance abuse are some of the key factors positively reinforcing market growth in the United States.

The U.S. accounted for over 34.0% of the global cardiovascular and soft tissue repair patch market in 2023. Heart diseases are the leading cause of death closely followed by stroke. CHDs are the leading cause of infant deaths across the globe. The prevalence of congenital heart diseases is high in pediatric population, which is expected to drive the demand for cardiac patches over the forecast period. Furthermore, high treatment rates and constantly increasing awareness about repair and reconstruction procedures among healthcare professionals and patients are key factors driving market growth.

High economic development, and the presence of advanced research centers, hospitals, medical device manufacturers, and universities are boosting new product development and commercialization in this country. Furthermore, presence of well-established reimbursement policies, and increasing awareness about cardiovascular patches as bridge-to-transplant, bridge-to-recovery, and destination therapy is expected to drive the demand for cardiovascular patches. The market is also expected to witness significant highs during the forecast period owing to several partnerships, and collaboration among the key industry players and research organizations.

In addition, the increasing prevalence of myocardial infarction, drastic shortage of organs, and limited improvements in reperfusion and pharmacological agents have triggered the need for engineered cardiac tissues during the forecast period. Growing government initiatives, such as the Million Hearts Initiative, Heart and Stroke Prevention Program, and Global Hearts are also expected to boost market growth. An increase in treatment rate, product penetration in U.S. market, and surging incidence of chronic heart diseases are major drivers.

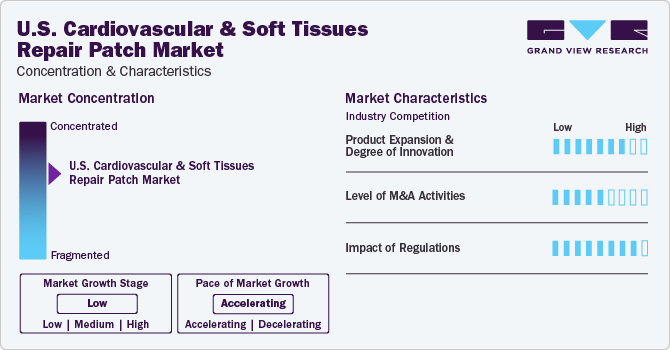

Market Concentration & Characteristics

Technology has been a key enabler for industry growth and expansion. Technological advancements in the fields of cell biology, cardiovascular & thoracic surgery, vascular surgery, and others had a significant impact on the industry growth of cardiovascular and soft tissue repair patches. Growing investments by key companies in U.S. cardiovascular and soft tissue repair industry are anticipated to expand their cardiovascular product portfolio, through various R&D activities.

The industry is witnessing several mergers and acquisitions (M&A), collaborations, and partnerships. These strategies are being adopted by players to expand their products and presence in this region. The increasing number of collaborations between government bodies and major players on expansion of small-diameter cardiac patches for infants is expected to propel market growth over the forecast period.

Compliance or adherence to the FDA standards is very critical for manufacturers to access the U.S. industry. U.S. FDA authorization is considered a key milestone in product commercialization stage. These agencies also have oversight for product recall in case of any deviations from manufacturing standards. Various acts of the U.S. FDA, such as section 361 of the Public Health Services Act, serve as strength for this industry because they regulate human cellular and tissue products to prevent spread of several communicable diseases, such as HIV-1 & 2, thus, improving the overall treatment scenario. Quality-related regulations by the U.S. FDA, such as routine inspection of a company, are expected to improve the quality of products and treatment procedures as well.

Application Insights

The cardiac repair segment held the largest revenue share of 25.71% in 2023. The cardiac repair market encompasses a broad portfolio of cardiovascular diseases in which patches are used. Cardiovascular patches are used to repair congenital heart defects. Favorable initiatives conducted by national organizations such as the National Institute on Alcohol Abuse and Alcoholism to curb the effects of cardiovascular diseases are anticipated to promote growth of tissue-engineered patches for cardiac repair.

The dural repair segment is expected to witness a considerable CAGR over the forecast period. The patches are usually made of synthetic or biological materials and their composition is like a patient’s dura mater, which facilitates easier integration and faster action. Some of the key products are TissuePatchDural; Neuro Patch; Lyoplant Onlay; Lyoplant; and Biodesign.

Raw Materials Insights

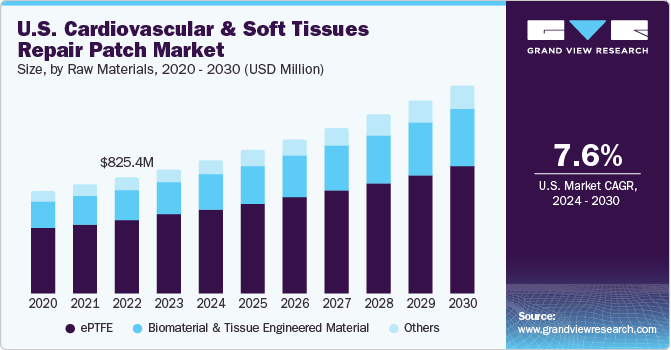

The ePTFE segment held the largest revenue share of 63.50% in 2023. Constant research & technological advancements for medical materials and metals led to the development of ePTFE. This material also has low flammability, low water absorption, the ability to resist harsh conditions, and a low coefficient of friction. Key attributes offered by ePTFE are good biocompatibility, chemical inertness, and high thermal & chemical resistance.

