U.S. Cancer Contrast Media Market Size, Share & Trends Analysis Report By Type (Gadolinium-based Contrast Media, Iodinated Contrast Media), By Modality (Nuclear Imaging, CT scans), By Application (Breast Cancer, Lung Cancer), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-184-8

- Number of Report Pages: 94

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

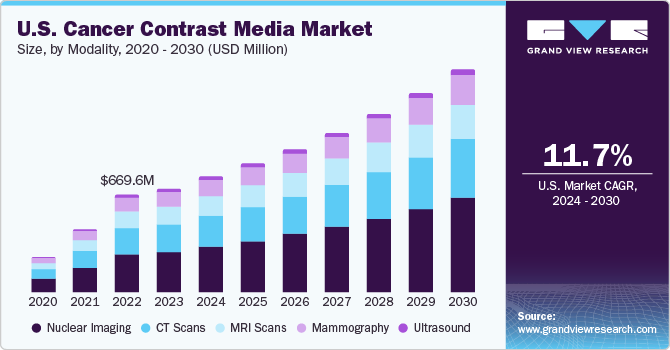

The U.S. cancer contrast media market size was valued at USD 708.07 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.7% from 2024 to 2030. The increasing number of cancer cases in the U.S. has significantly fueled the demand for cancer diagnostic and imaging devices, which drives the market growth. The diagnostic imaging techniques such as CT scans, MRI scans and X-rays use contrast media in enhancing the visibility of specific body structures.

As per the American Cancer Society reports published in 2022, it was projected that around 1.9 million people in the U.S. will receive cancer diagnosis, and approximately 609,360 individuals will lose their lives due to cancer in 2022. As the incidence of cancer rises, there is a growing need for more advanced imaging methods to identify and diagnose tumors in their early stages. Further, advancements in medical imaging technologies and improving diagnostic accuracy heavily rely on clinical studies and research. As the number of these studies increases, there is a growing demand for contrast media. These solutions play a crucial role in enhancing the quality of imaging, offering clearer insights into different health conditions. Thus, due to such factors the market is expected to grow in near future.

In October 2022, the CMIST (Contrast-Enhanced Mammography Imaging Screening Trial), was conducted by the ACR (American College of Radiology) in collaboration with the GE Healthcare and BCRF (Breast Cancer Research Foundation). The aim of the clinical study was to evaluate that using contrast-enhanced mammography could help better detect breast cancer and lower the chance of getting wrong results, especially in women with dense breasts. Thus, the rising number of clinical trials and research studies increases the demand of contrast agents, thereby propelling the market growth.

In recent years, there has been a growing demand for medical imaging, driven by technological advancements, aging population, increased awareness of preventive healthcare among the people, and rising number of people with chronic illnesses. Disease diagnosis and treatment planning for various medical conditions rely heavily on the crucial role of medical imaging, thus, driving the market growth. For instance, in January 2023, Bayer acquired Blackford Analysis Ltd., The acquisition was in line with Bayer's strategic vision to promote innovation in the field of radiology, emphasizing the integration and progression of AI within clinical workflows. The goal was to improve patient care and strengthen Bayer's presence in the digital medical imaging sector. Thus, the rising cases of intricate health conditions and chronic diseases have resulted in a higher demand for diagnostic imaging tests which positively impact the U.S. cancer contrast media market.

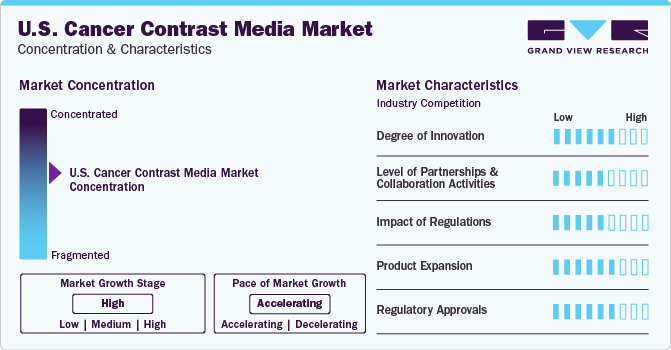

Market Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the development of high-resolution imaging techniques which increases the demand for effective contrast agents. Innovations in the contrast media industry mainly focus on enhancing the safety, effectiveness, and diagnostic abilities of these solutions.

The market is also characterized by a high level of partnerships and collaborations activity among the leading players. Collaborations and partnerships among pharmaceutical firms, manufacturers of medical devices, and healthcare providers are aimed towards enhancing diagnostic and imaging capabilities. The goal is to improve patient outcomes.

