- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Camping And Hiking Gear Market, Industry Report 2030GVR Report cover

![U.S. Camping And Hiking Gear Market Size, Share & Trends Report]()

U.S. Camping And Hiking Gear Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Tents & Shelters, Sleeping Bags/ Airbeds), By Price Range, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-314-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Camping & Hiking Gear Market Trends

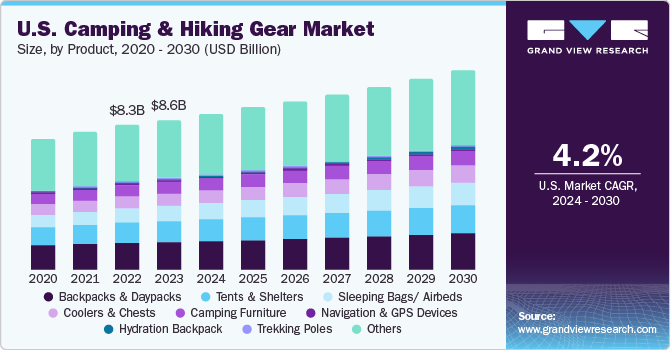

The U.S. camping and hiking gear market size was estimated to be USD 8.61 billion in 2024 and is expected to grow at a CAGR of 4.2% from 2024 to 2030. U.S. The market is primarily driven by a combination of lifestyle trends, increasing interest in outdoor activities, and a growing awareness of health and wellness. In recent years, there has been a significant rise in consumer preference for a more active and nature-oriented lifestyle. Many individuals are seeking opportunities to disconnect from the digital world, escape urban environments, and reconnect with nature. As a result, camping and hiking have become popular recreational activities, driving the demand for specialized gear and equipment.

According to the 2022 sports participation data published by the National Sporting Goods Association, the U.S. witnessed an 11.5% increase in participation in hiking in 2022, with a total of 54.4 million people participating. Furthermore, participation in camping also increased by around 7.0% in 2022, reaching an all-time high of 43.8 million participants in 2022.

The COVID-19 pandemic has played a major role in boosting the camping and hiking gear market in the U.S. Lockdowns and travel restrictions prompted people to explore nearby outdoor spaces as an alternative to traditional vacations. This surge in outdoor recreation fueled the need for quality gear and equipment, as both new and experienced outdoor enthusiasts wanted to invest in durable and reliable equipment for their adventures, driving the sales of camping & hiking gear in the U.S.

There is a growing awareness of the physical and mental health benefits associated with spending time outdoors. Camping and hiking offer opportunities for exercise, stress reduction, and relaxation, contributing to their popularity among individuals seeking to improve their overall well-being. As health and wellness trends continue to influence consumer behavior, the demand for camping and hiking gear is expected to remain strong.

Furthermore, schools, youth organizations, and outdoor education programs are increasingly incorporating camping and hiking into their curricula in the U.S. as a means of experiential learning and personal development. This trend has led to a growing market for camping and hiking gear tailored to educational and group settings.

Moreover, there is a notable rise of adventure tourism in the U.S., characterized by activities such as backpacking, mountaineering, and wilderness trekking, has fueled demand for specialized camping and hiking equipment designed for rugged and remote environments, further driving the market for camping & hiking gear in the U.S. during the forecast period.

Manufacturers are continually innovating their camping and hiking gear to meet the evolving needs and preferences of consumers. Advances in materials, design, and technology have led to the development of lighter, more durable, and more versatile gear. Features such as enhanced weather resistance, ergonomic designs, and sustainable materials appeal to consumers looking for high-performance outdoor equipment, augmenting the demand and growth of the camping & hiking gear in the U.S. during the forecast period.

Market Concentration & Characteristics

Manufacturers in the U.S. camping & hiking gear market are actively engaged in various initiatives to meet evolving consumer demands and market trends.

