- Home

- »

- Medical Devices

- »

-

U.S. Breast Pumps Market Size, Industry Report, 2030GVR Report cover

![U.S. Breast Pumps Market Size, Share & Trends Report]()

U.S. Breast Pumps Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Open System, Closed System), By Technology (Manual Pumps, Electric Pumps), By Application (Personal Use, Hospital Grade), And Segment Forecasts

- Report ID: GVR-4-68040-276-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Breast Pumps Market Size & Trends

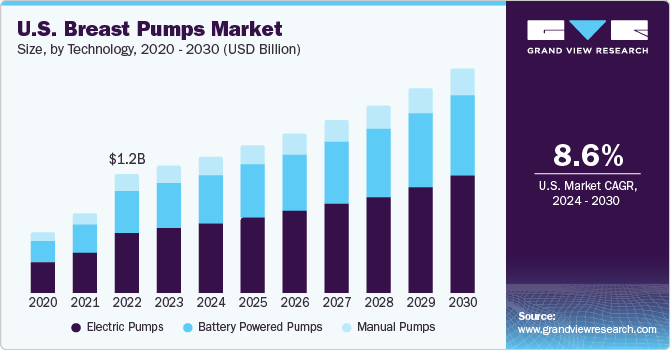

The U.S. breast pumps market size was valued at USD 1.30 billion in 2023 and is expected to register a CAGR of 8.6% from 2024 to 2030. The increasing awareness about the availability of breast pumps, growing number of employed women, and high disposable income are some of the significant factors driving the market growth.

In 2023, U.S. accounted for a market share of over 44% in the global breast pumps market. The U.S. has many nonprofit organizations such as United States Breastfeeding Committee (USBC) and Massachusetts Breastfeeding Coalition (MBC), which work to create awareness about the benefits of breastfeeding for mothers and newborns. Furthermore, the Association of State and Territorial Health Officials in collaboration with public health agencies support state health agencies to improve breastfeeding in workplace, hospitals, and the community. Various private and public companies also provide insurance coverage for breast pumps. For instance, Medela offers insurance coverage for its breast pump products. Such factors are anticipated to drive the growth of the market in the U.S.

The Affordable Care Act mandates that a mother should be provided with an electric breast pump once the baby is born. Electric pumps are the most preferred among mothers in the country, women who need to pump a lot, or moms who pump at work. Moreover, many U.S. breast pumps companies such as Medela rent hospital-grade breast pump for ample duration to mothers who cannot afford to buy a new pump. Working mothers generally prefer using electric pumps as they can easily extract more milk in lesser time. Thus, electric pumps are witnessing an upsurge in demand.

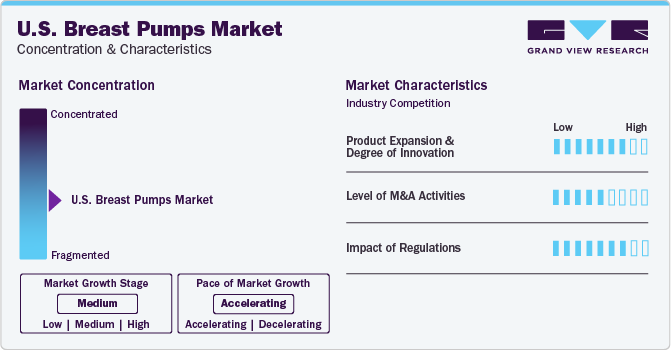

Market Characteristics & Concentration

The industry growth stage is medium (CAGR: 5-10%) and pace of the growth depicts an accelerating trend. Ongoing advancements in breast pump technology, such as the development of electric and battery-operated pumps, dual pumps for simultaneous expression, and smart pump features, have made breast pumping more convenient and efficient, driving the industry growth. Further, favorable policies and initiatives to support breastfeeding, including workplace accommodations for nursing mothers contribute to the adoption of breast pumps as a means to balance work and breastfeeding.

Key players are adapting to the shift towards user comfort through technological advancements and innovative products. Technological advancements in the breast pump industry have been continuous, with the emergence of smart and connected devices. These innovative breast pumps enable users to monitor and manage their pumping sessions via mobile apps. The prevalence of Bluetooth connectivity, data tracking capabilities, and customizable features is opportunistic for the product demand. For instance, In January 2023, Willow Innovations, Inc. launched Willow 3.0, the first breast pump companion app, for Apple Watch. The Willow 3.0 pumps have a smartwatch companion app that enables breastfeeding parents to easily track, control, and view their pumping sessions.

The U.S. breast pumps industry has witnessed a significant surge in merger and acquisition activities by leading players in recent years. As the industry continues to grow rapidly, companies are increasingly focusing on enhancing their product portfolios and consolidating their market positions. To achieve this, several players in the country are adopting this strategy to strengthen their portfolios. An excellent example of this is the partnership between Madela AG and Sarah Wells in February 2023, which introduced the Allie sling bag to Madela's Freestyle Hands-free Breast Pump portfolio for breastfeeding parents.

In addition to the surge in M&A activities, several legislations have been put in place to support working mothers in the U.S. These include the Fair Labor Standards Act of 1938 and the Employment Standards Act, 2000, which entitle working mothers to breaks to express (pump) breast milk for their babies. Furthermore, Medicaid covers most types of breast pumps, including electric and manual, under its insurance policies, which is expected to boost the sales of these products in the country.

Product Insights

In 2023, the closed system segment dominated the breast pump market with a revenue share of 66% and is expected to grow at the fastest CAGR during the forecast period. Closed breast pumps are rapidly replacing open systems due to their higher usage rates and more hygiene and contamination-free nature.

