U.S. Blood Pressure Monitoring Devices Market Size, Share & Trends Analysis Report By Product, By End-user, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-224-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

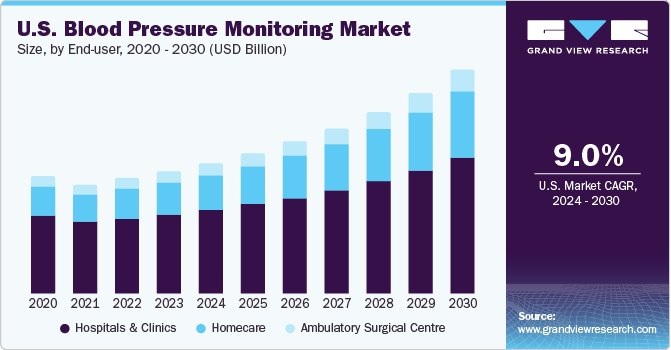

The U.S. Blood Pressure Monitoring Devices market size was estimated at USD 1.64 billion in 2023 and is estimated to grow at a CAGR of 9.0% from 2024 to 2030. The market's growth is primarily driven by technological advancements in blood pressure monitors, the increased prevalence of hypertension, and the rising geriatric population.

The increasing number of elderly individuals worldwide has led to a significant rise in the demand for Blood Pressure Monitoring Devices. According to the United Nations, the number of people aged 65 years and above is projected to double to 1.5 billion by 2050. This has made the development of innovative, user-friendly, and affordable devices for measuring blood pressure a top priority for manufacturers. In the United States, hypertension is prevalent in a significant number of people, leading to heart failure and stroke. As per CDC statistics, 119.1 million people in the country have hypertension, creating a massive demand for Blood Pressure Monitoring Devices. Manufacturers continually develop new technologies, such as digital sphygmomanometers, to cater to the market's needs. To address the high prevalence of hypertension among Americans, the Centers for Medicare & Medicaid Services have expanded reimbursement coverage for Ambulatory Blood Pressure Monitoring Devices(ABPM) devices. Currently, ABPM is covered for patients who have in-office blood pressure readings exceed 140/90 mm Hg on three separate visits. ABPM must be conducted for 24 hours to qualify for reimbursement under Medicare coverage.

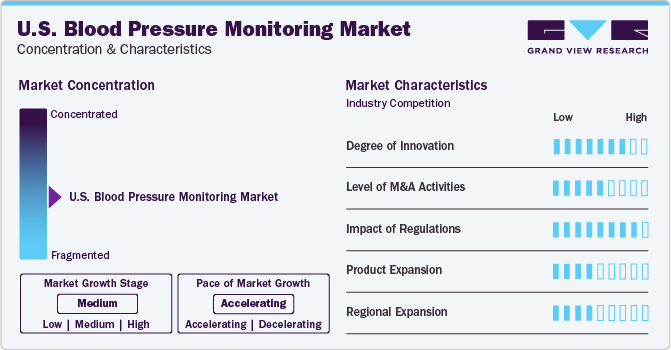

Market Concentration & Characteristics

The U.S. Blood Pressure Monitoring Devicesindustry is moderately fragmented. The industry is characterized by intense competition, with major companies focusing on innovation and technology advancements to strengthen their market presence.

The industry witnesses significant new product developments. For instance, in January 2022, OMRON Healthcare, Inc. introduced its new remote patient monitoring services at the 2022 Consumer Electronics Show. It connected blood pressure monitors and an advanced mobile app to expand its digital health services.

Acquiring other players in this industry is a strategic move that allows companies to enhance their industry position by boosting their capabilities, expanding product offerings, and strengthening competencies. For instance, in September 2021, SunTech Medical, Inc. announced an acquisition of all shares of Meditech Kft. The acquisition is likely to enhance expert blood pressure knowledge to bring customers better BP solutions.

Regulation bodies such as the US FDA impact the approvals of blood pressure monitors and further support the innovation and product expansion strategies undertaken by key industry players. For instance, in November 2023, the US FDA approved a Symplicity Spyral renal denervation system for the treatment of hypertension.

Several key companies are focusing on regional expansion initiatives to expand their geographic exposure and fulfill the needs of consumers in that region. For instance, In January 2022, Aktiia announced the launch of a 24/7 blood pressure monitor in the U.S. This novel innovative wearable would help healthcare personnel and patients.

Product Insights

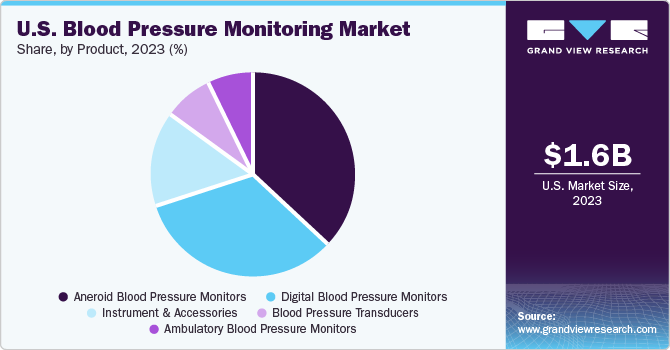

In 2023, aneroid blood pressure monitors dominated the market with a 36.0% share. The multifaceted applications of aneroid blood monitors, including easy accessibility, transport, and usage, are driving the growth of this segment. Another advantage of aneroid blood monitors is that they don't contain mercury, making them lightweight and portable. The higher preference for aneroid blood pressure in hospitals across the US is likely to boost the market growth even further. The digital blood pressure monitors segment is projected to grow at the fastest CAGR of 11.5% from 2024 to 2030. This growth is driven by the increasing awareness of cardiovascular diseases, hypertension, and BP monitoring devices among the US population.