The market shows a high degree of innovation. The increasing demand for camping and hiking gear with advanced features and functionalities drives innovation in the market. Consumers seek lightweight yet durable gear, eco-friendly materials, and versatile products that enhance their outdoor experiences. This demand incentivizes manufacturers to invest in research and development, leading to the introduction of innovative materials, designs, and technologies. Furthermore, intense competition among brands in the camping and hiking market further encourages continuous innovation, resulting in companies striving to differentiate themselves by offering unique and innovative products.

Mergers & acquisitions are moderate in the U.S. camping & hiking gear market. The companies in the camping & hiking gear market seek to expand their market presence and diversify their product offerings through strategic acquisitions which allow companies to access new distribution channels, enter new market segments, and acquire complementary brands or technologies. Furthermore, companies in this market also engage in merger activities to diversify their brand portfolios and gain access to niche markets or specialized product categories in the camping & hiking gear market.

Product launches are high in the market. Outdoor enthusiasts are constantly seeking gear that enhances their experiences, whether through improved comfort, functionality, or sustainability. This demand for innovative products compels companies to regularly introduce new and improved products to meet evolving consumer preferences and expectations.

Furthermore, there is a moderate impact of regulations in this market. Standards set by organizations such as the Consumer Product Safety Commission (CPSC) and American National Standards Institute (ANSI) ensure that gear such as tents, stoves, and safety gear meet minimum safety requirements. Moreover, organizations such as the Outdoor Industry Association (OIA) provide guidelines and certifications for sustainability, fair labor practices, and product quality. These voluntary standards help elevate the overall market without the need for heavy-handed regulatory intervention, resulting in having moderate impact of regulations.

Furthermore, companies in the camping and hiking gear market are undergoing regional expansion. This is due to the significant rise in people going camping and hiking across the U.S. since the pandemic. As more people engage in hiking and camping, especially in areas where these activities were previously less popular, companies seek to tap into these emerging markets to cater to new enthusiasts, resulting in high regional expansion in the market.

Product Insights

Backpacks & daypacks accounted for a revenue share of 18.6% in 2023. The growing popularity of hiking & camping has significantly increased the demand for backpacks and daypacks. As more people seek to explore nature, the need for functional and comfortable gear has risen including backpacks & daypacks. Furthermore, backpacks and daypacks are fundamental for carrying essential gear such as water, food, clothing, and camping equipment. Their role as a primary storage solution makes them essential for any hiking or camping trip, which is expected to drive its demand during the forecast period.

Furthermore, manufacturers are innovating backpacks and daypacks to make them more sustainable, comfortable and functional, which is expected to drive demand during the forecast period in the U.S. For instance, in July 2022, Gregory Mountain Products, under the umbrella of Samsonite IP Holdings S.AR. L, released its latest advancements in backpacking and hiking packs for the upcoming spring 2023 season. The collection revamped the well-known Miko, Jade, Zulu, and Maya suspension systems. The Zulu and women’s Jade models featured enhanced support and comfort through redesigned suspension systems, offering dynamic carrying capabilities, improved torso adjustment mechanisms, and the utilization of recycled materials.

Hydration backpacks are expected to grow at a CAGR of 10.1% from 2024 to 2030. Hydration backpacks cater to the increasing emphasis on hydration and health among outdoor enthusiasts. With hydration being crucial for outdoor activities such as hiking and camping, these packs offer a convenient solution for carrying water and staying hydrated on the go. Furthermore, they provide hands-free access to water, allowing users to stay hydrated without having to stop and unpack water bottles. This convenience appeals to hikers during their activities which is expected to augment its growth in the U.S. during the forecast period.

Price Range Insights

Mass priced camping & hiking gear accounted for revenue share of 72.5% in 2023. Many consumers prioritize affordability when purchasing outdoor gear. Mass-priced gear appeals to a broader segment of the market, including budget-conscious individuals and families. Furthermore, mass-priced gear is often more prominently available in mainstream retail channels in the U.S. such as big-box stores, department stores, and online marketplaces. These channels attract a broader audience of consumers, leading to higher sales volume for mass-priced gear. These factors are expected to contribute to the dominance of mass priced camping & hiking gear in the U.S. during the forecast period.

