- Home

- »

- Consumer F&B

- »

-

U.S. Bottled Water Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Bottled Water Market Size, Share & Trends Report]()

U.S. Bottled Water Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Spring Water, Sparkling Water), By Distribution Channel (On-Trade, Off-Trade), By Packaging, And Segment Forecasts

- Report ID: GVR-4-68040-228-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bottled Water Market Size & Trends

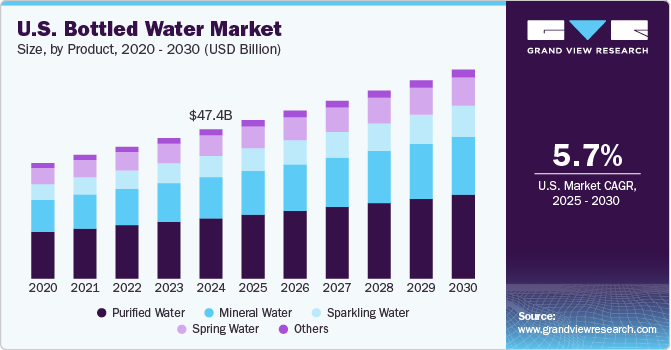

The U.S. bottled water market size was estimated at USD 47.42 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. This can be attributed to increasing health and wellness trends among consumers, the rising need for convenience and accessibility, and robust production innovation. The growing demand and consumption of bottled water can largely be attributed to increasing health consciousness among consumers. With rising awareness about the harmful effects of sugary beverages, such as sodas and juices, people are shifting towards healthier hydration options.

Bottled water is viewed as a simple and effective way to stay hydrated without the added sugars, calories, or artificial ingredients associated with other drinks. As more individuals prioritize wellness and hydration in their daily lives, bottled water has become a go-to choice, especially for those with active and health-conscious lifestyles.

Convenience also plays a crucial role in the rising demand for bottled water. It offers unmatched portability, making it easy for consumers to stay hydrated while on the go. Bottled water is readily available in grocery stores, convenience shops, and vending machines, which enhances its appeal as a staple beverage choice. This accessibility has solidified bottled water's position as one of the most popular beverage categories in the country.

Marketing strategies have further contributed to the growth of the bottled water industry. Companies have successfully created strong brand loyalty through campaigns that emphasize the purity and safety of bottled water compared to tap water. In some regions, concerns about tap water quality have bolstered consumer preference for bottled options, positioning them as a reliable source of hydration. Innovations in product offerings have also played a significant role in market expansion. The emergence of functional bottled waters-enhanced with vitamins, minerals, or flavor infusions-has attracted health-oriented consumers looking for added benefits beyond basic hydration. This segment is expected to grow substantially in the coming years, driven by consumer demand for beverages that provide health advantages. In addition, advancements in eco-friendly packaging are addressing environmental concerns while appealing to sustainability-minded consumers.

A notable factor propelling the growth of the bottled water industry is robust production innovation. This involves the introduction of enhanced manufacturing processes and the development of new product variants to meet diverse consumer demands and preferences. Innovations in packaging, such as eco-friendly materials and convenient designs, along with advancements in water purification and flavor infusion technologies, have significantly contributed to making bottled water more attractive to consumers. These innovative efforts not only aim to improve product quality and sustainability but also seek to differentiate offerings in a highly competitive market, thus driving consumer interest and market growth. For instance, in March 2023, an India-based startup developed an innovative technology that allows for the extraction of drinking water from the atmosphere. This breakthrough is particularly significant in regions facing water scarcity, as it provides a sustainable and renewable source of clean water. The technology employs a combination of cooling and dehumidification processes. The air is drawn into the system and cooled below its dew point, causing moisture to condense. The collected water is then filtered and mineralized to ensure it meets safety standards for drinking.

