U.S. Candy Market Size & Trends

The U.S. candy market was estimated at USD 16.5 billion in 2023 and is expected to grow at a CAGR of 4.9% from 2024 to 2030. Such lucrative growth can be attributed to the growing demand for delectable and high-quality candies such as bars, truffles, and pralines in various flavor options. Dark chocolate, with its perceived health benefits, has mainly gained popularity. Consumers indulge in candies as readily available snacks since these take less time to consume. Furthermore, athletes, bodybuilders, and fitness enthusiasts have driven the market growth by consuming protein-rich candies.

Moreover, the rising demand for high-quality indulgent treats is fueled by consumers who crave unique flavors and experiences. This has led manufacturers to innovate products to meet evolving preferences actively. Premium and gourmet candies flavored with top-notch ingredients and elegant packaging have become the go-to choices for special occasions and thoughtful gifts. As a result, manufacturers are increasingly introducing fresh flavors, textures, and packaging designs to gain traction as upscale confectionery options.

Furthermore, candies, considered simple and affordable treats, have an uncanny ability to boost mood, leading to enhanced emotional well-being. Candies' abundant sugar content triggers the release of serotonin, a "feel-good" neurotransmitter in the brain. The rapid absorption of sugar provides an immediate energy boost, uplifts mood, and temporarily alleviates stress and fatigue. This impact of candies is projected to augment market growth.

In addition, social media platforms played a significant role in expanding the U.S. candy market. These platforms provide a direct channel for brands to engage with their audience and offer production transparency. This aims to target consumers who increasingly align their choices with environmental values and prefer brands that prioritize eco-friendly practices. Social media channels help brands openly share information about sourcing, production practices, and sustainability efforts to build trust with their audience, further driving market growth.

Type Insights

Chocolate candies held the dominant share in this segment, with a revenue share of 54.7% in 2023. Chocolate candies enjoy widespread popularity across all age groups. These candies come in various forms, single flavors, or delightful combinations with ingredients, including caramel and nuts. Other than taste, chocolate candies offer remarkable health benefits, including mortality rates, and they potentially aid in treating depression and bronchitis. Dark chocolate mainly boasts significant advantages owing to its high cocoa content. It promotes proper blood flow, supports overall blood vessel function, and contains antibacterial agents that combat tooth decay. However, the sugar content in chocolate candies can limit these benefits. Some chocolate-flavored candies include Milk Duds, Mounds, and Almond Joy, manufactured by The Hershey Company. RedHots are dark chocolate-flavored chewing gums manufactured by Ferrara Candy Company.

Non-chocolate candies are expected to grow substantially during the forecast period due to their diverse types. Non-chocolate candies include a variety of flavors in the form of hard candies, chewing gums, lollipops, gummies, caramel, jelly candies, and more. In addition, consumers are increasingly opting for milk-free and sugar-free candies, which play a crucial role in minimizing health risks. This has led major companies to produce sugar-free, non-chocolate candies to mitigate the potential impact of health issues, including diabetes, heart disorders, and obesity. Sour candies with low sugar content and tangy flavor continue to be popular among consumers.

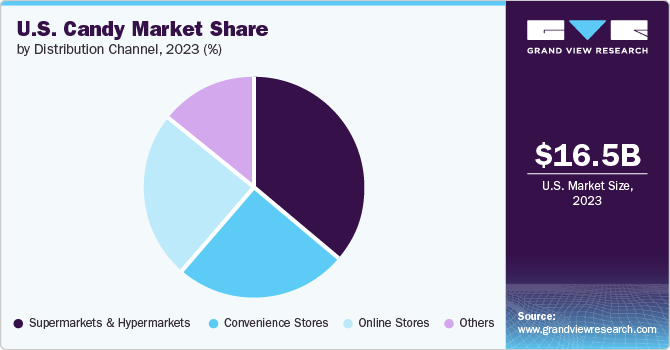

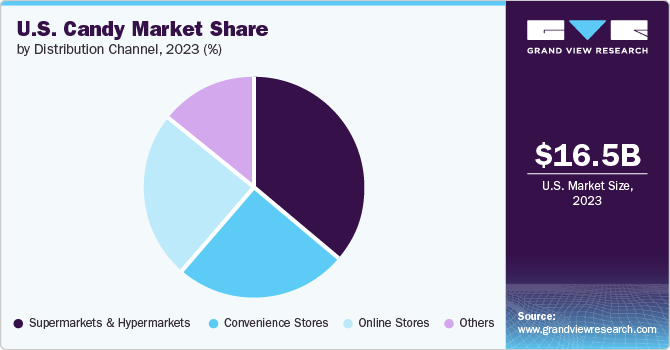

Distribution Channel Trends

Supermarkets and hypermarkets held a significant market share of 35.8% owing to their expansive storage capacity and diverse product offerings. Consumers prefer the convenience of finding a wide variety of candies under one roof. Moreover, supermarkets and hypermarkets operate on a self-service model, streamlining the shopping experience. These stores stock products in larger quantities than smaller grocery stores. They also gain considerable traction owing to their discounted prices.

Online distribution channels offer many candy options, enhancing consumer awareness of new products. Such digital alternatives boost customer knowledge and create lucrative market opportunities. Furthermore, discounted prices, lucrative offers, and a seamless shopping experience are vital motivators for consumers.

Key U.S. Candy Company Insights

The candy market in the U.S. is fiercely competitive. It is chiefly dominated by key players, including Mondelez International Inc., Mars Incorporated, and The Hershey Company. These companies consistently strive to launch innovative products to gain a competitive edge. They also prioritize expansion strategies through mergers and acquisitions.

-

The Hershey Company produces and sells chocolate, candy, snacks, and baked goods with over 90 brand names. Their portfolio includes sweets, mints, and other snacks.

-

Compartés, offers a wide range of premium chocolates, including bars, truffles, and other flavor combinations.

Key U.S. Candy Companies:

- The Hershey Company

- Ferrara Candy Co.

- Mars Incorporated

- Mondeléz International

- DeMet's Candy Co.

- Nestlé S.A.

- Compartés

- Vosges Haut-Chocolat

- Fortnum & Mason

- John Kelly Chocolates

Recent Developments

-

In June 2024, Nestlé announced the launch of the new travel retail-exclusive Nestlé Sustainably Sourced chocolate range. This product launch is aimed at the company's commitment to cater to the growing consumer demand for responsibly sourced ingredients.

-

In May 2024, the KIT KAT brand of The Hershey Company launched a new limited-edition flavor: the KIT KAT Pink Lemonade Flavored Bar, which aims to deliver a refreshing taste experience to consumers.

U.S. Candy Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 17.24 billion

|

|

Revenue forecast in 2030

|

USD 22.9 billion

|

|

Growth rate

|

CAGR of 4.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, distribution channel

|

|

Key companies profiled

|

The Hershey Company; Ferrara Candy Co.; Mars Incorporated; Mondeléz International; DeMet’s Candy Co.; Nestlé S.A; Compartés; Vosges Haut-Chocolat; Fortnum &Mason; John Kelly Chocolates

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Candy Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. candy market report based on type and distribution channel.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chocolate Candy

-

Non-chocolate Candy

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)