On the other hand, premium priced camping & hiking gear is expected to grow at a CAGR of 5.1% from 2024 to 2030. In the U.S., there is an increasing trend among consumers prioritizing quality and durability over price, preferring premium-priced gear that offers superior performance and longevity. Premium gear often incorporates advanced materials, innovative technology, and meticulous craftsmanship, appealing to enthusiasts who value these factors. Furthermore, a strong brand preference among consumers is seen in the U.S. Premium gear is often associated with reputable brands known for their quality, innovation, and heritage in the outdoor industry. Consumers in the U.S. are willing to pay a premium for products from these brands due to their perceived value, reputation for excellence, and status symbol within the outdoor community, thereby augmenting the growth of the premium-priced segment during the forecast period.

Distribution Channel Insights

Sales through sporting/ outdoor goods retailers accounted for a revenue share of 33.8% in 2023. These retailers offer a wide range of camping and hiking gear, including specialized equipment for various outdoor activities. The wide selection caters to the diverse needs and preferences of outdoor enthusiasts, driving sales through this channel. Furthermore, these stores offer a specialized retail experience tailored to outdoor enthusiasts, with knowledgeable staff who can provide expert advice and guidance on gear selection. Moreover, many outdoor brands choose to partner with sporting/outdoor retail stores to make their products available and accessible to consumers, resulting in the availability of products from multiple prominent and emerging brands for consumers to choose from, further driving gear sales through this channel in the U.S. during the forecast period.

Sales of camping & hiking gear through online channels are expected to grow with a CAGR of 6.3% from 2024 to 2030. Online channels offer convenience, allowing customers to browse, compare, and purchase hiking and camping gear from the comfort of their homes. Furthermore, online platforms facilitate transparent pricing and easy comparison shopping, enabling consumers to quickly compare prices, features, and customer reviews across different brands and retailers.

Moreover, changing consumer preferences, particularly among younger demographics in the U.S., favor online shopping due to its convenience, flexibility, and seamless user experience. As digital natives become a larger share of the consumer market in the U.S., the preference for online channels is expected to drive high sales growth through this channel in the U.S. hiking and camping gear market during the forecast period.

Key U.S. Camping & Hiking Gear Company Insights

The U.S. camping & hiking gear market is characterized by the presence of numerous well-established players such The North Face Inc.; The Coleman Company, Inc.; Johnson Outdoors Inc.; Cascade Designs, Inc.; Osprey Packs, Inc.; and Exxel Outdoors, LLC, among others. The market players face intense competition from each other as some of them are among the top U.S. camping & hiking gear manufacturers with diverse product portfolios for U.S. camping & hiking gear. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both regional and international consumers.

Johnson Outdoors Inc. and The Coleman Company, Inc. are the prominent players operating in the U.S. camping & hiking gear market.

-

Johnson Outdoors Inc. is a prominent manufacturer and supplier of camping, hiking, and outdoor recreational equipment. The company offers a diverse product portfolio tailored to outdoor enthusiasts, including high-quality tents, sleeping bags, backpacks, stoves & systems, camping furniture and other camping accessories under its well-known brands, Eureka! and Jetboil. The company is committed to innovation and excellence in outdoor gear, ensuring its products meet the rigorous demands of outdoor adventurers. Furthermore, it leverages cutting-edge technology and materials in the production of its camping gear, which includes features like lightweight construction, weather resistance, and user-friendly designs.

-

The Coleman Company, Inc. is a prominent brand in outdoor recreation products, especially camping gear, now owned by Newell Brands. The company offers a diverse range of products designed to cater to the needs of outdoor enthusiasts of all types. Its product portfolio includes tents & shelters, sleeping gear, coolers & food storage, camp kitchen essentials, and outdoor furniture, among others. Headquartered in Wichita, Kansas, U.S., the company operates globally, with distribution channels spanning North America, Europe, Asia Pacific, and beyond. Its products are available through a network of retail partners, e-commerce platforms, and company-owned stores, ensuring broad accessibility to outdoor enthusiasts in the U.S. and worldwide.

