U.S. Blood Collection Market Size, Share & Trends Analysis Report By Site (Venous, Capillary), By Application (Diagnostics, Treatment), By End Use, By Age, By Demography, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-413-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Blood Collection Market Size & Trends

The U.S. blood collection market size was estimated at USD 1.26 billion in 2024 and is projected to grow at a CAGR of 8.91% from 2025 to 2030. The growing demand for blood collection products is driven by the increasing volume of diagnostic procedures requiring blood samples, including disease screenings and medication monitoring. Regular tests are essential for evaluating and managing chronic conditions such as diabetes, cardiovascular disease, and cancer. Medical professionals favor these tests for their efficiency, ease of use, and reliability in ensuring accurate sample collection and preservation.

Moreover, the rising prevalence of chronic and infectious diseases is a key factor driving demand for blood collection devices. As the U.S. becomes increasingly globalized, health risks extend beyond borders, with economic integration, industrialization, urbanization, and large-scale migration all contributing to various public health challenges. In addition, the growing incidence of chronic conditions like diabetes and cardiovascular diseases is projected to increase the need for collection devices, as these illnesses require frequent testing and monitoring. Reliable blood collection methods are essential for effective management of such conditions. According to CDC data, around 38 million adults in the U.S. were living with diabetes in 2022 and the obesity cases are projected to grow up to 53% of new type 2 diabetes cases each year. Consequently, the increasing prevalence of diabetes is expected to drive demand for vacutainers used in routine diagnostic tests, including sugar assays.

Furthermore, the increasing demand for blood transfusions is a significant driver of the market growth. According to the National Blood Collection and Utilization Survey (NBCUS), there was a 1.7% rise in collected Red Blood Cell (RBC) units between 2019 and 2021. In 2021, 11.78 million RBC units were collected, while 10.76 million units were transfused. In addition, the collection of whole blood units for allogeneic, non-directed donations grew by 0.7%, reaching 9.84 million units, and apheresis RBC collections increased by 7.3% to 1.93 million units. Blood or platelets are needed every two seconds in the U.S., underscoring the steady demand for these components. Each day, approximately 29,000 units of RBCs, nearly 5,000 units of platelets, and 6,500 units of plasma are required. In total, nearly 16 million blood components are transfused annually in the U.S.

The increasing incidence of hematological disorders is a major driver for the use of blood collection devices. Conditions such as anemia, sickle cell disease, bleeding disorders like hemophilia, and clotting issues, as well as cancers including myeloma, lymphoma, and leukemia, are all on the rise. In the U.S., blood cancer claims a life every nine minutes, amounting to approximately 157 deaths daily or over six deaths every hour. In 2023 alone, leukemia, lymphoma, and myeloma are projected to cause around 57,380 deaths in the U.S., representing 9.4% of all cancer-related deaths.

An estimated 437,337 individuals in the U.S. are either living with or in remission from leukemia, while around 879,242 people are in the same condition with lymphoma. Blood clots affect approximately 900,000 Americans each year, leading to about 100,000 deaths annually. Notably, fewer than one in four people show any noticeable signs or symptoms of a blood clot, underscoring the silent but significant impact of this condition.

Site Insights

The venous segment dominated the market with a revenue share of 82.44% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This segment is primarily driven by the rising prevalence of chronic diseases and the increasing demand for precise diagnostic testing. Patients tend to prefer venous blood collection for laboratory tests due to its numerous benefits. This method allows for a higher volume of sample collection, minimizes pain and discomfort, and reduces the risk of hemolysis, making it a reliable and efficient approach for obtaining quality samples. Venous blood collection is a key segment of the market, valued for its dependability and effectiveness in securing high-quality samples. The demand for venous collection is growing in response to the increasing prevalence of chronic diseases and the need for accurate diagnostics.

