- Home

- »

- Medical Devices

- »

-

U.S. Capnography Devices Market Size,Share, Report, 2030GVR Report cover

![U.S. Capnography Devices Market Size, Share & Trends Report]()

U.S. Capnography Devices Market Size, Share & Trends Analysis Report By Product (Portable, Stationary), By Solution Offering (Integrated, Standalone), By Technology, By Component, By Application, By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-333-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Capnography Devices Market Trends

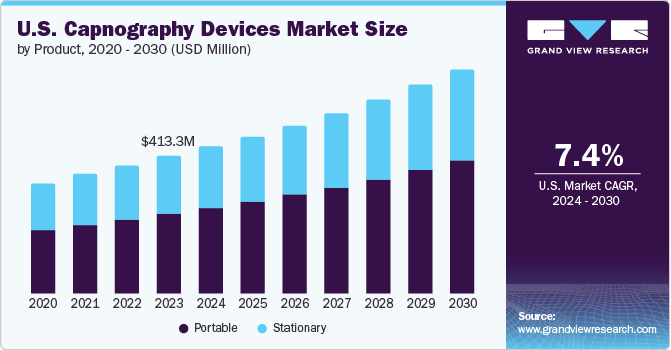

The U.S. capnography devices market was estimated at USD 413.3 million in 2023 and is expected to grow at a CAGR of 7.35% from 2024 to 2030. The market growth for capnography devices is expected to accelerate over the forecast period due to the increasing prevalence of respiratory diseases, technological advancements, and supportive government initiatives. For instance, the United States Environmental Protection Agency reported that in 2020, the rate of emergency room visits for asthma and other respiratory causes was 369 per 10,000 children, with asthma accounting for 47 visits and other respiratory causes for 322 visits per 10,000 children. This significant presence of respiratory issues drives the demand for capnography devices, which are needed for effective monitoring and timely intervention, improved patient outcomes, and integration into standard care protocols.

Furthermore, the COVID-19 pandemic highlighted the critical need for real-time respiratory monitoring in managing COVID-19 patients, leading to higher sales and adoption of capnography devices. In addition, the urgent need for effective respiratory care prompted technological innovations and accelerated regulatory approvals, benefiting manufacturers and suppliers in this market.

The pandemic had a positive impact on market players in the capnography device industry by significantly increasing the demand for respiratory monitoring equipment. For instance, in 2020, Medtronic reported higher demand for products such as capnography, ventilators, pulse oximetry, advanced parameter monitoring, and extracorporeal life support due to the pandemic. The company’s Respiratory, Gastrointestinal, & Renal (RGR) net sales for fiscal year 2020 reached USD 2.8 billion, a 4% increase from fiscal year 2019. This growth was partly driven by increased demand for ventilators and airway products related to COVID-19 in the fourth quarter, with notable strength in their Microstream capnography monitoring products, Puritan Bennett ventilator portfolio, and Nellcor pulse oximetry products.

Moreover, capnography devices have been essential in operating rooms in high-income countries for over three decades, significantly reducing anesthesia-related issues and deaths since their introduction in the U.S. in 1991. However, capnography is largely unavailable in many low-resource operating rooms, with research indicating a complete gap between the need and availability of capnography in these settings. Hence, in June 2024, organizations like Lifebox, Smile Train, and WFSA are working to ensure that all anesthesia providers, regardless of location, have access to this crucial monitoring device. They are also promoting the inclusion of capnographs in healthcare systems and equipment standards, including those set by the World Health Organization (WHO), as essential anesthesia monitors for safer surgery globally.

Furthermore, several studies have been conducted to understand the effectivity of capnography devices. For instance, the study published by the National Library of Medicine in 2019 evaluated three types of electronic monitoring devices-capnography, pulse oximetry, and minute ventilation (MV)-to identify the most effective in detecting respiratory compromise and to develop algorithms for earlier detection of respiratory depression.