Additionally, the rising use of advanced technology-based Blood Pressure Monitoring Deviceswearables such as apps and mobiles are boosting the growth of this segment. The growth is also fueled by rising R&D activities for manufacturing innovative devices. For example, in January 2023, researchers from the University of California San Diego Jacobs School of Engineering announced the development of a blood pressure monitor that can be connected to a smartphone. This novel monitor is designed to be small, can be operated with one touch, and is more cost-effective than traditional blood monitors.

End-user Insights

In the US, hospitals and clinics have been the dominant end-users of blood pressure monitors, accounting for around 65.0% of the market share in 2023. This can be attributed to the rising number of hospitalizations among the US population due to chronic diseases, injuries, and other emergencies. Notably, hospitals and clinics are the major consumers of blood pressure monitors as efficient pressure management is essential in a hospital healthcare setting. According to statistics published by the Centers for Disease Control and Prevention, around 48.1% of adults in the US suffer from hypertension, which further drives the demand for blood pressure monitors in hospitals and clinics.

Additionally, as per an article published by Journal of Managed Care and Specialty Pharmacy, rate of re-hospitalization due to heart failure is between 21-23% among the US population, which further emphasizes the importance of efficient pressure management in hospitals and clinics. On the other hand, the homecare segment is expected to grow at the fastest CAGR of 10.9% from 2024 to 2030.

The growth is primarily driven by the increasing popularity of home monitoring devices due to their user-friendly nature, reliability, cost-effectiveness, and reduced healthcare costs. The integration of technological trends such as WI-FI and cloud has further aided the growth of the market. Moreover, reimbursement or coverage policies provided by the US government have played a significant role in boosting the demand for blood pressure monitors in the homecare segment. As a result, the homecare segment is expected to witness significant growth in the coming years.

Key U.S. Blood Pressure Monitoring Devices Company Insights

Key companies in U.S. Blood Pressure Monitoring Devices market include Allyn, Inc., A&D Medical Inc., SunTech Medical, Inc., American Diagnostics Corporation, GE Healthcare, Kaz Inc., GF Health Products Inc., Spacelabs Healthcare Inc., and

There is intense competition in the U.S. Blood Pressure Monitoring Devices Market. The adoption of competitive strategies such as mergers & acquisitions, strategic alliances, collaborative agreements, and partnerships helps to sustain the competition. The industry growth is directly associated with the rising investments by manufacturers for the development of cost-effective, innovative, and easy-to-use products.

Key U.S. Blood Pressure Monitoring Devices Companies:

- American Diagnostics Corporation

- SunTech Medical, Inc

- GE Healthcare

- A&D Medical Inc

- Kaz Inc.

- GF Health Products Inc.

- Spacelabs Healthcare Inc.

- OMRON Healthcare, Inc.

- Welch Allyn

- Briggs Healthcare

- Spacelabs Healthcare

Recent Developments

-

In January 2024, Nanowear announced the US FDA 510(K) clearance for SimpleSence BP device. SimpleSence BP is a non-invasive, cuffless continuous blood pressure monitor manufactured using AI. This approval would enhance the company’s intellectual property portfolio

-

In January 2023, Valencell announced the launch of a calibration-free, cuff less Blood Pressure Monitoring DevicesSolution to improve the wearables for measuring cardiovascular functions during physical exercise. This novel product is designed to assist individuals in monitoring and managing hypertension by providing an accurate blood pressure measurement from the finger without the need for a cuff or calibration.

-

In September 2022, Garmin Ltd. announced US FDA clearance approval for IndexTM BPM smart blood pressure monitor. Index BPM is a stand-alone device that consists of an integrated display to quickly view measurements and can be operated using Wi-Fi.

U.S. Blood Pressure Monitoring Devices Market Report Scope

|

Report Attribute |

Details |

|

The market size value in 2024 |

USD 1.7 billion |

|

The revenue forecast for 2030 |

USD 3.0 billion |

|

Growth rate |

CAGR of 9.0% from 2024 to 2030 |

|

Actual estimates |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Billion & CAGR from 2023 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use |

|

Country Scope |

U.S. |

|

Key companies profiled |

American Diagnostics Corporation; SunTech Medical, Inc ; GE Healthcare A&D Medical Inc; Kaz Inc.; GF Health Products Inc. Spacelabs Healthcare Inc.; OMRON Healthcare, Inc. Welch Allyn; Briggs Healthcare; Spacelabs Healthcare |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Blood Pressure Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. Blood Pressure Monitoring Devices Marketbased on product and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Aneroid Blood Pressure Monitors

-

Digital Blood Pressure Monitors

-

Ambulatory Blood Pressure Monitors

-

Manufacturing

-

Blood Pressure Transducers

-

Instrument & Accessories

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centre

-

Homecare

-

Frequently Asked Questions About This Report

b. The U.S. blood pressure monitoring devices market size was estimated at USD 1.64 billion in 2023 and will reach USD 1.7 billion in 2024.

b. The U.S. blood pressure monitoring devices market is growing at a CAGR of 9.0% from 2024 to 2030 to reach USD 3.0 billion by 2030.

b. In the US, hospitals and clinics have been the dominant end-users of blood pressure monitors, accounting for around 65.0% of the market share in 2023.

b. Key companies in the U.S. blood pressure monitoring devices market include Allyn, Inc., A&D Medical Inc., SunTech Medical, Inc., American Diagnostics Corporation, GE Healthcare, Kaz Inc., GF Health Products Inc., Spacelabs Healthcare Inc.,

b. Technological advancements in blood pressure monitors primarily drive the market's growth, the increased prevalence of hypertension, and the rising geriatric population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."