Product Insights

Purified water accounted for a revenue share of 40.4% in 2024 in the U.S. market. Purified bottled water offers a convenient, portable hydration option, especially for people on the go, making it easy to access clean water anytime and anywhere. The increasing focus on personal health and wellness has led to a growing preference for purified water, which is perceived as a cleaner, more beneficial option compared to tap or other types of bottled water. Health-conscious consumers view purified water as free of impurities like chemicals, heavy metals, and bacteria, aligning with their desire for healthier hydration choices.

The sparkling bottled water segment is expected to grow at a CAGR of 6.5% from 2025 to 2030. As consumers become more willing to spend on premium and artisanal products, sparkling water brands that offer unique flavors and high-quality sourcing appeal to this growing market. Many people are shifting away from sugary sodas and other high-calorie beverages, seeking healthier alternatives. Sparkling water offers a refreshing, calorie-free option without added sugars or artificial ingredients. With the increasing emphasis on eco-friendly packaging, brands that offer sustainable bottles or reusable options are attracting environment-conscious consumers. This aligns with the wider trend of reducing plastic waste.

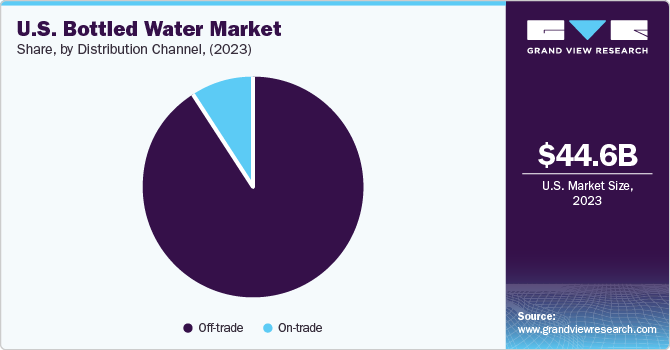

Distribution Channel Insights

Sales through off-trade accounted for a revenue share of 91.2% in 2024 in the U.S. market, owing to the comprehensive array of options these off-trade outlets offer, which appeals greatly to consumers. The availability of diverse brands and types of bottled water, coupled with the convenience of comparing products on the spot, makes off-trade channels such as hypermarkets, supermarkets, convenience stores, mini markets, and traditional stores highly attractive to consumers. Moreover, these retail outlets benefit from well-established supply chains and efficient distribution models, ensuring consistent product availability. This operational efficiency not only draws in a wider customer demographic but also solidifies the market share of the off-trade distribution channel. For instance, in March 2024, Greene Concepts announced plans to ship its BE WATER 6-packs to a Walmart distribution center, aiming for placement on store shelves. This strategic move is part of the company’s efforts to expand its market presence and increase product availability through one of the largest retail chains in the U.S.

Sales of bottled water through on-trade channels are expected to grow at a CAGR of 5.8% from 2025 to 2030 in the U.S. market due to the increasing health consciousness among consumers, a growing preference for convenient and portable hydration options, and the rising trend of premium bottled water offerings in restaurants and cafes. In addition, the expansion of food service establishments and the integration of bottled water into dining experiences are further propelling the industry's growth. As consumers seek healthier beverage alternatives, the demand for bottled water in on-trade settings continues to rise. For instance, in July 2024, Chipotle introduced a new lineup of ready-to-drink beverages available at all of its U.S. restaurants. This includes Open Water, which is canned water in aluminum bottles.

Packaging Insights

PET bottled water accounted for a revenue share of 80.1% in 2024, owing to its significant advantages in convenience, recyclability, and lightweight nature compared to other packaging materials. The widespread preference for PET bottles among consumers stems from their ease of transport and use, alongside a growing awareness and concern for environmental sustainability. PET bottles, being fully recyclable, align with increasing global initiatives towards reducing plastic waste and promoting circular economies. Furthermore, the lightweight characteristics of PET bottles reduce transportation costs and carbon footprint, making them a favored choice among manufacturers and consumers alike, thus driving their market growth.

In October 2023, Coca-Cola India launched its first 100% recycled polyethylene terephthalate (PET) bottle, specifically for its Kinley packaged drinking water brand. This initiative marks a significant step towards promoting sustainability and plastic circularity in the country. The company introduced these bottles as part of its broader commitment to environmental responsibility and aims to reduce its carbon footprint.