Conducted in the post anesthesia care unit (PACU) of an inner-city hospital, the study recruited 60 patients on the day of their surgery. 48 patients wore the three monitoring devices while recovering from neck, back, hip, or knee surgery. Of the 48 patients, 24 showed sustained signs of opioid-induced respiratory depression (OIRD). While SpO2 values remained unchanged, end-tidal CO2 levels increased, and MV decreased, indicating hypoventilation. A machine learning model successfully predicted an OIRD event 10 minutes in advance with 80% accuracy. The study concluded that capnography and MV effectively detect respiratory compromise in the PACU.

Market Concentration & Characteristics

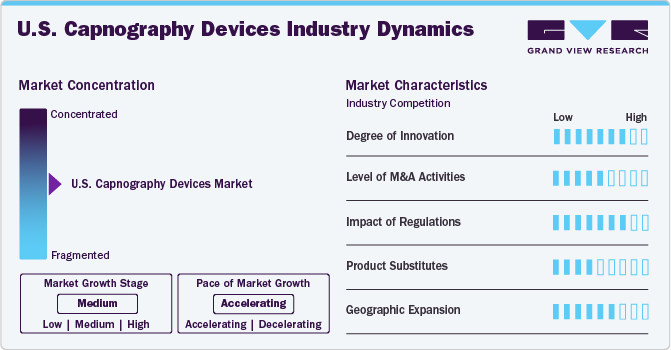

The degree of innovation in the U.S. capnography devices industry is high. It is driven by advancements in sensor technology and data analytics. Modern capnography devices offer enhanced accuracy, portability, and integration with electronic health records (EHRs), facilitating better patient monitoring and data management. The development of multiparameter devices, which combine capnography with other vital sign measurements, provides comprehensive monitoring solutions. In addition, machine learning algorithms enable early detection of respiratory events, improving patient outcomes and operational efficiency in clinical settings.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance,in December 2019, Masimo and Dräger expanded their partnership, with Dräger integrating additional Masimo brain monitoring and capnography technologies into its multi-parameter patient monitors. This integration aimed to enhance clinicians' ability to assess oxygenation, brain function, and ventilation status.

The regulatory impact on the U.S. capnography devices industry is significant. In the U.S., the capnography devices market is regulated by the Food and Drug Administration (FDA). The FDA ensures medical devices' safety, effectiveness, and quality. Capnography devices must comply with FDA guidelines and obtain the necessary approvals before being marketed.

Geographic expansion drives the U.S. capnography devices market by enabling access to diverse data sources, increasing market penetration and revenue, and fostering regulatory compliance and standardization. It also promotes partnerships and collaborations, improves localized healthcare outcomes, and necessitates investment in technological infrastructure.

Product Insights

The portable segment dominated the market and accounted for the largest share of more than 55% of the total revenue in 2023. The growth is attributed to its versatility and suitability for various clinical settings. These devices offer mobility and flexibility, allowing healthcare providers to monitor respiratory status in diverse environments such as emergency response vehicles, outpatient clinics, and home healthcare settings. Portable capnography devices enable real-time monitoring of end-tidal carbon dioxide (etCO2) levels and respiratory rate, crucial for assessing patient ventilation and detecting respiratory distress promptly. Their compact size, ease of use, and capability to deliver accurate readings contribute to their widespread adoption, meeting the demand for effective respiratory monitoring solutions that support patient care continuity across different healthcare scenarios.

However, the stationary capnography devices segment is growing significantly in the U.S. capnography devices market primarily because of its essential role in critical care and high-acuity settings within hospitals. These devices are integrated into fixed patient monitoring systems in operating rooms, intensive care units (ICUs), and procedural areas where continuous and precise respiratory monitoring is crucial. Stationary capnography devices provide reliable measurements of etCO2 levels and respiratory rate, aiding clinicians in assessing patient ventilation and identifying respiratory complications promptly. Their integration with hospital infrastructure ensures consistent monitoring capabilities and adherence to clinical protocols, making them indispensable tools for enhancing patient safety and clinical outcomes in controlled healthcare environments.

