- Home

- »

- Medical Devices

- »

-

U.S. Biotechnology And Pharmaceutical Services Outsourcing Market, Industry Report, 2030GVR Report cover

![U.S. Biotechnology And Pharmaceutical Services Outsourcing Market Size, Share & Trends Report]()

U.S. Biotechnology And Pharmaceutical Services Outsourcing Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Consulting, Auditing & Assessment), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-297-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

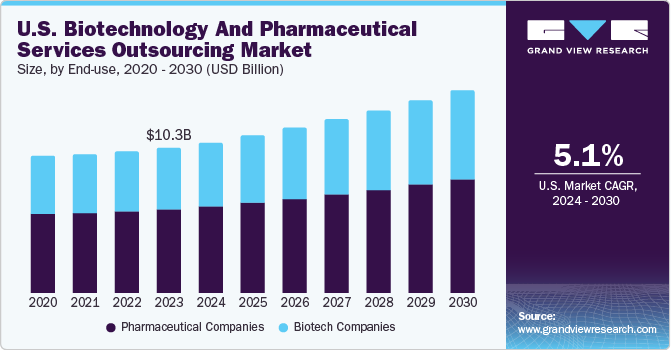

The U.S. biotechnology and pharmaceutical services outsourcing market size was estimated at USD 10.3 billion in 2023 and it is expected to grow at a CAGR of 5.05% from 2024 to 2030. This market growth can be attributed to an increased inclination towards outsourcing certain business functions, such as research, drug development, and clinical trials among others. In addition, changing regulatory landscapes create the need for consulting for biotechnology and pharmaceutical companies. A rise in drug development costs and the availability of cost-effective services offered by outsourcing contractors from other regions are also among the key market growth drivers.

The U.S. biotechnology and pharmaceutical services outsourcing market held a share of over 22.3% of the global biotechnology and pharmaceutical services outsourcing market revenue in 2023. Several biotechnology and pharmaceutical companies in the U.S. are opting to outsource major business functions, such as design verification & validation, clinical development, product registration, and clinical trial applications. Furthermore, operational elements, such as quality management, strategy, & concept generation, product maintenance, auditing, and training, are also being outsourced to contractors.

This is mainly due to the cost-effective services offered by outsourcing contractors, which are equipped with technologies, know-how, resources, facilities, and expert professionals. The growing pressure of regulatory compliances, a rise in costs associated with drug development, and, an increase in failure rates have remarkably affected the market dynamics. Well-rooted contract research organizations (CROs), outsourcing service providers, manufacturers working on contracts, and management consulting firms are persistently taking care of the multifaceted demands of the biotechnological and pharmaceutical industry.

End-use Insights

Based on the end-use, the pharmaceutical companies segment held the highest market share of 57.4% in 2023 mainly driven by factors, such as the changes in regulatory scenarios, developments and progress accomplished by competitors through outsourcing, improved product responses, and enhanced quality standards attained through expert assistance. Pharmaceuticals have also been outsourcing distribution to different service providers to leverage their robust networks in different regions.

A rise in expenses in areas, such as R&D, by pharmaceutical companies for the detection and development of potential exclusive products is estimated to fuel market growth in the coming years. The biotech companies segment is expected to register a CAGR of 5.4% from 2024 to 2030.

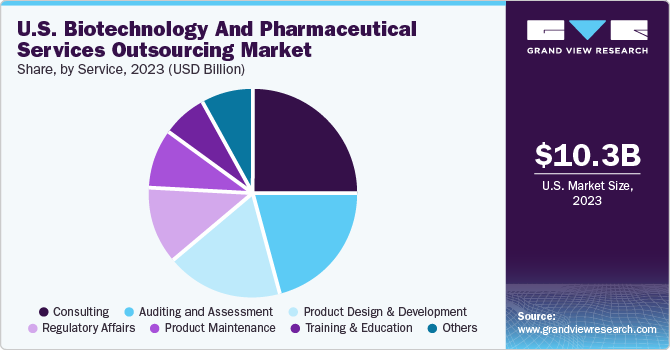

Service Insights

The consulting services segment dominated the market and accounted for a revenue share of 24.96% in 2023. Consulting companies offer several services to help pharmaceutical and biotechnology businesses adhere to regulatory compliances as well as accomplish better quality standards and reduce environmental footprint. For a pharmaceutical company, these companies deliver a greater level of proficiency and experience. A rise in fraudulent incidents and continuous growth in scientific innovations are two of the key challenges faced by pharmaceutical and biotechnological organizations. Therefore, such businesses prefer to outsource some of their business functions.

