- Home

- »

- Electronic Devices

- »

-

U.S. Brushless DC Motor Market Size, Industry Report, 2030GVR Report cover

![U.S. Brushless DC Motor Market Size, Share, & Trends Report]()

U.S. Brushless DC Motor Market Size, Share, & Trends Analysis Report By Rotor Type, Power Output (Less Than 750 Watt, 750 Watt- 2.99kW, 3kW- 75 kW, Above 75kW), By Speed, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-205-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

U.S. Brushless DC Motor Market Trends

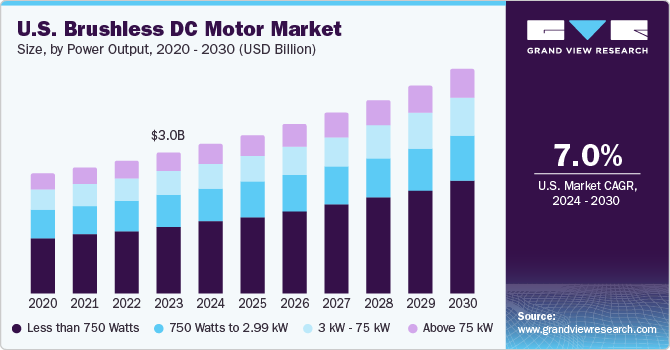

The U.S. brushless DC motor market size was estimated at USD 3.0 billion in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. In 2023, the US target market accounted for 10.75% of the global brushless DC (BLDC) motor market. The U.S. has a strong presence in industries that heavily rely on BLDC motors, such as automotive, aerospace, and industrial machinery. The U.S. is known for its technological advancements and innovation, which drives the demand for efficient and high-performance motors like BLDC motors. The abovementioned factors aid in fueling the market growth.

BLDC motors simultaneously offer optimum efficiency and reliability, which proves to be economical in majority of applications, such as sunroof actuators, air conditioners, and window lifters. The HVAC industry is heavily dependent on brushless DC motors. It is the primary component that powers blowers to move air. It drives compressors to compress refrigerants and powers pumps to move water for hot water & chilled water applications and fuel oil. Additionally, universal motors run on DC or AC and are assembled with brushless DC motors. They are extensively used in HVAC machinery & equipment and a higher output of these products helps boost the overall electric motor demand.

The increasing adoption of EVs addresses many problems, such as environmental pollution, global warming, and oil dependency. The U.S. government has initiated and implemented different policies to encourage and stimulate EV adoption and production. The advantages of BLDC motors, such as higher peak point efficiency and less rotor heat, prove critical in various applications, specifically in hybrid and EVs, which are projected to increase their adoption in hybrid vehicles over the coming years. Moreover, BLDC motors are preferred by EV manufacturers owing to their greater efficiency, high operating speed, low maintenance, and quick response.

The rising adoption of BLDC motors is restricted by several market restraints. These include the higher initial cost compared to traditional brushed DC motors, complexity of control systems requiring specialized knowledge, potential compatibility issues in retrofitting existing systems, electromagnetic interference concerns, susceptibility to supply chain disruptions for critical components, limitations in torque at low speeds, challenges in heat dissipation, need for compliance with regulatory standards, and limited power density in certain high-power applications. Addressing these constraints is essential for enhancing the broader acceptance of BLDC motors across diverse industries.

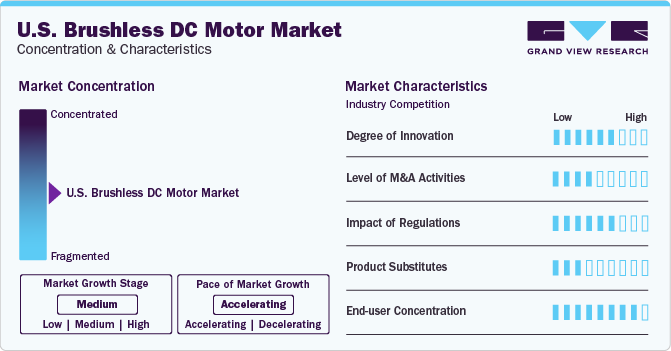

Market Concentration & Characteristics

The market growth stage is moderate and rate of growth is accelerating. The market for brushless DC motor in the U.S. is fairly fragmented. It consists of many big as well as small players that are vying for increased market share. There is a low-to-moderate degree of M&A activity seen in the U.S. market by the major players, who desire to increase their market share as well as gain access to the latest technological developments.

The degree of innovations in the market is quite high such as with the introduction of sensorless control in BLDC motors, which has allowed novel advancements in control algorithms that allow sensorless operation, without requiring any external sensors, thereby increasing its reliability and cost savings.

