U.S. Car Care Products Market Size, Share & Trends Analysis Report By Product (Car Cleaning Products, Car Polish, Car Wax,), By Packaging Volume (Less Than 250 ml, 251 - 500 ml), By End-use, By Distribution Channel, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-991-1

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

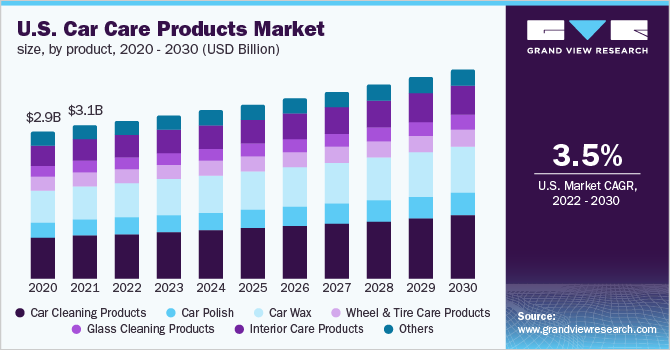

The U.S. car care products market size was estimated at USD 3.12 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.5% from 2022-2030. The market is expected to be driven by the increasing consumer spending on vehicle maintenance and the upkeep of its aesthetics is a major driver for the increase in market growth for car care products. The availability of automobiles at affordable prices in the form of used vehicles has proven to be lucrative for today’s users who see this as an opportunity to own vehicles at inexpensive prices. Consequently, the maintenance required for these vehicles goes up, which in turn further drives the growth of the market. Luxury vehicles and sports utility vehicles are the major consumers of car care products. Car care products such as waxes and polishes are used to shine the vehicle and offer protection. This trend is expected to propel product demand over the forecast period in the U.S. as it is one of the major automotive markets globally and is expected to witness significant demand for polishing and cleaning products for passenger automobiles.

Car care products are widely used by major automotive industry players such as Volkswagen, Hyundai Motor Group, Honda Motor Co., Ltd., and Toyota Motor Corporation. The rising focus on green technology and environmentally sustainable developments are expected to drive product innovation in terms of waterless products to reduce water usage.

Companies such as Permatex, Inc., Turtle Wax, The Clorox Company, Treatment Products, Inc., and Norton Abrasives are integrated across the value chain. They develop car care products and directly supply the product to application industry segments. In addition, companies such as Meguiar’s, Inc. and Chemical Guys sell their products through e-commerce and online portals.

Product Insights

Car cleaning products accounted for the largest market share in 2021, contributing over 28% to the market, owing to their widespread usage in the removal of contaminants and residues from the exterior surface of vehicles. The cleaning products include a variety of products used to maintain the exterior appearance of a vehicle. Car wash shampoo and detergent was the dominant segment in the U.S. car care products market, in 2021.

The car cleaning product market is also witnessing an increase in the demand for waterless dry automobile washes owing to the rising environmental concerns coupled with the ease of convenience the products offer. Waterless dry wash can be used to remove the light dirt on the vehicle surface without damaging the car paint. However, the product is not recommended for vehicles prone to exposure to thick mud.

U.S. wheel & tire care products are expected to expand at a CAGR of 2.3% during the forecast period. With increasing pollution levels in most countries, the demand for car care products is expected to grow. Wheel & tire cleaners are necessary to maintain wheels & tires and help them last longer. With time and use, tires and wheels tend to get dirty. Regular cleaning and care protect them from long-term damage.

Wheel & tire cleaners are available for alloy, chrome, aluminum, and clear-coated wheels. Chrome-plated or aluminum wheels require a special polish since aluminum tends to oxidize. Clear-coated or painted steel wheels are compatible with standard auto polishes. Wheel & tire cleaners are usually water-based and non-acidic so that they can be used on all-wheel finishes without spotting.

Packaging Volume Insights

The 251 - 500 ml packaging volume segment accounted for a revenue share of 25.9% in 2021 and is anticipated to exhibit the fastest growth, progressing at a CAGR of 4.2% in terms of revenue, during the forecast period. Improvement in consumer disposable income is expected to drive new car sales, which, in turn, is anticipated to drive the demand for car care products, thereby having a positive impact on the packaging volume segment growth.

Rising disposable incomes, especially among the younger and millennial population coupled with improving lifestyles are expected to drive new automobile sales. In addition, the increasing focus of people driving newer cars on maintaining their appearance is expected to drive the demand for tire foam, body polish, wax, and glass cleaners, which is anticipated to benefit the growth of the 251 - 500 ml packaging volume segment.

The 501 - 999 ml packaging volume segment contributed the largest market share in terms of revenue, accounting for 39% of the market in 2021 owing to its suitability for individuals as well as commercial use. This packaging volume is used for packaging moderate quantities of car care products and is usually a preferred option among independent repair shops, small workshops as well as individuals.