The market is also subject to impact of regulations. For the cancer contrast media industry, regulations are crucial for ensuring the effectiveness and safety of contrast media. Contrast media manufacturers in U.S. are bound by stringent quality and safety regulations imposed by regulatory agency U.S. FDA. For manufacturers to receive regulatory clearance for their cancer contrast agents, they must comply with certain guidelines.

Product expansion is a significant factor in the U.S. cancer contrast market. Pharmaceutical companies dedicated to produce contrast media consistently invest in research and development to enhance and innovate their products. This may include the formulation of new substances, refining delivery methods, or creating contrast agents tailored for emerging imaging technologies. Moreover, changing demographics and a growing number of elderly individuals can impact the need for diagnostic imaging procedures, consequently impacting the market for contrast media. As healthcare requirements change, there are chances to broaden product offerings to cater to specific medical conditions that are common among the aging population.

Type Insights

In 2023, the iodinated contrast media segment dominated the U.S. cancer contrast media with the market share of 39.5%. Computed tomography procedures with intravenous iodinated contrast agents serve as the main imaging technique for identifying, planning treatment, and monitoring post-treatment progress in the case of most cancers. Normally, iodinated contrast media is administered through an intravenous injection. However, in specific instances, barium-based contrast agents may be employed for either rectal or oral administration. The use of iodine-based contrast media significantly enhances the quality of CT and X-ray images, facilitating the clear visualization of the gastrointestinal tract, internal organs, arteries and veins, soft tissues, and the brain. Also, all the radiological examinations involving injected contrast utilize iodinated contrast media. Such factors propel the segment growth.

Moreover, the industry key players are involved in gaining regulatory approval for the novel product launch which has a positive impact on the market. For instance, in June 2023 , Bayer AG recently obtained approval from the FDA for its Ultravist injection (a nonionic iodinated contrast agents), specifically designed for Contrast-Enhanced Mammography (CEM). CEM seamlessly combines digital mammography with the incorporation of a contrast agent. Such initiatives drive the iodinated contrast media segment growth.

The radioactive agents segment is expected to grow at a highest CAGR over the forecast period. Nuclear medicine uses radioactive agents, radioisotopes for the study of specific organs of the body and disease diagnosis. Radiotherapy is essential in treating chronic disorders such as cancer by using radiation to focus on and remove specific cells.

Radioisotopes are also used to sterilize medical equipment following strict rules and adhering to standardized procedures which is crucial for making sure healthcare practices are safe. Moreover, researchers are involved in developing improved radiopharmaceuticals to capture clearer images inside the body. Their goal is to make these substances last longer by enhancing the half-life, target specific cancer types more precisely, and reduce the amount of radiation exposure for patients.

Also, the theragnostic agents which are primarily radioactive agents are used in diagnostic imaging and therapeutic purposes. Thus, there is increasing demand among the healthcare professionals for using these substances in nuclear medicine for cancer treatment. For instance, in June 2023 , the researchers found a new substance called CB-2PA-NT, which shows promising results in treating and diagnosing diseases. CB-2PA-NT has the ability to stick to tumors, adhere for a long time, and create clear images when tested with the animals. The substance targets neurotensin receptors found in different types of cancers, which could open new possibilities for treating specific kinds of diseases. This exciting research was shared in 2023 at the Society of Nuclear Medicine and Molecular Imaging Annual Meeting. Therefore, the increasing number of clinical trials for radioactive agents for their application in cancer diagnosis boost the segment growth in near future.

Modality Insights

The nuclear imaging segment held the largest share in the market in 2023 and is also expected to grow at the fastest CAGR over the forecast period. Nuclear imaging can detect small tumors hidden in the body, which helps physicians with better and more precise diagnosis. Nuclear imaging has transformed the approach to cancer detection and treatment, with the application of special contrast agents the enhance the accuracy and clarity of cancer imaging, enabling medical professionals to gain insights into the presence, location, & extent of tumors within the body. This is crucial for devising the most effective strategies to manage and treat cancer propelling the segment growth.

One notable method is Single Photon Emission Computed Tomography (SPECT), which utilizes radioactive substances called radiotracers to generate detailed 3D images of internal structures. These radiotracers are frequently designed to attach particular molecules to cancer cells, enabling accurate identification and description of malignant growths. Also, the Positron Emission Tomography (PET) plays a crucial role in nuclear imaging for cancer contrast agents. In PET scans, the body is introduced to biologically active molecules labeled with radioactive isotopes. This medical imaging technique provides high sensitivity. According to information from GE Healthcare in 2022 , the rising incidence of cancer has led to a growing demand for PET technology, driving the expansion of the market for PET/CT scanner devices. Thus, the rising number of cancer cases increases the demand for nuclear imaging diagnosis which has a positive impact for market expansion.