End Use Insights

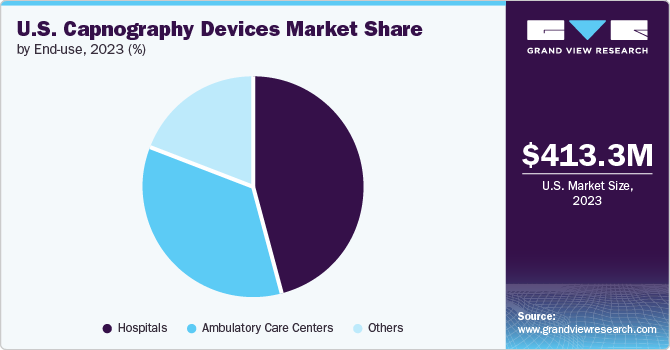

The hospitals segment dominated the market, with the largest share of 45.67% in 2023. The growth is due to its extensive use across various departments and specialties within healthcare facilities. Hospitals require capnography devices for various applications, including anesthesia monitoring, intensive care units (ICUs), emergency departments, procedural sedation, and general patient monitoring. These devices play a critical role in enhancing patient safety by providing real-time monitoring of respiratory status and detecting early signs of respiratory compromise. Moreover, hospitals have stringent regulatory and patient care standards that necessitate continuous monitoring during critical procedures and in high-acuity settings.

The others segment is expected to grow at the fastest CAGR over the forecast period. The others segment includes pharmaceutical companies, pharmacies, etc. Pharmaceutical companies are increasingly leveraging AI technologies to enhance patient engagement by providing personalized healthcare solutions, improving medication adherence, and streamlining patient communication. Whereas pharmacies are increasingly adopting AI-driven solutions to enhance patient engagement through personalized medication management, automated reminders, and efficient communication channels. These advancements help improve medication adherence, streamline pharmacy operations, and provide personalized care, thereby driving the demand for AI technologies in this segment.

Solution Offering Insights

The integrated segment dominated the market, with the largest share of over 58% in 2023. These devices offer seamless integration with existing patient monitoring systems, providing comprehensive and continuous respiratory monitoring without the need for separate equipment. This integration enhances workflow efficiency and reduces the complexity of patient care management. In addition, integrated capnography devices are preferred in various clinical settings, including operating rooms, intensive care units, and emergency departments, because they streamline the monitoring process and provide immediate, real-time data. The convenience, accuracy, and efficiency of these integrated systems drive their widespread adoption and market dominance.

The standalone capnography devices segment is experiencing significant growth in the U.S. market due to their versatility and standalone functionality, which cater to various clinical environments and scenarios. These devices do not require integration with other monitoring systems, making them easier to deploy in settings such as emergency departments, ambulatory care centers, and procedural areas where quick setup and mobility are crucial. Standalone capnography devices provide real-time monitoring of etCO2 levels and respiratory rate, essential for detecting respiratory distress and ensuring patient safety during sedation, anesthesia, and critical care procedures. Their standalone nature offers flexibility in usage across different healthcare settings, driving their adoption among healthcare providers seeking efficient and reliable respiratory monitoring solutions.

Parameter Insights

The multiparameter capnography devices segment dominated the U.S. capnography devices market with the largest revenue share of 52.17% in 2023. The growth is primarily due to their ability to provide comprehensive respiratory monitoring along with additional parameters such as pulse oximetry, blood pressure, heart rate, and more. These devices offer integrated monitoring capabilities that streamline clinical workflows and enhance patient care by simultaneously delivering real-time data on multiple physiological parameters. Healthcare providers prefer multiparameter capnography devices for their efficiency in critical care environments, where continuous monitoring of respiratory status and vital signs is essential for timely intervention and improved patient outcomes. Their capability to consolidate multiple monitoring functions into a single device reduces equipment clutter and supports seamless patient management across various healthcare settings, contributing to their widespread adoption and market dominance.

The single parameter capnography devices segment is experiencing significant growth in the U.S. market due to their specialized focus on monitoring etCO2 levels, which is critical for assessing respiratory status during anesthesia, procedural sedation, and respiratory therapy. These devices offer precise and reliable measurements of etCO2, aiding clinicians in detecting respiratory compromise and ensuring patient safety. Single parameter capnography devices are preferred for their simplicity and cost-effectiveness, making them accessible for a wide range of healthcare providers and clinical settings.