The capillary segment is anticipated to grow at a lucrative rate over the forecast period. The growth of capillary blood collection is fueled by its numerous advantages in phlebotomy. This method is less invasive, easy to perform, and carries fewer risks compared to traditional venipuncture. Requiring only minimal equipment, it is less painful, offering patients a more comfortable experience. For instance, capillary collection is widely used in managing chronic diseases like diabetes, where patients rely on finger-prick tests to monitor blood glucose levels at home. It's also commonly used in neonatal screening, allowing for essential blood tests in newborns with minimal discomfort. Capillary blood collection’s suitability for patients of all ages and its adaptability to various settings, such as pharmacies, homes, and outpatient clinics, make it a versatile and valuable technique in healthcare.

Application Insights

The diagnostics segment dominated the U.S. market in 2024 and is expected to grow at the fastest CAGR over the forecast period, driven by its vital role in accurately assessing and managing various medical conditions. Advances in technology have transformed diagnostic capabilities, enabling faster and more precise testing across a broad spectrum of conditions. The rise of personalized medicine and genomic testing has further broadened the range of diagnostic services, catering to individual needs and enhancing treatment outcomes. In addition, the increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, creates a need for regular monitoring and early detection through diagnostic tests, fueling market demand. For instance, chronic respiratory diseases like Chronic Obstructive Pulmonary Disease (COPD) and asthma rely on tests to evaluate gas exchange and inflammation levels, providing crucial insights for effective disease management.

The treatment segment is anticipated to grow at a lucrative rate over the forecast period. These products are essential in treating various conditions, including chronic kidney disorders, different types of cancer, autoimmune diseases, and neurological disorders. Patients may require transfusions of blood or specific components, such as platelets, plasma, or granulocytes, during treatment for severe infections, blood loss from surgery, or post-injury recovery. The global demand for blood and its components is high, driven by the rising number of surgeries and accidents. In addition, the need for transfusions has surged in cancer treatments, where patients often require regular transfusions to manage symptoms and support recovery.

End Use Insights

The hospitals segment dominated the market with a share of 28.01% in 2024. This growth can be attributed to the high volume of cases and diagnostic tests being performed. The increase in surgical procedures, including angioplasty and kidney and liver transplants, along with a rise in trauma incidents, has led to a substantial uptick in the demand for blood transfusions in hospitals. In addition, there is a notable need for the diagnosis of various diseases, such as cancer, heart and lung conditions, sickle cell anemia, and disorders like thalassemia and hemophilia. Furthermore, the prevalence of infectious diseases such as malaria, dengue, hepatitis, and pneumonia has risen significantly, necessitating the use of capillary blood collection devices for early detection and diagnosis.

The blood bank centers segment is anticipated to grow at a significant rate over the forecast period. The growth is largely due to government initiatives and support for blood donation programs and safety measures. Policies and funding aimed at improving collection and transfusion services are driving the adoption of advanced sample collection products, such as vacuum collection tubes. For example, in August 2022, the U.S. Department of Health and Human Services launched a new campaign to boost blood and plasma donations in the U.S. The campaign focused on raising awareness about the importance of blood donation and encouraging citizens to develop the habit of donating.

Age Insights

The 19 to 65 segments accounted for the largest market share in 2024 and are expected to grow at the fastest CAGR over the forecast period. The growth can be attributed to the rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and cancer, which necessitate regular blood testing for effective management. Greater awareness and emphasis on preventive healthcare are also driving demand for routine tests, such as cholesterol and glucose monitoring. In addition, advancements in blood collection methods, including less invasive techniques and improved point-of-care testing (POCT), enhance patient compliance and stimulate market growth. Furthermore, healthcare policies that promote regular health check-ups and screenings are contributing to an increase in test volumes.

