U.S. Canned Food Market Size & Trends

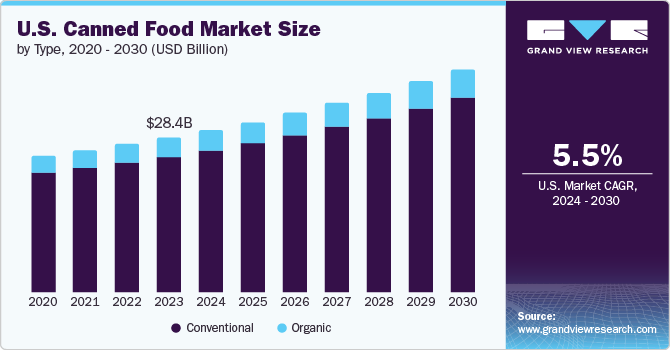

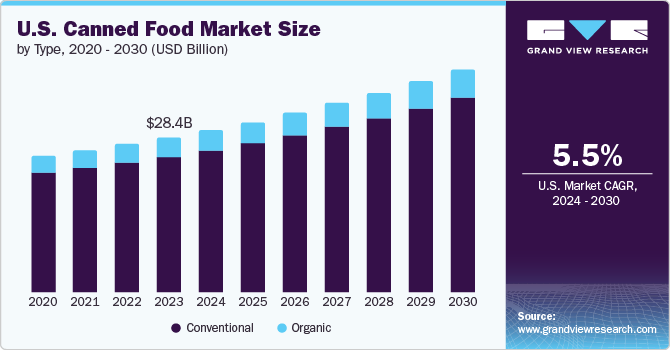

The U.S. canned food market size was valued at USD 28.4 billion in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. This growth was primarily driven by the increasing consumer demand for ready-to-eat meals. Canned food products, known for their convenience and extended shelf life align with the fast-paced lifestyles of modern consumers. These canned goods offer the ease of preparation and the ability to stock up on non-perishable items.

Canned foods offer convenient meal solutions including soups, vegetables, fruits, and protein-rich food that require minimal preparation time. The airtight packaging ensures longer shelf life, preserving nutritional content and reducing food waste. This convenience has made canned goods popular as efficient, time-saving meals. Additionally, these products align with dietary preferences while offering convenience without compromising nutrition.

Furthermore, canned foods have become essential during outdoor adventures including camping and hiking, where refrigeration and cooking facilities are limited. The rising global participation in these activities has contributed to the market growth. Moreover, canned foods have become a staple in emergency kits and relief supplies during natural disasters and crises.

Companies in the industry have increasingly invested in R&D efforts on technological advancements to enhance the quality and safety of canned food. Brands such as The Kraft Heinz Company, Campbell Soup Company, and Conagra Brands, Inc. have focused on sustainable packaging materials with clean-label products appealing to health-conscious consumers.

Type Insights

Conventional food secured the dominant market share with 87.7% in 2023. These foods are produced by using traditional farming methods and are more accessible and cost-effective compared to their organic counterparts. Their widespread availability in supermarkets and grocery stores contributed to their market dominance. Furthermore, the conventional segment encompasses an extensive range of products, including canned fruits, vegetables, meat, and seafood, catering to diverse consumer preferences.

Organic food is expected to grow substantially over the forecast period owing to the rising number of health-conscious consumers who increasingly seek organic products for perceived health benefits and environmental considerations. Although the prices are steeper as compared to conventional canned foods, consumers have favored the convenience of organic canned food as they combine health benefits with extended shelf life. Furthermore, rising urbanization and globalization have expanded access to organic canned food products. They are easily accessible in retail and online channels. This enables the market to cater to a diverse population with varying dietary preferences and lifestyles.

Product Insights

Canned fruits and vegetables dominated the market in terms of revenue share of 30.3% in 2023 attributed to the rising adoption of canned vegetables such as spinach and Brussels sprouts by nutritionists as they are high in micronutrients required for maintaining neurological health and general development. Vegetables help reduce heart disease, diabetes, osteoporosis, and other ailments and are preferred for the lower risk of methylmercury ingestion in consumers. Thus, in regions with low to no vegetation prefer canned fruits and vegetables. Furthermore, canned fruits and vegetables provide vitamins, minerals, and fiber. Fruits with vitamins and mineral content such as potassium, and vitamins A and B stay intact in heat during the manufacturing processes of these canned products.

The ready meals market is expected to witness significant growth at a CAGR of 6.5% over the forecast period owing to the widespread demand from the working class population. They prefer these meals as they are timesaving, require no elaborate preparation, and are easy to cook. These ready meals are available in convenience stores with a wide variety for immediate consumption. Furthermore, the adoption of advanced technology has enhanced the nutrition retention capacity of canned ready meals.