These systems have a protective layer that acts as a barrier between the collection kit and the pumping unit or motor, preventing the contamination of collected milk. They are easy to clean and provide better safety for a child's health, ensuring maximum removal of impurities. The introduction of portable instruments such as Ameda HygieniKit is expected to further drive the market's growth over the upcoming years.

Technology Insights

The global market for electric breast pumps is rapidly expanding, with a high demand from working mothers who prefer the convenience of these pumps. In 2023, the electric pumps segment accounted for the largest share of 50.6% and is expected to continue witnessing the fastest growth rate during the forecast period.

This is largely due to the double pumping model, which allows mothers to extract more milk in a shorter time, making it a popular choice. Although electric pumps can be quite heavy and noisy, manufacturers are using advanced technology to create lighter pumps with reduced noise. Some of the significant brands in this segment include the Purely Yours Ultra Breast Pump by Ameda AG and the Isis iQ Duo Breast Pump by Philips AVENT.

Additionally, electric breast pumps are also available for rent for mothers who cannot afford to buy a new pump and require them for short durations. With the introduction of portable instruments such as the Platinum electric breast pump by Ameda and Electric swing breast pumps by Medela, the market is expected to grow significantly in the next few years. These technological advancements are making electric breast pumps more accessible and convenient for mothers, further boosting the overall market growth.

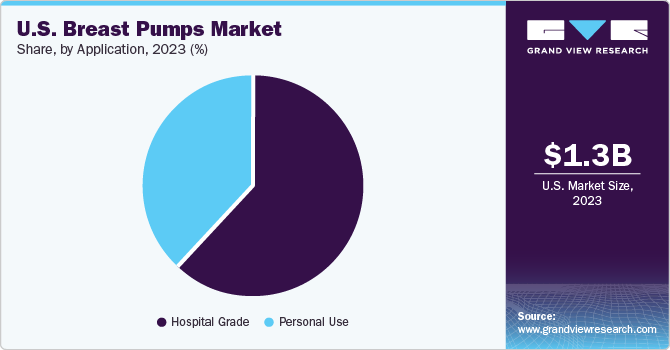

Application Insights

According to industry experts, the hospital-grade segment has emerged as one of the most promising segments in the breast pump market with the largest revenue share of 61.2% in 2023 and is projected to continue its growth trajectory in the coming years. The increasing demand for hospital-grade breast pumps can be attributed to their high-power motors and closed system operation. These pumps are usually used in hospital settings, but they can also be rented for personal use. The closed system operation of these pumps ensures less contamination and enhances safety for multiple users, which is a major factor contributing to their popularity and growth.

Breastfeeding is an important aspect of a newborn's health. However, some mothers may require assistance with producing enough milk for their baby. In such cases, hospital grade breast pumps can be a game-changer. These pumps are designed to cater to the needs of mothers who require a more powerful and efficient pump, with stronger suction and faster cycles. Additionally, they are also suitable for mothers whose babies have difficulty latching and nursing. With the increased awareness about the benefits of breast milk and the importance of breastfeeding, the demand for hospital-grade breast pumps is expected to grow significantly in the coming years.

Key U.S. Breast Pumps Company Insights

The industry is moderately fragmented with a majority of mid- and small-sized companies. Mergers & acquisitions are one of the key strategies adopted by most of the players to strenghten their position. For instance, in January 2023, International Biomedical announced the acquisition of Ameda, Inc. With the help of this purchase, International Biomedical expanded its product offerings to support the nutritional needs of critically ill infants.

Key U.S. Breast Pumps Companies:

- Ameda (Magento, Inc.)

- Hygeia Health

- Medela AG

- Koninklijke Philips N.V.

- Lansinoh Laboratories, Inc.

- Pigeon Corporation

- Motif Medical

- Chiaro Technology Limited (Elvie)

- Willow Innovations, Inc.

- Spectra Baby USA

Recent Developments

-

In January 2024, Annabella announced its seed funding of USD 8.5 million and its entrance into the U.S. market. Annabella has sold approximately 4,000 breast pumps in Israel since February 2023. This expansion demonstrates Annabella's product excellence, illustrated by its patented, FDA-cleared breast pump, which provides mothers with a product comparable to breastfeeding while emphasizing efficiency and comfort.

-

In November 2023, Pigeon unveiled the launch of GoMini Plus, the company’s second-generation of GoMini Electric Breast Pump.

-

In August 2023, Lansinoh introduced the Lansinoh Wearable Pump as part of their commitment to ‘Stand with the Mothers’, offering support to new moms and simplify their journey with advanced products.

-

In February 2023, Madela AG entered into a strategic partnership with Sarah Wells to add the Allie sling bag to Madela’s Freestyle Hands-free Breast Pump portfolio for breastfeeding parents.

U.S. Breast Pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.40 billion

Revenue forecast in 2030

USD 2.30 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application

Country scope

U.S.

Key companies profiled

Ameda (Magento, Inc.); Hygeia Health; Medela AG; Koninklijke Philips N.V.; Lansinoh Laboratories, Inc.; Pigeon Corporation; Motif Medical; Chiaro Technology Limited (Elvie); Willow Innovations, Inc.; Spectra Baby USA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Breast Pumps Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. breast pumps market based on product, technology, and application:

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Open System

-

Closed System

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Pumps

-

Battery Powered Pumps

-

Electric Pumps

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Use

-

Hospital Grade

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.