The 0-18 segment is anticipated to grow at a significant rate over the forecast period.The growth is driven by the rising prevalence of infectious diseases such as pneumonia, diarrhea, malaria, and sepsis, which require frequent diagnostic testing and, consequently, increase the demand for collection services. For instance, the World Health Organization has reported a significant rise in malaria cases in regions like Sub-Saharan Africa, where children under the age of 5 are particularly vulnerable. In addition, the ongoing challenges posed by pneumonia in young children have led to initiatives like the Global Action Plan for Pneumonia and Diarrhea, which emphasize the need for effective diagnostic testing. Similarly, outbreaks of diseases such as HIV and tuberculosis in various parts of the world have highlighted the urgent need for reliable blood collection and testing services to ensure timely diagnosis and treatment.

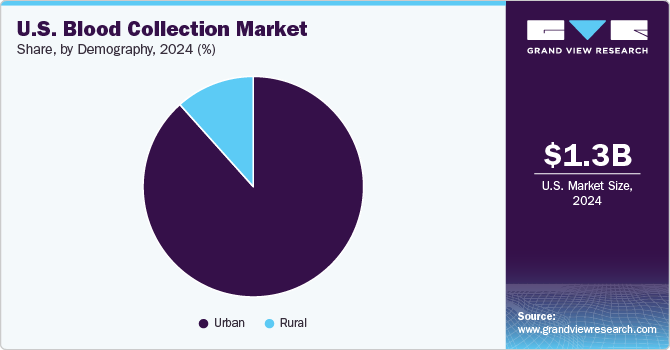

Demography Insights

The urban segment dominated the U.S. market in 2024 and is expected to grow at the fastest CAGR over the forecast period, owing to the presence of a robust hospital infrastructure and a high number of diagnostic laboratories in the region. According to the 2020 Census, the urban population in the U.S. increased by 6.4% between 2010 and 2020, influenced in part by a redefinition of urban areas. Globally, urbanization has been a continuous trend since the 18th-century Industrial Revolution, with the United Nations estimating that 3.9 billion people now inhabit urban centers. For example, cities like New York and Los Angeles have seen significant expansions in their healthcare facilities to meet the needs of their growing populations. In India, urban centers such as Mumbai and Delhi have experienced similar growth, leading to the establishment of numerous diagnostic labs to cater to increased healthcare demands. This trend underscores the importance of developing healthcare infrastructure in densely populated areas to ensure accessible and efficient medical services.

The rural segment is anticipated to grow at a lucrative rate during the forecast period. Chronic diseases pose a considerable challenge to rural healthcare systems and residents in the U.S., affecting quality of life, mortality rates, and healthcare costs. Compared to urban areas, rural communities frequently have fewer resources for effective prevention and treatment of these conditions. This disparity is exacerbated by the higher prevalence of multiple chronic diseases among the rural population, making management more complex and treatment more expensive. For instance, studies have shown that rural residents often face greater obstacles in accessing specialized care for conditions like diabetes and heart disease, leading to worse health outcomes. In addition, programs like the Rural Health Clinics (RHC) initiative aim to address these challenges, but many areas still struggle with limited healthcare access and high rates of chronic illness.

Key U.S. Blood Collection Company Insights

The market is highly competitive. Key companies deploy strategic initiatives, such as service development, launches, and sales & marketing strategies to increase product awareness and regional expansions and partnerships to strengthen their market share. Market players are also involved in conducting clinical testing of their procedures, patent applications, and increasing service penetration.

Key U.S. Blood Collection Companies:

- Sekisui Medical Co., Ltd.

- Becton, Dickinson and Company (BD)

- Greiner Bio-One

- QIAGEN

- Nipro Corporation

- Terumo Corporation

- Haemonetics Corp.

- Zhejiang Gongdong Medical Technology Co., Ltd

- Drucker Diagnostics

- AdvaCare Pharma

Recent Developments

-

In May 2024, the U.S. FDA approved the Rika Plasma Donation System featuring the iNomi Nomogram developed by Terumo Corporation. This product helps determine plasma collection volume based on an individual donor's weight, height, and hematocrit level at the time of donation.

