U.S. Biotechnology Instruments Market Size, Share & Trends Analysis Report By Product (Analytical Instruments, Cell Culture Instruments, Cell Separation Instruments), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-246-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

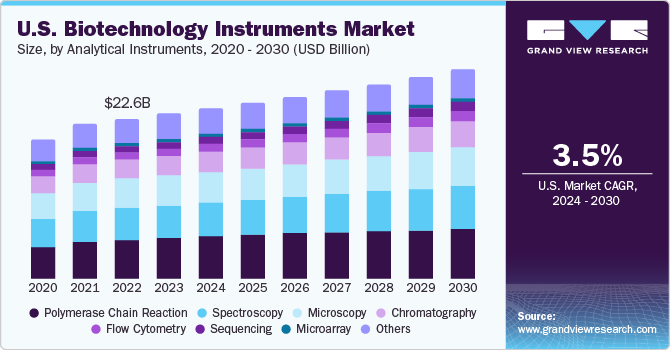

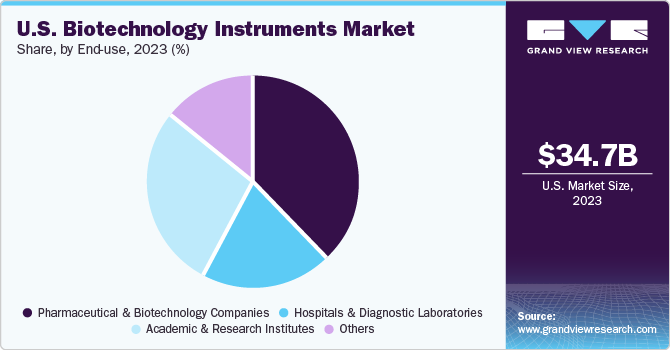

The U.S. biotechnology instruments market was valued at USD 34.66 billion in 2023 and is expected to grow at a CAGR of 3.45% from 2024 to 2030 which can be attributed to the high demand and affordability of biotechnology instrumentation. Moreover, inclination toward manual automation in biotechnology, pharmaceuticals, and related industries in this area is projected to boost the demand for advanced & sophisticated instruments to ease & accelerate process.

Furthermore, the presence of local companies and easy availability of government funding for research are anticipated to boost the market. High adoption of point-of-care diagnostic devices and continuous advancements in R&D have enhanced the capabilities of point-of-care testing systems. Moreover, novel POC devices allow real-time transmission of test results to patient's electronic medical records for easy review by physicians. The systems have also been designed to comply with changes in laboratory regulations easily.

The rising prevalence of chronic disorders, including infectious diseases, cardiovascular disorders, diabetes, cancer, and others, is expected to propel market growth. High unmet medical needs for cardiovascular diseases and increasing patient awareness are expected to boost the demand for IVD instruments. An increase in the adoption of unhealthy habits, such as smoking, a rise in the incidence of obesity, and dietary irregularities are responsible for the increase in prevalence of cardiovascular diseases. Moreover, the prevalence of diabetes is increasing, widening the patient pool.

The U.S. biotechnology instruments market accounted for 40% of the global biotechnology instruments market in 2023. This can be attributed mainly to the growing demand for automation in industrial and clinical settings. Automation in the industrial workplace has enabled companies to maximize output and profits, whereas laboratory automation in clinical settings has increased speed & reliability of patient data. A report stated that biotech startups offer on-demand experimental automation and outsourcing scientific research & development services. Such initiatives have improved the accessibility of automation services at the industrial level, boosting the market.

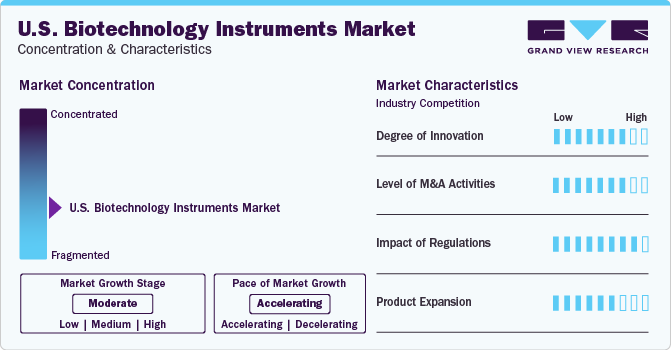

Market Concentration & Characteristics

The market is fragmented with several emerging lucrative opportunities. Growing geriatric population is expected to boost the demand for diagnostic instruments. Furthermore, laser therapy, which can be used for a broad range of applications, including cancer treatment such as chemotherapy, surgery, and other treatment modalities, is also being highly explored.

This industry is witnessing several R&D activities and product launches for product expansion and company profile upgrades. Prominent companies are launching new products to facilitate rapid downstream processing. For instance, in February 2021, Waters Corporation launched Waters ACQUITY PREMIER Solution, which is a next-generation liquid chromatography system that features MaxPeak High-Performance Surface technology. Advantages associated with these systems include elimination of time-consuming steps and improvement in analytical data quality.

Many smaller companies involved in these activities are strategically merging or being acquired by larger ones. A substantial increase in mergers and acquisitions of companies having assets that are valuable, but with insufficient funds, is anticipated to drive market growth. In December 2023, Roche announced the successful acquisition of Carmot Therapeutics, a U.S. based biotechnology company that focuses on therapeutics for people suffering from metabolic diseases.

