U.S. Business Process Outsourcing Market Size, Share & Trends Analysis Report By Service Type (Customer Services, Finance & Accounting), By End-use (IT & Telecommunication, BFSI), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-067-1

- Number of Report Pages: 132

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

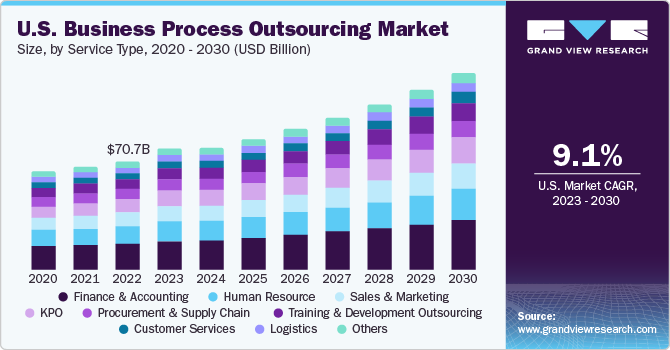

The U.S. business process outsourcing market size was valued at USD 70.66 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.1% from 2023 to 2030. The growth can be attributed to the factors such as the growing popularity of cloud computing in BPO and the growing inclination toward outsourcing, especially in industries such as BFSI, HR, and IT & telecommunication. Business Process Outsourcing (BPO) has witnessed significant changes due to the high adoption of cloud computing in the U.S. market. The delivery of BPO services has transformed mainly owing to the rising popularity of cloud computing, which provides numerous benefits to businesses. The cost-effectiveness of cloud computing is one of the main factors contributing to its increasing popularity in BPO.

Businesses can avoid sizable upfront expenditures in infrastructure, software, and hardware by using cloud-based BPO services, as cloud service providers supply and manage these resources. This enables companies to spend less on capital projects and operating costs, saving money, and improving financial flexibility. U.S.-based organizations are required to have effective back-office administration and operations. There is a growing need for improved back-office solutions due to numerous transactional operations, including application processing, order fulfillment, and collection & billing.

As a result, many businesses prefer to use cloud computing for business process outsourcing. Moreover, cloud-based BPO offers improved mobility and remote access, enabling organizations to access their BPO services and data at any time and location using any internet-connected device. This allows companies to take advantage of a distributed workforce, access global talent, and integrate smoothly across borders, improving cooperation, and efficiency.

Moreover, BPO service providers leverage online computing's capabilities to reduce the time needed to complete data-intensive business procedures. Cloud computing in BPO organizations helps enhance the data processing workflow while reducing turnaround time. The increasing popularity of the web and its high level of dependability has also made it possible to store programs in the cloud rather than in complex infrastructures prone to breakdowns.

Additionally, many industry participants are working to improve the outsourcing process by incorporating cloud computing into their portfolio of business process outsourcing services. Increasing government measures to encourage the use of cloud technology is one of the factors fueling market expansion. The government's growing investments in cloud computing-related fields are anticipated to accelerate industry expansion and increase the demand for outsourcing business processes.

Information and communication technology (ICT) developments have helped the BPO market grow. Enterprises can now outsource labor-intensive services to countries such as India and the Philippines to leverage the advantages of low labor costs and cutting-edge IT infrastructure owing to developments in ICT, along with the increasingly fragmented production processes in these regions. The growth of the IT sector in the U.S., supportive government regulations, and the growing number of IT startups are contributing to the market expansion.

Developing markets generally offer cheaper labor costs than developed economies, making them attractive for outsourcing. Businesses that outsource their processes can save money by using BPO service providers in emerging economies to offer competitive pricing to clients in the U.S. It has become simpler for BPO service providers in emerging economies to interact with customers in the U.S. and other countries owing to globalization and enhanced connectivity, including better internet infrastructure and communication networks.

The manufacturing end-use segment of the U.S. business process outsourcing market is projected to witness a significant growth rate over the forecast period. The growth of the manufacturing segment can be attributed to the benefits of outsourcing, which include cost savings, increased efficiency, better quality, flexibility, and risk management, among others.

However, there are a few disadvantages to outsourcing in the manufacturing industry, including quality control, capacity, lead time management, and contractual agreement, among others. However, the benefits overpower the concerns, which has resulted in a wide range of manufacturing industries opting for manufacturing outsourcing, thereby driving the industry’s growth.

Services Insights

The finance & accounting segment of the U.S. business process outsourcing occupied more than 20% of the revenue share in 2022. The growth can be attributed to finance & accounting outsourcing trends such as automation & AI, cloud technology, and remote work. Accounting professionals can minimize additional time by using AI and automation to automate time-consuming, manual tasks. This will allow them to focus on more valuable tasks such as analyzing data trends, building relationships with clients and other departments, and in 2021, assisting businesses with reporting compliance.

The HR segment is projected to witness a CAGR of more than 9% over the forecast period. The growth of the segment can be attributed to cost savings, reduced legal complexities, and prevent overworking of employees. Furthermore, many organizations focus on outsourcing specific human resources activities, such as recruitment, salary surveys, job evaluation, and tax administration and payroll. Moreover, top companies such as Genpact, and IBM Corporation, offering HR outsourcing services have also contributed to the wider adoption of HR outsourcing services, driving this growth.