BLDC motors eliminate the need for brushes compared to traditional brushed DC motors, resulting in reduced friction and energy losses, thereby increasing their efficiency. This enhanced efficiency plays an important role in applications where conserving energy is vital, such as consumer electronics, industrial automation, and electric vehicles. The priority on sustainability and energy efficiency has propelled the demand for BLDC motors in these sectors.

The threat from substitutes is low in certain applications where BLDC motors are essentially required. AC motors can be a major threat due to fewer components that cause lesser wear and tear, thereby protecting the motor and ultimately increasing its life. BLDC motors have limited applicability in higher-end and complex machinery.

The BLDC motor market has high end-user concentration, which spans across several industries. The automotive sector is primarily the major consumer, with BLDC motors being the integral components in EVs and numerous automotive systems, emphasizing precise control and efficiency. Industrial automation is hugely dependent on BLDC motors for their position control and precise speed in manufacturing processes and robotics. With latest developments in cooling techniques and materials, BLDC motors can operate reliably in extreme temperatures, which further expands their applications in automotive sectors and aerospace. BLDC motors integrated with IoT have capabilities of remote control and monitoring, optimizing energy usage in smart home appliances.

Rotor Type Insights

In terms of rotor type, the market is further bifurcated into inner rotor and outer rotor segments. The inner rotor motors have the rotor located at the core, surrounded by the stator winding. At the same time, the outer rotor motors have the rotor external to the motor, with the stator on the inside. Outer rotor motors have a larger rotor diameter, allowing for more magnets and higher output power in a compact size. However, outer rotor motors have poor heat radiation properties and larger inertia, making it difficult to start and stop quickly.

Power Output Insights

In terms of revenue, the less than 750 watt segment dominated the market in 2023 with a revenue share of 47.86% and is also anticipated to grow at the fastest CAGR over the forecast period. This large share is attributed to the extensive use of the products in numerous applications, such as power tools, machine tools, domestic appliances, electric cars, pumps, compressors, HVAC applications, fans, and automated robots. The high-efficiency BLDC motors are gaining importance due to their long operating life, lower maintenance, low energy consumption, and a higher tolerance for fluctuating voltages.

Followed by the less than 750 Watt segment, the above 75 kW segment also is expected to witness significant growth from 2024 to 2030. This is due to the better performance offered, in terms of reliability and efficiency over the traditional DC motors with the same power output rating. The above 75 kW BLDC motors are used in diverse industrial applications, such as grinding, drilling, and milling, deployed in industrial machinery, such as CNC machines. Moreover, government policies regarding energy conservation and rising consumer awareness are also anticipated to fuel the market growth over the forecast period.

Speed Insights

Based on speed, the market is categorized based on the speed ranges that include less than 500 RPM, ranging from 501 to 2,000 RPM, ranging from 2,001 to 10,000 RPM, and speeds exceeding 10,000 RPM. Motors with speeds less than 500 RPM are commonly used in applications requiring low-speed operation and high torque, such as industrial machinery and power tools. The 501-2,000 RPM range has a broad range of applications in automotive systems, consumer electronics, and manufacturing equipment. Brushless BLDC motors in the 2,001-10,000 RPM range are frequently used in medical equipment, providing the necessary power and precision required in applications like gas analyzers and dental instruments. Motors with speeds exceeding 10,000 RPM are less common but have specialized applications, such as high-speed industrial machinery or specific automotive applications.

End-use Insights

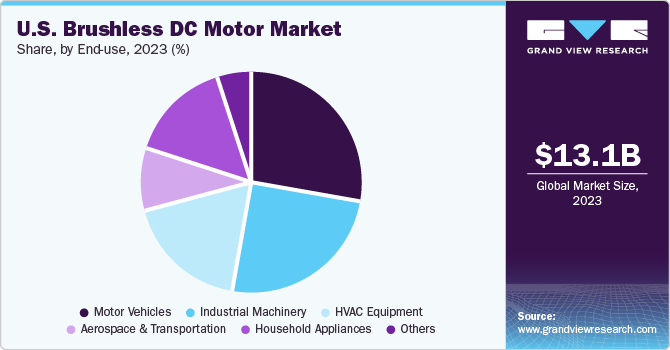

In terms of revenue, the motor vehicle segment dominated the market in 2023 with a revenue share of 27.8%. It is also anticipated to witness the fastest CAGR of 8.0% from 2024 to 2030. The automobile industry uses motors of various types and specifications for diverse applications. Brushless DC motors are preferred over conventional powertrains mainly because of the absence of brushes resulting in less friction. Reduction in friction causes less wear and tear of the brushless DC motor ultimately resulting in a reduction of maintenance required. Therefore, these motors are used in many applications in motorized vehicles.