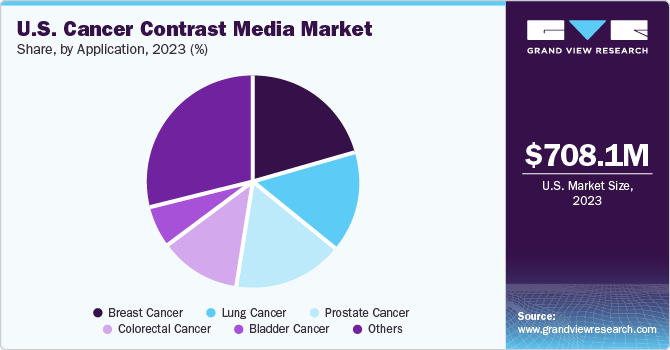

Application Insights

The others segment held the largest share in the U market in 2023. The segment includes revenues generated from contrast media products used for other cancer types, such as brain cancer, kidney cancer, and pancreatic cancer. The geriatric population is more prone for developing pancreatic cancer. Thus, the increasing elderly population, increasing use of cigarette smoking among the people, rising cases of diabetes are the factors resulting in the growing number of pancreatic cancer cases in U.S. Thus, the demand for contrast agents for disease diagnosis increases, driving the market growth.

For instance, in December 2023, as per the data reported by Society Of Nuclear Medicine & Molecular Imaging, PET imaging using 68Ga-FAPI is more effective in detecting pancreatic cancer when compared to 18F-FDG imaging or contrast-enhanced CT. In a direct comparison, 68Ga-FAPI identified a higher number of pancreatic tumors per lesion, per patient, or per region, resulting in significant adjustments to the clinical management of patients. Beyond its improved accuracy in detecting pancreatic cancer, 68Ga-FAPI imaging also opens possibilities for targeted radiopharmaceutical therapies in the future. Furthermore, the increasing application of contrast agents in pancreatic cancer diagnosis with rising cancer cases boosts the segment growth.

The lung cancer segment is expected to grow at the fastest CAGR over the forecast period. Lung cancer ranks among the leading cause of cancer-related fatalities. Inhaling air pollutants such as particulate matter, chemical toxins, and carcinogens has been associated with an increased risk of developing lung cancer. Additionally, residing in urban areas with higher pollution levels may also raise the chances of encountering lung cancer. For instance, as per the data reported by American Cancer Society in 2023 , in U.S. approximately 238,340 new cases of lung cancer were estimated, with 117,550 affecting men and 120,790 affecting women. Tragically, there were around 127,070 deaths attributed to lung cancer, with 67,160 occurring in men and 59,910 in women. Contrast media is essential for diagnosing lung cancer as it improves the detection of abnormalities in lung tissue during imaging procedures.

Improved imaging aids in evaluating lymph nodes for potential cancer spread by highlighting abnormal nodes that exhibit increased contrast agents absorption. Thus, the market is significantly influenced by the growing cases of lung cancer cases in U.S.

Key Companies & Market Share Insights

Some of the key players operating in the market include Bayer AG; Bracco GE HealthCare; and Guerbet

-

Bayer AG is a publicly held company founded in 1863. is actively involved in exploring, creating, producing, and bringing to market a range of products that cater to both human health and agriculture. The company is dedicated to offering medications addressing cardiovascular diseases, women's health issues, cancer, hematology, ophthalmology, and various other health conditions.

-

Bracco designs and manufactures diagnostic imaging solutions to improve the effectiveness of diagnostics, ensure patient safety, and achieve cost-effectiveness. The product portfolio includes agents, procedures, and devices, reinforced by data to guarantee the safety and effectiveness of patient care. This helps healthcare organizations enhance their overall patient care services.

Nano Therapeutics Pvt. Ltd., IMAX Diagnostic Imaging are some of the emerging market participants in the market.

-

Nano Therapeutics Pvt. Ltd. is a medical equipment manufacturing company. The company is dedicated to offering products for the cardiovascular sector. It also manufactures contrast media and vascular medical devices.

-

IMAX Diagnostic Imaging manufactures generic drugs, active pharmaceutical ingredients, and various drug products.

Key U.S. Cancer Contrast Media Companies:

- Bayer AG

- Bracco

- Guerbet

- Lantheus

- Cardinal Health

- Telix Pharmaceuticals Limited

- GE HealthCare

- Nano Therapeutics Pvt. Ltd.

