Market Size & Trends

The U.S. bone grafts and substitutes market size was estimated at USD 948.1 million in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. The increasing prevalence of bone-related conditions, such as fractures, degenerative disc disease, and spinal disorders, has fueled the demand for bone grafts and substitutes. As the number of people experiencing bone-related issues increases, the market is expected to continue its growth. Innovations in synthetic substitutes and biological grafts have led to better patient outcomes, driving adoption in orthopedic surgeries.

Patients and healthcare providers increasingly favor minimally invasive procedures due to shorter recovery times, reduced complications, and improved patient comfort. Bone grafts and substitutes play a crucial role in these less invasive approaches. The aging population worldwide contributes to the rising demand for bone graft alternatives. As people get older, they become more vulnerable to bone degeneration, osteoporosis, and fractures, leading to a higher demand for effective bone grafting solutions.

The U.S. market accounted for 32.1% of the revenue share of the global bone grafts and substitutes market in 2023. The bone graft substitutes are classified as medical devices. Hence, they need to undergo rigorous regulatory approval processes before introduction to the market. These processes can be costly and time-consuming, which in turn limit the introduction of new products and hamper market growth. However, regulatory authorities' approvals also play a crucial role in driving market growth. For instance, in May 2023, Locate Bio's LDGraft, a device under development for treating degenerative disc disease (DDD), received the Breakthrough Device designation from the U.S. Food and Drug Administration (FDA). Favorable regulatory environments coupled with industry-driven innovation in bioactivity, biocompatibility, and mechanical properties have further propelled market growth.

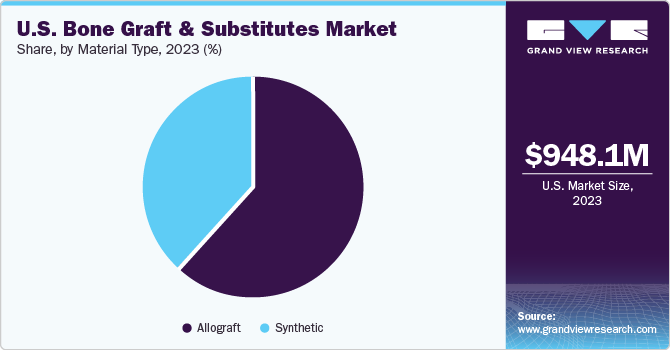

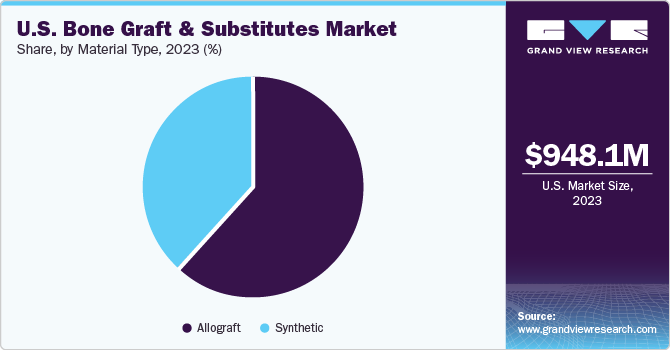

Material Type Insights

Allografts led the market, capturing a 61.6% revenue share in 2023. This dominance likely stems from the familiarity and inherent biocompatibility that allografts offer surgeons. Derived from human tissues, allografts closely resemble natural bone structure, promoting osteoconductivity (bone formation on the graft's surface) and potentially leading to faster integration. In addition, the abundant availability of allografts through tissue banks further strengthens their position in the market.

The synthetic bone grafts segment is anticipated to grow at the fastest CAGR of 7.4% from 2024 to 2030. This rapid rise can be attributed to advancements in material science. New-generation synthetic materials are increasingly biocompatible and osteoconductive, mimicking the properties of natural bone. Moreover, synthetics offer distinct advantages over allografts, such as a minimized risk of disease transmission and a limitless supply independent of donor availability. These factors are likely driving the strong growth trajectory for synthetic bone grafts within the U.S. market.