The others segment is expected to witness the fastest CAGR over the forecast period. Other raw materials are used to manufacture polypropylene, polyethylene terephthalate, PTFE etc. The use of medical-grade polypropylene in manufacturing various patches, meshes, and other devices gained popularity owing to its properties such as low density, versatility, and moldability.

Key U.S. Cardiovascular & Soft Tissue Repair Patch Company Insights

Some of the key U.S. cardiovascular and soft tissue repair patch companies operating in this market are Medtronic; Bard Peripheral Vascular, Inc.; Terumo Cardiovascular: W.L. Gore & Associates; GETINGE Group; CryoLife; Edwards Life Sciences; Baxter; and Admedus. The growing number of mergers and acquisitions by some of the key players, such as Terumo Cardiovascular and Medtronic, to gain market share is one of the crucial factors that indicate the existing competition in the market.

The market is soon expected to witness significant gains during the forecast period due to increasing collaboration between various industry giants and research organizations. Technological advancements pertaining to new product development such as tissue engineered based products are expected to significantly affect the market growth during the forecast period.

Key U.S. Cardiovascular And Soft Tissue Repair Patch Companies:

- Baxter

- Admedus

- St. Jude MedicalLeMaitre Vascular Inc.

- Biointegral Surgical Inc.

- Edwards Life Sciences Corporation

- Glycar SA Pty Ltd.

- LabCor

- Cryolife, Inc.

- Terumo Medical Corporation

- Bard Peripheral Vascular Inc.

- Neovasc

Recent Developments

-

In August 2023, Anika Therapeutics received the FDA 510 (k) clearance for its Integrity Implant System, which is designed to augment an injured tendon, promoting healing in rotator cuff repair procedures

-

In July 2023, the FDA approved a liver-directed treatment, melphalan hydrochloride for injection/Hepatic Delivery System, for adults with uveal melanoma and unresectable hepatic metastases affecting more than 50% of the liver

-

In April 2023, Aziyo Biologics announced its partnership with LeMaitre Vascular, granting the latter distribution rights for the products within its cardiovascular segment such as ProxiCor PC, ProxiCor CTR, Tyke and VasCure

U.S. Cardiovascular and Soft Tissue Repair Patch Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 948.9 million

Revenue forecast in 2030

USD 1.47 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, raw materials

Country scope

U.S.

Key companies profiled

Baxter; Admedus; St. Jude Medical; LeMaitre Vascular Inc; Biointegral Surgical Inc; Edwards Life Sciences Corporation; Glycar SA Pty Ltd; LabCor; Cryolife, Inc; Terumo Medical Corporation; Bard Peripheral Vascular Inc; Neovasc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cardiovascular and Soft Tissue Repair Patch Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cardiovascular and soft tissue repair patch market report based on application, and raw materials:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac repair

-

Atrial Septal Defect

-

Common Atrium

-

Defects of the Endocardial Cushion

-

Ventricular Septal Defect

-

Tetralogy of Fallot

-

Right Ventricular Outflow Tract Reconstruction

-

Suture Bleeding

-

-

Vascular repair & reconstruction

-

Carotid Endarterectomy

-

Anomalous Connection Of The Pulmonary Veins

-

Transposition of The Great Vessels

-

Reconstruction of Portal and Superior Mesenteric Veins

-

Other Vascular Repair and Reconstruction

-

-

Pericardial repair

-

Dural repair

-

Soft Tissue repair

-

Defects of the Abdominal Wall

-

Defects of the Thoracic wall

-

Gastric Binding

-

Hernias

-

-

-

Raw Materials Outlook (Revenue, USD Million, 2018 - 2030)

-

ePTFE

-

Biomaterial and Tissue Engineered Material

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cardiovascular and soft tissue repair patch market size was valued at USD 884.6 million in 2023 and is expected to reach USD 948.9 million in 2024.

b. The U.S. cardiovascular and soft tissue repair patch market is expected to grow at a CAGR of 7.6% from 2024 to 2030 to reach USD 1.47 billion by 2030.

b. The ePTFE segment held the largest revenue share for U.S. cardiovascular and soft tissue repair patch with 63.50% in 2023. Constant research & technological advancements for medical materials and metals led to the development and growth of ePTFE.

b. Baxter; Admedus; St. Jude Medical; LeMaitre Vascular Inc; Biointegral Surgical Inc; Edwards Life Sciences Corporation; Glycar SA Pty Ltd; LabCor; Cryolife, Inc; Terumo Medical Corporation; Bard Peripheral Vascular Inc; Neovasc. These are some of the prominent companies in U.S. cardiovascular and soft tissue repair patch. These key players are identified based on their product portfolios, revenues, collaborations, and other strategic initiatives adopted by them.

b. The increasing prevalence of cardiac diseases owing to sedentary lifestyle, junk food, alcohol consumption, tobacco consumption, and substance abuse are some of the key factors positively reinforcing market growth in the United States.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."