End-use Insights

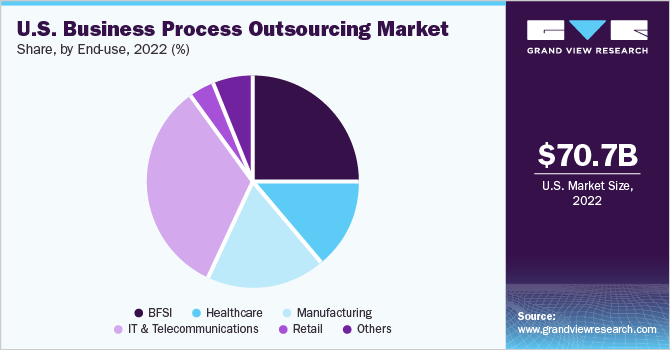

By end-use, the IT & telecommunication segment occupied the largest share in the U.S. business process outsourcing market with more than 30% in 2022. Moreover, the IT & Telecommunication segment is projected to witness a growth rate of more than 9% over the forecast period. The increase in the number of IT businesses and rapid industrialization globally are factors boosting the demand for business process services across IT and telecommunication companies. IT & telecom BPO services cater to the increasing demand for connectivity, address security issues, and innovate new offerings for the latest devices and technology standards.

Telecom companies outsource business functions, ranging from call-center outsourcing to billing operations to finance and accounting. Outsourcing enables telecom companies to reduce their capital expenses, access specialized resources, optimize current investments, create a flexible strategy for acquiring and retaining more customers, and manage cost pressures.

The BFSI segment is projected to witness the highest CAGR from 2023 to 2030. The growth of the BFSI segment can be attributed to the initiatives taken by BFSI institutions to improve their cost efficiency. BFSI institutions opt for outsourcing processes for various BFSI domains, including investment and asset management, to stay ahead in market competition.

Moreover, major financial institutions, such as JPMorgan Chase & Co., Morgan Stanley, and American Bank, N.A., along with the presence of top companies in the U.S., the business process outsourcing market, which includes Genpact, IBM Corporation, and Helpware, has also contributed to the growth of the BFSI segment.

Key Companies & Market Share Insights

The key players include Accenture,Wipro Limited,Genpact, IBM Corporation, Capgemini, and Cognizant. To broaden their product offering, industry companies utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. For instance, in September 2022, Infosys Limited announced the acquisition of BASE life science, a consulting company headquartered in Denmark. The acquisition was aimed at helping various global life sciences companies scale drug development and speed up clinical trials. The company was looking forward to leveraging the acquisition to expand its footprint in the Nordic and strengthen its foothold in the market. Some prominent players in the U.S. business process outsourcing market include:

-

Accenture

-

Capgemini

-

Cognizant

-

Concentrix Corporation

-

ExlService Holdings, Inc.

-

Genpact

-

HCL Technologies Limited

-

IBM Corporation

-

Infosys Limited

-

NCR Corporation

-

NTT DATA Corporation

-

TATA Consultancy Services Limited

-

TTEC

-

Wipro Limited

-

WNS (Holdings) Ltd.

U.S. Business Process Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 139.32 billion |

|

Growth rate |

CAGR of 9.1% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, end-use |

|

Country scope |

U.S. |

|

Key companies profiled |

Accenture; Capgemini; Cognizant; Concentrix Corporation; ExlService Holdings, Inc.; Genpact; HCL Technologies Limited; IBM Corporation; Infosys Limited; NCR Corporation; NTT DATA Corporation; TATA Consultancy Services Limited; TTEC; Wipro Limited; WNS (Holdings) Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Business Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. business process outsourcing market based on service and end-use:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance & Accounting

-

Order-to-Cash

-

Procure-to-Pay

-

Record-to-Report

-

Source-to-Pay

-

Multi Processed

-

-

HR

-

Payroll

-

HR Consulting

-

Administrative Services Organization (ASO)

-

Recruitment

-

Performance Management

-

Others

-

-

KPO

-

Procurement & Supply Chain

-

Customer Services

-

Fund Administration Business

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

IT & Telecommunications

-

Retail

-

Others

-

Frequently Asked Questions About This Report

b. Some key players operating in the U.S. business process outsourcing market include Accenture, Genpact, IBM Corporation, and Capgemini.

b. The major factors driving the growth of the U.S. business process outsourcing market include reduced costs, time optimization, better resource utilization, enhanced customer service, and better technical expertise.

b. The U.S. business process outsourcing market is expected to grow at a compound annual growth rate of 9.1% from 2023 to 2030 to reach USD 139.32 billion by 2030.

b. The U.S. business process outsourcing market size was estimated to be USD 70.66 billion in 2022 and is expected to reach USD 75.56 billion in 2023

b. The customer services segment of the U.S. business process outsourcing market holds a share of 31.64% in 2022. This is attributed to the lower cost of outsourcing customer services, a high number of English speakers across the globe, and resource & time optimization.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."