The product design & development segment is expected to witness a CAGR of 4.19% from 2024 to 2030 due to the dynamic nature of the industry. Companies provide services, such as formulation for analyzing & optimizing chemical & physical properties of API; formulation development studies determining the optimal dosage form, composition, & manufacturing route of pharmaceutical products; analytical solutions for complex research needs; and stability studies. It also includes pharmaceutical product development strategies, such as nonclinical studies, management of changing CMC issues, and timing & requirements for regulatory submissions to support ongoing development activities.

Key U.S. Biotechnology And Pharmaceutical Services Outsourcing Company Insights

Some of the key and emerging companies in the U.S. biotechnology and pharmaceutical services outsourcing market include AbbVie Inc., Lifecore Biomedical, Inc., IQVIA Inc., Parexel International (MA) Corporation, Lachman Consultant Services, Inc., Covance Inc. (Labcorp Drug Development), Charles River Laboratories, ICON Plc, Simtra (Baxter), and others. The highly competitive market has been encouraging key companies to embrace advanced technologies, accommodate changes in manufacturing processes, and develop highly skilled and competitive teams of experts.

-

Covance, Inc. is a CRO that offers its services to biopharmaceutical & pharmaceutical industries. This mainly includes clinical and commercialization services, such as drug development. The company is owned by Labcorp Drug Development and provides its services to organizations operating in 60 countries across the world

-

AbbVie Inc. is a pharmaceutical company in the U.S. that provides contract development and manufacturing services related to biologics, eye care, microbial fermentation, custom APIs, and more

Key U.S. Biotechnology And Pharmaceutical Services Outsourcing Companies:

- AbbVie Inc.

- Lifecore Biomedical, Inc.

- IQVIA Inc.

- Parexel International (MA) Corporation

- Lachman Consultant Services

- Covance, Inc. (Labcorp Drug Development)

- Charles River Laboratories

- ICON plc

- Simtra (Baxter)

- Alcami Corporation

Recent Developments

-

In January 2024, Alcami Corp., one of the experienced CDMOs in the U.S. market, acquired Pacific Pharmaceutical Services Inc., a preferred provider of warehousing and related services for companies engaged in pharmaceutical developments. This enables Alcami Corp. to cater to market needs on the West Coast and to enhance the safeguarding of materials from frequent natural disasters with multi-location facilities

U.S. Biotechnology And Pharmaceutical Services Outsourcing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 14.3 billion

Growth Rate

CAGR of 5.05% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, service

Key companies profiled

AbbVie Inc.; Lifecore Biomedical, Inc.; IQVIA Inc.; Parexel International (MA) Corp.; Lachman Consultant Services; Covance, Inc.; Charles River Laboratory; PRA Health Sciences; Simtra (Baxter); Alcami Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biotechnology And Pharmaceutical Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biotechnology and pharmaceutical services outsourcing market report based on end-use and service:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotech Companies

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Consulting

-

Regulatory Consulting

-

Clinical Development Consulting

-

Strategic Planning & Business Development Consulting

-

Quality Management Systems Consulting

-

Others

-

-

Regulatory Affairs

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Others

-

-

Product Design & Development

-

Research, Strategy, & Concept Generation

-

Concept & Requirements Development

-

Detailed Design & Process Development

-

Design Verification & Validation

-

Process Validation & Manufacturing Transfer

-

Production & Commercial Support

-

-

Auditing and Assessment

-

Product Maintenance

-

Training & Education

-

Others

-

Frequently Asked Questions About This Report

b. Some key players operating in the U.S. biotechnology and pharmaceutical services outsourcing market include AbbVie Inc.; Lifecore Biomedical, Inc.; IQVIA Inc.; Parexel International (MA) Corporation; Lachman Consultant Services; Covance, Inc.; Charles River Laboratory; PRA Health Sciences; Simtra (Baxter); Alcami Corporation.

b. Key factors that are driving the market growth include growing number of clinical trials, increasing R&D activities pertaining to personalized medicine and orphan drug development, and rising outsourcing trends among biopharmaceutical companies among others.

b. The U.S. biotechnology and pharmaceutical services outsourcing market size was estimated at USD 10.27 billion in 2023 and is expected to reach USD 10.64 billion in 2024.

b. The U.S. biotechnology and pharmaceutical services outsourcing market is expected to grow at a compound annual growth rate of 5.05% from 2024 to 2030 to reach USD 14.30 billion by 2030.

b. On the basis of the service, the consulting segment dominated the U.S. biotechnology and pharmaceutical services outsourcing market with a share of 24.96% in 2023. This is attributable to the high number of clinical trials, advanced healthcare infrastructure, high research and development investment and development activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.