Technology Insights

The sidestream segment dominated the market, with the largest share of 37.42% in 2023. Sidestream devices offer continuous monitoring of End-Tidal CO2 (EtCO2) levels, which is crucial for assessing ventilation and respiratory status in both intubated and non-intubated patients. They are highly accurate in detecting changes in respiratory function, facilitating prompt intervention in critical care settings. Sidestream capnography devices are also valued for their compatibility with different patient populations and procedural contexts, from anesthesia to intensive care, contributing significantly to their widespread adoption and market dominance. Sidestream capnography utilizes a non-invasive and diverting method. This involves transporting the gas sample from the sampling site through a plastic tube to be analyzed in a sample cell. However, this process introduces a delay of a few seconds in the analysis and may potentially distort the results, which could be critical in emergency scenarios.

The microstream segment is expected to grow at the fastest CAGR of 9.6% during the forecast period. Microstream technology optimizes capnography by enhancing its effectiveness compared to other systems, offering adaptable breath sampling capabilities across a wide patient demographic. It is particularly advantageous in clinical settings due to its sensor-free design for sidestream applications, suitable for both intubated and non-intubated patients of varying ages. Utilizing laser-based molecular correlation spectroscopy (MCS) as its infrared emission source, Microstream facilitates end-tidal carbon dioxide (EtCO2) monitoring in non-intubated patients, expanding capnography's utility beyond traditional roles. This includes vital monitoring during procedural sedation, aligning with current standards from the American Society of Anesthesiologists (ASA) and the Joint Commission mandating CO2 monitoring for all anesthetized patients.

Component Insights

The sensors segment holds a substantial market share of approx. 30% in the U.S. capnography device market in 2023. The growth is primarily due to their critical role in accurately capturing and measuring end-tidal carbon dioxide (EtCO2) levels. These sensors are essential components that directly influence the reliability and effectiveness of capnography devices in respiratory monitoring. Sensor technology advancements have improved accuracy, durability, and compatibility with various patient monitoring systems, making them essential for healthcare providers seeking precise respiratory assessments across different clinical settings. The increasing demand for high-quality sensors stems from their key contribution to patient safety and clinical decision-making, driving their dominance in the U.S. capnography device market's component segment.

The sampling lines segment is expected to grow at the fastest CAGR of 9.1% during the forecast period. Sampling lines in capnography devices are essential for transporting respiratory gas samples from the patient's airway to the capnograph for analysis. These lines are crucial in sidestream, mainstream, and microstream capnography systems, ensuring accurate measurement of EtCO2 levels. They are designed in various sizes to maintain the integrity of the gas sample, minimizing delays and potential contamination in patients of all ages. High-quality sampling lines are vital for reliable monitoring in various clinical settings, including during anesthesia, in intensive care units, and for patients under procedural sedation, thereby enhancing patient safety and care outcomes.

Application Insights

The procedural sedation dominated the market with the largest share of over 24% in 2023. Waveform capnography monitoring is recommended during procedural sedation in instances of decreased response to verbal stimuli or when using tracheal tubes and airway devices. In lighter sedation, capnography aids in monitoring airway patency, respiratory rate, and patterns. The ASA guidelines specify that patients under moderate to deep sedation require monitoring with pulse oximetry, capnography, and visual observation. These factors cumulatively contribute to the segment growth in the U.S. capnography devices market.

Furthermore, the pain medicine segment is expected to grow at the fastest CAGR during the forecast period. The use of patient-controlled analgesia (PCA) and opiates in pain management can suppress respiratory function, posing significant risks. Capnography, by measuring EtCO2, enables rapid detection of respiratory depression symptoms, allowing clinicians to promptly intervene and prevent severe outcomes such as coma or cardiac arrest. This capability drives the growth of the capnography market in the pain management segment. Infinium Medical offers Cleo capnograph, which is used to measure CO2 levels during pain management. Furthermore, Nonin offers RespSense and LifeSense capnography devices used in pain management.

Key U.S. Capnography Devices Company Insights

The U.S. capnography devices market is fairly competitive, and some of the most notable participants in the market are Masimo, Nonin, Koninklijke Philips N.V., and Medtronic.