Key U.S. Camping & Hiking Gear Companies:

- The North Face, Inc.

- Columbia Sportswear Company

- The Coleman Company, Inc.

- Johnson Outdoors Inc.

- Cascade Designs, Inc.

- Osprey Packs, Inc.

- GSI Outdoors

- Big Agnes, Inc.

- NEMO Equipment, Inc

- Exxel Outdoors, LLC

Recent Developments

-

In November 2023, Osprey Packs, Inc. collaborated with the fashion-forward running brand Satisfy to introduce the "SATISFY Osprey Talon Mineral backpack". The product has ten unique color options, utilizing natural mineral pigments, showcasing a commitment to eco-conscious production in outdoor gear. The partnership emphasizes both brands' dedication to sustainability and mindfulness.

-

In October 2023, Osprey Packs, Inc. announced the celebration of its 50th anniversary in 2024 with a wave of new products, including expansions in the Pro Series and Extended Fit lines, as well as the launch of the Talon | Tempest Velocity vest. Osprey's Pro Series offers progressive gear for outdoor professionals. The updated Aether | Ariel Pro from the Pro Series features a 75L capacity, a versatile, simplified design, and strippable components for reduced weight, while the Talon | Tempest Pro comes in three volumes with updated frame sheets, improved sizing, and a lighter, slimmer LidLock.

-

In May 2023, Johnson Outdoors Inc. launched its first plastic-free stove called Jetboil, with recycled packaging. The product is a stand-alone stove with a titanium burner. Its FluxRing technology ensures a rapid boil time of about 2.5 minutes. The Nesting design of the product makes it compact and easy to transport.

-

In May 2023, The North Face, Inc. launched new products under its Summer 2023 collection. The lineup included a camping tent crafted using lightweight materials from the STORMBREAK collection. Also introduced was the new WAWONA 8P Tunnel Tent, featuring a unique three-door design and a spacious living room separated from the main tent area by netting. The WAWONA Blanket is designed with a simple folding structure to provide protection and readiness for various weather conditions during outdoor adventures.

U.S. Camping And Hiking Gear Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 11.45 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price range, distribution channel

Country scope

U.S.

Key companies profiled

The North Face, Inc.; Columbia Sportswear Company; The Coleman Company, Inc.; Johnson Outdoors Inc.; Cascade Designs, Inc.; Osprey Packs, Inc.; GSI Outdoors; Big Agnes, Inc.; NEMO Equipment, Inc; and Exxel Outdoors, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Camping And Hiking Gear Market Report Segmentation

This report forecasts revenue growth for the U.S. and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. camping & hiking gear market report on the basis of product, price range, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tents & Shelters

-

Sleeping Bags/ Airbeds

-

Backpacks & Daypacks

-

Coolers & Chests

-

Hydration Backpack

-

Trekking Poles

-

Navigation & GPS Devices

-

Camping Furniture

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting/ Outdoor Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. camping and hiking gear market size was estimated at USD 8.61 billion in 2023 and is expected to reach USD 8.94 billion in 2024.

b. The U.S. camping and hiking gear market market is expected to grow at a compounded growth rate of 4.2% from 2024 to 2030 to reach USD 11.45 billion by 2030.

b. Backpacks & daypacks dominated the U.S. camping & hiking gear market with a share of 18.6% in 2023. The growing popularity of hiking & camping has significantly increased the demand for backpacks and daypacks. As more people seek to explore nature, the need for functional and comfortable gear has risen including backpacks & daypacks.

b. Some key players operating in the U.S. camping and hiking gear market include The North Face Inc.; The Coleman Company, Inc.; Johnson Outdoors Inc.; Cascade Designs, Inc.; Osprey Packs, Inc.; and Exxel Outdoors, LLC.

b. Key factors driving market growth include the increasing outdoor activity participation post-pandemic, technological advancements in gear, growing environmental consciousness among consumers, and health and wellness trends influencing consumer behavior.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.