The increasing average length of car ownership is expected to drive the demand for car maintenance and detailing, thereby, fueling the demand for car care products. The market is expected to witness the introduction of new products owing to the increasing focus of car care product manufacturers on acquiring a larger customer base, especially the millennial population.

End-Use Insights

The retail end-use segment dominated the market in 2021 and is projected to ascend at a CAGR of 3.6% during the forecast period. Growing demand for products from individual vehicle owners coupled with the wide availability of car care products in commercial markets are likely to support the segment growth in the projected time.

Wide distribution networks by the players offering products at niche levels are expected to further support the car care products retail end-use segment growth in the upcoming future. Furthermore, growing trends for Do-It-Yourself (DIY) applications for automobile maintenance by individual owners are expected to support the products’ sales through the retail market.

High service cost for automobile maintenance at a professional service station is another factor individual owners are opting for the retail purchase of the products and self-application. Moreover, the availability of a wide range of options to choose from local market has supported the growth of the retail segment.

The professional end-use segment is expected to grow at a CAGR of 3.1% during the forecast period. Professional end-use for car care products includes its application from equipped services stations, maintenance yards, and car cleaning service providers. The segment is anticipated to ascend at a slower pace owing to high service costs and the limited availability of products at professional service stores.

Distribution Channel Insights

Retail chains accounted for the largest distribution channel for car care products in 2021 and is anticipated to ascend at a CAGR of 3.5% during the forecast period. Growing penetration of retail stores in niche markets through third-party agreements and the establishment of local service shops are expected to support the retail distribution channels.

Car care products available at organized retail stores are represented in a dedicated section wherein the users can test the products. Promotional offers and discounts on products are other factors increasing the popularity of retail channels for distribution. Multinational retail chains including Costco, Walmart, and others offers discounted pricing structure, thus offering car care products at lower prices as compared to other channels.

The e-commerce distribution channel is expected to witness the fastest growth rate of 3.8% during the forecast period. Growing trends for online shopping owing to the wide availability of car care products from several manufacturers are expected to further increase the popularity of the e-commerce segment.

Online portals allow users to select from a wide variety of car care products according to the vehicle’s surface need. Moreover, pictorial representation and existing consumer reviews present on the portal help users to make an easy choice for car care products. Convenient product delivery at the doorstep along with comparatively lower costs are other factors driving the penetration of e-commerce distribution for car care products.

Key Companies & Market Share Insights

The industry exhibits a large number of players providing a variety of car care products including cleaning products, polishes, protectants, and wheel & tire cleaners. The players in the U.S. car care market face intense competition from each other as well as from regional players with strong distribution networks and know-how about suppliers and regulations. In addition, the manufacturers of car care products also provide products to garages and workshops, which in turn, intensifies the competition. Some of the prominent players in the U.S. car care products market include:

-

3M

-

Sonax GmbH

-

Tetrosyl Ltd.

-

Chemical Guys

-

Armor All

-

Turtle Wax, Inc.

-

Autoglym

-

Mother’s

-

Adam's Polishes

-

Griot's Garage

U.S. Car Care Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 3.21 billion |

|

Revenue forecast in 2030 |

USD 4.25 billion |

|

Growth Rate |

CAGR of 3.5% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Actual estimates/Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, packaging volume, end-use, distribution channel |

|

Country scope |

U.S. |

|

Key companies profiled |

3M; Sonax GmbH; Tetrosyl Ltd.; Chemical Guys; Armor All; Turtle Wax, Inc.; Autoglym; Mother’s; Adam's Polishes; Griot's Garage |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Car Care Products Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. car care products market based on product, packaging volume, end-use, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Car Cleaning Products

-

Car Polish

-

Car Wax

-

Glass Cleaning Products

-

Interior Care Products

-

Wheel & Tire Care Products

-

-

Packaging Volume Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 250 ml

-

251 - 500 ml

-

501 - 999 ml

-

1000 - 5000 ml

-

More than 5000 ml

-

-

End-Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail (B2C)

-

Professional (B2B)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

E-commerce

-

Retail Stores

-

Car Detailing Stores

-

Frequently Asked Questions About This Report

b. The global U.S. car care products market size was estimated at USD 3.12 billion in 2021 and is expected to reach USD 3.21 billion in 2022.

b. The U.S. car care products market is expected to grow at a compound annual growth rate of 3.5% from 2022 to 2030 to reach USD 4.25 billion by 2030.

b. Car cleaning products accounted for the largest market share in 2021, contributing over 28% to the market, owing to its wide use for the removal of contaminants and residues from the exterior surface of vehicles.

b. Some of the key players operating in the U.S. car care products market include 3M, Sonax GmbH, Tetrosyl Ltd., Chemical Guys, Armor All, Turtle Wax, Inc., Autoglym, Mother’s, Adam's Polishes, Griot's Garage.

b. The key factors that are driving the U.S. car care products market include rising automotive sales, coupled with growing awareness regarding the appearance and maintenance of vehicles. In addition, the focus on car care has led to the usage of D-I-F-M (Do it for me) services, which in turn has led to an increase in demand.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."