The motor vehicle end-use segment is further sub-segmented into safety, comfort, and performance. The comfort segment held the largest revenue share in 2023 and is anticipated to witness the fastest CAGR by 2030. Comfort motors have applications primarily in mirror adjusters, sun-roof actuators, automatic window operations, air conditioning, and HVAC systems. Multiple powertrains are required for the abovementioned applications, which are subsequently expected to drive the demand for brushless DC motors in vehicles by 2030.

The industrial machinery segment held a substantial market share of more than 24% in 2023 and is anticipated to grow steadily from 2024 to 2030. This growth is attributed to the deployment of such equipment in complex industrial applications such as feeder drives, extruders, and robotics. In addition, technological advancements have resulted in increased efficiency of these motors, which is further expected to drive the market growth over the forecast period.

Key U.S. Brushless DC Motor Company Insights

Some of the key players operating in the market include ABB Ltd, and NIDEC CORPORATION, among others.

-

In October 2023, ABB strengthened its ability to meet growing demand for instrumentation in the North American market by consolidating instrumentation manufacturing under one roof in Bartlesville, Oklahoma, and expanding the Bartlesville site with a new 12,000-square-foot calibration hall.

-

In July 2023, Nidec Corporation acquired full ownership of TAR, LLC d/b/a Houma Armature Works, a privately owned US company from its founding family, through the Company’s subsidiary, Nidec Motor Corporation. As a result, Houma became a consolidated subsidiary of Nidec

Johnson Electric and TECO Corporation are some of the emerging market participants in the target market.

-

In March 2022, Johnson Electric launched the ECI-043 brushless motor platform, which aims at high torque low-speed applications and delivers a stable torque output with a high level of controllability suitable for robotic lawn mower traction, cutter, and autonomous vehicle traction systems.

-

TECO Corporation is a motor manufacturer & solution provider. The company provides home appliances, heavy electric equipment, key electronic components, information technology, financial investment, communications, dining, and infrastructural engineering. TECO Electric & Machinery Co., Ltd. has four manufacturing facilities located in Taiwan, the U.S., Malaysia, and China.

Key U.S. Brushless DC Motor Companies:

- ABB

- Ametek Inc.

- Regal Rexnord Corporation

- Johnson Electric Holdings Limited.

- NIDEC CORPORATION

- Allied Motion Technologies, Inc.

- Schneider Electric

- Siemens

- TECO Corporation

- WorldWide Electric (North American Electric, Inc.)

Recent Developments

-

In February 2024, ABB announced that it has entered into an agreement to acquire SEAM Group, a major provider of energized asset management and advisory services to clients across industrial and commercial building markets.

-

In September 2023, Schneider Electric, unveiled its new 160,000 square foot manufacturing plant in El Paso, TX. The plant is part of a $300 million U.S. manufacturing investment the company has made to support customers who will use the electrical equipment produced in it.

U.S. Brushless DC Motor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.22 billion

Revenue forecast in 2030

USD 4.83 billion

Growth Rate

CAGR of 7.0% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Rotor type, power output, speed, end-use

Country scope

U.S.

Key companies profiled

ABB; Ametek Inc.; Regal Rexnord Corporation; Johnson Electric Holdings Limited; NIDEC CORPORATION; Allied Motion Technologies, Inc.; Schneider Electric; Siemens; TECO Corporation; WorldWide Electric

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Brushless DC Motor Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. Brushless DC Motor Market report based on rotor type, power output, speed, and end-use.

-

Rotor Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Inner Rotor

-

Outer Rotor

-

-

Power Output Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 750 Watts

-

750 Watts to 2.99 kW

-

3 kW - 75 kW

-

Above 75 kW

-

-

Speed Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 500 RPM

-

501-2,000 RPM

-

2,001-10,000 RPM

-

More than 10,000 RPM

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial Machinery

-

Motor Vehicles

-

Safety

-

Comfort

-

Performance

-

-

HVAC Equipment

-

Aerospace & Transportation

-

Household Appliances

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. brushless DC motor market size was estimated at USD 3.0 billion in 2023 and is expected to reach USD 3.22 billion in 2024.

b. The U.S. brushless DC motor market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 4.83 billion by 2030.

b. The less than 750 Watts dominated the U.S.brushless DC motor market with a share of over 47.86% in 2023.

b. Some key players operating in the U.S. brushless DC motor market include ABB, Ametek Inc., Regal Rexnord Corporation, Johnson Electric Holdings Limited, and NIDEC CORPORATION.

b. Key factors driving the market growth include the increasing government regulations aimed at reducing carbon emissions and promoting energy-efficient technologies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."