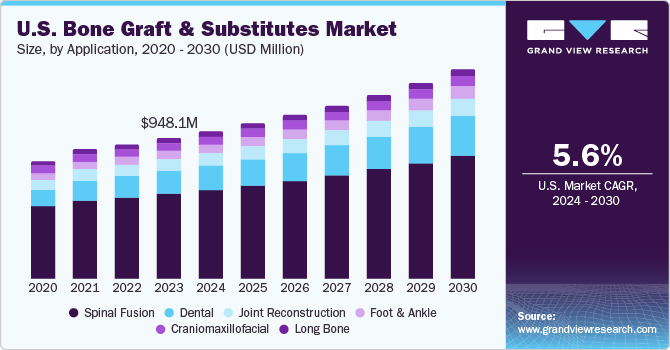

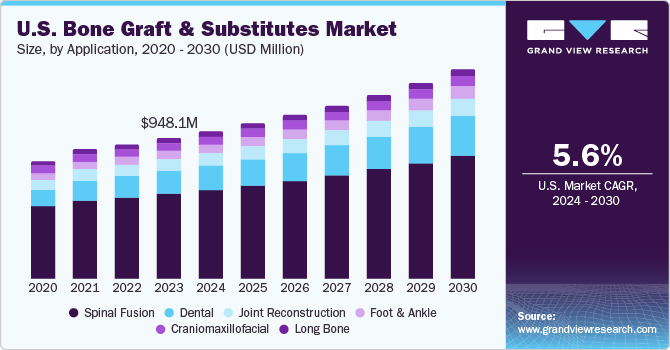

Application Insights

The spinal fusion segment dominated the market, capturing 60.6% of revenue in 2023. This segment thrives due to the rising prevalence of spinal conditions such as degenerative disc disease and spondylolisthesis. These disorders necessitate spinal fusion surgeries to achieve stabilization and alleviate pain. As the aging population in the U.S. continues to grow, the incidence rate of these spinal issues is expected to grow, solidifying the demand for bone graft substitutes in spinal fusion procedures.

Dental applications, on the other hand, are projected to grow at a CAGR of 8.7% between 2024 and 2030. This surge is attributed to the burgeoning demand for dental implants and alveolar ridge augmentation procedures. These procedures enhance both the aesthetics and functionality of smiles, fueling the need for bone grafting materials in dentistry. The growing emphasis on cosmetic dentistry and rising disposable incomes are expected to propel the segment expansion further.

Key U.S. Bone Grafts And Substitutes Company Insights

The industry encompasses a variety of business operators, both large and small scale. It is characterized by intense competition and predominantly led by major players such as Orthofix, Stryker, Nuvasive, and Medtronic.

Some key players operating in the U.S. bone grafts and substitutes industry are:

-

Medtronic, headquartered in Ireland, is a medical technology company that offers a wide range of bone graft products, including autografts, allografts, and synthetic substitutes.

-

Zimmer Biomet Holdings, Inc., based in the U.S., is a key player in the bone grafts and orthopedic space. The company provides a comprehensive portfolio of bone graft materials, such as demineralized bone matrix (DBM), ceramic-based substitutes, and collagen-based products.

Key U.S. Bone Grafts And Substitutes Companies:

- Bioventus

- Medtronic

- NuVasive

- Osiris Therapeutics

- Stryker

- Zimmer Biomet

- BioHorizons

- Collagen Matrix

- Maxigen Biotech

- Osteogenics Biomedical

Recent Developments

-

In November 2023, Smith+Nephew completed the acquisition of CartiHeal, the developer of the Agili-C implant. The acquisition deal was valued at up to USD 330 million.

-

In October 2023, Orthofix Medical Inc. received 510(k) clearance from the FDA for its novel bioactive synthetic bone graft, OsteoCove. This graft is designed to deliver superior bone formation capabilities, expanding Orthofix's biologics portfolio and addressing a significant need within the market.

-

In September 2023, Globus Medical finalized its acquisition of NuVasive. This merger creates a leading musculoskeletal company with a comprehensive portfolio of solutions and enabling technologies designed to improve patient care across the continuum.

U.S. Bone Grafts And Substitutes Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 1.4 billion

|

|

Growth rate

|

CAGR of 5.6% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Material type, application

|

|

Key companies profiled

|

Bioventus; Medtronic; NuVasive; Osiris Therapeutics; Stryker; Zimmer Biomet; BioHorizons; Collagen Matrix; Maxigen Biotech; Osteogenics Biomedical

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Bone Grafts And Substitutes Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bone grafts and substitutes market report based on material type and application:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Craniomaxillofacial

-

Dental

-

Foot & Ankle

-

Joint Reconstruction

-

Long Bone

-

Spinal Fusion