The canned bottled water segment is expected to grow at a CAGR of 7.0% from 2025 to 2030. This can be primarily attributed to increasing consumer awareness towards environmental sustainability. It can offer an eco-friendlier alternative to plastic bottles due to their higher recyclability rate and efficiency in transportation, which contributes to lower carbon emissions. In addition, the convenience and durability of cans appeal to active and on-the-go lifestyles, making them a popular choice among consumers. As a result, both beverage companies and consumers are shifting towards canned water, driving significant growth in this market segment. For instance, in April 2024, Coca-Cola’s Smartwater brand unveiled 12-ounce aluminum cans with a new design, marking the first instance of vapor-distilled water being offered in this packaging format. The cans feature both Smartwater Original and SmartWater Alkaline with Antioxidant, catering to consumer preferences for convenient and environmentally friendly options.

Key U.S. Bottled Water Company Insights

The U.S. market for bottled water is characterized by numerous well-established and emerging players. Manufacturers in the bottled water industry are engaging in a variety of strategic initiatives to keep pace with evolving consumer demand and market trends.

Key U.S. Bottled Water Companies:

- Adidas AG

- Nestlé

- PepsiCo

- The Coca-Cola Company

- DANONE

- Primo Water Corporation

- FIJI Water Company LLC

- Gerolsteiner Brunnen GmbH & Co. KG

- VOSS WATER

- Nongfu Spring

- National Beverage Corp.

- Keurig Dr Pepper Inc.

Recent Developments

-

In July 2024, Source, a company based in Scottsdale, Arizona, unveiled a groundbreaking method to tackle the water crisis by generating canned water using air and sunlight. This initiative is part of the increasing trend towards sustainable technologies that aim to resolve environmental challenges while ensuring access to vital resources. The product will be branded as Sky Wtr and is designed to offer an off-grid solution for producing drinking water. Source intends to launch this water for public sale across the U.S. in major retail outlets around August or September 2024. The canned drinking water will be packaged in recyclable aluminum cans and bottles.

-

In February 2024, Gatorade announced the launch of its first unflavored water product, Gatorade Water, in the U.S., marking a significant expansion into the bottled water category. This move is part of Gatorade’s strategy to diversify its offerings beyond traditional sports drinks and tap into the growing market for functional beverages. Gatorade Water is available nationwide across various retail platforms as well as on Amazon, and Gatorade.com.

U.S. Bottled Water Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 50.34 billion

Revenue forecast in 2030

USD 66.41 billion

Growth rate (Revenue)

CAGR of 5.7% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/ billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, packaging

Country scope

U.S.

Key companies profiled

Nestlé; PepsiCo; The Coca-Cola Company; DANONE; Primo Water Corporation; FIJI Water Company LLC; Gerolsteiner Brunnen GmbH & Co. KG; VOSS WATER; Nongfu Spring; National Beverage Corp.; Keurig Dr Pepper Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bottled Water Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bottled water market report based on product, distribution channel, and packaging:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Spring Water

-

Purified Water

-

Mineral Water

-

Sparkling Water

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Others

-

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

PET

-

Cans

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. bottled water market size was estimated at USD 47.42 million in 2024 and is expected to reach USD 50.34 million in 2025.

b. The U.S. bottled water market is expected to grow at a compounded growth rate of 5.7% from 2025 to 2030 to reach USD 66.41 billion by 2030.

b. Sparkling bottled water is expected to growth with a CAGR of 6.5% from 2025 to 2030. The broad range of flavors and customization options in sparkling water has made it more appealing to consumers who enjoy variety in their beverages, contributing to its growing popularity.

b. Some key players operating in U.S. bottled water market include Givaudan, Urban Platter, Ajinomoto Co. Inc., Kerry Group plc, Sensient Technologies Corporation, Symega, and others.

b. Key factors that are driving the market growth include rising umami flavor consumption and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.