Distribution Channel Insights

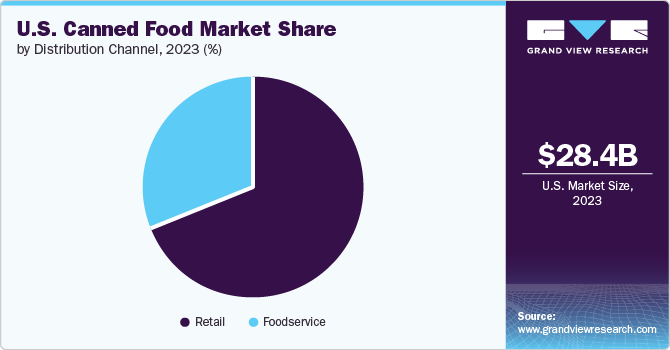

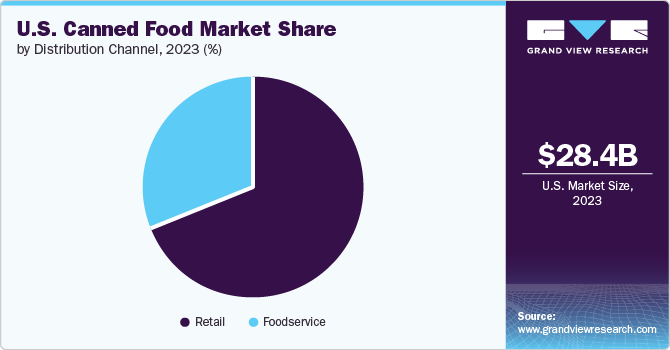

The retail segment registered the dominant market share with 68.7% in 2023. Large-scale retail channels such as supermarkets & hypermarkets, and convenience stores offer convenient and one-stop shopping experiences for consumers. The huge accessibility of canned goods including fruits, vegetables, meat, seafood, and ready meals with promotional discounts and bulk purchase options in these outlets has significantly contributed to their popularity.

Moreover, online platforms offered a wide variety of canned products, including specialty and organic items that are not always found in physical stores. Consumers have increasingly favored the convenience of browsing and purchasing from home, comparing prices, reading reviews, and exploring niche or international brands for canned foods.

Key U.S. Canned Food Company Insights

Some of the key market players including Bumble Bee Seafoods, StrKist Co, and American Tuna have propelled growth by strategically capitalizing on market trends and consumer preferences. These companies have increasingly prioritized product innovation with research and development efforts to enhance canning processes and packaging solutions.

-

Bumble Bee Seafoods is a branded canned seafood company that offers a full line of canned seafood products, including tuna, salmon, and specialty seafood. The company provides a diverse range of options, including seasoned Light Tuna pouches, and Albacore Solid White tuna.

-

LDH (La Doria) Ltd is a food distribution company that specializes in canned tomato products, including whole, chopped, pureed forms, and prepared sauces. The company also offers dried pasta, canned fish, fruit, vegetables, and other related food items.

Key U.S. Canned Food Companies:

- Bumble Bee Seafoods

- StarKist Co

- ICICLE SEAFOODS, INC.

- LDH (La Doria) Ltd

- Thai Union Frozen Products

- American Tuna, Inc.

- Tri Marine Group

- NIPPON SUISAN KAISHA, LTD

- Conagra Brands, Inc.

- Connors Bros. Ltd.

Recent Developments

-

In December 2023, StarKist Co., introduced their latest product innovations including enhancements to the StarKist Tuna & Chicken Creations Pouches, and also launched StarKist Lunch-To-Go Kits. The Tuna and Chicken Creations Pouches provide versatile protein-packed choices, while kits offer a complete, on-the-go meal solution.

-

In June 2023, Bumble Bee Seafoods expanded its acclaimed lineup of canned, pouched, and kit-based high-quality tuna products by introducing 12 new additions. The company aims to deliver quality and variety with its classic canned tuna, easy-to-use pouches, and complete meal kits.

U.S. Canned Food Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 29.8 billion

|

|

Revenue forecast in 2030

|

USD 41.0 billion

|

|

Growth rate

|

CAGR of 5.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, product, distribution channel

|

|

Key companies profiled

|

Bumble Bee Seafoods; StarKist Co; ICICLE SEAFOODS, INC., LDH (La Doria) Ltd; Thai Union Frozen Products; American Tuna, Inc.; Tri Marine Group; NIPPON SUISAN KAISHA, LTD; Conagra Brands, Inc.; Connors Bros. Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Canned Food Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. canned food market report based on type, product, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)