- IMAX Diagnostic Imaging

Recent Developments

-

In November 2023, the American Cancer Society expanded its Get Screened program to boost rates of lung cancer screening. In order to accomplish this goal, the organization collaborated with local health systems and ensure that information about cancer screenings is distributed effectively, prioritizing a proper, safe, and equitable approach.

-

In September 2023 , Koninklijke Philips N.V. introduced a cutting-edge ultrasound application CEUS (Contrast-Enhanced Ultrasound), aimed at enhancing diagnostic reliability for individuals with cancer. This innovative technique uses micro-bubble contrast agents instead of the usual iodinated ones. These tiny bubbles, generated by a non-reactive gas exhaled by the patient, significantly enhance the clarity of the images. The company rolled out an innovative imaging technology named Microvascular Imaging Super Resolution Contrast-Enhanced Ultrasound (CEUS) on the EPIQ Elite system. This advancement showcased an impressive 200% improvement in spatial resolution when compared to its earlier versions.

-

In May 2023 , Guerbet revealed that Elucirem (gadopiclenol) was categorized as a Group II agent by the ACR Committee on Drugs and Contrast Media, based on the most recent scientific and clinical findings. This cutting-edge GBCA by Guerbet belongs to the advanced generation, boasting a remarkably stable macrocyclic gadolinium-based contrast agent (GBCA) with the highest relaxivity in its class for magnetic resonance imaging (MRI). Its approval for usage extends to both adults and children aged 2 years and older. Notably, Elucirem necessitates only half the gadolinium dose compared to conventional non-specific GBCAs, effectively addressing practitioners' concerns regarding gadolinium exposure.

-

In December 2022 , On Target Laboratories, Inc. revealed that the U.S. FDA approved the extended usage of CYTALUX in the treatment of lung cancer. CYTALUX, recognized as the pioneering targeted molecular imaging agent, uniquely lights up both lung and ovarian cancer during surgery, facilitating the identification and removal of a greater extent of cancerous tissue. This expanded approval empowered surgeons to seamlessly incorporate CYTALUX into their treatment strategies for adult patients diagnosed with or suspected of having lung cancer, broadening its application from its previous approval solely for adults with ovarian cancer.

-

In September 2022, Guerbet announced that the U.S. FDA has granted approval to Elucirem (Gadopiclenol) following a priority review. This innovative gadolinium-based contrast agent (GBCA) could be used in contrast-enhanced magnetic resonance imaging (MRI).

U.S. Cancer Contrast Media Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 787.38 million |

|

Revenue forecast in 2030 |

USD 1.53 billion |

|

Growth Rate |

CAGR of 11.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, modality, application |

|

Key companies profiled |

Bayer AG; Bracco; Guerbet; Trivitron Healthcare; Lantheus; Cardinal Health; Telix Pharmaceuticals Limited; GE HealthCare; Nano Therapeutics Pvt. Ltd.; IMAX Diagnostic Imaging |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S, Cancer Contrast Media Market Report Segmentation

This report forecasts revenue growth that provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cancer contrast media market report based on type, modality, and application.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gadolinium-based Contrast Media

-

Iodinated Contrast Media

-

Radioactive Agents

-

Others

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Nuclear Imaging

-

CT scans

-

Mammography

-

MRI scans

-

Ultrasound

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Lung Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Bladder Cancer

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cancer contrast media market size was estimated at USD 708.07 million in 2023 and is expected to reach USD 787.38 million in 2024.

b. The U.S. cancer contrast media market is expected to grow at a compound annual growth rate of 11.7% from 2024 to 2030 to reach USD 1.53 billion by 2030.

b. Iodinated contrast media segment dominated the U.S. cancer contrast media market with a share of 39.54% in 2023. The use of iodine-based contrast media significantly enhances the quality of CT and X-ray images, facilitating the clear visualization of the gastrointestinal tract, internal organs, arteries and veins, soft tissues, and the brain. Also, all the radiological examinations involving injected contrast utilize iodinated contrast media. Such factors propel the segment's growth.

b. Market players operating in U.S. cancer contrast media market include Bayer AG, Brocco, Guerbet, Trivitron Healthcare, Lantheus, Cardinal Health, Telix Pharmaceuticals Limited, GE HealthCare, Nano Therapeutics Pvt. Ltd., IMAX Diagnostic Imaging.

b. The increasing collaboration and partnerships among key market players, coupled with growing government and private sector R&D investments, alongside the integration of AI in diagnostic imaging enhances the capabilities of contrast media. Thus, these factors collectively propel the growth of U.S. cancer contrast media market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."