-

In December 2023, BD received 510(k) clearance from the U.S. FDA for the BD MiniDraw Capillary Blood Collection System. The BD MiniDraw Capillary Blood Collection System provides a less invasive alternative to traditional venous blood draws.

U.S. Blood Collection Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.36 billion |

|

Revenue forecast in 2030 |

USD 2.08 billion |

|

Growth Rate |

CAGR of 8.91% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report Updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Site, application, end use, age, demography, states |

|

States scope |

California, Texas, Florida, New York, Pennsylvania, Illinois, Ohio, Georgia, North Carolina, South Carolina, Michigan, Alabama, Arkansas, Kentucky, Louisiana, Mississippi, Tennessee, West Virginia, Virginia, Colorado, Alaska, Vermont, South Dakota, Maine, Oregon, Rest of U.S. |

|

Key companies profiled |

Sekisui Medical Co., Ltd., Becton, Dickinson and Company (BD), Greiner Bio-One, QIAGEN, Nipro Corporation, Terumo Corporation, Haemonetics Corp., Zhejiang Gongdong Medical Technology Co., Ltd., Drucker Diagnostics, AdvaCare Pharma |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Blood Collection Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. blood collection market report based on site, application, end use, age, demography, and states.

-

Site Outlook (Volume, Units in Million; Revenue, USD Million, 2018 - 2030)

-

Venous

-

Needles and Syringes

-

Double-Ended Needles

-

Winged Blood Collection Sets

-

Standard Hypodermic Needles

-

Other Blood Collection Needles

-

-

Blood Collection Tubes

-

Serum-separating

-

EDTA

-

Heparin

-

Plasma-separating

-

-

Blood Bags

-

Others

-

-

Capillary

-

Lancets

-

Micro-Container Tubes

-

Micro-Hematocrit Tubes

-

Warming Devices

-

Others

-

-

-

Application Outlook (Volume, Units in Million; Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Treatment

-

-

End Use Outlook (Volume, Units in Million; Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinical Laboratories

-

Blood Banks Centers

-

Clinics

-

Mobile Service

-

Emergency Departments

-

Others

-

-

Age Outlook (Volume, Units in Million; Revenue, USD Million, 2018 - 2030)

-

0-18

-

19 to 65

-

66 years and above

-

-

Demography Outlook (Volume, Units in Million; Revenue, USD Million, 2018 - 2030)

-

Urban

-

Rural

-

-

States Outlook (Volume, Units in Million; Revenue, USD Million, 2018 - 2030)

-

California

-

Texas

-

Florida

-

New York

-

Pennsylvania

-

Illinois

-

Ohio

-

Georgia

-

North Carolina

-

South Carolina

-

Michigan

-

Alabama

-

Arkansas

-

Kentucky

-

Louisiana

-

Mississippi

-

Tennessee

-

West Virginia

-

Virginia

-

Colorado

-

Alaska

-

Vermont

-

South Dakota

-

Maine

-

Oregon

-

Rest of U.S.

-

Frequently Asked Questions About This Report

b. The global U.S. blood collection market size was estimated at USD 1.26 billion in 2024 and is expected to reach USD 2.08 billion in 2025.

b. The U.S. blood collection market is expected to grow at a compound annual growth rate of 8.91% from 2024 to 2030 to reach USD 2.08 billion by 2030.

b. California dominated the U.S. blood collection market with a share of 10.12% in 2024. This is attributable to a large population, well-developed healthcare infrastructure, and high awareness of overall clinical diagnostics

b. Some key players operating in the U.S. blood collection market include SEKISUI CHEMICAL; NIPRO Medical Corp.; Becton, Dickinson and Company; Terumo Corp.; Haemonetics Corp.; Qiagen; and Greiner Holding AG

b. Key factors that are driving the market growth include Increasing prevalence of chronic and infectious diseases and rising prevalence of hematological disorders.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."