These players are involved in several business strategies, including new product launches, acquisitions, and partnerships to gain a competitive edge over each other. For instance, in October 2022, Medtronic announced plans to separate its Patient Monitoring and Respiratory Interventions businesses from the Medical Surgical portfolio, with the separation expected to be completed within 18 to 24 months from the announcement date.

Key U.S. Capnography Devices Companies:

- Koninklijke Philips N.V.

- Infinium Medical, Inc.

- Masimo

- Medtronic

- Nihon Kohden Corporation

- ICU Medical Inc.

- Nonin

- BD

- EdanUSA

- Avante Health Solutions

- Drägerwerk AG & Co. KGaA

Recent Developments

-

In June 2023, Masimo and Royal Philips announced FDA approval for starting SedLine Brain Function Monitoring, CO₂, and Regional Oximetry (O3) measurements in Philips Patient Monitors - IntelliVue MX750 and MX850. This extension of their collaboration enables clinicians to make quick, informed decisions without additional monitoring equipment.

-

In June 2022, GE Healthcare and Medtronic received FDA 510(k) authorization and CE Mark approval for integrating advanced INVOS regional oximetry and Microstream capnography technologies into the CARESCAPE precision monitoring platform. This integration aims to enhance patient outcomes and safety. Microstream capnography technology monitors respiratory compromise. At the same time, INVOS regional oximetry assists clinicians in predicting and preventing perioperative complications more effectively than traditional peripheral measurements.

-

In April 2021, Masimo disclosed that Radius PCG, a portable real-time capnograph with FDA 510(k) clearance, features wireless Bluetooth connectivity. Radius PCG integrates with the Root Patient Monitoring and Connectivity Platform, offering streamlined and tetherless mainstream capnography suitable for patients of all ages.

-

In October 2019, Masimo announced that Radius Capnography, a real-time portable capnograph having wireless Bluetooth connectivity, received a CE marking. Radius Capnography integrates with the Root Patient Monitoring and Connectivity Platform to offer seamless mainstream capnography for patients of all ages.

U.S. Capnography Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 675.7 million

Growth Rate

CAGR of 7.35% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, solution offering, parameter, technology, component, application, end use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

Koninklijke Philips N.V.; Infinium Medical, Inc.; Masimo; Medtronic; Nihon Kohden Corporation; ICU Medical Inc.; Nonin; BD; EdanUSA; Avante Health Solutions; Drägerwerk AG & Co. KGaA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Capnography Devices Market Segmentation

This report forecasts revenue growth and provides at country level an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. capnography devices market report based on product, solution offering, parameter, technology, component, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Stationary

-

-

Solution Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated

-

Standalone

-

-

Parameter Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Parameter

-

Multiparameter

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Mainstream

-

Sidestream

-

Microstream

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM Modules

-

Filters

-

Sensors

-

Sampling Line

-

Other Accessories (Cuvettes, Adaptors, etc.)

-

-

Application Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Emergency medicine

-

Pain medicine

-

Procedural sedation

-

Critical care

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Care Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. capnography devices market was estimated at USD 413.3 million in 2023 and is expected to reach USD 413.3 million in 2024.

b. The U.S. capnography devices market is expected to grow at a compound annual growth rate of 7.35% from 2024 to 2030 to reach USD 675.7 million by 2030.

b. The integrated segment dominated the market, with the largest share of over 58% in 2023. These devices offer seamless integration with existing patient monitoring systems, providing comprehensive and continuous respiratory monitoring without the need for separate equipment.

b. Some key players operating in the U.S. capnography devices market include Koninklijke Philips N.V.; Infinium Medical, Inc.; Masimo; Medtronic; Nihon Kohden Corporation; ICU Medical Inc.; Nonin; BD; EdanUSA; Avante Health Solutions; Drägerwerk AG & Co. KGaA

b. Key factors that are driving the capnography devices market growth include increasing adoption of capnography in anesthesia administration in target applications, such as monitoring patients undergoing procedural sedation, intubated patients during patient transfer in hospitals, and patient-controlled analgesia.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."