Regulatory framework on approval processes of instruments is the most critical factor in biotechnology. However, fundraising initiatives by government and other funding bodies for the enhancement of R&D activities in biotechnology and instruments is projected to significantly impact the industry’s growth. Government and key organizations engage constantly in activities intended at curbing cancer-related healthcare expenditure by encouraging patients to undergo regular diagnostic examinations.

Product Insights

Based on product, analytical instruments accounted for the largest market share of 65% in 2023. These instruments comprise advanced technologies including chromatography, mass spectrometry, and spectroscopy that are vital for enabling analysis and characterization accuracy of biological samples. Their extensive use highlights their importance in biotechnology sector’s progress which is making substantial contributions to research, advancement, and ingenuity.

The cell culture instruments segment is expected to grow at the fastest CAGR during the forecast period. Bioreactors, and incubators media are significant tools that enables the cultivation and manipulation of cells across diverse fields including drug development, and tissue engineering. The surge in demand for personalized medicine and escalating importance of cell-based therapies are propelling the growth.

End-use Insights

Based on end use, pharmaceutical & biotechnology companies dominated the biotechnology instruments market with a market share of 38.58% in 2023. Biotechnological instruments are used in pharmaceutical industry for experimentation, testing, and analysis. Companies are engaging capital in R&D programs owing to the growing demand for rapid drug development and commercialization of new drug molecules for the treatment of different diseases.

The academic & research industries segment is expected to grow at the fastest CAGR of 5.07% from 2024 to 2030. Several academic and research institutions are adopting a wide variety of biotechnology instruments such as DNA synthesizers, and microarray systems. The growth is driven by a surge in interdisciplinary research, collaborations, and breakthrough discoveries across fields like genomics, proteomics, and synthetic biology. These efforts are expected to emphasize innovation and consequently accelerate drug research and development.

Key U.S. Biotechnology Instruments Company Insights

Some prominent U.S. biotechnology instruments market companies include Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd.; Agilent Technologies; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Waters Corp.; Danaher; Avantor, Inc.; and Shimadzu Corp. Companies are engaged in continuous development of advanced tools for life sciences research.

Biotechnology instruments have gained significant attention in recent years. This can be attributed to the expanding pool of companies coupled with the need to incorporate advanced instrumentation across different workflows in the biotechnology industry.

Key U.S. Biotechnology Instruments Companies:

- Thermo Fisher Scientific, Inc.

- Waters Corp.

- Shimadzu Corp.

- Danaher

- Agilent Technologies, Inc.

- Bruker Corp.

- PerkinElmer, Inc.

- Mettler Toledo

- Zeiss Group

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Eppendorf SE

- F. Hoffmann-La Roche AG

- Sartorius AG

- Avantor, Inc.

Recent Developments

-

In February 2024, SkyWater Technology announced its production agreement with Nautilus Biotechnology, Inc., intending to supply silicon-based microfluidic biochips for proteome analysis system by Nautilus’

-

In February 2024, BioDot, Inc., announced the launch of MODULIS which is a combination of the BioJet and SuperTrak Gen3 smart conveyance and ATS Smart vision platforms

-

In October 2023, Roche announced the U.S. launch of cobas connection modules (CCM) Vertical which is the only laboratory conveyor system in the U.S. that is capable of moving samples vertically without reducing overall track speed, throughput, or turnaround times.

U.S. Biotechnology Instruments Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 34.66 billion |

|

Revenue forecast in 2030 |

USD 45.31 billion |

|

Growth Rate |

CAGR of 3.45% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use |

|

Country scope |

U.S. |

|

Thermo Fisher Scientific, Inc., Waters Corp., Shimadzu Corp., Danaher, Agilent Technologies, Inc., Bruker Corp., PerkinElmer, Inc., Mettler Toledo, Zeiss Group, Bio-Rad Laboratories, Inc., Illumina, Inc., Eppendorf SE, F. Hoffmann-La Roche AG, Sartorius AG, and Avantor, Inc. |

|

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Biotechnology Instruments Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biotechnology instruments market based on product, and end-use:

-

Product Outlook (USD Million; 2018 - 2030)

-

Analytical Instruments

-

Polymerase Chain Reaction

-

Spectroscopy

-

Microscopy

-

Chromatography

-

Flow Cytometry

-

Sequencing

-

Microarray

-

Others

-

-

Cell Culture Instruments

-

Culture Systems

-

Incubators

-

Cryostorage Equipment

-

Biosafety Equipment

-

Pipetting Instruments

-

-

Cell Separation Instruments

-

Centrifuge

-

Filtration Systems

-

Magnetic-activated Cell Separator Systems

-

-

Immunoassay Instruments

-

Clinical Chemistry Analyzers

-

Others

-

-

End-use Outlook (USD Million; 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Diagnostic Laboratories

-

Academic & Research Institutes

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. biotechnology instruments market was valued at USD 34.66 billion in 2023.

b. The U.S. biotechnology instruments market is expected to grow at a CAGR of 3.45% from 2024 to 2030 to reach USD 45.31 billion by 2030.

b. Analytical instruments accounted for the largest market share of 65% in 2023. These instruments comprise advanced technologies including chromatography, mass spectrometry, and spectroscopy, that are vital for enabling analysis and characterization accuracy of biological samples.

b. Some prominent U.S. biotechnology instruments market companies include Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd.; Agilent Technologies; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Waters Corp.; Danaher; Avantor, Inc.; and Shimadzu Corp. Companies are engaged in continuous development of advanced tools for life sciences research.

b. Inclination toward manual automation in biotechnology, pharmaceuticals, and related industries in this area is projected to boost the demand for advanced & sophisticated instruments to ease & accelerate process

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."